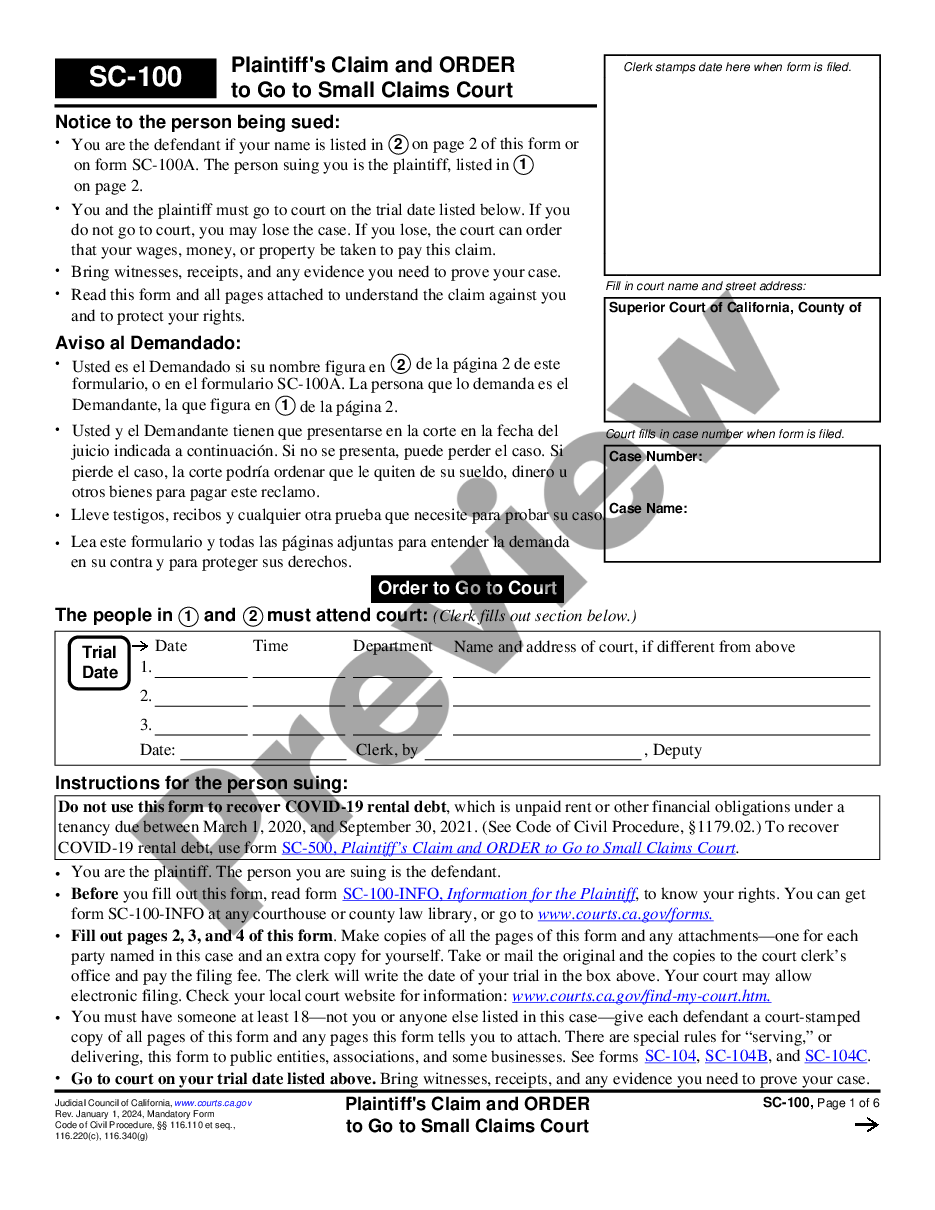

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Santa Clarita California Other Charges — Standard and Simplified Accounts refer to the different types of fees and expenses that may be applicable to financial accounts offered by banks or financial institutions in Santa Clarita, California. These charges vary depending on the type of account and the services provided. Here is a detailed description of both account types and the potential associated charges: 1. Santa Clarita California Other Charges — Standard Account— - A standard account typically refers to a regular checking or savings account offered by banks in Santa Clarita, California. — Monthly Account Maintenance Fee: This fee is charged by some banks to cover the administrative costs of maintaining the account. It may vary from bank to bank and can be waived under certain conditions, such as maintaining a minimum balance or enrolling in direct deposit. — Overdraft Fee: If you overdraw your account by making a transaction without sufficient funds, an overdraft fee may be applied. It is important to keep track of your account balance and avoid spending more than you have available. — ATM Transaction Fee: Often, banks charge a fee for using another bank's ATM or for exceeding a certain number of ATM withdrawals per month. Some accounts may offer a limited number of free ATM transactions or reimburse fees incurred. — Returned Deposit Fee: If a deposited check bounces or is deemed invalid, a fee may be charged for the inconvenience caused to the bank. 2. Santa Clarita California Other Charges — Simplified Account— - A simplified account usually refers to a basic banking product targeted at individuals who prefer minimal fees and simple account features. — Monthly Maintenance Fee: This fee is usually lower than that of a standard account or may be waived altogether, offering cost-effective account management. — Limited Transactions: Simplified accounts may have restrictions on certain types of transactions, such as limited check writing or ATM usage. Exceeding these limits may result in additional charges. — Low Balance Fee: Some simplified accounts require a minimum balance to avoid a low balance fee. If the account balance falls below the specified limit, a fee may be incurred. — Fewer Add-On Services: Simplified accounts may not include added services like overdraft protection or online banking features. These services, if desired, may be available for an additional fee or could require an upgrade to a standard account. It is important to thoroughly review and compare different account types offered by banks in Santa Clarita, California, including their specific terms, conditions, and fees. By understanding the different charges associated with each type of account, individuals can make informed decisions regarding their banking needs and select the account that aligns best with their financial preferences.