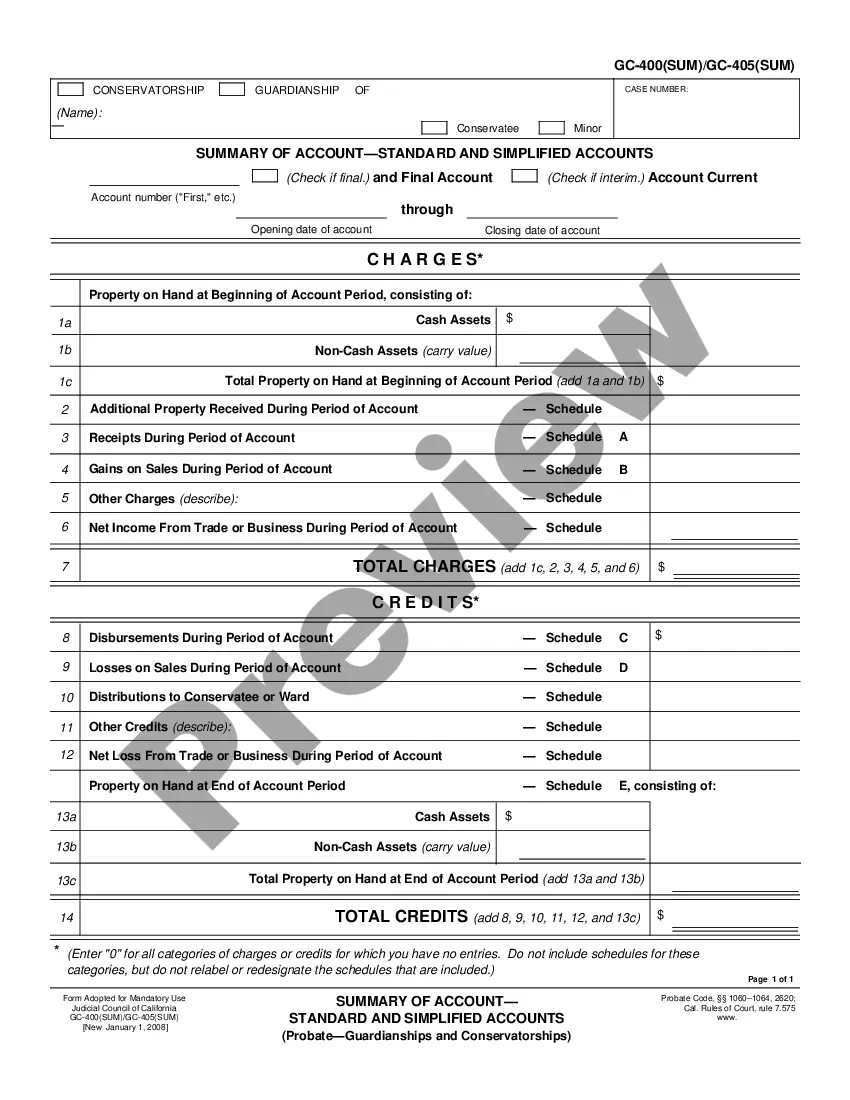

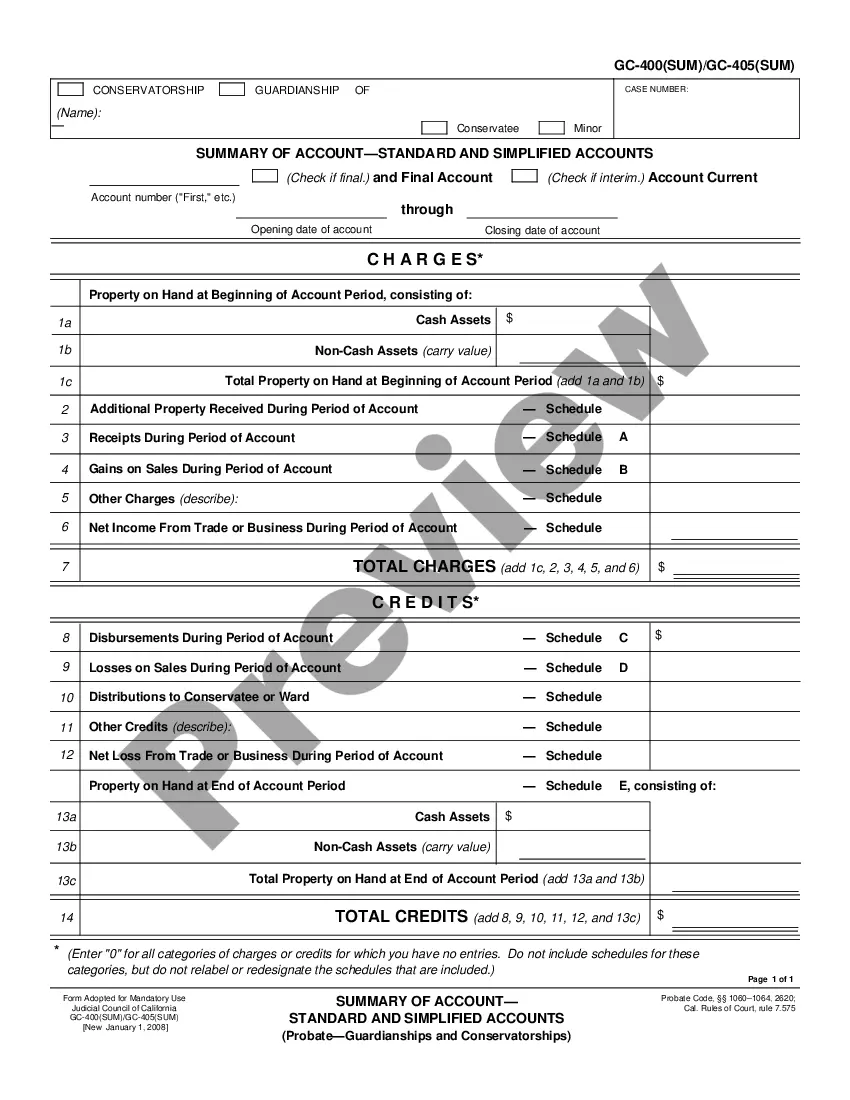

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Concord California Other Credits - Standard and Simplified Accounts

Description

How to fill out California Other Credits - Standard And Simplified Accounts?

Are you looking for a trustworthy and affordable provider of legal documents to purchase the Concord California Other Credits - Standard and Simplified Accounts? US Legal Forms is your preferred option.

Whether you require a simple agreement to establish guidelines for living together with your partner or a collection of paperwork to advance your divorce or separation through the legal system, we have you covered. Our site features over 85,000 current legal document templates for both personal and commercial use. All templates we provide are tailored specifically to the regulations of individual states and counties.

To obtain the form, you must Log In to your account, find the necessary template, and click the Download button beside it. Please note that you can retrieve your previously acquired document templates at any time from the My documents section.

Is this your first visit to our platform? No problem. You can effortlessly create an account, but first, make sure to do the following.

You can now set up your account. Then select your subscription plan and proceed to make payment. Once the payment is completed, download the Concord California Other Credits - Standard and Simplified Accounts in any available format. You can revisit the website whenever necessary and download the form again for free.

Acquiring updated legal documents has never been more straightforward. Try US Legal Forms today and stop wasting your precious time learning about legal documents online for good.

- Verify if the Concord California Other Credits - Standard and Simplified Accounts aligns with the laws of your state and local jurisdiction.

- Review the form's description (if provided) to determine who and what the form is meant for.

- Restart your search if the template does not fit your legal situation.

Form popularity

FAQ

To claim a California tax credit, start by determining which credits you are eligible for based on your financial situation. You will usually need to complete specific forms, such as the California tax return, to report your income and claim credits. The California Franchise Tax Board provides detailed instructions on what documentation is necessary for each credit. For comprehensive support in claiming Concord California Other Credits - Standard and Simplified Accounts, explore U.S. Legal Forms, which offers tailored assistance to simplify your tax preparation.

The final accounting form for probate is typically Form DE-161, which is used to document all transactions that occurred during the probate process. This includes income, expenses, distributions to heirs, and the overall management of the estate. It is crucial to ensure this accounting is completed accurately to provide transparency to the beneficiaries. If you need assistance with these legal forms, consider the services offered by U.S. Legal Forms, especially for navigating Concord California Other Credits - Standard and Simplified Accounts.

Refundable tax credits in California include the California Earned Income Tax Credit and the Young Child Tax Credit, among others. These credits provide taxpayers with the opportunity to receive a refund even if their tax liability is zero. Understanding which credits are available can significantly impact your financial situation. Utilizing resources from U.S. Legal Forms can help you navigate Concord California Other Credits - Standard and Simplified Accounts efficiently.

The income limit for the California Earned Income Tax Credit varies based on your filing status and the number of qualifying children you have. For tax year 2023, single filers with no children can earn up to $18,000, while those with three or more children can earn up to $58,000. It is essential to check the current guidelines on the California Franchise Tax Board's website to ensure you have the latest information. Many residents benefit from Concord California Other Credits - Standard and Simplified Accounts to maximize their tax returns.