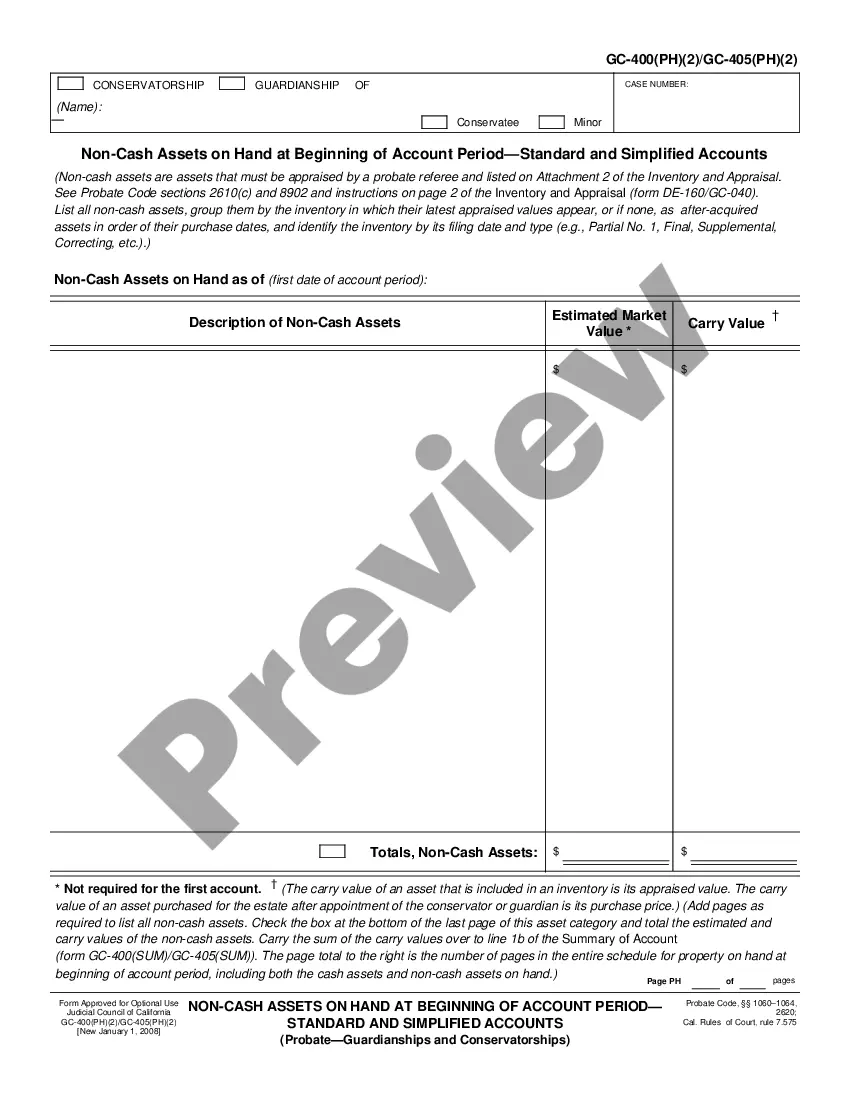

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

In Garden Grove, California, the residents and businesses can benefit from various types of Other Credits — Standard and Simplified Accounts. These accounts offer a range of financial solutions catered specifically to the needs of the local community. Let's delve into the different types of Garden Grove California Other Credits — Standard and Simplified Accounts available: 1. Personal Savings Accounts: Garden Grove offers standard and simplified personal savings accounts. These accounts help individuals save money conveniently and securely. Through these accounts, residents can enjoy competitive interest rates, low minimum balance requirements, and easy access to their funds. 2. Business Checking Accounts: Garden Grove provides standard and simplified business checking accounts tailored to the needs of local businesses. These accounts offer valuable features like online banking, mobile check deposit, fraud protection, unlimited transactions, and detailed statements. They are designed to simplify financial management for businesses of all sizes. 3. Mortgage Loans: Garden Grove California Other Credits also extend to mortgage loans for buying or refinancing homes. These accounts come with competitive interest rates and flexible repayment terms, making homeownership more accessible to the residents of Garden Grove. 4. Auto Loans: For those looking to finance a new or used vehicle purchase, Garden Grove California Other Credits — Standard and Simplified Accounts offer auto loans. These accounts provide affordable interest rates, convenient repayment options, and pre-approval services to make the car buying process hassle-free. 5. Personal Loans: Garden Grove understands that unexpected expenses or special occasions may require additional financial support. That's where personal loans come in. These credits offer a simplified application process and quick approvals, allowing residents to access funds promptly while benefiting from competitive interest rates. 6. Credit Cards: Garden Grove California Other Credits include standard and simplified credit card offerings. These accounts provide flexibility, convenience, and a variety of rewards programs. Cardholders can take advantage of features like low interest rates, no annual fees, and enhanced security measures. 7. Student Loans: Recognizing the importance of education, Garden Grove California offers student loans to assist students in pursuing their academic endeavors. These loans often have favorable terms, competitive interest rates, and flexible repayment options, helping students manage their educational expenses efficiently. 8. Home Equity Line of Credit (HELOT): Homeowners in Garden Grove can utilize the equity built in their homes through a Home Equity Line of Credit (HELOT). These accounts allow individuals to borrow against their home's equity at competitive rates, providing access to funds for home improvements, debt consolidation, or other financial needs. These different Garden Grove California Other Credits — Standard and Simplified Accounts efficiently cater to the diverse financial requirements of the local residents and businesses. Whether it's savings, borrowing, or managing expenses, these accounts provide comprehensive solutions to help individuals and organizations thrive in Garden Grove, California.In Garden Grove, California, the residents and businesses can benefit from various types of Other Credits — Standard and Simplified Accounts. These accounts offer a range of financial solutions catered specifically to the needs of the local community. Let's delve into the different types of Garden Grove California Other Credits — Standard and Simplified Accounts available: 1. Personal Savings Accounts: Garden Grove offers standard and simplified personal savings accounts. These accounts help individuals save money conveniently and securely. Through these accounts, residents can enjoy competitive interest rates, low minimum balance requirements, and easy access to their funds. 2. Business Checking Accounts: Garden Grove provides standard and simplified business checking accounts tailored to the needs of local businesses. These accounts offer valuable features like online banking, mobile check deposit, fraud protection, unlimited transactions, and detailed statements. They are designed to simplify financial management for businesses of all sizes. 3. Mortgage Loans: Garden Grove California Other Credits also extend to mortgage loans for buying or refinancing homes. These accounts come with competitive interest rates and flexible repayment terms, making homeownership more accessible to the residents of Garden Grove. 4. Auto Loans: For those looking to finance a new or used vehicle purchase, Garden Grove California Other Credits — Standard and Simplified Accounts offer auto loans. These accounts provide affordable interest rates, convenient repayment options, and pre-approval services to make the car buying process hassle-free. 5. Personal Loans: Garden Grove understands that unexpected expenses or special occasions may require additional financial support. That's where personal loans come in. These credits offer a simplified application process and quick approvals, allowing residents to access funds promptly while benefiting from competitive interest rates. 6. Credit Cards: Garden Grove California Other Credits include standard and simplified credit card offerings. These accounts provide flexibility, convenience, and a variety of rewards programs. Cardholders can take advantage of features like low interest rates, no annual fees, and enhanced security measures. 7. Student Loans: Recognizing the importance of education, Garden Grove California offers student loans to assist students in pursuing their academic endeavors. These loans often have favorable terms, competitive interest rates, and flexible repayment options, helping students manage their educational expenses efficiently. 8. Home Equity Line of Credit (HELOT): Homeowners in Garden Grove can utilize the equity built in their homes through a Home Equity Line of Credit (HELOT). These accounts allow individuals to borrow against their home's equity at competitive rates, providing access to funds for home improvements, debt consolidation, or other financial needs. These different Garden Grove California Other Credits — Standard and Simplified Accounts efficiently cater to the diverse financial requirements of the local residents and businesses. Whether it's savings, borrowing, or managing expenses, these accounts provide comprehensive solutions to help individuals and organizations thrive in Garden Grove, California.