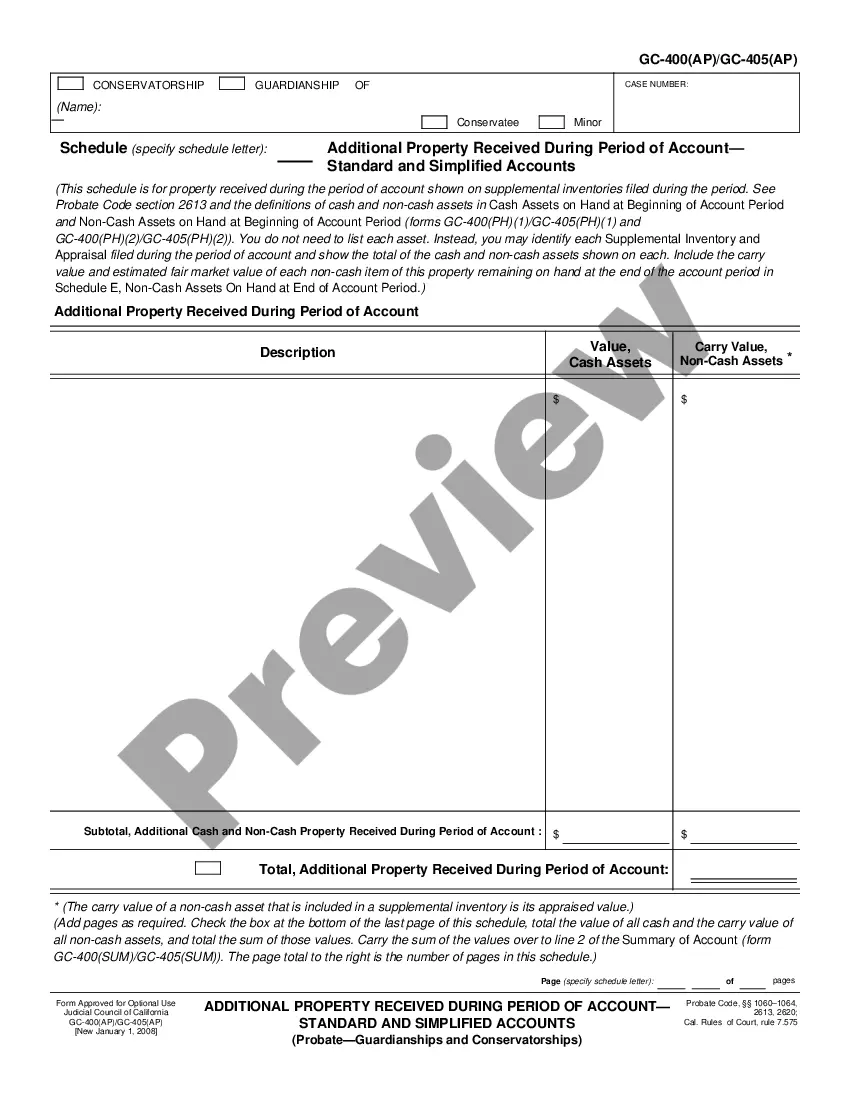

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Santa Clara, California- Non-Cash Assets on Hand at Beginning of Account Period — Standard and Simplified Accounts In Santa Clara, California, businesses and organizations maintain detailed records of their financial transactions and assets. Non-cash assets refer to valuable resources owned by the entity that do not exist in physical form, such as securities, intellectual property, or contractual rights. These assets are crucial for the smooth functioning and growth of businesses and usually require careful tracking and documentation. Standard accounting practices in Santa Clara, California include maintaining a comprehensive record of the non-cash assets on hand at the beginning of an account period. This information is crucial for accurate financial reporting and determining the net worth of the entity at a given time. When it comes to non-cash assets, there are various types that businesses in Santa Clara might possess. Let's explore some common examples within standard and simplified accounts: 1. Marketable Securities: These are financial instruments, such as stocks, bonds, or mutual funds that can be readily bought or sold in public markets. Companies in Santa Clara may hold these securities as an investment strategy or as part of employee benefit plans. 2. Intellectual Property: This includes patents, trademarks, copyrights, and trade secrets. Businesses in Santa Clara may have developed unique products, software programs, or branding elements that are considered valuable non-cash assets. 3. Lease Agreements: Some businesses in Santa Clara may have entered into lease agreements for assets like buildings, equipment, or vehicles. These agreements represent non-cash assets, entitling the entity to use the assets without ownership. 4. Goodwill: Goodwill represents the intangible value of a business, including its reputation, customer relationships, and brand recognition. When a company acquires another entity in Santa Clara, any excess payment made over the acquired company's net assets is recorded as goodwill. Simplified accounts also play a role in tracking non-cash assets in Santa Clara, California. However, this approach is generally used by small businesses or organizations with less complex financial structures. The simplified accounts' method utilizes basic financial categories and may focus on essential non-cash assets to provide a concise overview of an entity's financial standing. Regardless of whether a business adopts a standard or simplified accounting approach, accurately assessing and documenting non-cash assets on hand at the beginning of an account period is crucial for maintaining financial transparency. This information enables stakeholders, including investors, lenders, and management, to make informed decisions based on a comprehensive understanding of the entity's overall worth and potential. In conclusion, Santa Clara, California, showcases a diverse range of non-cash assets that businesses may possess. These assets, such as marketable securities, intellectual property, lease agreements, and goodwill, contribute to the overall value and success of an entity. Applying the appropriate accounting standards, whether standard or simplified accounts, helps ensure accurate reporting and informed decision-making for businesses in Santa Clara.Santa Clara, California- Non-Cash Assets on Hand at Beginning of Account Period — Standard and Simplified Accounts In Santa Clara, California, businesses and organizations maintain detailed records of their financial transactions and assets. Non-cash assets refer to valuable resources owned by the entity that do not exist in physical form, such as securities, intellectual property, or contractual rights. These assets are crucial for the smooth functioning and growth of businesses and usually require careful tracking and documentation. Standard accounting practices in Santa Clara, California include maintaining a comprehensive record of the non-cash assets on hand at the beginning of an account period. This information is crucial for accurate financial reporting and determining the net worth of the entity at a given time. When it comes to non-cash assets, there are various types that businesses in Santa Clara might possess. Let's explore some common examples within standard and simplified accounts: 1. Marketable Securities: These are financial instruments, such as stocks, bonds, or mutual funds that can be readily bought or sold in public markets. Companies in Santa Clara may hold these securities as an investment strategy or as part of employee benefit plans. 2. Intellectual Property: This includes patents, trademarks, copyrights, and trade secrets. Businesses in Santa Clara may have developed unique products, software programs, or branding elements that are considered valuable non-cash assets. 3. Lease Agreements: Some businesses in Santa Clara may have entered into lease agreements for assets like buildings, equipment, or vehicles. These agreements represent non-cash assets, entitling the entity to use the assets without ownership. 4. Goodwill: Goodwill represents the intangible value of a business, including its reputation, customer relationships, and brand recognition. When a company acquires another entity in Santa Clara, any excess payment made over the acquired company's net assets is recorded as goodwill. Simplified accounts also play a role in tracking non-cash assets in Santa Clara, California. However, this approach is generally used by small businesses or organizations with less complex financial structures. The simplified accounts' method utilizes basic financial categories and may focus on essential non-cash assets to provide a concise overview of an entity's financial standing. Regardless of whether a business adopts a standard or simplified accounting approach, accurately assessing and documenting non-cash assets on hand at the beginning of an account period is crucial for maintaining financial transparency. This information enables stakeholders, including investors, lenders, and management, to make informed decisions based on a comprehensive understanding of the entity's overall worth and potential. In conclusion, Santa Clara, California, showcases a diverse range of non-cash assets that businesses may possess. These assets, such as marketable securities, intellectual property, lease agreements, and goodwill, contribute to the overall value and success of an entity. Applying the appropriate accounting standards, whether standard or simplified accounts, helps ensure accurate reporting and informed decision-making for businesses in Santa Clara.