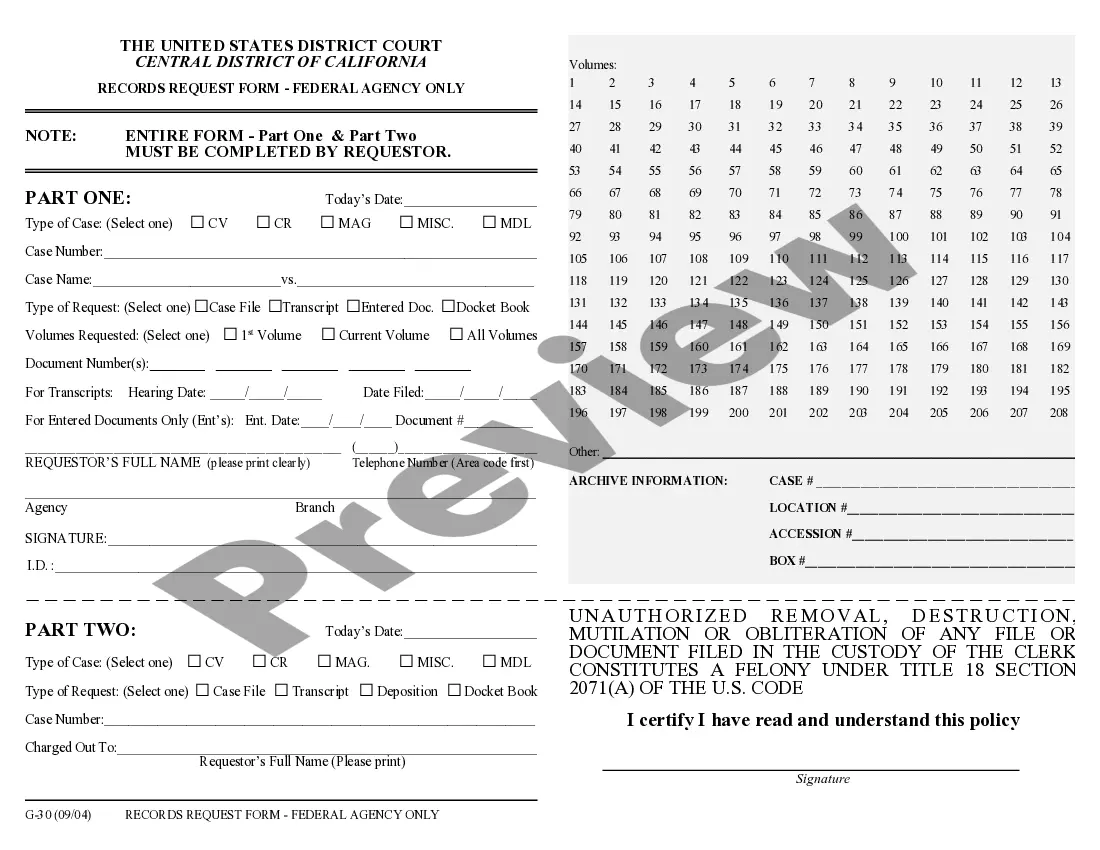

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

San Diego, California: A Detailed Overview of Standard and Simplified Accounts Summary of Account: A "Summary of Account" refers to a report that provides a comprehensive overview of an individual's financial activities. In the context of San Diego, California, the concept of Summary of Account mainly revolves around two types: Standard and Simplified accounts. These accounts serve as essential tools for managing personal finances and maintaining a record of transactions, offering residents a clear snapshot of their financial status. Standard Account: A Standard Summary of Account in San Diego, California is a detailed report that encompasses various aspects of an individual's financial activities. It includes essential information such as income, expenses, investments, assets, liabilities, and any other financial obligations. This account type offers a comprehensive breakdown, allowing individuals to analyze their spending patterns, identify areas of improvement, and make informed decisions accordingly. Standard accounts are often utilized by those seeking a thorough understanding of their financial situation. Simplified Account: Unlike the Standard Account, a Simplified Summary of Account in San Diego, California provides a condensed version of an individual's financial summary. This account type caters to those who want a quick overview, highlighting the key aspects of their finances without getting into intricate details. Simplified accounts usually present the user with an overview of income and expenses, including major transactions and trends in cash flow. This type of account is beneficial for individuals who prefer a more concise and straightforward representation of their financial position. Key Elements Covered in both Standard and Simplified Accounts: 1. Income: Information about various income sources, such as salary, investment returns, rental income, etc., is included in both types of accounts. 2. Expenses: A breakdown of expenses, including categories such as housing, transportation, food, entertainment, utilities, and more, allows individuals to analyze their spending habits. 3. Investments: Details regarding investment portfolios, such as stocks, bonds, mutual funds, retirement accounts, and real estate investments, are often included. 4. Assets and Liabilities: Summary of assets like property, vehicles, savings, and outstanding liabilities such as mortgages, loans, credit card debt, and other financial obligations. 5. Cash Flow: Both accounts provide an analysis of cash inflows and outflows over a specific period, offering insights into monthly or yearly trends. Importance of San Diego California Summary of Account: The San Diego California Summary of Account, be it Standard or Simplified, holds great significance for residents in managing their finances effectively. These accounts enable individuals to track their spending, evaluate their financial goals, and make informed choices regarding savings, investments, and budgeting. By reviewing the summary, people can identify areas where adjustments are required to achieve financial stability, plan for the future, and ensure a secure financial position. In conclusion, the San Diego California Summary of Account, available in Standard and Simplified formats, plays a crucial role in helping residents gain a comprehensive understanding of their financial status. Through these accounts, individuals can monitor their income, expenses, investments, assets, and liabilities, allowing them to make informed decisions and take control of their financial well-being.San Diego, California: A Detailed Overview of Standard and Simplified Accounts Summary of Account: A "Summary of Account" refers to a report that provides a comprehensive overview of an individual's financial activities. In the context of San Diego, California, the concept of Summary of Account mainly revolves around two types: Standard and Simplified accounts. These accounts serve as essential tools for managing personal finances and maintaining a record of transactions, offering residents a clear snapshot of their financial status. Standard Account: A Standard Summary of Account in San Diego, California is a detailed report that encompasses various aspects of an individual's financial activities. It includes essential information such as income, expenses, investments, assets, liabilities, and any other financial obligations. This account type offers a comprehensive breakdown, allowing individuals to analyze their spending patterns, identify areas of improvement, and make informed decisions accordingly. Standard accounts are often utilized by those seeking a thorough understanding of their financial situation. Simplified Account: Unlike the Standard Account, a Simplified Summary of Account in San Diego, California provides a condensed version of an individual's financial summary. This account type caters to those who want a quick overview, highlighting the key aspects of their finances without getting into intricate details. Simplified accounts usually present the user with an overview of income and expenses, including major transactions and trends in cash flow. This type of account is beneficial for individuals who prefer a more concise and straightforward representation of their financial position. Key Elements Covered in both Standard and Simplified Accounts: 1. Income: Information about various income sources, such as salary, investment returns, rental income, etc., is included in both types of accounts. 2. Expenses: A breakdown of expenses, including categories such as housing, transportation, food, entertainment, utilities, and more, allows individuals to analyze their spending habits. 3. Investments: Details regarding investment portfolios, such as stocks, bonds, mutual funds, retirement accounts, and real estate investments, are often included. 4. Assets and Liabilities: Summary of assets like property, vehicles, savings, and outstanding liabilities such as mortgages, loans, credit card debt, and other financial obligations. 5. Cash Flow: Both accounts provide an analysis of cash inflows and outflows over a specific period, offering insights into monthly or yearly trends. Importance of San Diego California Summary of Account: The San Diego California Summary of Account, be it Standard or Simplified, holds great significance for residents in managing their finances effectively. These accounts enable individuals to track their spending, evaluate their financial goals, and make informed choices regarding savings, investments, and budgeting. By reviewing the summary, people can identify areas where adjustments are required to achieve financial stability, plan for the future, and ensure a secure financial position. In conclusion, the San Diego California Summary of Account, available in Standard and Simplified formats, plays a crucial role in helping residents gain a comprehensive understanding of their financial status. Through these accounts, individuals can monitor their income, expenses, investments, assets, and liabilities, allowing them to make informed decisions and take control of their financial well-being.