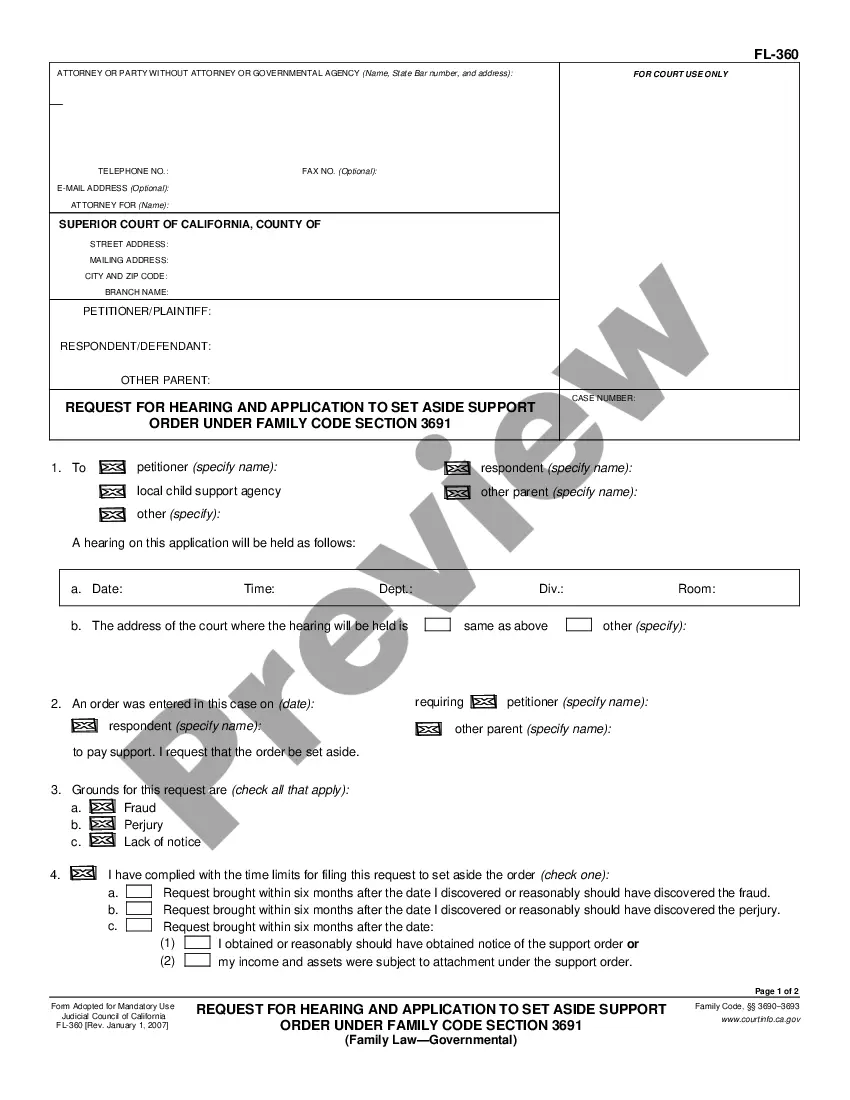

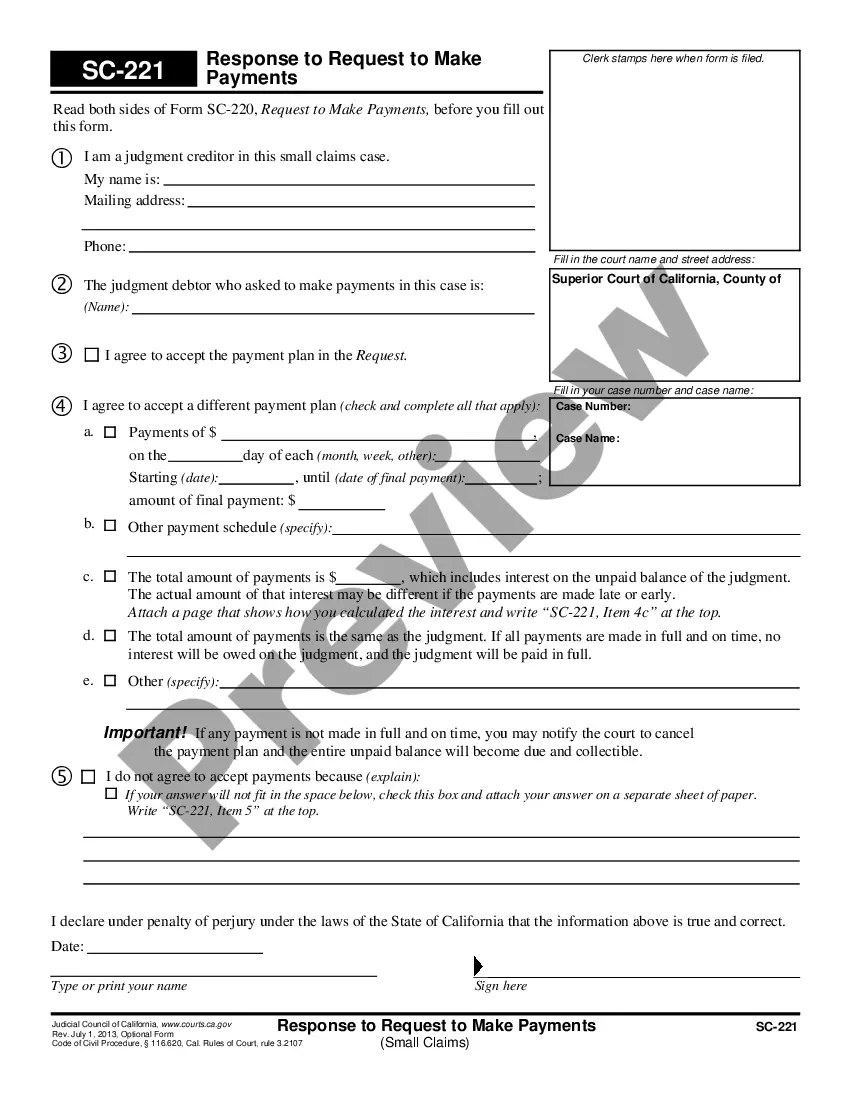

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Victorville, California Summary of Account — Standard and Simplified Accounts In Victorville, California, individuals have access to various types of accounts to manage their finances efficiently. Among the options available are the Standard and Simplified Accounts, each with its unique features and benefits. 1. Standard Account: The Standard Account in Victorville, California, is a comprehensive banking solution designed to cater to the diverse needs of account holders. It provides a wide range of services that are ideal for individuals who require extensive banking features. Some key features of the Standard Account include: — Checking and Savings: The Standard Account offers both checking and savings account facilities, allowing customers to seamlessly manage their daily transactions and save for the future. — Online Banking: Account holders can enjoy the convenience of managing their finances from anywhere at any time through online banking. This feature provides access to account statements, transaction history, bill payments, and fund transfers. — Debit Card: With a Standard Account, customers can avail themselves of a debit card linked to their checking account, enabling them to make purchases or withdraw cash conveniently and securely. — Overdraft Protection: This account type often offers overdraft protection, providing a safety net in case of insufficient funds by automatically transferring money from the savings or credit line to cover the transaction. 2. Simplified Account: The Simplified Account is designed for individuals seeking a straightforward banking experience with basic features. It is an excellent option for those who prefer a no-frills account without unnecessary complexities. Key features of the Simplified Account include: — Basic Checking: The Simplified Account focuses primarily on providing a simple checking account to facilitate day-to-day transactions such as bill payments, direct deposits, and cash withdrawals. — Limited Fees: This account type typically has minimal fees, making it an attractive option for individuals looking to avoid excessive charges associated with additional banking services. — Easy Account Management: Account holders can easily access their Simplified Account balances and transaction history through online banking or mobile banking applications, ensuring convenient account management on the go. — No-Frills Benefits: While the Simplified Account may not offer all the bells and whistles of a Standard Account, it still provides essential features, including the ability to set up automatic payments and track expenses. In summary, Victorville, California offers two primary types of accounts: the Standard Account, catering to customers seeking comprehensive banking services, and the Simplified Account, focused on providing a hassle-free and straightforward banking experience. Both account types serve different needs, allowing individuals to choose the one that best suits their lifestyle and financial goals.

Victorville, California Summary of Account — Standard and Simplified Accounts In Victorville, California, individuals have access to various types of accounts to manage their finances efficiently. Among the options available are the Standard and Simplified Accounts, each with its unique features and benefits. 1. Standard Account: The Standard Account in Victorville, California, is a comprehensive banking solution designed to cater to the diverse needs of account holders. It provides a wide range of services that are ideal for individuals who require extensive banking features. Some key features of the Standard Account include: — Checking and Savings: The Standard Account offers both checking and savings account facilities, allowing customers to seamlessly manage their daily transactions and save for the future. — Online Banking: Account holders can enjoy the convenience of managing their finances from anywhere at any time through online banking. This feature provides access to account statements, transaction history, bill payments, and fund transfers. — Debit Card: With a Standard Account, customers can avail themselves of a debit card linked to their checking account, enabling them to make purchases or withdraw cash conveniently and securely. — Overdraft Protection: This account type often offers overdraft protection, providing a safety net in case of insufficient funds by automatically transferring money from the savings or credit line to cover the transaction. 2. Simplified Account: The Simplified Account is designed for individuals seeking a straightforward banking experience with basic features. It is an excellent option for those who prefer a no-frills account without unnecessary complexities. Key features of the Simplified Account include: — Basic Checking: The Simplified Account focuses primarily on providing a simple checking account to facilitate day-to-day transactions such as bill payments, direct deposits, and cash withdrawals. — Limited Fees: This account type typically has minimal fees, making it an attractive option for individuals looking to avoid excessive charges associated with additional banking services. — Easy Account Management: Account holders can easily access their Simplified Account balances and transaction history through online banking or mobile banking applications, ensuring convenient account management on the go. — No-Frills Benefits: While the Simplified Account may not offer all the bells and whistles of a Standard Account, it still provides essential features, including the ability to set up automatic payments and track expenses. In summary, Victorville, California offers two primary types of accounts: the Standard Account, catering to customers seeking comprehensive banking services, and the Simplified Account, focused on providing a hassle-free and straightforward banking experience. Both account types serve different needs, allowing individuals to choose the one that best suits their lifestyle and financial goals.