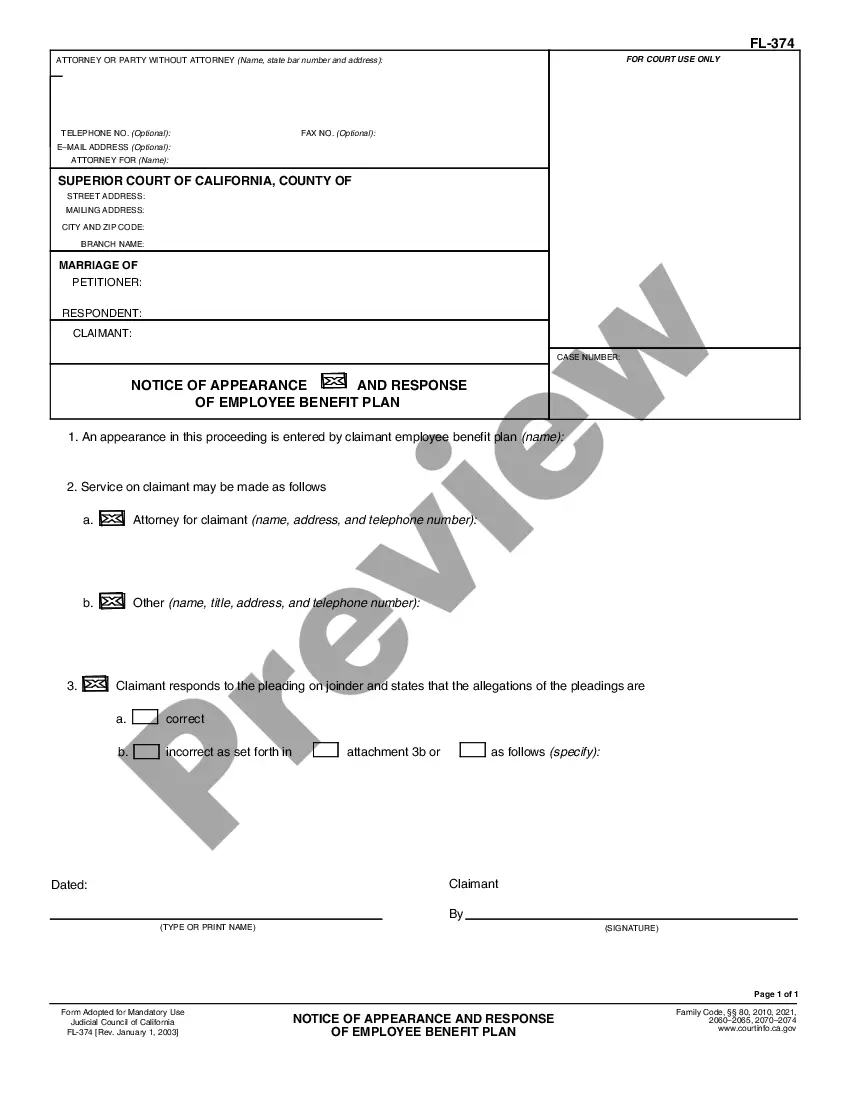

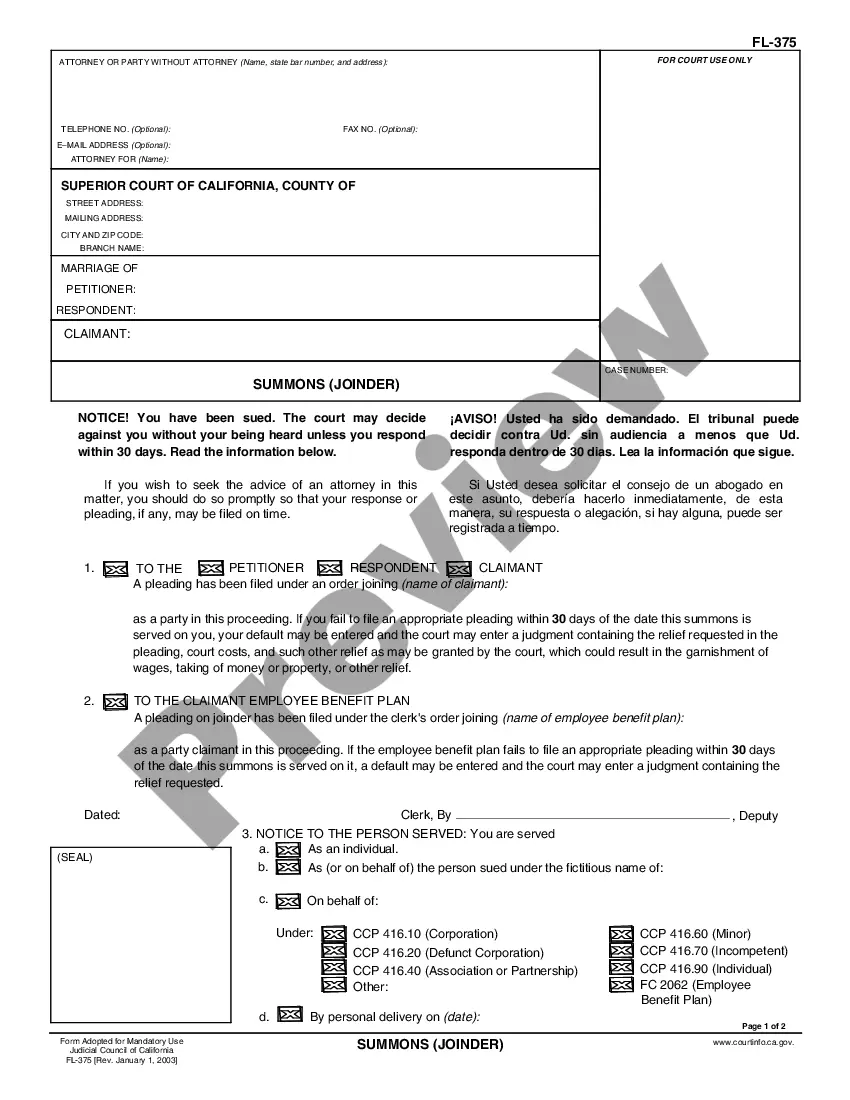

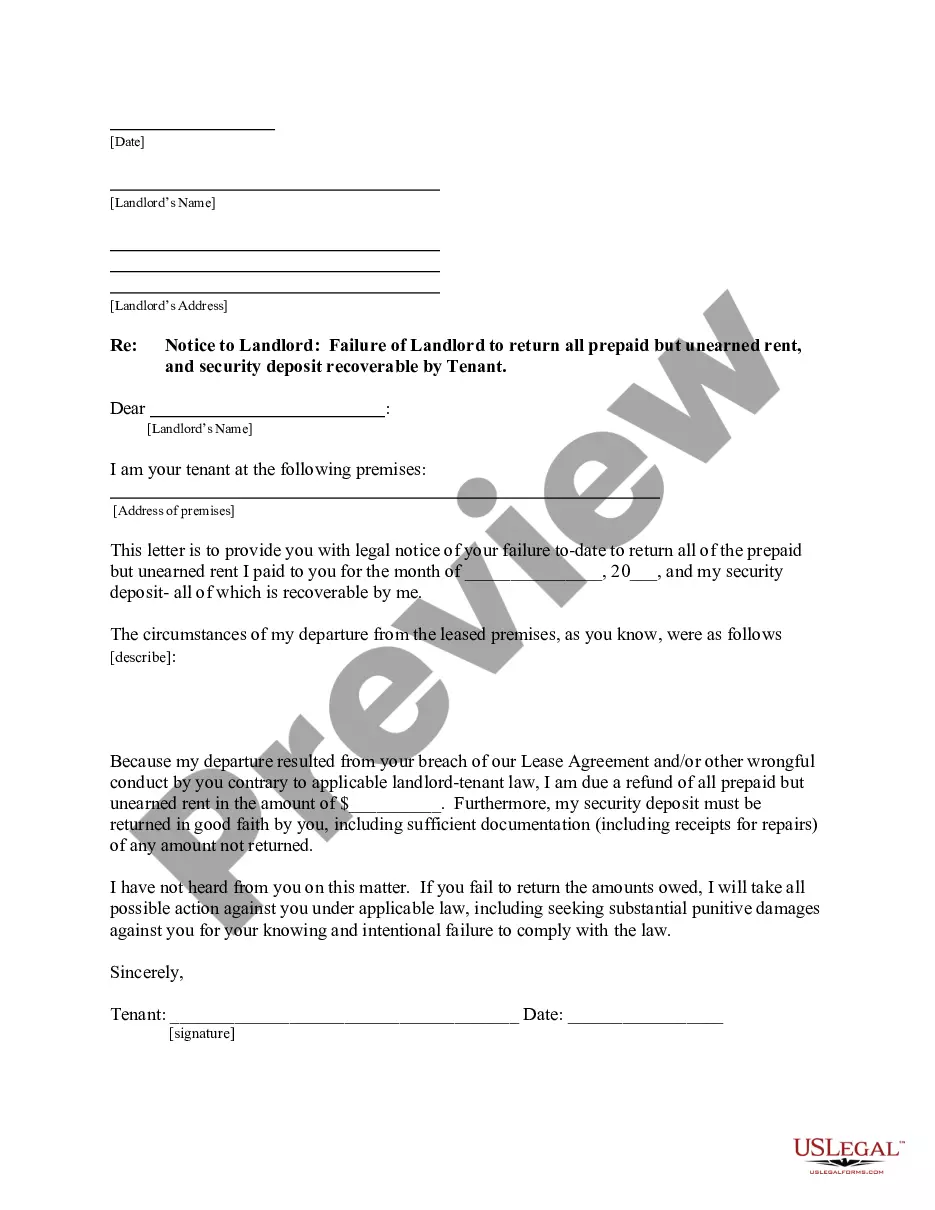

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Long Beach California Schedule A, Receipts-Simplified Account refers to a specific form or document used by businesses and individuals in Long Beach, California to report and provide details of their expenses and receipts. This document helps track and record various financial transactions accurately and efficiently. Below are two types of Long Beach California Schedule A, Receipts-Simplified Account: 1. Individual Schedule A, Receipts-Simplified Account: This type of schedule is primarily designed for individual taxpayers in Long Beach, California. It allows taxpayers to list and categorize their deductible expenses and receipts related to their personal income, such as medical expenses, charitable contributions, and real estate taxes, among others. By maintaining this form, individuals can ensure accurate reporting of their income and claim eligible deductions, ultimately reducing their tax liability. 2. Business Schedule A, Receipts-Simplified Account: This variant of the schedule is specifically tailored for businesses operating in Long Beach, California. It facilitates the organization and documentation of various operational expenses incurred by businesses, including but not limited to rent, utilities, office supplies, advertising expenses, employee wages, and travel expenses. Keeping a detailed record of these expenditures is vital for businesses to track their cash flow, maintain accurate financial statements, and accurately determine their tax liability. Both types of Long Beach California Schedule A, Receipts-Simplified Account are significant tools that help individuals and businesses maintain transparency and compliance with the state's tax regulations. By using these forms, taxpayers can ensure that their financial records are properly documented and can provide necessary support during audits or tax assessments. Efficiently completing the Schedule A, Receipts-Simplified Account can significantly streamline tax filing processes, reduce errors, and maximize eligible deductions, ultimately benefiting both individuals and businesses in Long Beach, California.Long Beach California Schedule A, Receipts-Simplified Account refers to a specific form or document used by businesses and individuals in Long Beach, California to report and provide details of their expenses and receipts. This document helps track and record various financial transactions accurately and efficiently. Below are two types of Long Beach California Schedule A, Receipts-Simplified Account: 1. Individual Schedule A, Receipts-Simplified Account: This type of schedule is primarily designed for individual taxpayers in Long Beach, California. It allows taxpayers to list and categorize their deductible expenses and receipts related to their personal income, such as medical expenses, charitable contributions, and real estate taxes, among others. By maintaining this form, individuals can ensure accurate reporting of their income and claim eligible deductions, ultimately reducing their tax liability. 2. Business Schedule A, Receipts-Simplified Account: This variant of the schedule is specifically tailored for businesses operating in Long Beach, California. It facilitates the organization and documentation of various operational expenses incurred by businesses, including but not limited to rent, utilities, office supplies, advertising expenses, employee wages, and travel expenses. Keeping a detailed record of these expenditures is vital for businesses to track their cash flow, maintain accurate financial statements, and accurately determine their tax liability. Both types of Long Beach California Schedule A, Receipts-Simplified Account are significant tools that help individuals and businesses maintain transparency and compliance with the state's tax regulations. By using these forms, taxpayers can ensure that their financial records are properly documented and can provide necessary support during audits or tax assessments. Efficiently completing the Schedule A, Receipts-Simplified Account can significantly streamline tax filing processes, reduce errors, and maximize eligible deductions, ultimately benefiting both individuals and businesses in Long Beach, California.