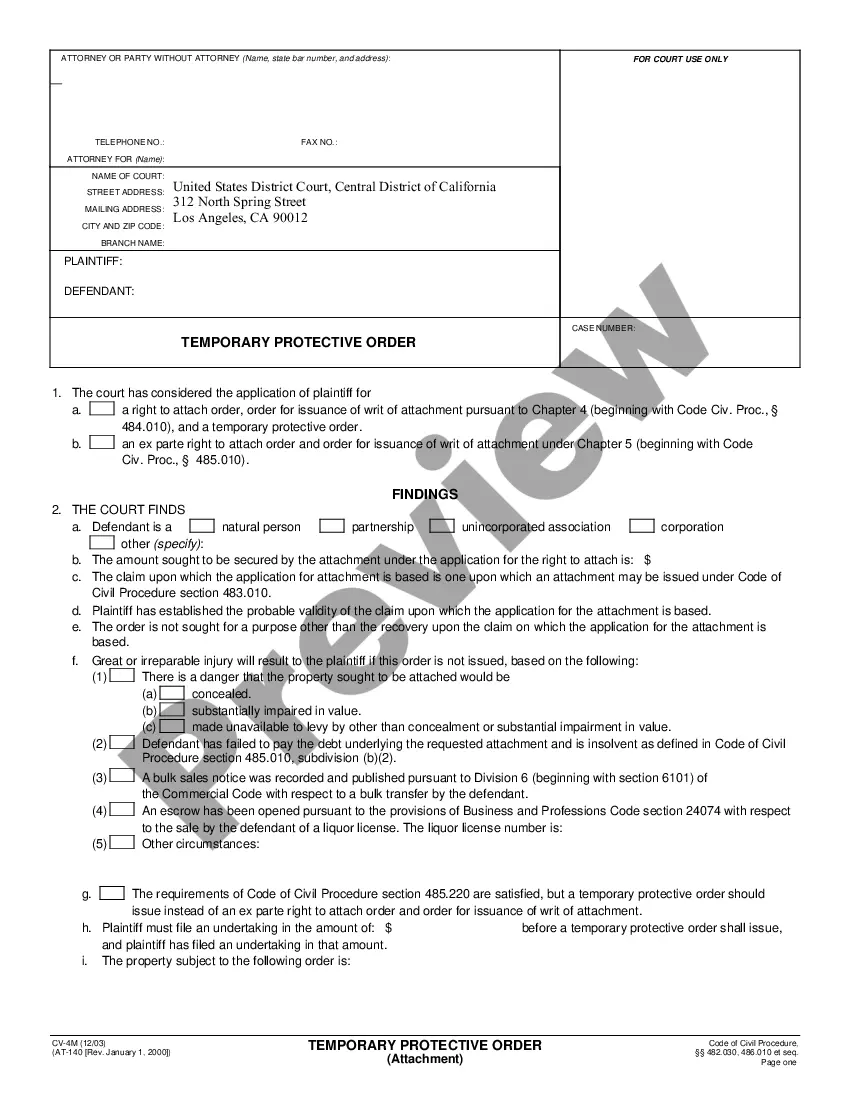

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Concord California Additional Property Received During Period of Account — Standard and Simplified Accounts In the state of California, when it comes to property tax assessment, there are two main types of accounts: Standard Accounts and Simplified Accounts. Under these accounts, homeowners in Concord, California, may experience situations where they receive additional properties during the period of their account. Standard Accounts: In a Standard Account, the property tax assessment process is detailed and comprehensive. When additional property is received during the period of account, thorough evaluations are conducted to determine its value and tax implications. The additional property could include land, residential or commercial buildings, or any other real estate assets. Standard Accounts ensure that the assessment is accurate and fair, considering factors such as market value, condition, size, and location of the property. Homeowners who receive additional property must report it to the appropriate tax authorities for assessment purposes. Simplified Accounts: On the other hand, Simplified Accounts provide a more streamlined process for property tax assessment. This type of account is commonly used for smaller properties and properties that do not significantly change during the account period. Under a Simplified Account, the assessment process is generally less detailed and quicker. However, when additional property is received during the period of account, it may require some extra steps to be properly evaluated. Homeowners in Concord need to report and provide relevant information to the tax authorities so that the additional property can be assessed accurately. Different Types of Concord California Additional Property Received During the Period of Account: The types of additional property that can be received during the period of account in Concord, California, can vary widely. It could include: 1. Land Acquisition: If a homeowner purchases an adjacent vacant land or any additional plot, it will be considered as additional property. The size and location of the land will influence its assessed value. 2. Construction of New Buildings: If a homeowner constructs a new residential or commercial building on their existing property, it will be categorized as additional property. The value of the structure, including its size, quality, and purpose, will be taken into account during assessment. 3. Acquiring an Existing Property: If a homeowner acquires an already established property adjacent to their existing one, it will be considered additional property. Factors such as the market value, condition, and purpose of the property will be assessed. 4. Conversion of Space: If a homeowner converts an existing space within their property, such as a garage or basement, into a livable area, it may be deemed additional property. The change in usage and size will be evaluated. It is important for homeowners in Concord, California, to be fully aware of the rules and regulations regarding any additional property received during the period of their account. By promptly reporting and providing accurate information to the tax authorities, homeowners can ensure that their property tax assessment remains fair and transparent.