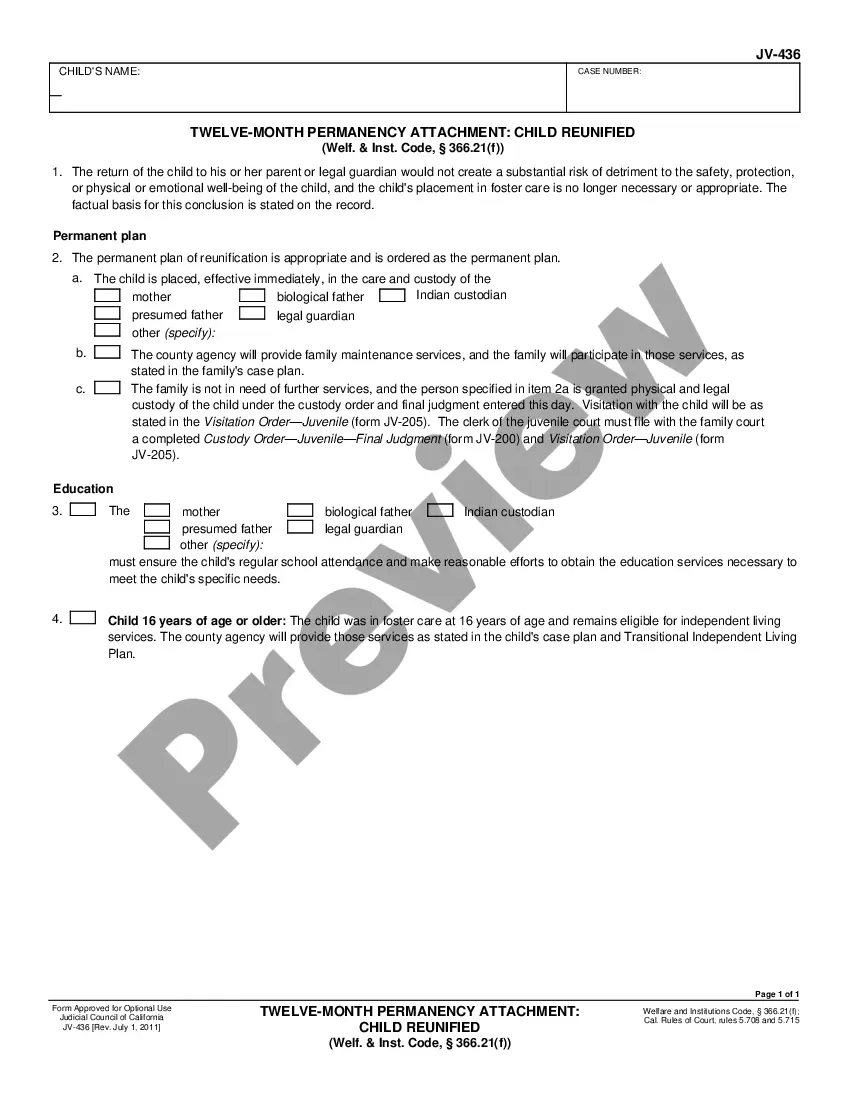

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Los Angeles, California Additional Property Received During Period of Account — Standard and Simplified Accounts In Los Angeles, California, individuals and businesses often deal with additional property received during a specified period of their account. This could pertain to various types of assets or investments acquired within a specific timeframe. The process of accounting for such acquisitions can be categorized into two main types: Standard Accounts and Simplified Accounts. Let's explore each in detail: Standard Accounts: Standard Accounts refer to the traditional method of accounting for additional property received. This involves a comprehensive and more detailed approach to record-keeping. It requires meticulous documentation and reporting of all assets acquired during the specific period of the account. The types of additional property received under standard accounts may include: 1. Real Estate: Los Angeles being a prime location for property investments, additional real estate acquired during the period of the account is a common form of additional property. Examples may include residential houses, commercial buildings, vacant land, or rental properties. 2. Vehicles: This category covers any cars, trucks, motorcycles, or other motor vehicles obtained during the period of the account. It is vital to accurately record the make, model, year, vehicle identification number (VIN), and purchase price. 3. Stocks and Bonds: Standard accounts also encompass additional stocks, bonds, and other securities received during the account period. This requires documentation of the specific security, stock symbol, number of shares, and purchase value. 4. Business Assets: For businesses, additional property received might incorporate equipment, machinery, furniture, or any other assets necessary for the operation. These items should be accounted for separately, listing their descriptions, values, and date of acquisition. Simplified Accounts: Simplified Accounts offer a more streamlined approach to record additional property received during the period of the account. This option is ideal for individuals or small businesses with simpler accounting needs. While still specifying acquired assets, Simplified Accounts may not require as much detailed documentation. Different types of additional property received under Simplified Accounts could include: 1. Personal Property: This covers a wide range of tangible assets acquired, such as electronic devices, furniture, jewelry, or appliances. While it is essential to record the date and value of these items, Simplified Accounts might not require extensive descriptions. 2. Small Investments: Simplified Accounts are suitable for minor investment activities, such as the acquisition of stocks, bonds, or mutual funds. Although the principles of documentation still apply, the specific details might be less comprehensive than in Standard Accounts. 3. Limited Real Estate: If a simplified account deals with real estate, it commonly involves smaller-scale properties like condos, townhouses, or small rental units. Property information, such as address, purchase price, and date of acquisition, should still be recorded. By clearly distinguishing Standard and Simplified Accounts, individuals and businesses in Los Angeles can effectively manage their additional property received during a specified period. Whether dealing with real estate, vehicles, stocks, business assets, or personal belongings, accurate documentation plays a crucial role in maintaining financial integrity and supporting beneficial tax reporting.Los Angeles, California Additional Property Received During Period of Account — Standard and Simplified Accounts In Los Angeles, California, individuals and businesses often deal with additional property received during a specified period of their account. This could pertain to various types of assets or investments acquired within a specific timeframe. The process of accounting for such acquisitions can be categorized into two main types: Standard Accounts and Simplified Accounts. Let's explore each in detail: Standard Accounts: Standard Accounts refer to the traditional method of accounting for additional property received. This involves a comprehensive and more detailed approach to record-keeping. It requires meticulous documentation and reporting of all assets acquired during the specific period of the account. The types of additional property received under standard accounts may include: 1. Real Estate: Los Angeles being a prime location for property investments, additional real estate acquired during the period of the account is a common form of additional property. Examples may include residential houses, commercial buildings, vacant land, or rental properties. 2. Vehicles: This category covers any cars, trucks, motorcycles, or other motor vehicles obtained during the period of the account. It is vital to accurately record the make, model, year, vehicle identification number (VIN), and purchase price. 3. Stocks and Bonds: Standard accounts also encompass additional stocks, bonds, and other securities received during the account period. This requires documentation of the specific security, stock symbol, number of shares, and purchase value. 4. Business Assets: For businesses, additional property received might incorporate equipment, machinery, furniture, or any other assets necessary for the operation. These items should be accounted for separately, listing their descriptions, values, and date of acquisition. Simplified Accounts: Simplified Accounts offer a more streamlined approach to record additional property received during the period of the account. This option is ideal for individuals or small businesses with simpler accounting needs. While still specifying acquired assets, Simplified Accounts may not require as much detailed documentation. Different types of additional property received under Simplified Accounts could include: 1. Personal Property: This covers a wide range of tangible assets acquired, such as electronic devices, furniture, jewelry, or appliances. While it is essential to record the date and value of these items, Simplified Accounts might not require extensive descriptions. 2. Small Investments: Simplified Accounts are suitable for minor investment activities, such as the acquisition of stocks, bonds, or mutual funds. Although the principles of documentation still apply, the specific details might be less comprehensive than in Standard Accounts. 3. Limited Real Estate: If a simplified account deals with real estate, it commonly involves smaller-scale properties like condos, townhouses, or small rental units. Property information, such as address, purchase price, and date of acquisition, should still be recorded. By clearly distinguishing Standard and Simplified Accounts, individuals and businesses in Los Angeles can effectively manage their additional property received during a specified period. Whether dealing with real estate, vehicles, stocks, business assets, or personal belongings, accurate documentation plays a crucial role in maintaining financial integrity and supporting beneficial tax reporting.