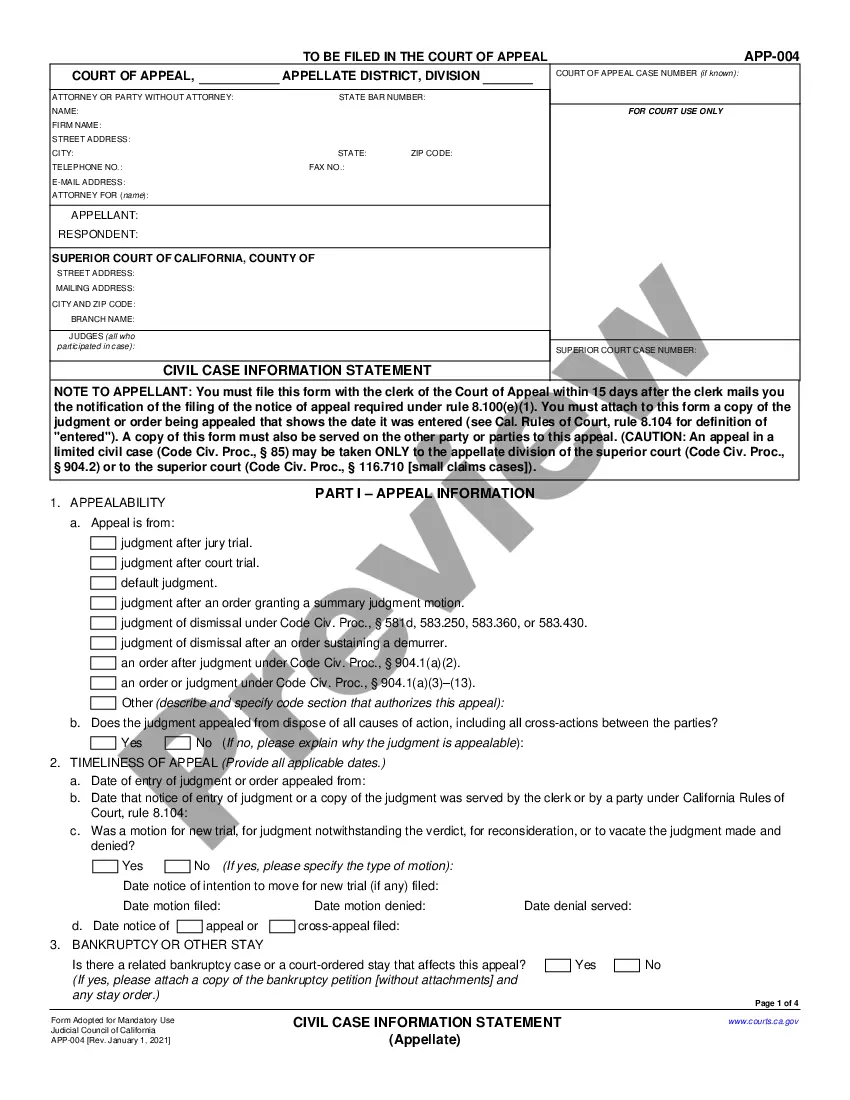

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Roseville California Additional Property Received During Period of Account — Standard and Simplified Accounts When filing taxes in Roseville, California, it is essential to accurately report all additional property received during the period of the account. This requirement applies to both Standard and Simplified Accounts, which are two types of tax filing options available to taxpayers. 1. Standard Account: Under the Standard Account, taxpayers are expected to provide a meticulous and detailed description of any additional property acquired throughout the tax year. The additional property includes but is not limited to real estate, vehicles, stocks, bonds, and any other valuable assets. It is crucial to disclose these assets accurately to ensure compliance with tax regulations in Roseville, California. 2. Simplified Account: The Simplified Account option offers a simplified process for filing taxes, aiming to streamline the reporting procedure for qualifying taxpayers. However, it does not exempt taxpayers from disclosing any additional property received during the period of the account. The same obligations regarding reporting additional property apply, albeit with a more straightforward approach. It is necessary to note that failure to report or misreporting additional property received during the period of the account can lead to penalties, fines, or legal consequences. Accurate reporting is crucial to maintaining tax compliance and preventing potential issues with taxation authorities. To report additional property during the period of the account, taxpayers must provide detailed information regarding the nature of the property, its current value, and the date it was obtained. It is advisable to consult tax professionals or use reputable tax software to ensure proper documentation and accurate reporting. For real estate, taxpayers should include details such as the property address, purchase price, date of acquisition, and any relevant mortgage or loan information. In the case of vehicles, make, model, year, vehicle identification number (VIN), purchase value, and acquisition date are essential. When reporting stocks, bonds, or other financial assets, taxpayers should provide information such as the type of asset, the number of shares or units, purchase price, acquisition date, and any associated dividends or capital gains. Overall, whether utilizing Standard or Simplified Accounts, all taxpayers in Roseville, California, must diligently report any additional property received during the period of the account. By adhering to these requirements and accurately documenting all relevant information, taxpayers can ensure compliance with tax regulations and avoid potential penalties.