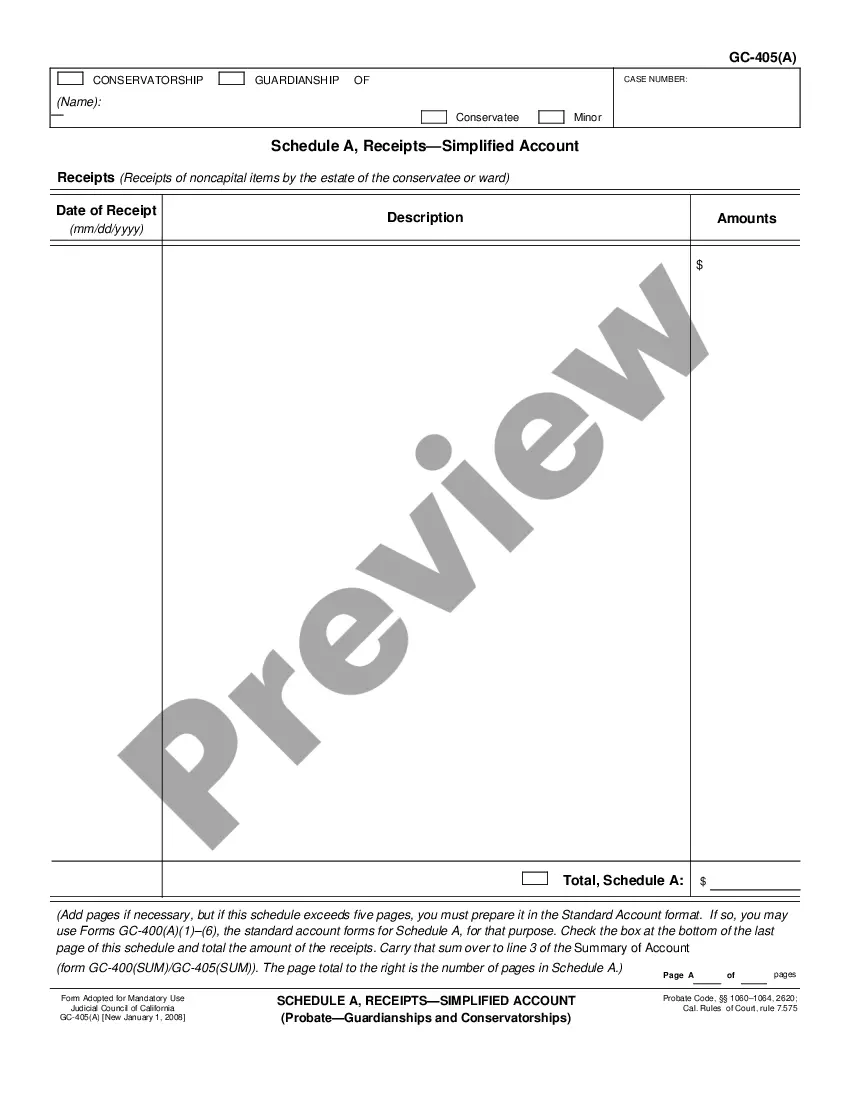

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Bakersfield California Schedule B, Gains on Sales-Standard and Simplified Accounts, is a crucial financial document used for reporting and analyzing gains from sales in the Bakersfield area. It helps individuals, businesses, and tax professionals in accurately assessing their taxable income while adhering to the state's tax regulations. Here are the different types of Bakersfield California Schedule B, Gains on Sales-Standard and Simplified Accounts: 1. Standard Accounts: The Standard Accounts variant of Bakersfield California Schedule B is the comprehensive version that requires detailed reporting of gains on sales. It includes various sections to categorize gains based on different types of assets, such as real estate, stocks, bonds, and other investments. Taxpayers are expected to provide specific information regarding the sales price, cost basis, and holding period of each asset. 2. Simplified Accounts: Designed for individuals or businesses with relatively simpler financial transactions, the Bakersfield California Schedule B, Gains on Sales-Simplified Accounts offers a more streamlined approach. This variant simplifies the reporting process, where taxpayers can report aggregate gains from sales without providing detailed information for each transaction. It provides a summarized overview of gains earned from multiple sales, ensuring ease of use for those with less complicated financial scenarios. Keywords: Bakersfield California, Schedule B, Gains on Sales, Standard Accounts, Simplified Accounts, financial document, reporting, taxable income, tax regulations, assets, comprehensive, real estate, stocks, bonds, investments, sales price, cost basis, holding period, simplified, streamlined, aggregate gains, summarized overview, transactions, less complicated financial scenarios.Bakersfield California Schedule B, Gains on Sales-Standard and Simplified Accounts, is a crucial financial document used for reporting and analyzing gains from sales in the Bakersfield area. It helps individuals, businesses, and tax professionals in accurately assessing their taxable income while adhering to the state's tax regulations. Here are the different types of Bakersfield California Schedule B, Gains on Sales-Standard and Simplified Accounts: 1. Standard Accounts: The Standard Accounts variant of Bakersfield California Schedule B is the comprehensive version that requires detailed reporting of gains on sales. It includes various sections to categorize gains based on different types of assets, such as real estate, stocks, bonds, and other investments. Taxpayers are expected to provide specific information regarding the sales price, cost basis, and holding period of each asset. 2. Simplified Accounts: Designed for individuals or businesses with relatively simpler financial transactions, the Bakersfield California Schedule B, Gains on Sales-Simplified Accounts offers a more streamlined approach. This variant simplifies the reporting process, where taxpayers can report aggregate gains from sales without providing detailed information for each transaction. It provides a summarized overview of gains earned from multiple sales, ensuring ease of use for those with less complicated financial scenarios. Keywords: Bakersfield California, Schedule B, Gains on Sales, Standard Accounts, Simplified Accounts, financial document, reporting, taxable income, tax regulations, assets, comprehensive, real estate, stocks, bonds, investments, sales price, cost basis, holding period, simplified, streamlined, aggregate gains, summarized overview, transactions, less complicated financial scenarios.