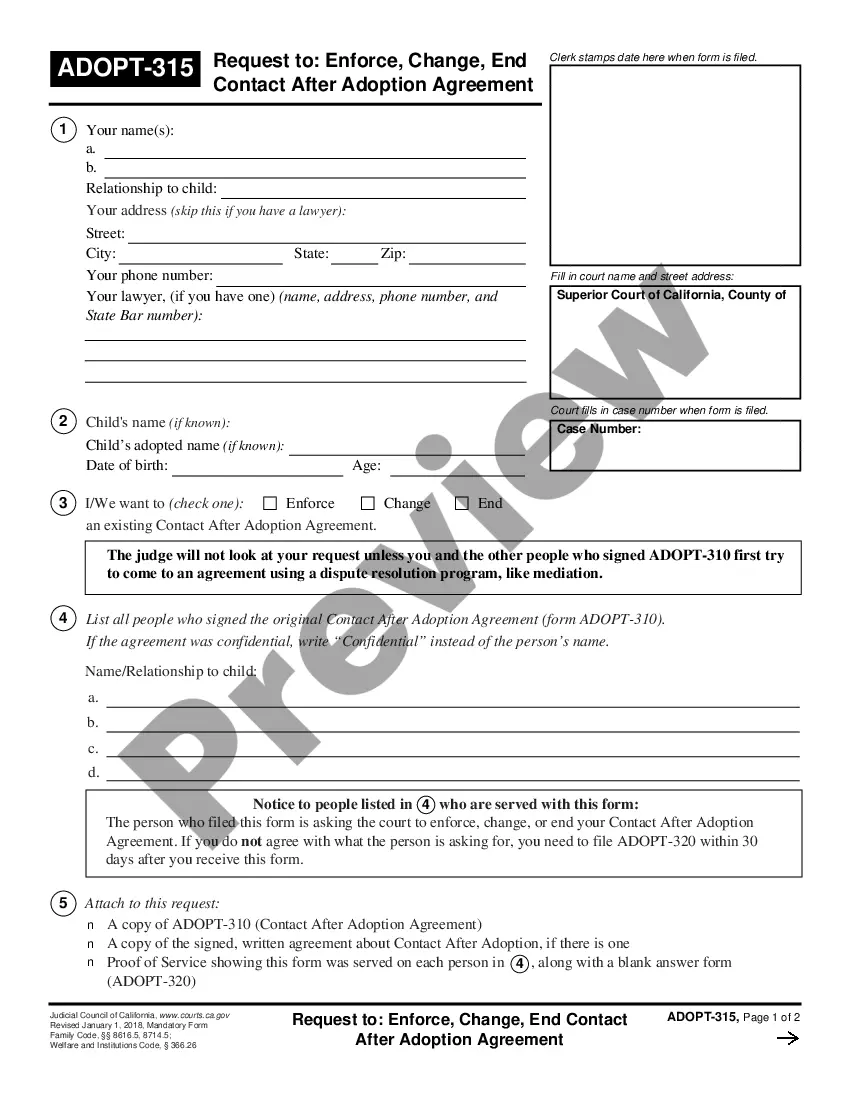

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Garden Grove California Schedule B, Gains on Sales-Standard and Simplified Accounts is a crucial financial document that provides a comprehensive breakdown of the gains realized on sales within the Garden Grove region. This specific schedule is essential for businesses and individuals alike, as it enables accurate reporting and tracking of taxable gains. In Garden Grove California, there are two types of Schedule B accounts that pertain to gains on sales: Standard and Simplified. Let's delve into each of these types to understand their distinctive features: 1. Garden Grove California Schedule B, Gains on Sales-Standard Account: The Standard Account variant of Schedule B is a comprehensive and detailed report that covers all gains on sales within the specified time frame. It requires meticulous record-keeping and a thorough analysis of each sale to accurately determine gains. Taxpayers using this type of account are required to provide comprehensive information, including the sale date, sale price, cost basis, and the resulting gain for each transaction. This detailed account ensures compliance with tax regulations and facilitates precise calculations. 2. Garden Grove California Schedule B, Gains on Sales-Simplified Account: The Simplified Account variant of Schedule B is designed for individuals and businesses with fewer sales transactions or those who prefer a streamlined approach. It offers a more straightforward and summarized report of gains on sales. Taxpayers using the Simplified Account must provide a total sum of their gains instead of itemizing each individual transaction. This option is particularly useful for those with a limited sales volume or those seeking to simplify the reporting process. Both the Standard and Simplified Accounts of Garden Grove California Schedule B, Gains on Sales play a crucial role in ensuring accurate tax reporting. They facilitate transparency, enable the identification of taxable gains, and support compliance with tax regulations. Businesses and individuals need to carefully review their sales records to determine which type of account suits their reporting needs best. Keywords: Garden Grove California, Schedule B, Gains on Sales, Standard Account, Simplified Account, reporting, taxable gains, comprehensive, detailed, record-keeping, compliance, tax regulations, summarized, streamlined, transactions, itemizing, sales volume, reporting process.

Garden Grove California Schedule B, Gains on Sales-Standard and Simplified Accounts is a crucial financial document that provides a comprehensive breakdown of the gains realized on sales within the Garden Grove region. This specific schedule is essential for businesses and individuals alike, as it enables accurate reporting and tracking of taxable gains. In Garden Grove California, there are two types of Schedule B accounts that pertain to gains on sales: Standard and Simplified. Let's delve into each of these types to understand their distinctive features: 1. Garden Grove California Schedule B, Gains on Sales-Standard Account: The Standard Account variant of Schedule B is a comprehensive and detailed report that covers all gains on sales within the specified time frame. It requires meticulous record-keeping and a thorough analysis of each sale to accurately determine gains. Taxpayers using this type of account are required to provide comprehensive information, including the sale date, sale price, cost basis, and the resulting gain for each transaction. This detailed account ensures compliance with tax regulations and facilitates precise calculations. 2. Garden Grove California Schedule B, Gains on Sales-Simplified Account: The Simplified Account variant of Schedule B is designed for individuals and businesses with fewer sales transactions or those who prefer a streamlined approach. It offers a more straightforward and summarized report of gains on sales. Taxpayers using the Simplified Account must provide a total sum of their gains instead of itemizing each individual transaction. This option is particularly useful for those with a limited sales volume or those seeking to simplify the reporting process. Both the Standard and Simplified Accounts of Garden Grove California Schedule B, Gains on Sales play a crucial role in ensuring accurate tax reporting. They facilitate transparency, enable the identification of taxable gains, and support compliance with tax regulations. Businesses and individuals need to carefully review their sales records to determine which type of account suits their reporting needs best. Keywords: Garden Grove California, Schedule B, Gains on Sales, Standard Account, Simplified Account, reporting, taxable gains, comprehensive, detailed, record-keeping, compliance, tax regulations, summarized, streamlined, transactions, itemizing, sales volume, reporting process.