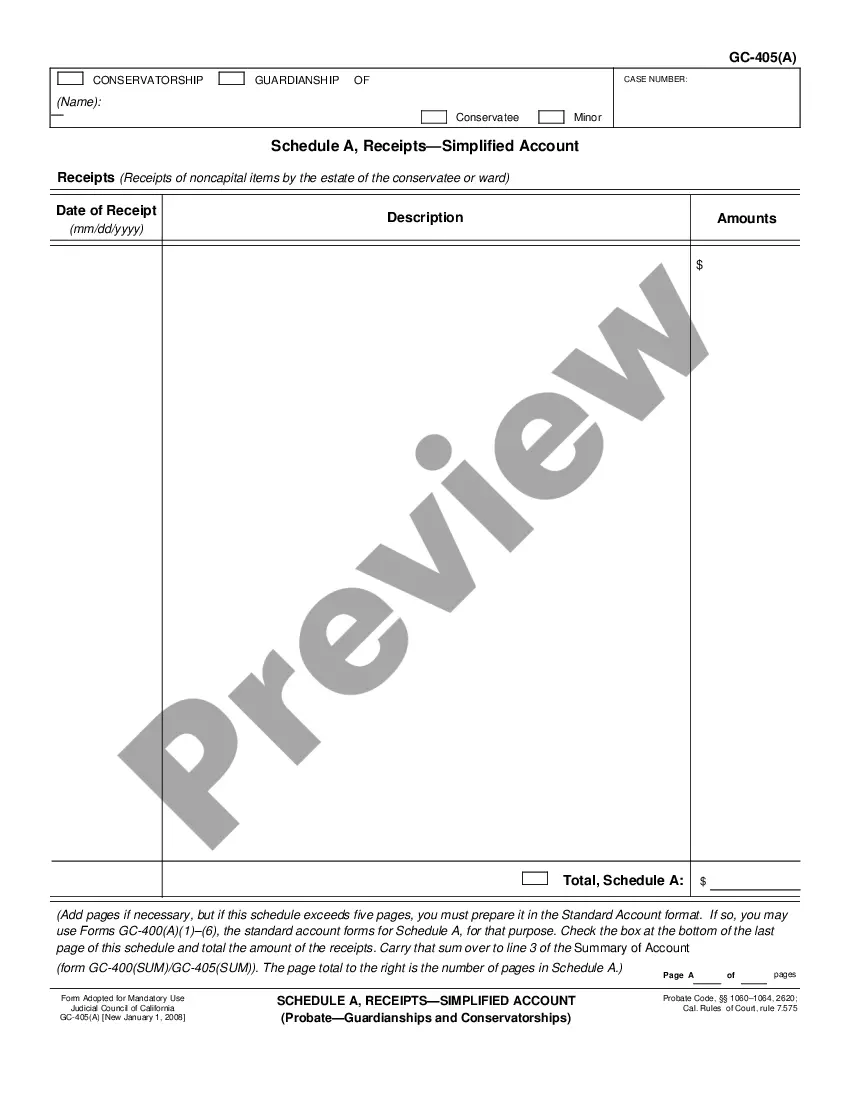

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Hayward California Schedule B, Gains on Sales-Standard and Simplified Accounts is a financial reporting schedule that provides detailed information regarding gains on sales for standard and simplified accounts in the city of Hayward, California. This schedule is usually part of the annual tax filings and is utilized to disclose profits or gains realized from the sale of assets within a given taxable period. The Hayward California Schedule B, Gains on Sales-Standard and Simplified Accounts consists of various types, each catering to different types of accounts and entities. Here are the main types of this schedule: 1. Individual Accounts: This type of Schedule B pertains to gains on sales reported by individual taxpayers residing in Hayward, California. It applies to gains derived from the sale of personal property such as real estate, vehicles, collectibles, or any other valuable assets held for personal use. 2. Business Accounts: Business entities, such as corporations, partnerships, or sole proprietorship operating in Hayward, California, must file this Schedule B to report gains on sales resulting from the disposal of business assets. It includes gains realized from the sale of inventory, equipment, buildings, or any other business assets held for investment or operational purposes. 3. Investment Accounts: Investors residing in Hayward, California, are required to file this Schedule B to report gains obtained from the sale of financial investments such as stocks, bonds, mutual funds, or other securities. It helps determine the capital gains tax applicable to these investments. 4. Real Estate Accounts: This type of Schedule B applies specifically to gains on sales related to real estate transactions within Hayward, California. It mandates detailed reporting on gains realized from selling residential, commercial, or industrial properties, including land, buildings, or any other real estate holdings. The purpose of the Hayward California Schedule B, Gains on Sales-Standard and Simplified Accounts is to ensure accurate reporting and compliance with the local tax regulations. It assists tax authorities in evaluating the taxable income generated from sales transactions, thereby determining the applicable tax liability for the city of Hayward, California taxpayers. By precisely categorizing gains on sales derived from various sources, this schedule aids in maintaining transparency and promoting fair taxation practices. It is essential for individuals, businesses, and investors to carefully complete this schedule, keeping accurate records and adhering to the guidelines set forth by the applicable tax authorities. Keywords: Hayward California, Schedule B, Gains on Sales, Standard and Simplified Accounts, individuals, businesses, investments, real estate, taxable period, tax filings, financial reporting schedule, tax compliance, tax liability, taxable income.Hayward California Schedule B, Gains on Sales-Standard and Simplified Accounts is a financial reporting schedule that provides detailed information regarding gains on sales for standard and simplified accounts in the city of Hayward, California. This schedule is usually part of the annual tax filings and is utilized to disclose profits or gains realized from the sale of assets within a given taxable period. The Hayward California Schedule B, Gains on Sales-Standard and Simplified Accounts consists of various types, each catering to different types of accounts and entities. Here are the main types of this schedule: 1. Individual Accounts: This type of Schedule B pertains to gains on sales reported by individual taxpayers residing in Hayward, California. It applies to gains derived from the sale of personal property such as real estate, vehicles, collectibles, or any other valuable assets held for personal use. 2. Business Accounts: Business entities, such as corporations, partnerships, or sole proprietorship operating in Hayward, California, must file this Schedule B to report gains on sales resulting from the disposal of business assets. It includes gains realized from the sale of inventory, equipment, buildings, or any other business assets held for investment or operational purposes. 3. Investment Accounts: Investors residing in Hayward, California, are required to file this Schedule B to report gains obtained from the sale of financial investments such as stocks, bonds, mutual funds, or other securities. It helps determine the capital gains tax applicable to these investments. 4. Real Estate Accounts: This type of Schedule B applies specifically to gains on sales related to real estate transactions within Hayward, California. It mandates detailed reporting on gains realized from selling residential, commercial, or industrial properties, including land, buildings, or any other real estate holdings. The purpose of the Hayward California Schedule B, Gains on Sales-Standard and Simplified Accounts is to ensure accurate reporting and compliance with the local tax regulations. It assists tax authorities in evaluating the taxable income generated from sales transactions, thereby determining the applicable tax liability for the city of Hayward, California taxpayers. By precisely categorizing gains on sales derived from various sources, this schedule aids in maintaining transparency and promoting fair taxation practices. It is essential for individuals, businesses, and investors to carefully complete this schedule, keeping accurate records and adhering to the guidelines set forth by the applicable tax authorities. Keywords: Hayward California, Schedule B, Gains on Sales, Standard and Simplified Accounts, individuals, businesses, investments, real estate, taxable period, tax filings, financial reporting schedule, tax compliance, tax liability, taxable income.