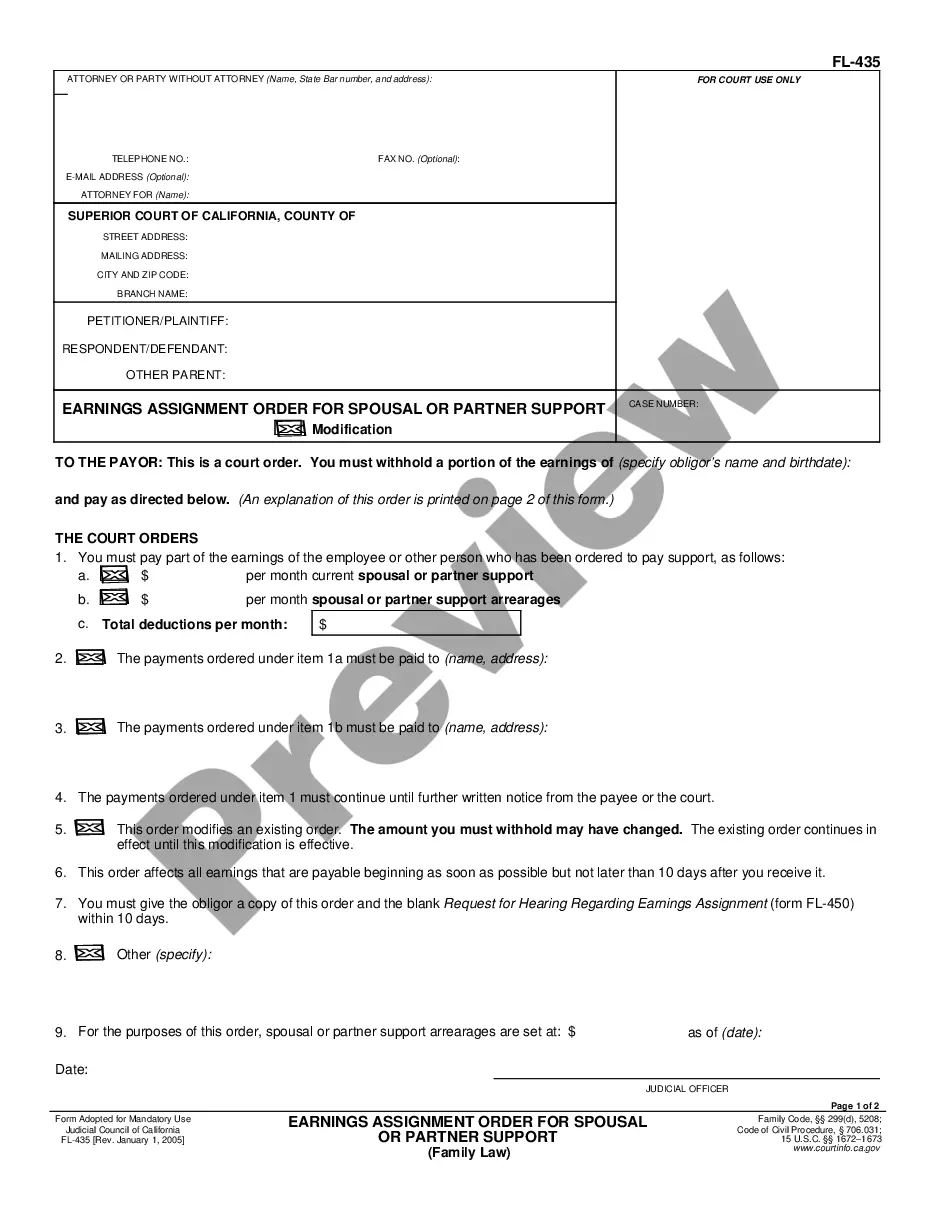

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Victorville California Schedule C, Disbursements, Simplified Account: Detailed Description and Types In Victorville, California, Schedule C refers to a tax form utilized by self-employed individuals to report and calculate their business income or loss. Specifically, Victorville business owners or individuals conducting independent business activities file this form to report profits or losses from a sole proprietorship, freelancer work, or other similar ventures. Disbursements, on the other hand, refer to the payments made or expenses incurred by a business. These expenses can include costs related to supplies, utilities, travel, advertising, wages, and more. By accurately tracking and documenting disbursements, businesses can deduct these expenses from their income, thereby reducing their taxable profits. To streamline the bookkeeping process, business owners in Victorville can opt for the Simplified Account option, allowing them to maintain a simplified record of their business transactions. This simplified method significantly eases the burden of bookkeeping for smaller businesses that may not require complex accounting systems. Keywords: 1. Victorville California Schedule C: This term refers to the specific tax form used by self-employed individuals in Victorville, California, to report their business income or losses. 2. Disbursements: Describes the expenses or payments made by a business entity, which can be deducted from the business's income to reduce taxable profits. 3. Simplified Account: Indicates a simplified record-keeping method chosen by small business owners in Victorville, which minimizes complex accounting processes and streamlines bookkeeping tasks. Regarding different types or variations of Schedule C or Disbursements, there aren't any distinct classifications specific to Victorville, California. However, it is worth mentioning that Schedule C forms can vary based on the taxpayer's business activity type or industry, such as professional services, retail, construction, etc. Disbursements can also vary significantly depending on the nature of the business, its size, and the industry in which it operates.Victorville California Schedule C, Disbursements, Simplified Account: Detailed Description and Types In Victorville, California, Schedule C refers to a tax form utilized by self-employed individuals to report and calculate their business income or loss. Specifically, Victorville business owners or individuals conducting independent business activities file this form to report profits or losses from a sole proprietorship, freelancer work, or other similar ventures. Disbursements, on the other hand, refer to the payments made or expenses incurred by a business. These expenses can include costs related to supplies, utilities, travel, advertising, wages, and more. By accurately tracking and documenting disbursements, businesses can deduct these expenses from their income, thereby reducing their taxable profits. To streamline the bookkeeping process, business owners in Victorville can opt for the Simplified Account option, allowing them to maintain a simplified record of their business transactions. This simplified method significantly eases the burden of bookkeeping for smaller businesses that may not require complex accounting systems. Keywords: 1. Victorville California Schedule C: This term refers to the specific tax form used by self-employed individuals in Victorville, California, to report their business income or losses. 2. Disbursements: Describes the expenses or payments made by a business entity, which can be deducted from the business's income to reduce taxable profits. 3. Simplified Account: Indicates a simplified record-keeping method chosen by small business owners in Victorville, which minimizes complex accounting processes and streamlines bookkeeping tasks. Regarding different types or variations of Schedule C or Disbursements, there aren't any distinct classifications specific to Victorville, California. However, it is worth mentioning that Schedule C forms can vary based on the taxpayer's business activity type or industry, such as professional services, retail, construction, etc. Disbursements can also vary significantly depending on the nature of the business, its size, and the industry in which it operates.