This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

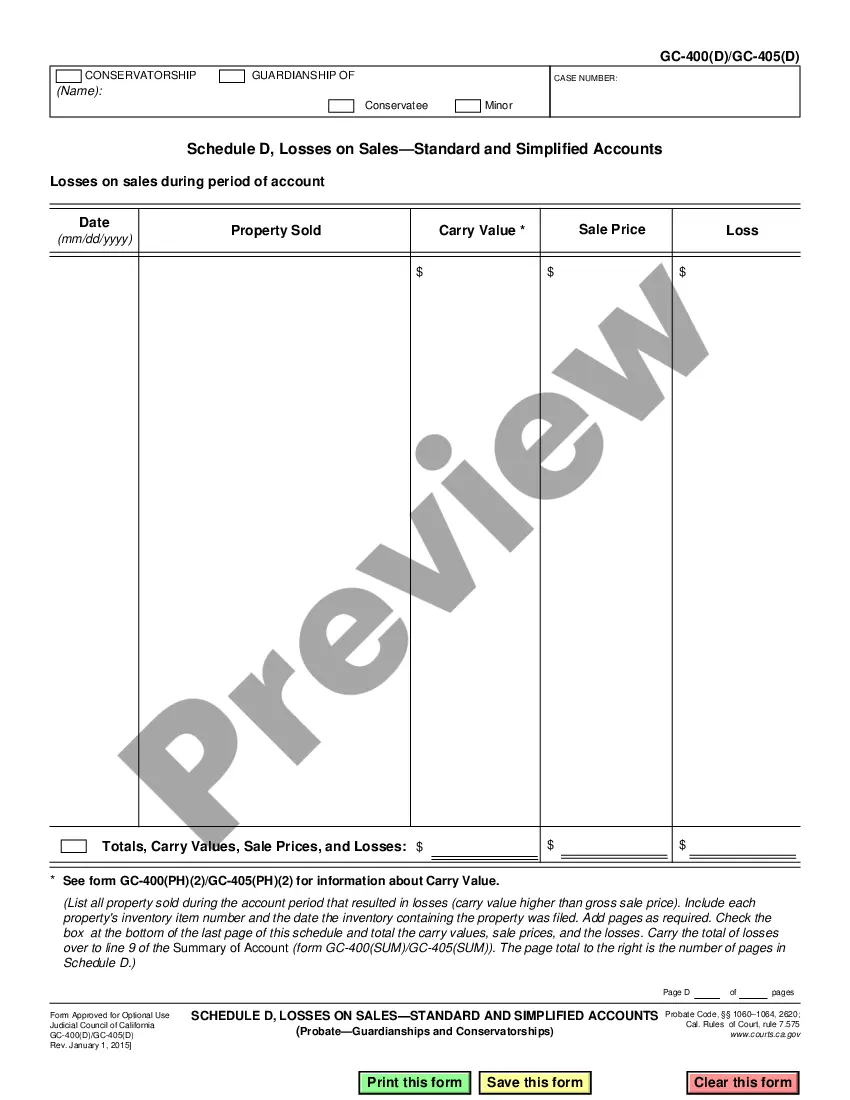

Elk Grove California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D)

Description

How to fill out California Schedule D, Losses On Sales-Standard And Simplified Accounts 405(D)?

Utilize the US Legal Forms and gain immediate access to any document you need.

Our user-friendly website featuring a vast array of forms makes it easy to locate and obtain nearly any document example you need.

You can download, fill out, and endorse the Elk Grove California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) in merely a few minutes instead of spending hours online seeking the correct template.

Using our collection is a great way to enhance the security of your document submissions.

Locate the document you need. Make sure it is the form you were looking for: review its title and description, and utilize the Preview feature if it is available. Otherwise, use the Search field to find the correct one.

Initiate the download process. Click Buy Now and select the payment plan that fits your needs best. Then, register for an account and pay for your purchase using a credit card or PayPal.

- Our skilled attorneys routinely review all documents to ensure that the templates are suitable for specific regions and comply with current regulations and laws.

- How can you acquire the Elk Grove California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D)? If you already possess an account, simply Log In to your profile.

- The Download button will be available on all the forms you view.

- Additionally, you can access all previously saved documents in the My documents section.

- If you have not yet created an account, follow the instructions listed below.

Form popularity

FAQ

To find your California capital loss carryover in TurboTax, navigate to the section for investment income and losses. Here, you will input your relevant information, including any losses reported on your Schedule D. TurboTax will automatically calculate carryover amounts based on your entries. Using this software simplifies the process and ensures you capture all available tax benefits related to Elk Grove California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D).

To figure out your California capital loss carryover, start by reviewing your completed Schedule D. Calculate your total capital gains and losses for the year, and if your losses exceed gains, you can carry over the remaining amount. Keep detailed records of your transactions to support your calculations. Utilizing resources like USLegalForms can help clarify the complexities of the Elk Grove California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D).

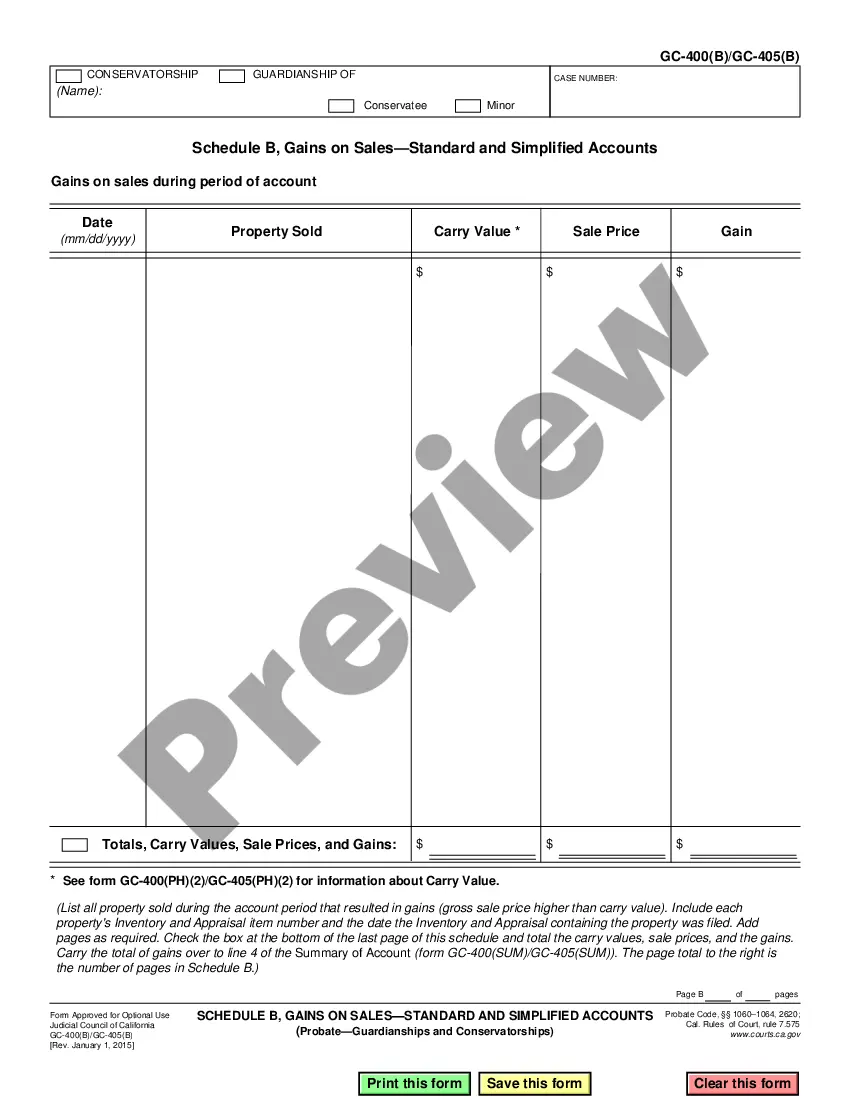

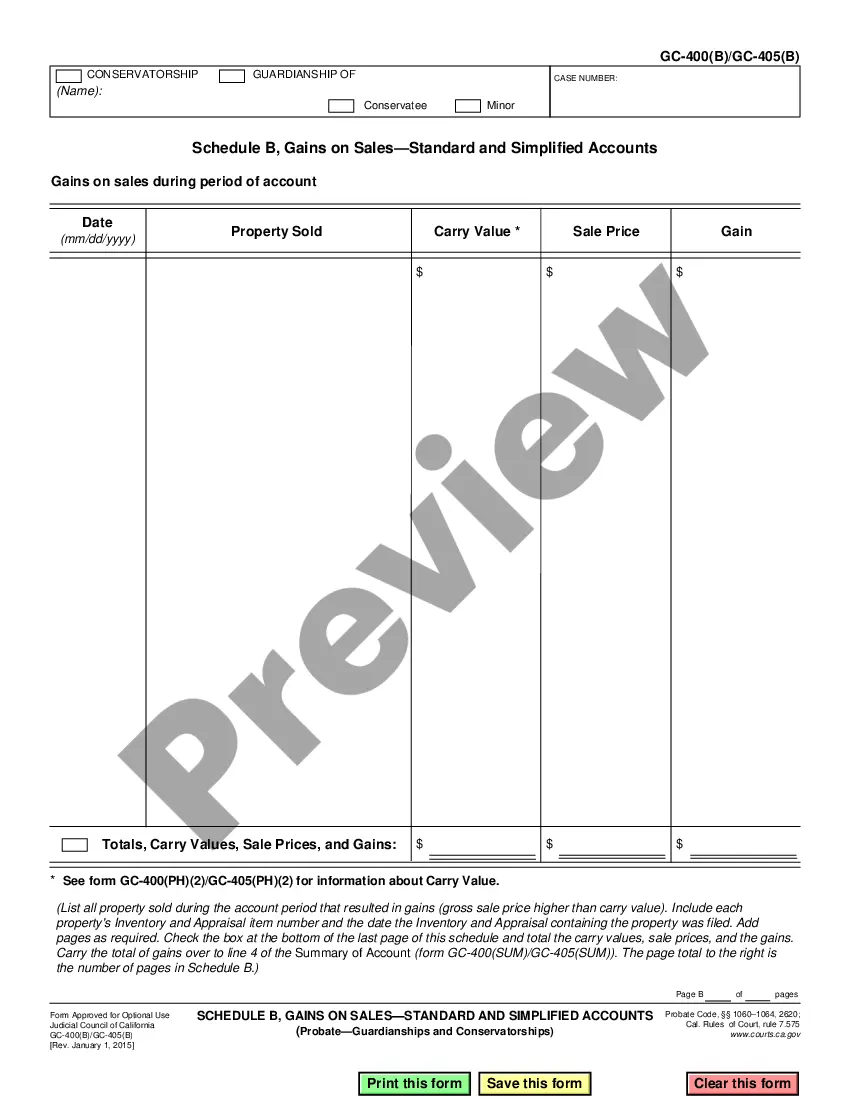

An example of a Schedule D would include transactions such as selling stocks or bonds at a loss. For instance, if you bought 100 shares of a company for $1,000 and sold them for $600, you would report a capital loss of $400 on your Schedule D. This reporting allows you to apply your losses against future gains, ultimately lowering your taxable income. Understanding how to fill out the Elk Grove California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) is essential for effective tax management.

To determine your California capital loss carryover, refer to your federal tax return where you report capital losses. California treats capital losses similarly, so this amount will usually mirror the figures on your Schedule D. For accuracy, ensure to review any adjustments specific to California tax laws. If you need assistance, USLegalForms can help guide you through the process.

You can find your capital loss carryover amount on your previous year’s tax return. Specifically, this information is typically reported on Schedule D for the prior tax year. If you have used your losses to offset other income, the carryover amount may also be indicated there. This detail is crucial for accurately completing your current tax return, especially when utilizing Elk Grove California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D).

The Schedule D tax worksheet assists you in calculating your capital gains and losses, streamlining your tax preparation process. When dealing with Elk Grove California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D), this worksheet helps you identify which transactions qualify as losses. The worksheet guides you through the calculations required to determine your net capital gain or loss. By using it, you can ensure compliance with the IRS requirements.

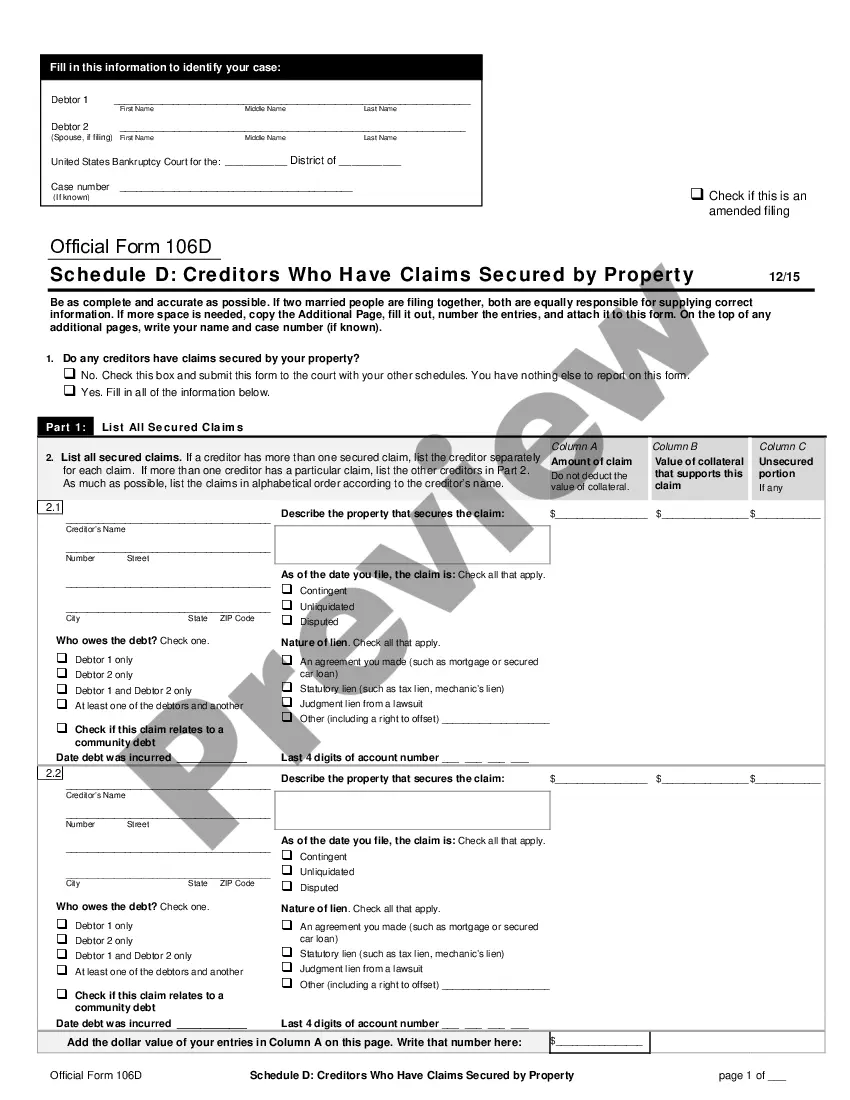

To claim investment losses, you will typically use Form 1040, Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D). This form helps you report capital gains and losses. By completing Schedule D, you can effectively summarize your investment losses, providing a clear picture of your financial situation. Make sure to include all relevant information to ensure accurate filing.