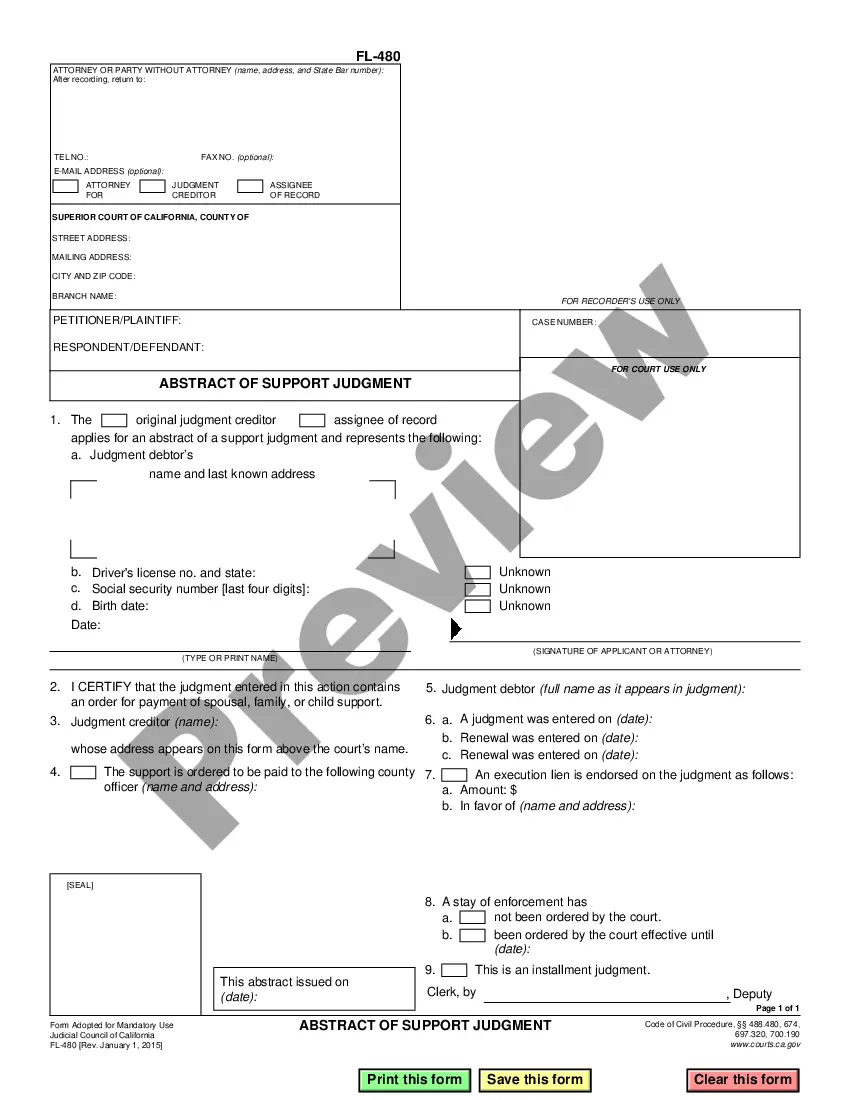

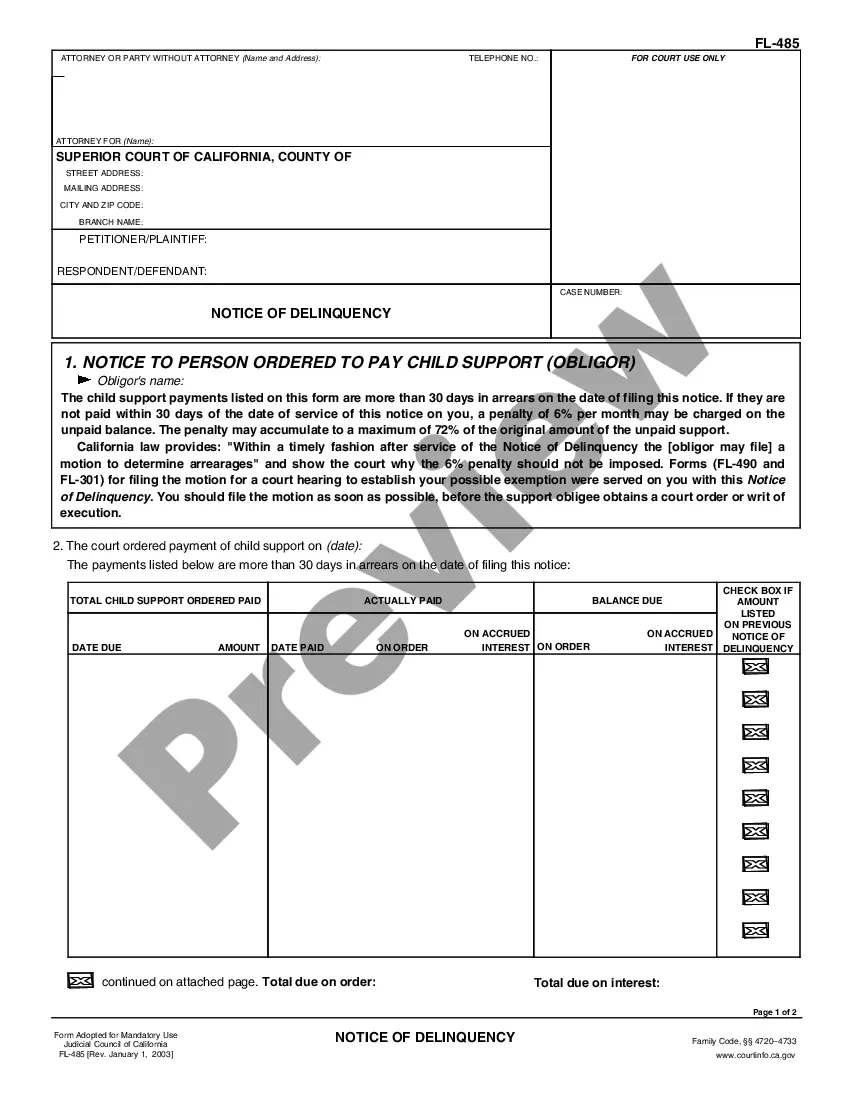

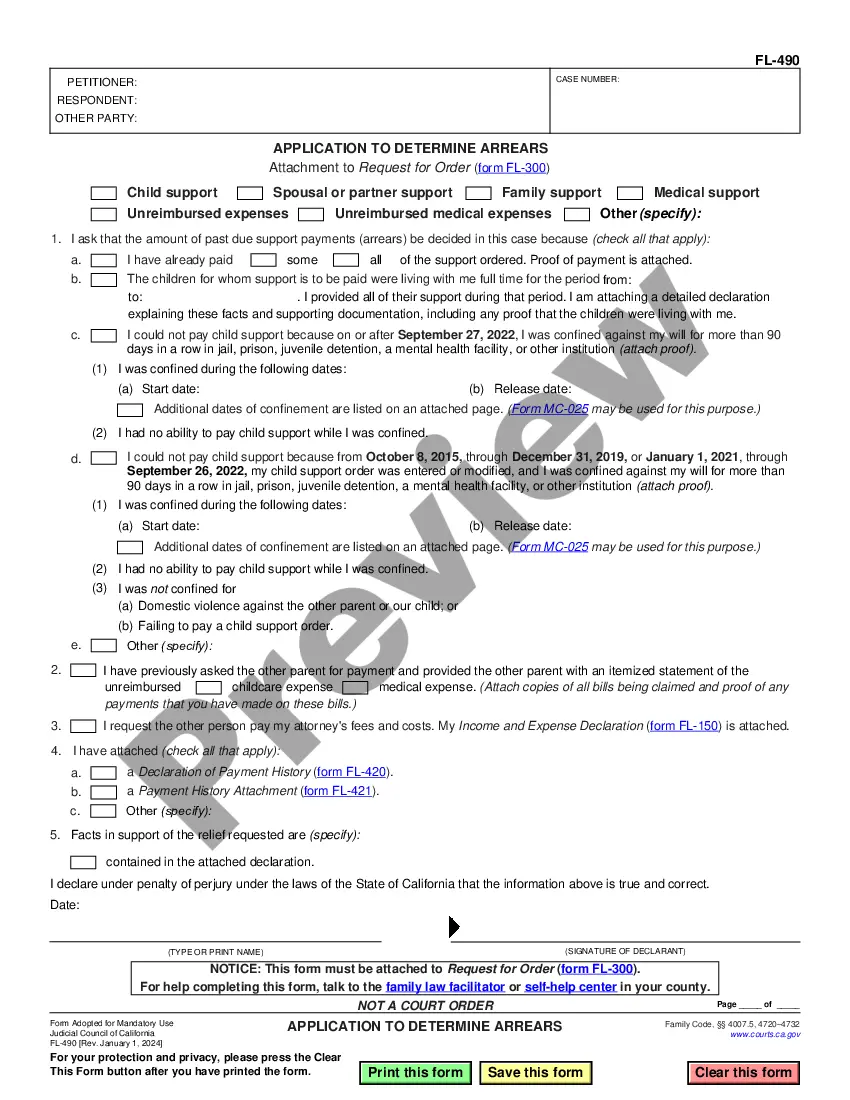

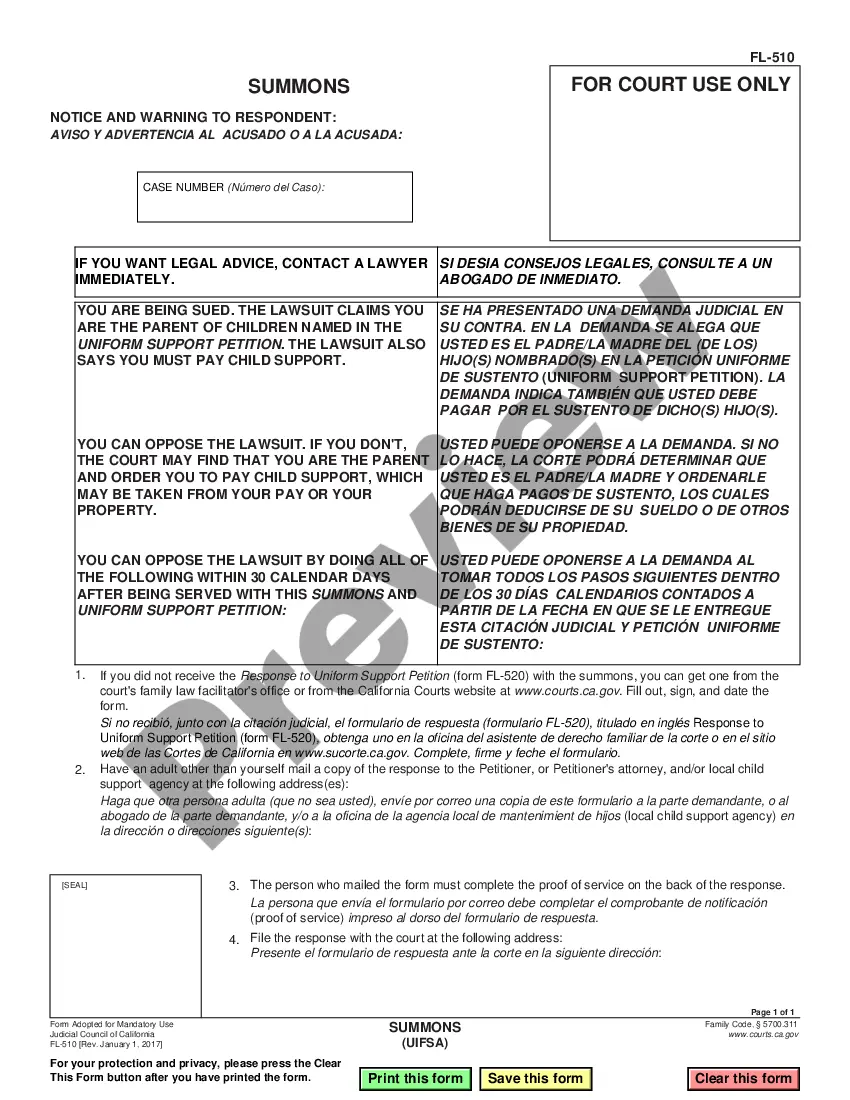

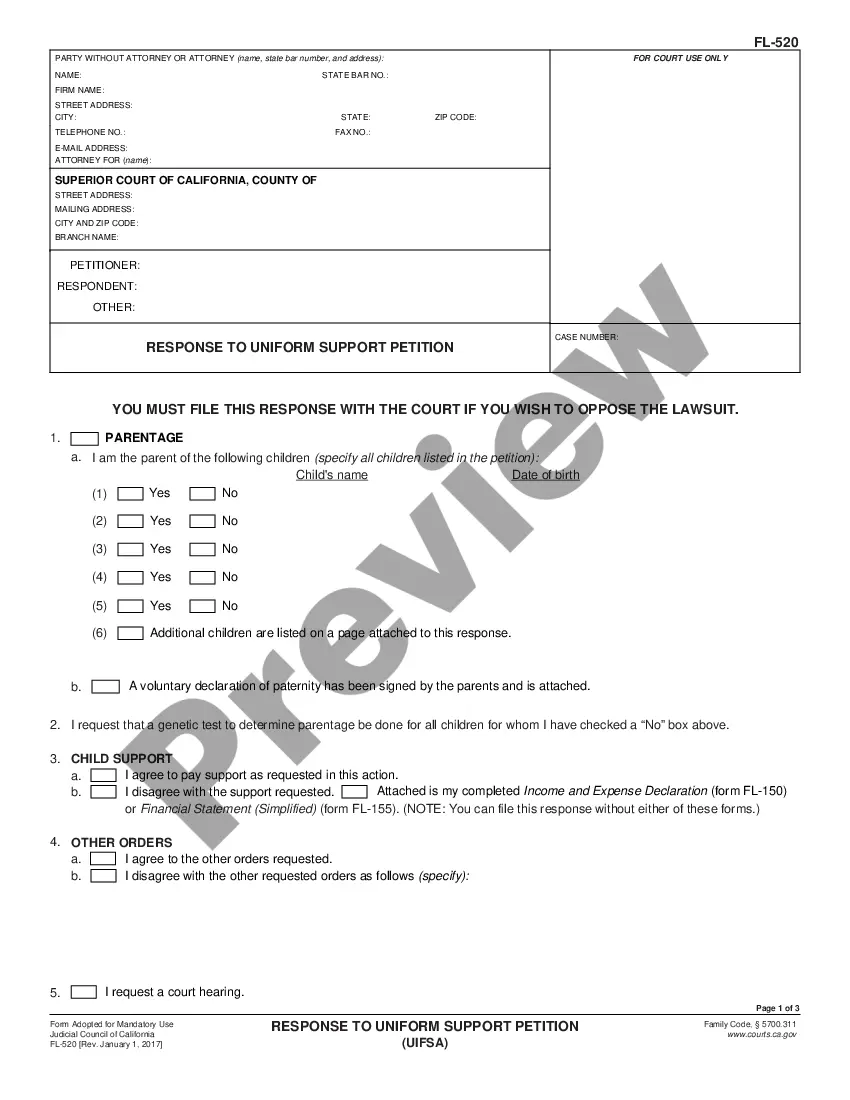

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Long Beach California Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts refer to the available cash resources held by an individual or organization in Long Beach, California at the end of an accounting period. This financial indicator showcases the amount of cash that remained utilized or invested, providing insight into the entity's liquidity and financial position. In standard accounting practices, Long Beach California Cash Assets on Hand at End of Account Period-Standard Accounts involve a detailed examination of all cash inflows and outflows throughout the accounting period. This includes tracking revenue from sales, investments, financing activities, and various operating costs, such as salaries, rent, utilities, and inventory expenses. By comparing the total cash inflows to the outflows, one can determine the net cash assets acquired or depleted during the period. On the other hand, Long Beach California Cash Assets on Hand at End of Account Period-Simplified Accounts utilize a more straightforward approach to calculate cash assets. Rather than delving into minute details, simplified accounts focus on the overall cash balances at the beginning and end of the accounting period. This eliminates the need for tracking every transaction, making it more suitable for small businesses, entrepreneurs, or individuals who don't require a complex accounting system. Different types of Long Beach California Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts may include: 1. Operating Cash Assets: This refers to the cash accumulated or depleted through routine business operations, such as sales, customer payments, and day-to-day expenses. 2. Investing Cash Assets: These are cash resources involved in long-term investments, such as purchasing assets, stocks, bonds, or real estate. Investing activities impact the overall cash assets on hand. 3. Financing Cash Assets: This category involves cash obtained or utilized through activities like borrowing money, repaying loans, issuing stocks, or paying dividends. It determines the cash flow related to external sources, ensuring cash availability for business operations. 4. Cash Equivalents: Apart from physical cash, cash equivalents like short-term investments, treasury bills, or money market funds are also considered when calculating Long Beach California Cash Assets on Hand at the End of an Account Period. These assets can be quickly converted into cash and contribute to the overall liquidity of an entity. In conclusion, Long Beach California Cash Assets on Hand at the End of an Account Period-Standard and Simplified Accounts provide vital insights into an individual or organization's financial stability and liquidity. By analyzing the various types of cash assets and their changes over time, businesses can make informed decisions regarding investment opportunities, working capital, and future growth strategies.Long Beach California Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts refer to the available cash resources held by an individual or organization in Long Beach, California at the end of an accounting period. This financial indicator showcases the amount of cash that remained utilized or invested, providing insight into the entity's liquidity and financial position. In standard accounting practices, Long Beach California Cash Assets on Hand at End of Account Period-Standard Accounts involve a detailed examination of all cash inflows and outflows throughout the accounting period. This includes tracking revenue from sales, investments, financing activities, and various operating costs, such as salaries, rent, utilities, and inventory expenses. By comparing the total cash inflows to the outflows, one can determine the net cash assets acquired or depleted during the period. On the other hand, Long Beach California Cash Assets on Hand at End of Account Period-Simplified Accounts utilize a more straightforward approach to calculate cash assets. Rather than delving into minute details, simplified accounts focus on the overall cash balances at the beginning and end of the accounting period. This eliminates the need for tracking every transaction, making it more suitable for small businesses, entrepreneurs, or individuals who don't require a complex accounting system. Different types of Long Beach California Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts may include: 1. Operating Cash Assets: This refers to the cash accumulated or depleted through routine business operations, such as sales, customer payments, and day-to-day expenses. 2. Investing Cash Assets: These are cash resources involved in long-term investments, such as purchasing assets, stocks, bonds, or real estate. Investing activities impact the overall cash assets on hand. 3. Financing Cash Assets: This category involves cash obtained or utilized through activities like borrowing money, repaying loans, issuing stocks, or paying dividends. It determines the cash flow related to external sources, ensuring cash availability for business operations. 4. Cash Equivalents: Apart from physical cash, cash equivalents like short-term investments, treasury bills, or money market funds are also considered when calculating Long Beach California Cash Assets on Hand at the End of an Account Period. These assets can be quickly converted into cash and contribute to the overall liquidity of an entity. In conclusion, Long Beach California Cash Assets on Hand at the End of an Account Period-Standard and Simplified Accounts provide vital insights into an individual or organization's financial stability and liquidity. By analyzing the various types of cash assets and their changes over time, businesses can make informed decisions regarding investment opportunities, working capital, and future growth strategies.