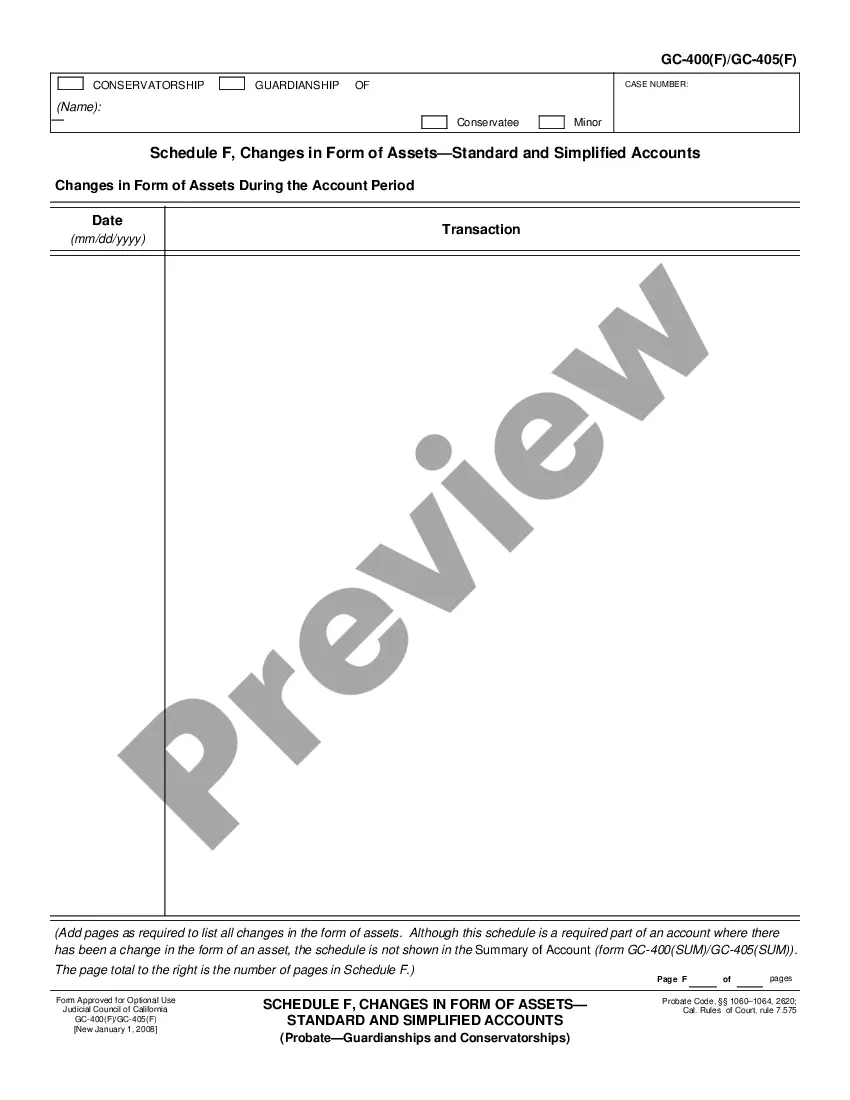

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Vacaville California Cash Assets on Hand at End of Account Period: Standard and Simplified Accounts In Vacaville, California, Cash Assets on Hand at the End of an Account Period is an important financial factor for individuals and businesses alike. It refers to the total amount of cash resources available at the end of a specific accounting period. Standard Accounts generally follow the traditional accrual basis of accounting, while Simplified Accounts rely on a simplified cash basis. Both methods provide a comprehensive view of financial transactions, but they differ in terms of complexity and reporting requirements. For Standard Accounts, the Cash Assets on Hand at the End of the Account Period includes various types of cash resources. These can consist of: 1. Cash in Hand: This refers to physical currency and coins held by an individual or organization at the end of the accounting period. It includes cash kept in registers, safes, or lockboxes. 2. Cash in Bank: This category includes all funds deposited in banks and financial institutions, including checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). 3. Cash Equivalents: These are highly liquid investments that can be readily converted into cash within a short period, usually within three months or less. Examples of cash equivalents are treasury bills, commercial paper, and certificates of deposit. 4. Deposited Funds: These comprise cash or checks received but not yet deposited into a bank account. It might consist of payments collected on the last day of the accounting period, which have not been submitted to a financial institution. In Simplified Accounts, the Cash Assets on Hand at the End of the Account Period is generally more straightforward. It mainly focuses on physical cash, cash in bank accounts, and deposited funds, omitting cash equivalents, which are not as common for simpler accounting systems. It is crucial for individuals and businesses in Vacaville, California to accurately calculate their Cash Assets on Hand at the End of an Account Period. This information helps in assessing financial stability, evaluating liquidity, and making informed decisions regarding investments, expenses, and savings. By diligently tracking and recording these cash resources, individuals and businesses can ensure financial transparency, fulfill tax obligations, and make strategic financial plans for the future. Remember, maintaining accurate and up-to-date financial records is a fundamental aspect of successful financial management in Vacaville, California.Vacaville California Cash Assets on Hand at End of Account Period: Standard and Simplified Accounts In Vacaville, California, Cash Assets on Hand at the End of an Account Period is an important financial factor for individuals and businesses alike. It refers to the total amount of cash resources available at the end of a specific accounting period. Standard Accounts generally follow the traditional accrual basis of accounting, while Simplified Accounts rely on a simplified cash basis. Both methods provide a comprehensive view of financial transactions, but they differ in terms of complexity and reporting requirements. For Standard Accounts, the Cash Assets on Hand at the End of the Account Period includes various types of cash resources. These can consist of: 1. Cash in Hand: This refers to physical currency and coins held by an individual or organization at the end of the accounting period. It includes cash kept in registers, safes, or lockboxes. 2. Cash in Bank: This category includes all funds deposited in banks and financial institutions, including checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). 3. Cash Equivalents: These are highly liquid investments that can be readily converted into cash within a short period, usually within three months or less. Examples of cash equivalents are treasury bills, commercial paper, and certificates of deposit. 4. Deposited Funds: These comprise cash or checks received but not yet deposited into a bank account. It might consist of payments collected on the last day of the accounting period, which have not been submitted to a financial institution. In Simplified Accounts, the Cash Assets on Hand at the End of the Account Period is generally more straightforward. It mainly focuses on physical cash, cash in bank accounts, and deposited funds, omitting cash equivalents, which are not as common for simpler accounting systems. It is crucial for individuals and businesses in Vacaville, California to accurately calculate their Cash Assets on Hand at the End of an Account Period. This information helps in assessing financial stability, evaluating liquidity, and making informed decisions regarding investments, expenses, and savings. By diligently tracking and recording these cash resources, individuals and businesses can ensure financial transparency, fulfill tax obligations, and make strategic financial plans for the future. Remember, maintaining accurate and up-to-date financial records is a fundamental aspect of successful financial management in Vacaville, California.