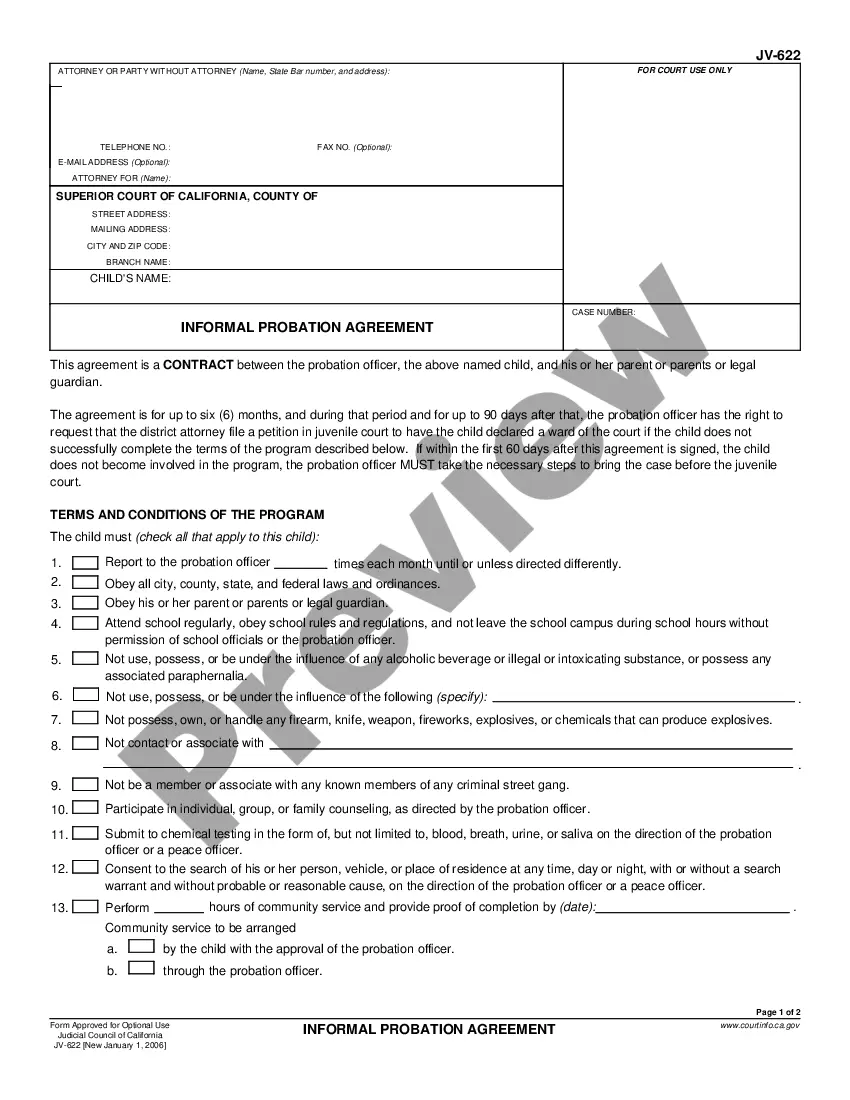

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Jurupa Valley, located in California, maintains a comprehensive record of its non-cash assets on hand at the end of each accounting period. This data is crucial for assessing the organization's financial health and making informed decisions regarding future growth and investments. Jurupa Valley utilizes both standard and simplified accounts to track these non-cash assets effectively. 1. Standard Accounts: a. Real Estate Holdings: Jurupa Valley possesses various properties, including land, buildings, and infrastructure, that are valuable assets for the city's development. These assets contribute to the city's overall net worth. b. Equipment and Machinery: Non-cash assets such as vehicles, heavy machinery, computers, and office equipment are essential for Jurupa Valley's daily operations. The city maintains a detailed record of the value and condition of these assets. c. Infrastructure Assets: Public infrastructure, including roads, bridges, parks, and utilities, like water and sewer systems, are valuable non-cash assets. Jurupa Valley keeps a thorough account of their worth and ensures their upkeep. d. Publicly Owned Facilities: Additionally, buildings and facilities owned by Jurupa Valley, such as libraries, community centers, and sports complexes, are considered non-cash assets. e. Land Assets: Apart from real estate holdings, undeveloped land or vacant lots owned by the city are significant non-cash assets that can be utilized for future projects or sold for economic development. 2. Simplified Accounts: a. Inventories: Jurupa Valley may have inventories of supplies or materials that they use on a regular basis but do not track individually. They may estimate the value of these items as a non-cash asset. b. Accounts Receivable: Non-cash assets can also include outstanding payments due to the city, such as unpaid taxes, grants, or fees from residents, businesses, or government entities. c. Prepaid Expenses: Any advance payments made for services or expenses that Jurupa Valley may incur in the future, such as insurance premiums or maintenance contracts, are recorded as non-cash assets. Jurupa Valley's accounting professionals carefully compile and monitor these non-cash assets to provide an accurate picture of the city's financial standing. This information is essential for making informed budgetary decisions, securing financing for development projects, and ensuring accountability and transparency in managing public resources.