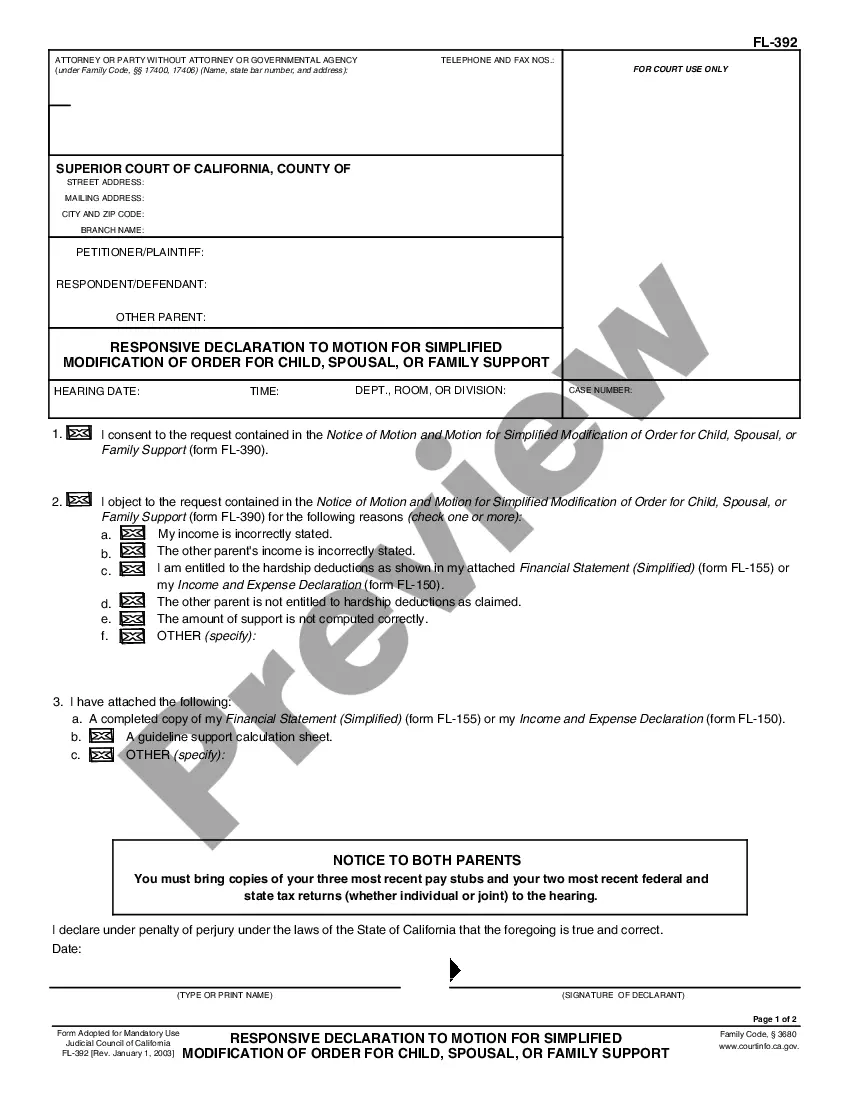

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Salinas California Schedule F, Changes in Form of Assets — Standard and Simplified Accounts is a financial reporting document that outlines the different types of asset changes and provides a detailed account of any modifications made to the assets in Salinas, California. This schedule is crucial for individuals, companies, and organizations to accurately keep track of their assets and report any changes to the appropriate authorities. There are two main types of Salinas California Schedule F, Changes in Form of Assets — Standard and Simplified Accounts: Standard and Simplified. Let's explore each type in more detail: 1. Standard Salinas California Schedule F: The standard version of Schedule F provides a comprehensive overview of all changes in the form of assets. It includes a detailed breakdown of various asset categories, such as real estate, investments, vehicles, machinery, equipment, and more. Each asset category is further divided to capture specific changes made within that category, such as purchase, sale, transfer, lease, or disposal. This version of the schedule is commonly used by larger organizations or individuals with complex asset portfolios that require more detailed reporting. 2. Simplified Salinas California Schedule F: The simplified version of Schedule F is designed for individuals or small businesses with relatively straightforward asset holdings. It offers a condensed and user-friendly format to report changes in asset forms, making it easier to complete and understand. While it still captures key information regarding asset changes, it may not provide the same level of granularity as the standard version. This simplified version is suited for individuals or businesses with fewer asset types or more straightforward transactions. Regardless of the type chosen, Salinas California Schedule F, Changes in Form of Assets — Standard and Simplified Accounts must be filled out accurately and submitted in a timely manner to comply with financial reporting regulations. It is crucial to consult with a qualified accountant or use appropriate accounting software to ensure the schedule is completed correctly and adheres to the relevant guidelines. Keywords: Salinas California, Schedule F, Changes in Form of Assets, Standard Accounts, Simplified Accounts, asset changes, financial reporting, asset categories, real estate, investments, vehicles, machinery, equipment, purchase, sale, transfer, lease, disposal, larger organizations, individuals, small businesses, simplified format, accurate reporting, financial regulations, qualified accountant, accounting software.