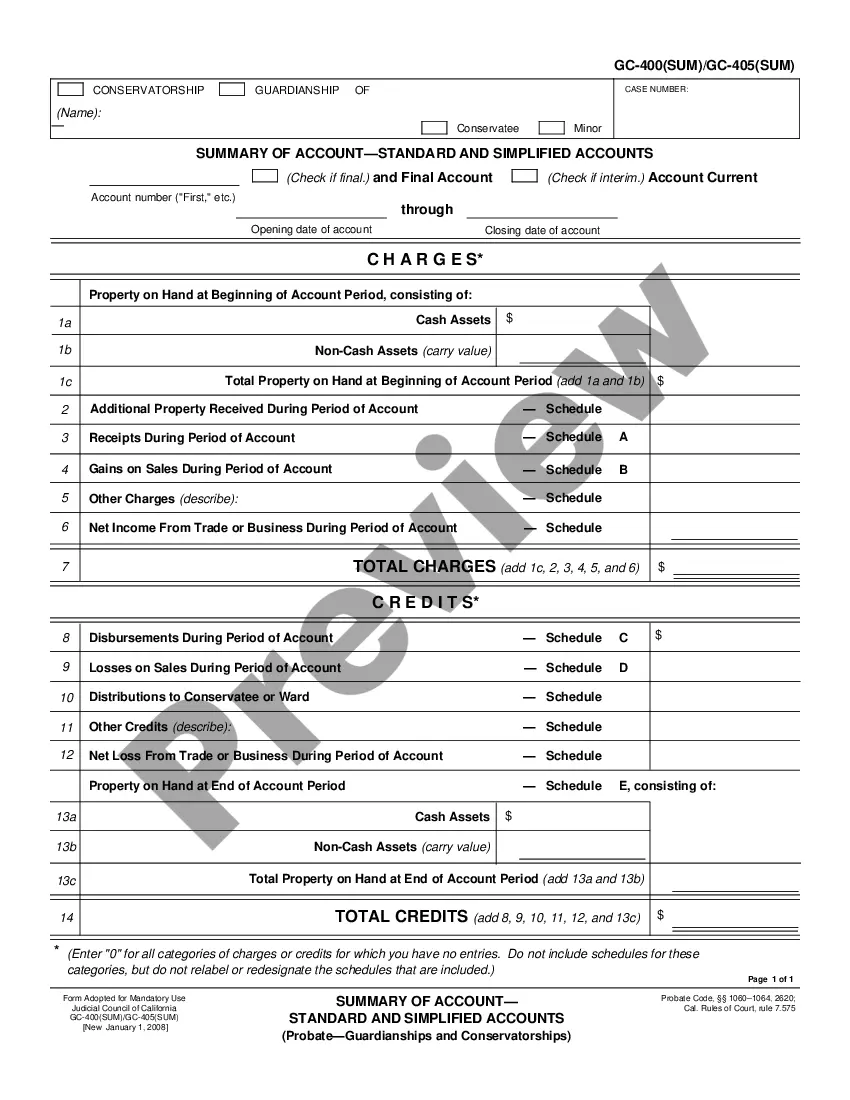

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Vallejo California Schedule F, also known as Changes in Form of Assets — Standard and Simplified Accounts, is a crucial document filed by individuals, businesses, and organizations operating in Vallejo, California. This form pertains to recording any alterations made in the form of assets owned by the entity during a specific tax period. The purpose of Vallejo California Schedule F is to provide a comprehensive overview of any changes that have occurred in the assets owned by an individual or business. These changes can include conversions, exchanges, dispositions, distributions or adjustments that may have taken place. Keywords: Vallejo California Schedule F, Changes in Form of Assets, Standard and Simplified Accounts, tax period, alterations, conversions, exchanges, dispositions, distributions, adjustments. There are two types of Vallejo California Schedule F, namely the Standard and Simplified Accounts: 1. Standard Accounts: The Standard Accounts version of Vallejo California Schedule F typically applies to businesses, corporations, and organizations with more complex holdings and financial structures. This form requires a more detailed account of the changes in assets, including specific figures and supporting documentation. 2. Simplified Accounts: The Simplified Accounts version of Vallejo California Schedule F is designed for individuals and businesses with relatively straightforward asset portfolios. It aims to simplify the process by allowing individuals to provide a more condensed overview of the changes in their assets. While this version may not require as much detailed information as the Standard Accounts version, it still requires accurate reporting ensuring compliance with tax regulations. Regardless of the version used, filing Vallejo California Schedule F is essential for maintaining accurate financial records and complying with tax laws in the city of Vallejo. It is advisable to consult with a qualified accountant or tax professional when completing this form to ensure accuracy and proper adherence to all legal requirements. In conclusion, Vallejo California Schedule F, Changes in Form of Assets — Standard and Simplified Accounts, is an important document used for reporting changes in assets during a specific tax period in Vallejo, California. Both the Standard and Simplified Accounts versions exist, catering to different entities' needs based on the complexity of their asset portfolios. Accurate completion of this form is vital for complying with tax regulations and maintaining proper financial records.