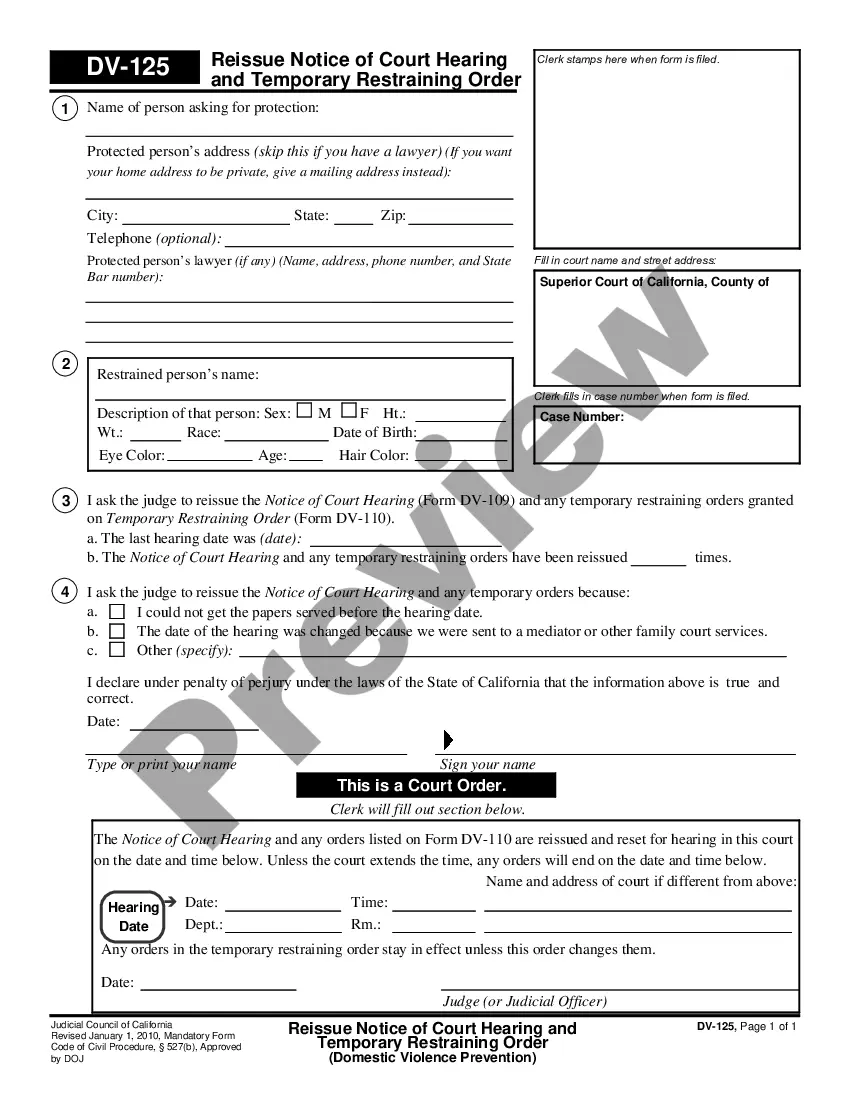

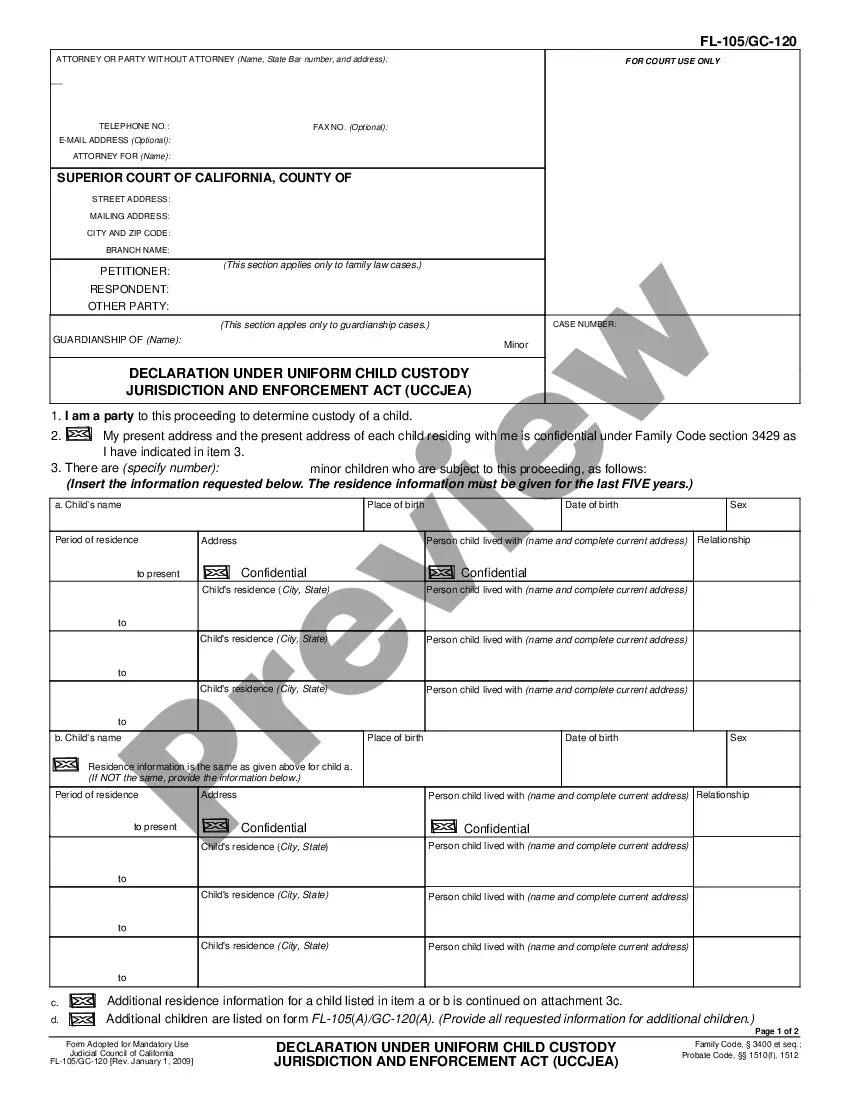

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Bakersfield California Schedule G, Liabilities at End of Account Period-Standard and Simplified Accounts is a financial document used for reporting liabilities at the end of an accounting period in Bakersfield, California. The schedule provides a detailed breakdown of an entity's outstanding debts and obligations, allowing for accurate financial reporting and analysis. In Standard Accounts, Bakersfield California Schedule G requires a more comprehensive and detailed approach towards reporting liabilities. It involves capturing and categorizing all types of debts, ranging from short-term liabilities such as accounts payable, accrued expenses, and short-term loans, to long-term obligations like mortgages, notes payable, and pension obligations. By differentiating between short-term and long-term liabilities, Standard Accounts provide a clear picture of an entity's financial health and its ability to meet its obligations. On the other hand, Simplified Accounts Bakersfield California Schedule G is designed for smaller businesses or entities with less complex financial structures. This version of the schedule may involve a more condensed list of liabilities, typically including only those accounts payable, notes payable, and other significant obligations relevant to the entity's operations. The use of relevant keywords to further explain the significance of Bakersfield California Schedule G, Liabilities at End of Account Period-Standard and Simplified Accounts can enhance the content's value and provide more context for readers. Keywords may include: 1. Financial reporting 2. Liabilities 3. Accounting period 4. Bakersfield, California 5. Standard Accounts 6. Simplified Accounts 7. Outstanding debts 8. Financial analysis 9. Short-term liabilities 10. Long-term obligations 11. Accurate financial reporting 12. Financial health 13. Meet obligations 14. Small businesses 15. Complex financial structures.