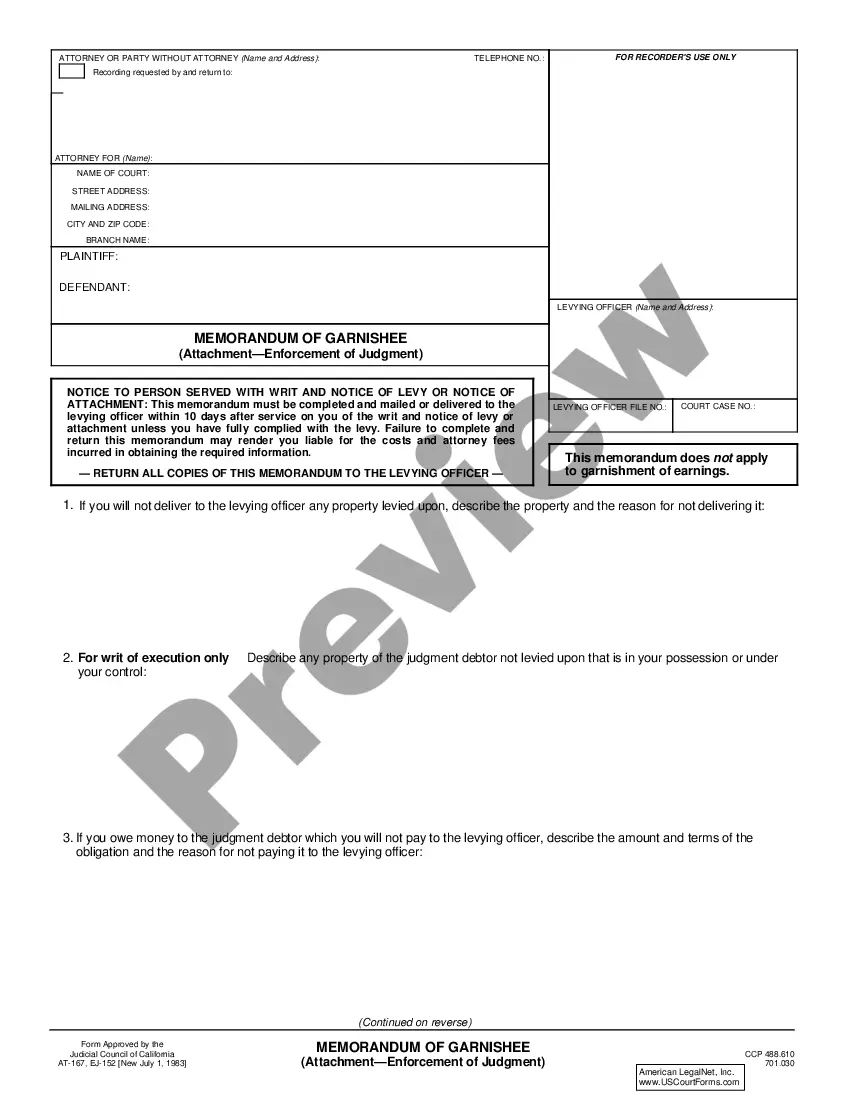

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Rialto California Schedule G, Liabilities at End of Account Period-Standard and Simplified Accounts is a financial document that provides a comprehensive overview of liabilities held by individuals or organizations at the end of an accounting period in Rialto, California. This schedule is an essential component of both standard and simplified accounts and helps in accurately determining the financial standing and obligations of an entity. This particular schedule is designed to focus specifically on liabilities, including outstanding debts, payables, and other financial obligations. By organizing and categorizing liabilities, Schedule G enables businesses and individuals to better understand their financial position, make informed decisions, and fulfill their obligations. In Rialto, California, there are two main types of Schedule G, namely Standard and Simplified Accounts. Let's explore each in more detail: 1. Rialto California Schedule G — Liabilities at End of Account Period-Standard Accounts: This version of Schedule G is typically used by larger businesses or entities with more complex financial structures. It requires a more detailed and comprehensive analysis of liabilities. The Standard Accounts version of Schedule G includes various sections and sub-sections to record liabilities with meticulous accuracy. It accounts for short-term and long-term liabilities, such as accounts payable, loans, mortgages, accrued expenses, taxes payable, and other obligations that might arise from business activities. 2. Rialto California Schedule G — Liabilities at End of Account Period-Simplified Accounts: The Simplified Accounts version of Schedule G is a condensed and streamlined version intended for small businesses, sole proprietors, or individuals with less complex financial arrangements. It offers an easier and more straightforward approach to reporting liabilities. The Simplified Accounts version focuses on capturing essential liability information. It may include sections like accounts payable, credit card balances, outstanding invoices, or any other financial obligations relevant to the entity. Both versions of Schedule G, Standard and Simplified Accounts, serve the purpose of presenting a clear picture of liabilities held at the end of an accounting period. The specific format and level of detail may vary, depending on the complexity and size of the entity. In summary, Rialto California Schedule G, Liabilities at End of Account Period-Standard and Simplified Accounts, is a crucial financial document used to disclose and organize liabilities effectively. It helps entities in Rialto, California, understand their financial obligations and make informed decisions regarding their finances. Both the Standard and Simplified Accounts versions of Schedule G offer distinct reporting options tailored to the complexity of the entity's financial structure.