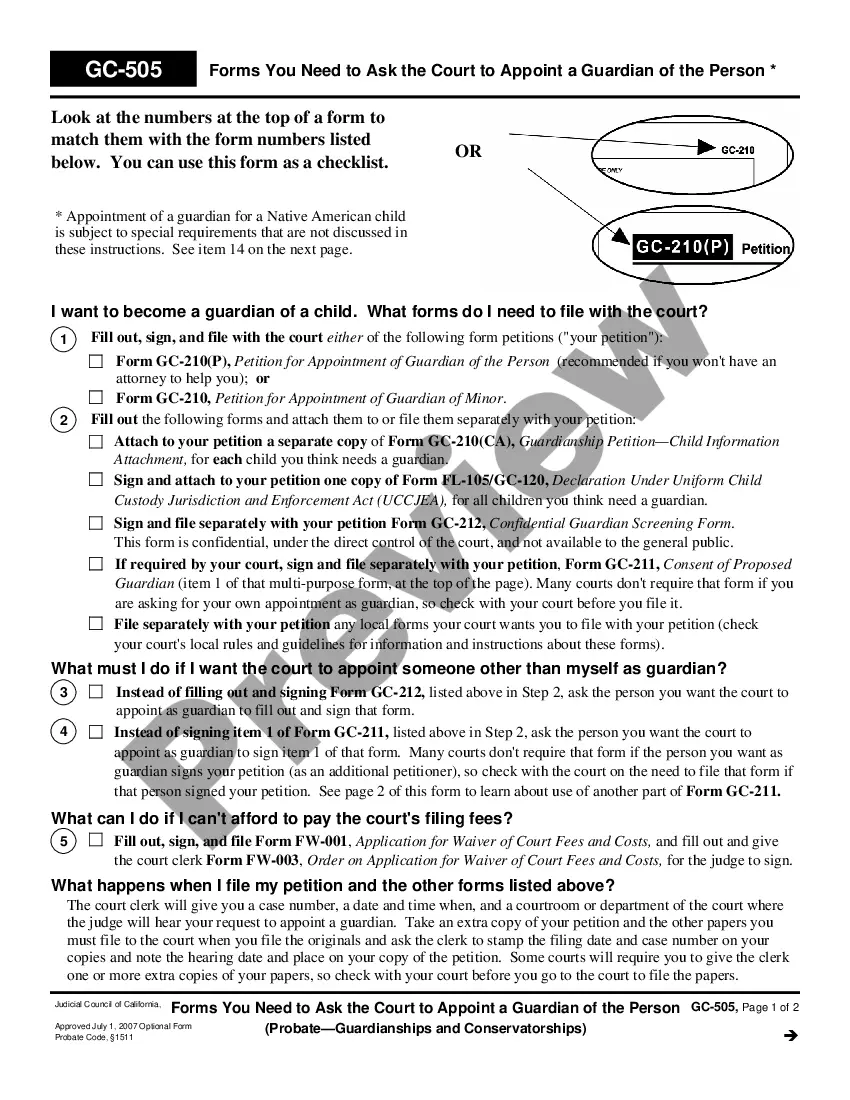

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Corona California Other Credits — Standard and Simplified Accounts serve as a valuable financial tool for individuals and businesses in the Corona, California area. Designed to offer diverse credit options to meet specific needs, these accounts provide flexibility, convenience, and numerous benefits to account holders. "Standard Accounts" are the traditional credit accounts offered in Corona, California. These accounts require completion of a detailed application process where applicants provide relevant personal and financial information. Once approved, account holders gain access to a predefined credit limit, often based on their creditworthiness, which they can use for various purposes such as making purchases, paying bills, or handling unforeseen expenses. "Standard Accounts" typically offer numerous advantages, including the ability to establish a credit history, improve credit scores, and access financial resources during cash flow fluctuations. Additionally, these accounts often come with added benefits like purchase protection, extended warranty coverage, and rewards programs, ensuring customers can maximize their financial gains. On the other hand, "Simplified Accounts" cater to individuals or businesses who may not have a well-established credit history or face challenges in meeting the eligibility criteria for traditional credit accounts. These accounts offer a simplified application process, requiring minimal documentation, making them accessible to a broader range of users. Simplified accounts may have lower credit limits initially, but as users demonstrate responsible usage and repayment behavior, they can unlock higher limits and more benefits. Both Standard and Simplified Accounts offer a range of features such as online account management, mobile banking applications, and customer support services, making them user-friendly and convenient. Account holders can monitor their balances, review transaction history, and set up automatic payments or alerts to stay on top of their finances. Whether it's for personal or business use, Corona California Other Credits — Standard and Simplified Accounts provide financial stability and peace of mind. They enable users to manage their expenses, build creditworthiness, and meet their financial obligations effectively. With the ability to tailor credit options to individual needs, these accounts empower individuals and businesses to thrive financially in the vibrant community of Corona, California. Keywords: Corona California, Other Credits, Standard Accounts, Simplified Accounts, credit options, financial tool, convenience, flexibility, credit limit, creditworthiness, purchases, bills, unforeseen expenses, credit history, credit scores, financial resources, cash flow fluctuations, purchase protection, extended warranty coverage, rewards programs, simplified application process, documentation, responsible usage, repayment behavior, online account management, mobile banking applications, customer support services, financial stability, peace of mind, manage expenses, build creditworthiness, vibrant community.Corona California Other Credits — Standard and Simplified Accounts serve as a valuable financial tool for individuals and businesses in the Corona, California area. Designed to offer diverse credit options to meet specific needs, these accounts provide flexibility, convenience, and numerous benefits to account holders. "Standard Accounts" are the traditional credit accounts offered in Corona, California. These accounts require completion of a detailed application process where applicants provide relevant personal and financial information. Once approved, account holders gain access to a predefined credit limit, often based on their creditworthiness, which they can use for various purposes such as making purchases, paying bills, or handling unforeseen expenses. "Standard Accounts" typically offer numerous advantages, including the ability to establish a credit history, improve credit scores, and access financial resources during cash flow fluctuations. Additionally, these accounts often come with added benefits like purchase protection, extended warranty coverage, and rewards programs, ensuring customers can maximize their financial gains. On the other hand, "Simplified Accounts" cater to individuals or businesses who may not have a well-established credit history or face challenges in meeting the eligibility criteria for traditional credit accounts. These accounts offer a simplified application process, requiring minimal documentation, making them accessible to a broader range of users. Simplified accounts may have lower credit limits initially, but as users demonstrate responsible usage and repayment behavior, they can unlock higher limits and more benefits. Both Standard and Simplified Accounts offer a range of features such as online account management, mobile banking applications, and customer support services, making them user-friendly and convenient. Account holders can monitor their balances, review transaction history, and set up automatic payments or alerts to stay on top of their finances. Whether it's for personal or business use, Corona California Other Credits — Standard and Simplified Accounts provide financial stability and peace of mind. They enable users to manage their expenses, build creditworthiness, and meet their financial obligations effectively. With the ability to tailor credit options to individual needs, these accounts empower individuals and businesses to thrive financially in the vibrant community of Corona, California. Keywords: Corona California, Other Credits, Standard Accounts, Simplified Accounts, credit options, financial tool, convenience, flexibility, credit limit, creditworthiness, purchases, bills, unforeseen expenses, credit history, credit scores, financial resources, cash flow fluctuations, purchase protection, extended warranty coverage, rewards programs, simplified application process, documentation, responsible usage, repayment behavior, online account management, mobile banking applications, customer support services, financial stability, peace of mind, manage expenses, build creditworthiness, vibrant community.