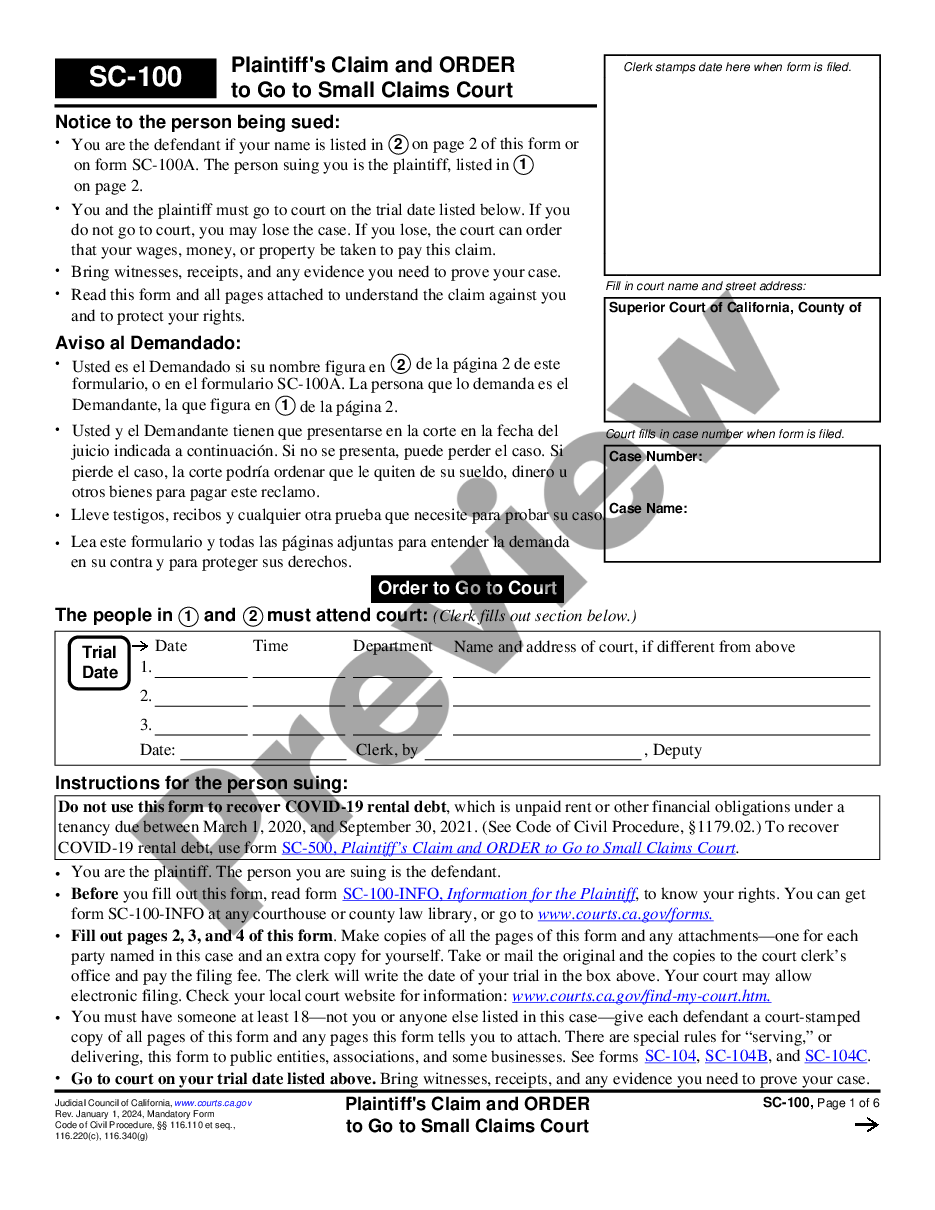

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Concord California Cash Assets on Hand at Beginning of Account Period-Standard and Simplified Accounts Concord, California, is a vibrant city located in Contra Costa County. As businesses and individuals manage their finances, understanding the cash assets on hand at the beginning of an account period becomes crucial. This financial metric helps track the available cash resources an individual or business possesses at the start of an accounting period, enabling effective financial planning and decision-making. In accounting, two types of accounts are commonly used to track cash assets on hand at the beginning of an account period: Standard Accounts and Simplified Accounts. Standard Accounts offer a comprehensive approach to recording and managing cash assets. This accounting method requires meticulous documentation and provides a detailed analysis of cash inflows and outflows within a given period. By recording various financial transactions accurately, businesses or individuals can gain a clear understanding of their starting cash balance for the account period. On the other hand, Simplified Accounts provide a more straightforward and condensed method for tracking cash assets. This approach is especially suitable for small businesses or individuals with less complex financial operations. Simplified Accounts focus on essential cash transactions, capturing key inflows and outflows to determine the starting cash balance when a new accounting period begins. When examining Concord California Cash Assets on Hand at the Beginning of an Account Period, it is important to consider some relevant keywords: 1. Cash Assets: Refers to the total amount of money, including physical cash, bank account balances, and other liquid assets, that an individual or business possesses. 2. Account Period: Defines a specific timeframe during which financial transactions are recorded and summarized. 3. Financial Planning: The process of assessing current financial resources and creating strategies for achieving future financial goals. 4. Decision-making: Involves selecting the most suitable course of action based on a comprehensive understanding of financial data and analysis. 5. Cash Inflows: Represents money coming into an individual or business, including revenue from sales, investments, or loans. 6. Cash Outflows: Refers to the expenditure of cash on various items such as expenses, bills, loans, or investments. By effectively managing and understanding the Concord California Cash Assets on Hand at the Beginning of an Account Period-Standard and Simplified Accounts, individuals and businesses can make informed financial decisions. This knowledge aids in achieving financial stability, maintaining cash flow, and ensuring business growth in Concord, California.