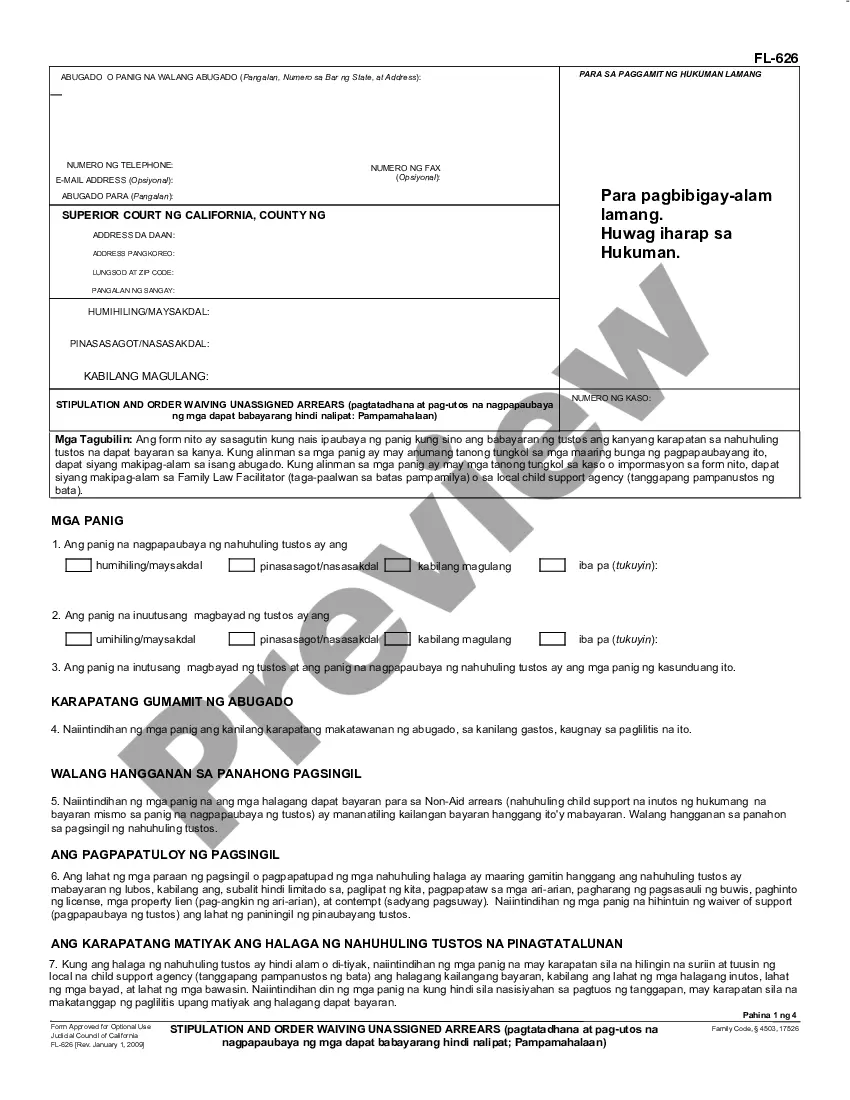

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Long Beach California Cash Assets on Hand at Beginning of Account Period — Standard and Simplified Accounts In the realm of accounting and financial management, having a clear understanding of the cash assets on hand at the beginning of an account period is essential. In the case of Long Beach, California, this aspect is no exception as it plays a significant role in tracking the financial health of various entities, whether they are businesses, organizations, or individuals. There are two main types of accounts used for such purposes: Standard and Simplified Accounts. 1. Standard Accounts: Standard accounts are comprehensive and detailed financial documents utilized by larger entities or those with more complex financial structures. These accounts provide a complete picture of an organization's assets, liabilities, and equity at the beginning of an accounting period. When it comes to the Long Beach cash assets on hand at the beginning of the account period, standard accounts offer an in-depth breakdown of different types of cash assets, including but not limited to: a. Operating Cash: This type of cash asset includes the funds used for daily operational activities such as paying for salaries, rent, utilities, inventory, and other ongoing expenses. b. Investing Cash: Investing cash assets represent the funds allocated for long-term investments, such as purchasing property, equipment, or stocks that yield future returns. c. Financing Cash: Financing cash assets encompass funds obtained through external sources to finance the business or organization's operations. Such sources may involve taking loans, issuing bonds, or attracting investments. 2. Simplified Accounts: On the other hand, simplified accounts are designed for smaller entities or individuals with straightforward financial setups. Although not as detailed as standard accounts, simplified accounts still provide a clear overview of cash assets at the beginning of an accounting period. In the context of Long Beach, there are two main types of cash assets addressed in simplified accounts: a. Cash on Hand: Cash on hand refers to the physical currency and coins held by individuals or businesses at the beginning of an accounting period. This typically includes the cash stored in cash registers, safes, or petty cash funds. b. Cash in Bank Accounts: Cash in bank accounts includes the funds deposited in various bank accounts, such as checking or savings accounts. This category covers the cash reserves that are readily accessible for transactions or investments. In conclusion, whether following standard or simplified accounts, having a precise understanding of the cash assets on hand at the beginning of an accounting period is vital for any business or entity operating in Long Beach, California. Understanding the different types of cash assets, such as operating, investing, and financing cash for larger entities, or cash on hand and cash in bank accounts for smaller entities, enables transparent financial management and the ability to make informed decisions.Long Beach California Cash Assets on Hand at Beginning of Account Period — Standard and Simplified Accounts In the realm of accounting and financial management, having a clear understanding of the cash assets on hand at the beginning of an account period is essential. In the case of Long Beach, California, this aspect is no exception as it plays a significant role in tracking the financial health of various entities, whether they are businesses, organizations, or individuals. There are two main types of accounts used for such purposes: Standard and Simplified Accounts. 1. Standard Accounts: Standard accounts are comprehensive and detailed financial documents utilized by larger entities or those with more complex financial structures. These accounts provide a complete picture of an organization's assets, liabilities, and equity at the beginning of an accounting period. When it comes to the Long Beach cash assets on hand at the beginning of the account period, standard accounts offer an in-depth breakdown of different types of cash assets, including but not limited to: a. Operating Cash: This type of cash asset includes the funds used for daily operational activities such as paying for salaries, rent, utilities, inventory, and other ongoing expenses. b. Investing Cash: Investing cash assets represent the funds allocated for long-term investments, such as purchasing property, equipment, or stocks that yield future returns. c. Financing Cash: Financing cash assets encompass funds obtained through external sources to finance the business or organization's operations. Such sources may involve taking loans, issuing bonds, or attracting investments. 2. Simplified Accounts: On the other hand, simplified accounts are designed for smaller entities or individuals with straightforward financial setups. Although not as detailed as standard accounts, simplified accounts still provide a clear overview of cash assets at the beginning of an accounting period. In the context of Long Beach, there are two main types of cash assets addressed in simplified accounts: a. Cash on Hand: Cash on hand refers to the physical currency and coins held by individuals or businesses at the beginning of an accounting period. This typically includes the cash stored in cash registers, safes, or petty cash funds. b. Cash in Bank Accounts: Cash in bank accounts includes the funds deposited in various bank accounts, such as checking or savings accounts. This category covers the cash reserves that are readily accessible for transactions or investments. In conclusion, whether following standard or simplified accounts, having a precise understanding of the cash assets on hand at the beginning of an accounting period is vital for any business or entity operating in Long Beach, California. Understanding the different types of cash assets, such as operating, investing, and financing cash for larger entities, or cash on hand and cash in bank accounts for smaller entities, enables transparent financial management and the ability to make informed decisions.