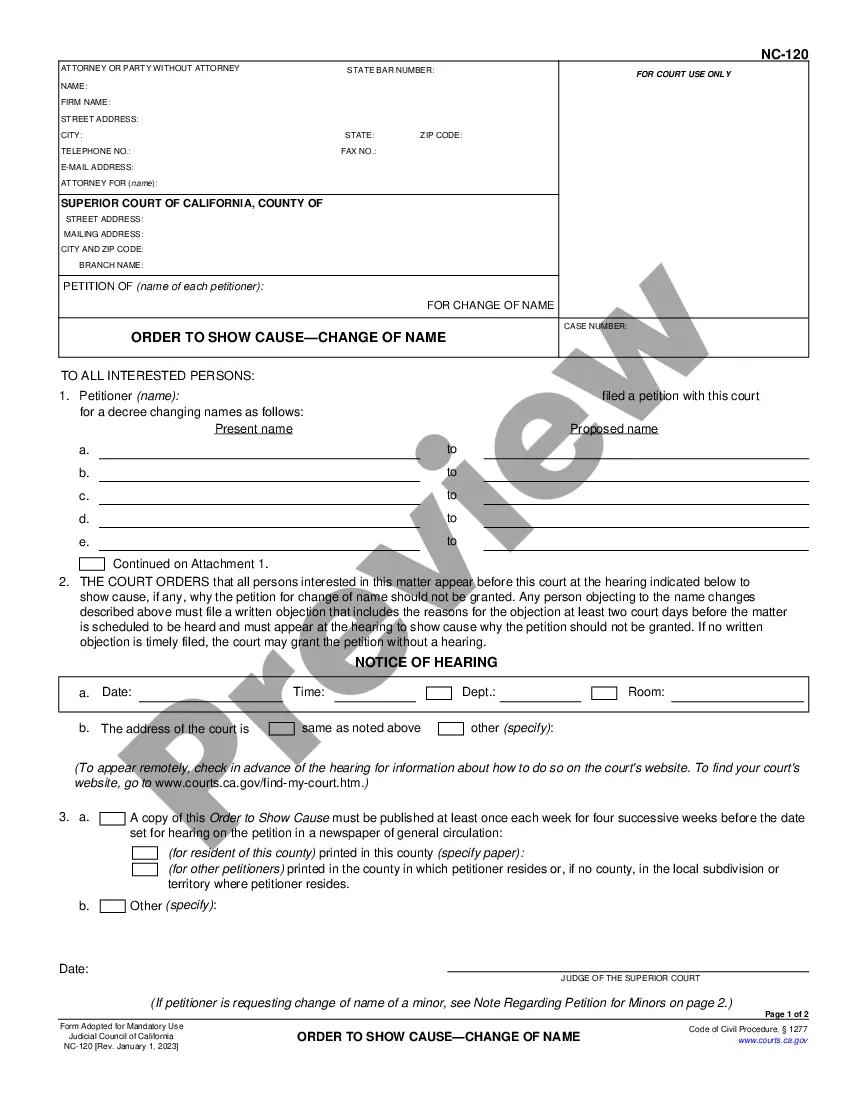

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Chula Vista California Non-Cash Assets on Hand at the Beginning of the Account Period for Standard and Simplified Accounts In Chula Vista, California, both standard and simplified accounts require businesses to accurately record their non-cash assets on hand at the beginning of the account period. These non-cash assets represent valuable resources and investments that are not in the form of physical currency, but still hold significant value to the business. Here, we will explore and detail the different types of non-cash assets commonly found in Chula Vista, California, for both standard and simplified accounting systems. 1. Accounts Receivable: — These are amounts owed to the business by its customers or clients for goods or services provided on credit. It represents the conversion of sales into future cash inflows. Chula Vista businesses may have accounts receivable at the beginning of an account period, indicating the value of pending payments. 2. Inventories: — Inventories are goods held for sale in the ordinary course of business or materials used in production. Hula Vista-based businesses may possess inventory on hand at the start of an account period, including finished products, works in progress, and raw materials. These non-cash assets contribute to determining the cost of goods sold and the overall profitability of the business. 3. Prepaid Expenses: — Prepaid expenses include payments made in advance for services or goods that are yet to be received. Chula Vista businesses might have prepaid expenses at the beginning of an account period, such as prepaid rent, insurance premiums, or annual subscriptions. These expenses are recorded as assets initially but are gradually expensed out over time as they are consumed. 4. Investments: — Investments represent the ownership of assets with the expectation of earning returns or capital appreciation. Chula Vista businesses may possess non-cash investments, such as stocks, bonds, mutual funds, or real estate properties, at the start of an account period. These investments are reported at their fair market value. 5. Intangible Assets: — Intangible assets lack physical substance but hold value for businesses. These include patents, copyrights, trademarks, brand names, customer lists, or goodwill. Chula Vista businesses may have intangible assets on hand at the beginning of an account period, reflecting their value in the marketplace. Both standard and simplified accounts require Chula Vista businesses to provide a detailed account of these non-cash assets on hand at the beginning of the account period. Accurate record-keeping and proper classification of these assets are vital for understanding the financial health, profitability, and growth potential of a business in Chula Vista, California.Chula Vista California Non-Cash Assets on Hand at the Beginning of the Account Period for Standard and Simplified Accounts In Chula Vista, California, both standard and simplified accounts require businesses to accurately record their non-cash assets on hand at the beginning of the account period. These non-cash assets represent valuable resources and investments that are not in the form of physical currency, but still hold significant value to the business. Here, we will explore and detail the different types of non-cash assets commonly found in Chula Vista, California, for both standard and simplified accounting systems. 1. Accounts Receivable: — These are amounts owed to the business by its customers or clients for goods or services provided on credit. It represents the conversion of sales into future cash inflows. Chula Vista businesses may have accounts receivable at the beginning of an account period, indicating the value of pending payments. 2. Inventories: — Inventories are goods held for sale in the ordinary course of business or materials used in production. Hula Vista-based businesses may possess inventory on hand at the start of an account period, including finished products, works in progress, and raw materials. These non-cash assets contribute to determining the cost of goods sold and the overall profitability of the business. 3. Prepaid Expenses: — Prepaid expenses include payments made in advance for services or goods that are yet to be received. Chula Vista businesses might have prepaid expenses at the beginning of an account period, such as prepaid rent, insurance premiums, or annual subscriptions. These expenses are recorded as assets initially but are gradually expensed out over time as they are consumed. 4. Investments: — Investments represent the ownership of assets with the expectation of earning returns or capital appreciation. Chula Vista businesses may possess non-cash investments, such as stocks, bonds, mutual funds, or real estate properties, at the start of an account period. These investments are reported at their fair market value. 5. Intangible Assets: — Intangible assets lack physical substance but hold value for businesses. These include patents, copyrights, trademarks, brand names, customer lists, or goodwill. Chula Vista businesses may have intangible assets on hand at the beginning of an account period, reflecting their value in the marketplace. Both standard and simplified accounts require Chula Vista businesses to provide a detailed account of these non-cash assets on hand at the beginning of the account period. Accurate record-keeping and proper classification of these assets are vital for understanding the financial health, profitability, and growth potential of a business in Chula Vista, California.