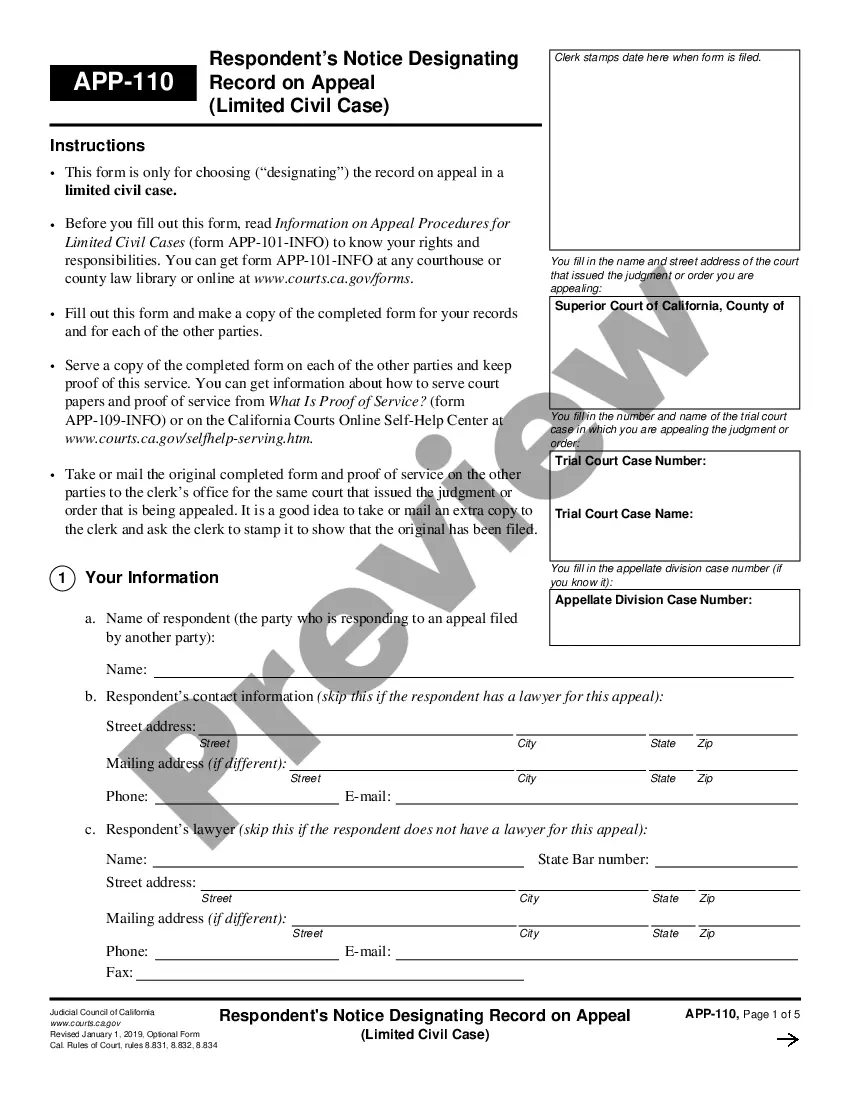

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

In Clovis, California, non-cash assets on hand at the beginning of an account period are crucial components for businesses operating under both standard and simplified accounts. These assets are essential for the smooth functioning and growth of enterprises in the area. Here, we dive into a detailed description of the various types of non-cash assets found in Clovis, California, at the beginning of an account period, highlighting their significance and relevance. 1. Real Estate Properties: This refers to land, buildings, and other physical properties owned by businesses in Clovis. Real estate assets are critical for conducting operations, such as office spaces, manufacturing units, warehouses, or retail stores. These assets are valued using their fair market value and can be significant contributors to a company's overall net worth. 2. Equipment and Machinery: Businesses in Clovis often rely on various types of specialized equipment and machinery to carry out operations efficiently. This may include computers, vehicles, manufacturing machinery, technology infrastructure, or specialized tools needed for specific industries. These assets are valuable, and their condition affects the productivity and competitiveness of enterprises. 3. Intellectual Property: In the modern knowledge-based economy, intellectual property assets are becoming increasingly important. These assets may consist of trademarks, copyrights, patents, trade secrets, and proprietary software developed or acquired by businesses in Clovis, California. Intellectual property assets contribute to a company's competitive advantage, market positioning, and potentially generate royalty income. 4. Investments: Clovis-based businesses may have investments in various financial instruments, such as stocks, bonds, mutual funds, or ownership stakes in other companies. These investments provide potential returns, further diversification of assets, and strategic business partnerships. Investments are usually valued at their fair market value at the beginning of the account period. 5. Goodwill: Goodwill represents the intangible value of a business beyond its tangible assets. It includes factors such as reputation, customer loyalty, brand recognition, and relationships with suppliers and clients. Businesses in Clovis may have accumulated goodwill over time, enhancing their market position and creating a competitive edge. 6. Leasehold Improvements: Leasehold improvements are any alterations or improvements made to rented or leased properties to suit business needs. These assets can include renovations, interior design, fixtures, or customized installations. Leasehold improvements are typically amortized over the lease term and are considered non-cash assets. To summarize, Clovis, California, encompasses various types of non-cash assets on hand at the beginning of an account period, which include real estate properties, equipment and machinery, intellectual property, investments, goodwill, and leasehold improvements. Proper management and valuation of these assets are vital for businesses to accurately assess their financial position, make informed decisions, and drive growth and success in the vibrant business environment of Clovis, California.