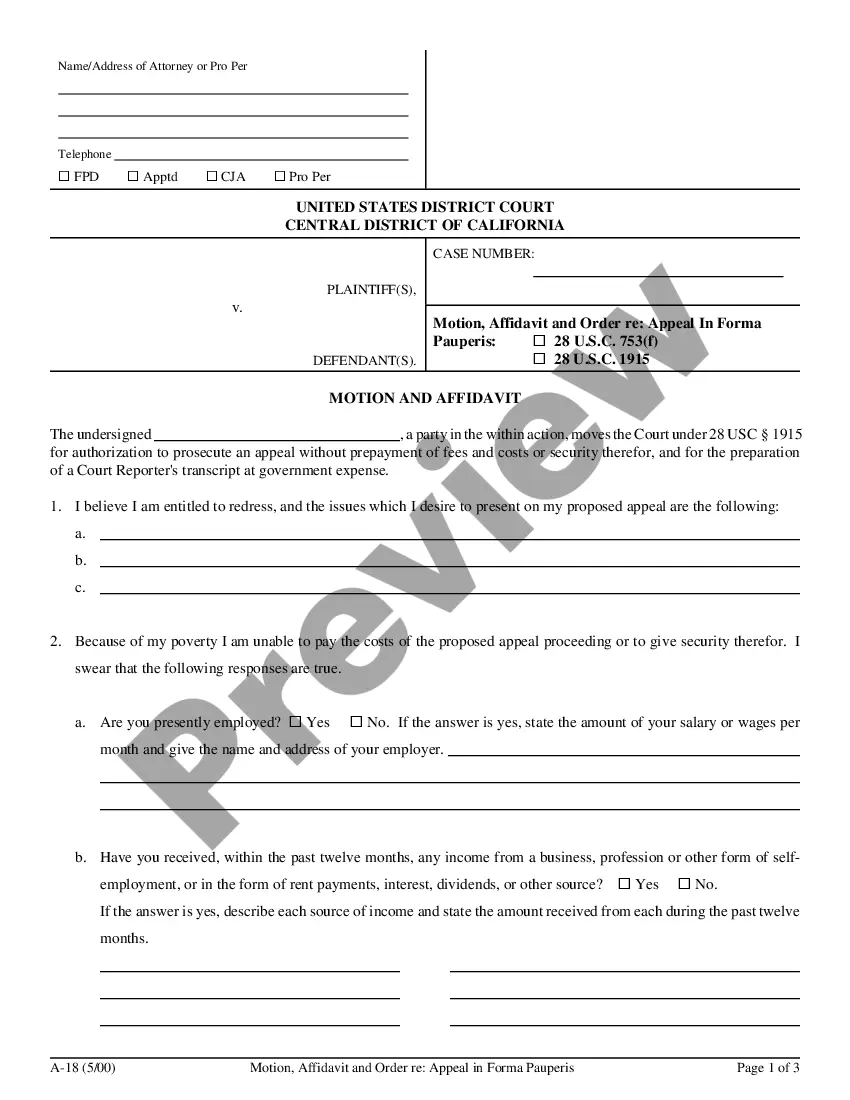

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Concord California Non-Cash Assets on Hand at Beginning of Account Period — Standard and Simplified Accounts In accounting, the term 'non-cash assets on hand at the beginning of the account period' refers to the assets that a company possesses in a physical form, other than cash, at the start of a specific accounting period. These non-cash assets hold significant value and play a crucial role in the financial health and operations of an organization. In the context of Concord, California, various types of non-cash assets might be held by businesses or individuals. Some common examples include: 1. Real Estate Holdings: Non-cash assets in the form of owned or leased properties, such as buildings, land, or commercial spaces located in Concord, California. These assets contribute to the overall net worth of a business and might appreciate over time. 2. Vehicles and Equipment: Companies in Concord might possess non-cash assets such as cars, trucks, vans, or machinery utilized for business operations. These assets are essential for production, transportation, or providing services. 3. Investments and Securities: Non-cash assets can also take the shape of stocks, bonds, mutual funds, or other investment instruments held by businesses or individuals residing in Concord, California. These assets generate potential income through dividends, interest payments, or capital appreciation. 4. Intellectual Property: Non-cash assets in the form of patents, trademarks, copyrights, or trade secrets owned by businesses in Concord. These intangible assets can significantly contribute to a company's competitive advantage and revenue streams. 5. Inventory: Retailers or manufacturers in Concord might possess a variety of non-cash assets represented by inventory, including merchandise, raw materials, or work in progress. Proper management and valuation of inventory are essential for accurate financial reporting. 6. Goodwill: Non-cash assets in the form of goodwill reflect the value associated with a company's reputation, customer loyalty, and brand recognition. These intangibles arise from factors such as positive community impact, customer satisfaction, or unique position within the Concord market. Both the standard and simplified accounts in Concord, California, require businesses to accurately assess, record, and monitor their non-cash assets. Standard accounts follow Generally Accepted Accounting Principles (GAAP), while simplified accounts might adopt modified standards suitable for smaller businesses. The classification and valuation of non-cash assets might differ based on the accounting framework used. Tracking and reporting non-cash assets on hand at the beginning of an account period is paramount for evaluating a company's financial position, determining depreciation or amortization expenses, and complying with tax regulations. Concord businesses must ensure accurate and detailed documentation to maintain transparency, facilitate decision-making, and provide stakeholders with a comprehensive view of the organization's non-cash assets.