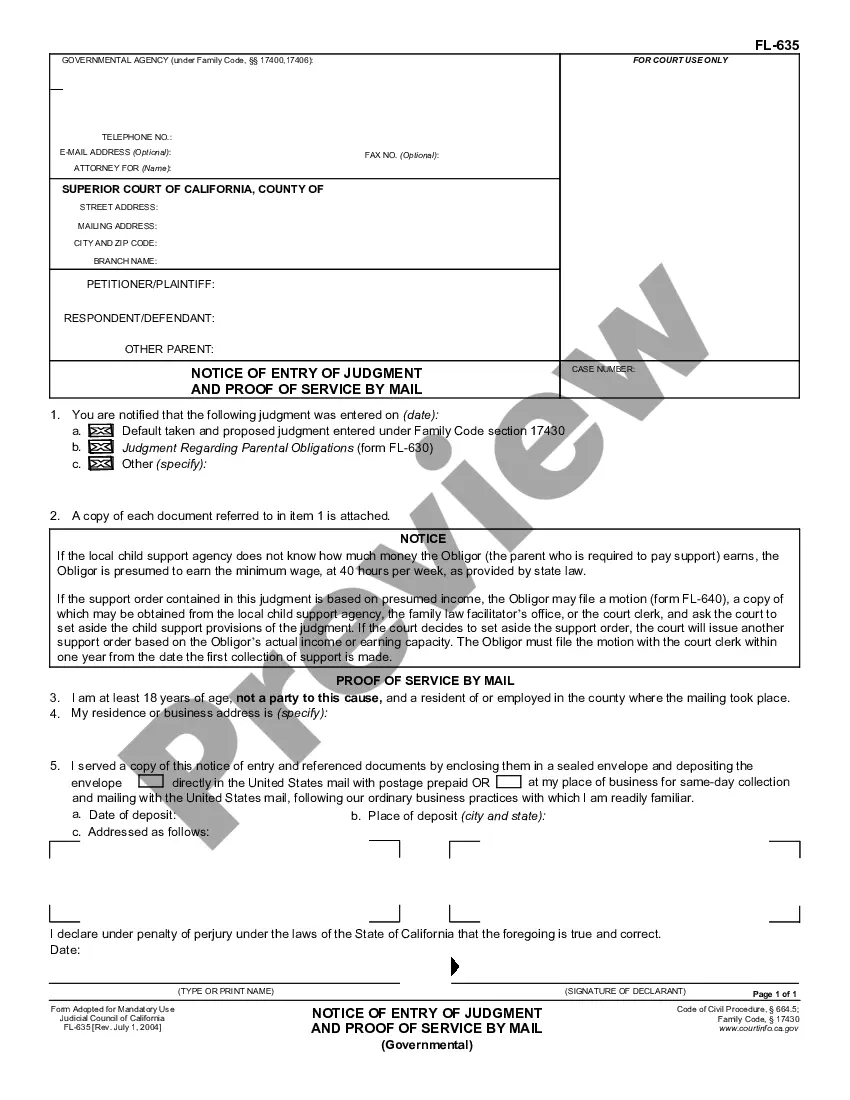

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

In Long Beach, California, non-cash assets on hand at the beginning of an account period play a crucial role in both standard and simplified accounting. These assets encompass various categories, each indispensable to a comprehensive financial overview. Let's explore some key types of non-cash assets commonly found in Long Beach, California, using relevant keywords. 1. Property and Real Estate Assets: Long Beach boasts a diverse range of non-cash assets linked to property and real estate. From commercial buildings and residential complexes to vacant land and industrial spaces, these assets hold immense value, influencing the financial health of businesses and individuals alike. Proper identification, valuation, and management of property assets are essential for maintaining accurate accounting records. 2. Equipment and Fixed Assets: Another significant category of non-cash assets comprises various types of equipment and fixed assets. This encompasses machinery, vehicles, computers, furnishings, and other tangible assets used in daily operations across diverse industries. Accurate tracking of these assets allows businesses to assess depreciation, forecast repairs and maintenance costs, and gauge overall asset performance. 3. Intangible Assets: Intangible assets represent valuable resources without a physical presence, contributing to Long Beach's vibrant economic landscape. These assets generally include trademarks, patents, copyrights, software licenses, brand names, and customer relationships. Evaluation and proper accounting of intangible assets enable businesses to ascertain their value, monitor legal rights, and include them in financial statements. 4. Financial Investments and Securities: Non-cash assets in the form of financial investments and securities form a crucial aspect of Long Beach's accounting ecosystem. These investments might include stocks, bonds, mutual funds, certificates of deposit, and other financial instruments. Accurate and up-to-date valuation of these assets is vital to reflect their market value accurately. 5. Accounts Receivable and Other Debts: For businesses in Long Beach, accounts receivable and other outstanding debts can be considered as non-cash assets that need proper tracking. Such assets, arising from credit sales or services rendered, represent money owed to the entity and can significantly impact liquidity. A systematic approach to monitoring accounts receivable aids businesses in managing cash flow and minimizing bad debt losses. 6. Prepaid Expenses: Prepaid expenses constitute yet another type of non-cash asset commonly found in Long Beach accounting. These include payments made in advance for goods or services yet to be received, such as insurance premiums or lease payments. Indicator keywords for prepaid expenses may include deferred costs, unexpired portions, and amortization. 7. Inventory and Raw Materials: Inventory, consisting of finished goods or raw materials, represents a non-cash asset category essential to Long Beach businesses engaged in manufacturing, retail, or wholesale activities. Effective inventory management helps minimize costs, optimize production, and ensure smooth supply chain operations. By acknowledging and categorizing these various types of non-cash assets on hand at the beginning of an account period, Long Beach businesses can adhere to standard and simplified accounting practices. Capable handling of these assets promotes financial transparency, aids decision-making processes, and supports the overall growth and stability of organizations in Long Beach, California.In Long Beach, California, non-cash assets on hand at the beginning of an account period play a crucial role in both standard and simplified accounting. These assets encompass various categories, each indispensable to a comprehensive financial overview. Let's explore some key types of non-cash assets commonly found in Long Beach, California, using relevant keywords. 1. Property and Real Estate Assets: Long Beach boasts a diverse range of non-cash assets linked to property and real estate. From commercial buildings and residential complexes to vacant land and industrial spaces, these assets hold immense value, influencing the financial health of businesses and individuals alike. Proper identification, valuation, and management of property assets are essential for maintaining accurate accounting records. 2. Equipment and Fixed Assets: Another significant category of non-cash assets comprises various types of equipment and fixed assets. This encompasses machinery, vehicles, computers, furnishings, and other tangible assets used in daily operations across diverse industries. Accurate tracking of these assets allows businesses to assess depreciation, forecast repairs and maintenance costs, and gauge overall asset performance. 3. Intangible Assets: Intangible assets represent valuable resources without a physical presence, contributing to Long Beach's vibrant economic landscape. These assets generally include trademarks, patents, copyrights, software licenses, brand names, and customer relationships. Evaluation and proper accounting of intangible assets enable businesses to ascertain their value, monitor legal rights, and include them in financial statements. 4. Financial Investments and Securities: Non-cash assets in the form of financial investments and securities form a crucial aspect of Long Beach's accounting ecosystem. These investments might include stocks, bonds, mutual funds, certificates of deposit, and other financial instruments. Accurate and up-to-date valuation of these assets is vital to reflect their market value accurately. 5. Accounts Receivable and Other Debts: For businesses in Long Beach, accounts receivable and other outstanding debts can be considered as non-cash assets that need proper tracking. Such assets, arising from credit sales or services rendered, represent money owed to the entity and can significantly impact liquidity. A systematic approach to monitoring accounts receivable aids businesses in managing cash flow and minimizing bad debt losses. 6. Prepaid Expenses: Prepaid expenses constitute yet another type of non-cash asset commonly found in Long Beach accounting. These include payments made in advance for goods or services yet to be received, such as insurance premiums or lease payments. Indicator keywords for prepaid expenses may include deferred costs, unexpired portions, and amortization. 7. Inventory and Raw Materials: Inventory, consisting of finished goods or raw materials, represents a non-cash asset category essential to Long Beach businesses engaged in manufacturing, retail, or wholesale activities. Effective inventory management helps minimize costs, optimize production, and ensure smooth supply chain operations. By acknowledging and categorizing these various types of non-cash assets on hand at the beginning of an account period, Long Beach businesses can adhere to standard and simplified accounting practices. Capable handling of these assets promotes financial transparency, aids decision-making processes, and supports the overall growth and stability of organizations in Long Beach, California.