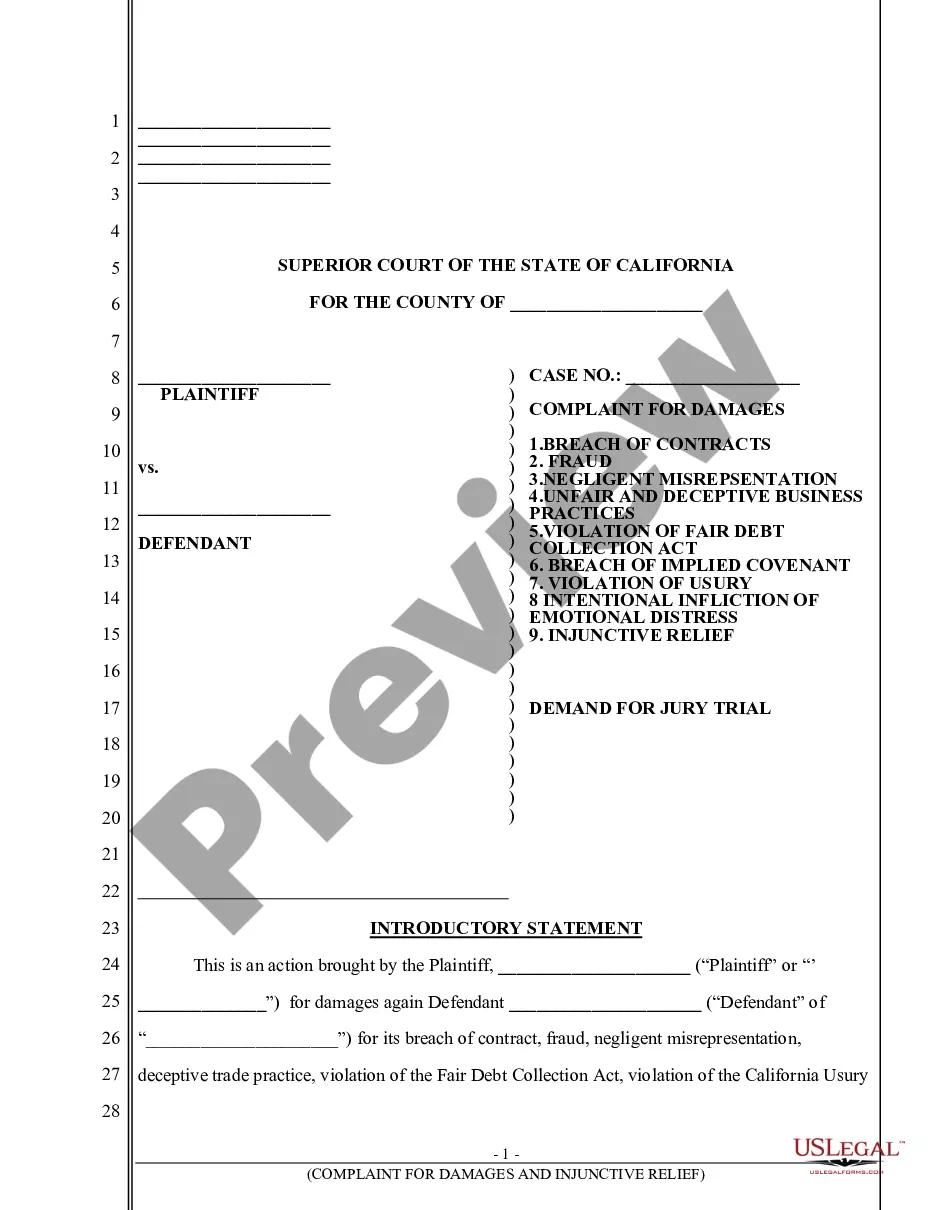

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Santa Maria, California Non-Cash Assets on Hand at Beginning of Account Period — Standard and Simplified Accounts In Santa Maria, California, non-cash assets on hand at the beginning of an account period play a crucial role in the financial planning and tracking of businesses and organizations. These assets represent the value of possessions or resources that are not in the form of cash but hold significant worth and contribute to the overall wealth of an entity. Both standard and simplified accounts recognize these non-cash assets, although they may differ slightly in their classification and presentation. 1. Property and Real Estate: One of the most valuable non-cash assets present in Santa Maria is property and real estate. This encompasses land, buildings, offices, warehouses, and other immovable assets that are owned, leased, or held for the purpose of conducting business operations or generating revenue. These assets are typically listed on the balance sheet under the category of "Property, Plant, and Equipment." 2. Vehicles and Equipment: Another important category of non-cash assets includes vehicles and equipment owned by businesses in Santa Maria. This may include company cars, trucks, delivery vans, machinery, computers, furniture, and other tangible assets that are utilized in daily operations. These assets are recorded on the balance sheet as "Equipment" or "Fixed Assets." 3. Inventory and Stock: In businesses involving the sale of products, inventory and stock form a significant portion of non-cash assets. Inventory includes finished goods, raw materials, work-in-progress, or components that are required for the manufacturing, retail, or distribution processes. These assets are reported under "Inventory" on the balance sheet. 4. Intellectual Property: Often overlooked, but highly valuable, non-cash assets can include intellectual property. This category comprises trademarks, copyrights, patents, and proprietary technologies that give a business a competitive advantage. Intellectual property is recorded on the balance sheet separately and valued based on their legal or economic significance. 5. Investments and Securities: Non-cash assets in the form of investments and securities are vital for many organizations in Santa Maria, especially those with excess cash reserves. This includes bonds, stocks, mutual funds, treasury bills, and other financial instruments held for both short-term and long-term investment purposes. Investments are typically reported on the balance sheet at fair market value. 6. Accounts Receivable: Accounts receivable represents the amounts owed to a business by its customers or clients for products or services provided on credit. While not in the form of cash, these outstanding receivables are considered non-cash assets and are recorded on the balance sheet as an asset. They are also an indicator of the company's liquidity and cash flow management. It's important to note that the classification and presentation of non-cash assets may vary slightly between standard and simplified accounts. Standard accounts, typically used by larger businesses or those requiring more detailed reporting, may have more specific categorization and disclosure requirements for non-cash assets. Simplified accounts, on the other hand, used by smaller businesses or for simplifying bookkeeping, may have a more general approach to asset reporting. However, regardless of the accounting system used, it is crucial for businesses in Santa Maria, California, to accurately identify, value, and track their non-cash assets to gain a comprehensive view of their financial health and sustainability.