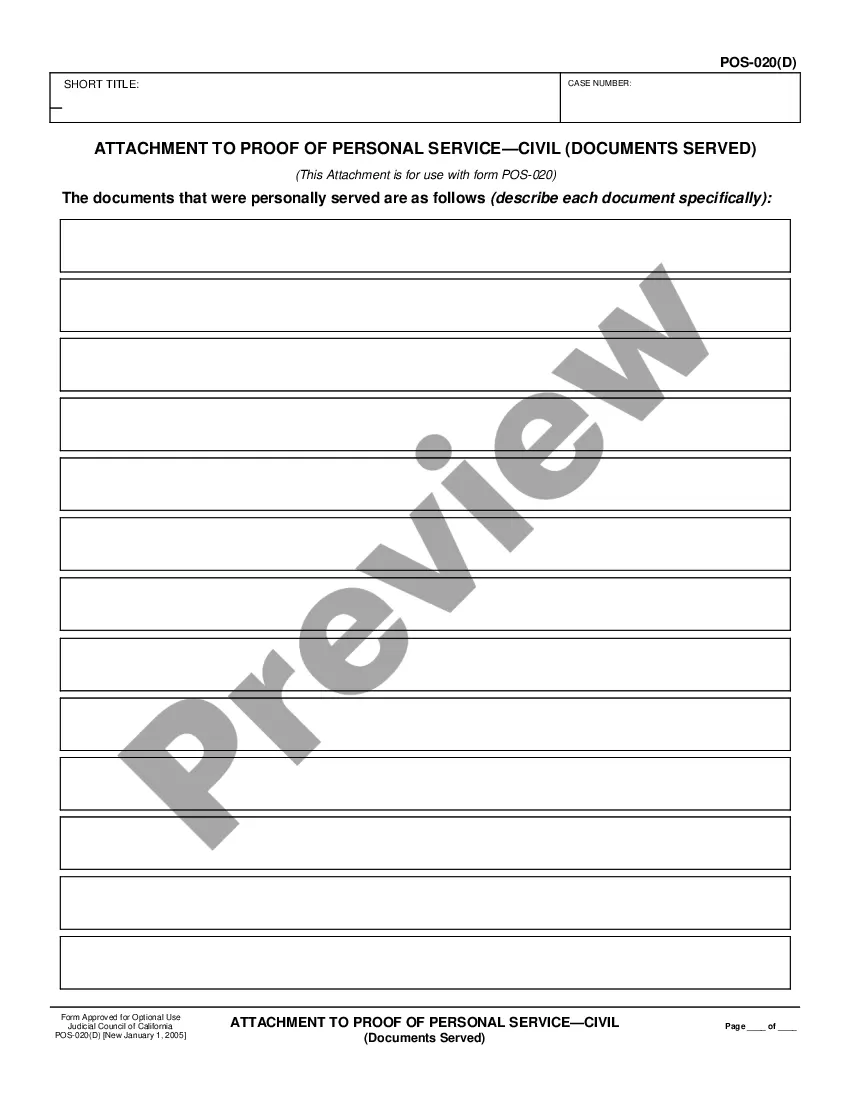

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Thousand Oaks California's Non-Cash Assets on Hand at the Beginning of the Account Period — Standard and Simplified Accounts In Thousand Oaks, California, non-cash assets play a crucial role in the financial accounts of individuals, businesses, and organizations. Non-cash assets are tangible or intangible properties held by an entity that do not involve physical currency. They are classified as non-cash assets because they cannot be readily converted into cash. Standard and Simplified Accounts When it comes to recording non-cash assets at the beginning of an account period, Thousand Oaks employs both a standard and simplified account system, allowing individuals and businesses to choose the one that best aligns with their needs and resources. Under the standard account system, entities maintain a comprehensive record of various non-cash assets held at the beginning of the accounting period, accounting for their value and potential impact on financial statements. This system covers a wide range of non-cash assets, including but not limited to: 1. Real Estate Holdings: Non-cash assets such as land, buildings, residential and commercial properties, and undeveloped land held for investment or operational purposes. 2. Vehicles and Equipment: Includes company-owned automobiles, trucks, machinery, furniture, fixtures, and other tools used for business operations. 3. Intellectual Property: Non-physical assets like patents, copyrights, trademarks, and trade secrets that contribute to a business's competitive advantage and hold intrinsic value. 4. Investments: Non-cash assets comprising stocks, bonds, mutual funds, or other financial instruments held for the purpose of generating income or capital appreciation. 5. Long-term Contracts: Non-cash assets that arise from contracts and agreements, such as leases or licensing agreements, providing future economic benefits. 6. Goodwill: Represents the premium value of a business over its net tangible assets, resulting from factors such as reputation, customer loyalty, or brand recognition. On the other hand, the simplified account system provides a streamlined approach to recording non-cash assets at the beginning of an accounting period. This system is commonly used by small businesses or individuals with fewer and less complex non-cash assets. While less comprehensive, it still covers major non-cash asset categories, including: 1. Real Estate Holdings: Primarily residential properties, small office spaces, or personal properties not classified as investments or used for business purposes. 2. Vehicles and Equipment: Limited to personal vehicles, small tools, or equipment owned for personal use or simple business operations. 3. Intellectual Property: Focuses on trademarks, copyrights, or patents directly relevant to personal or small-scale business endeavors. 4. Investments: Generally excludes complex or high-risk investments, limited to residential properties, personal retirement accounts, or small-value securities. In conclusion, Thousand Oaks, California acknowledges that non-cash assets constitute significant elements of individuals' and businesses' financial accounts. The standard and simplified account systems offer versatile methods to record and categorize diverse non-cash assets, ranging from real estate holdings and intellectual property to vehicles, equipment, and investments.