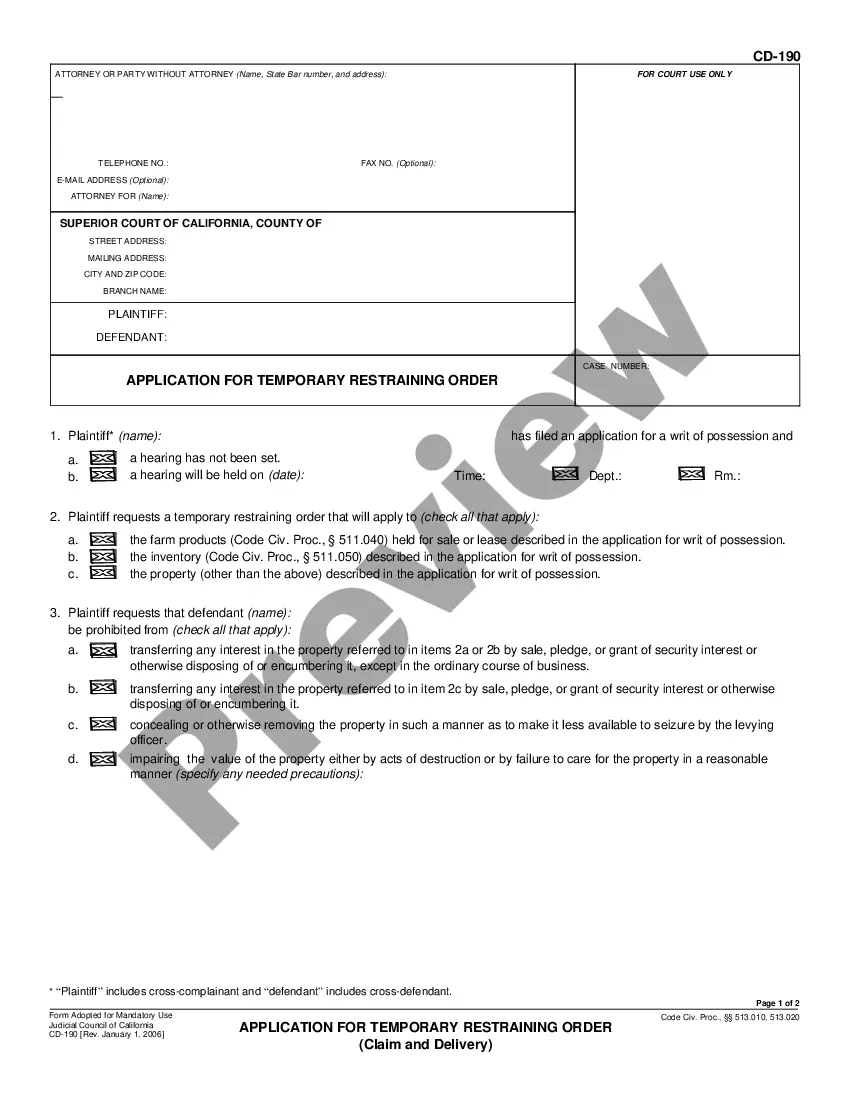

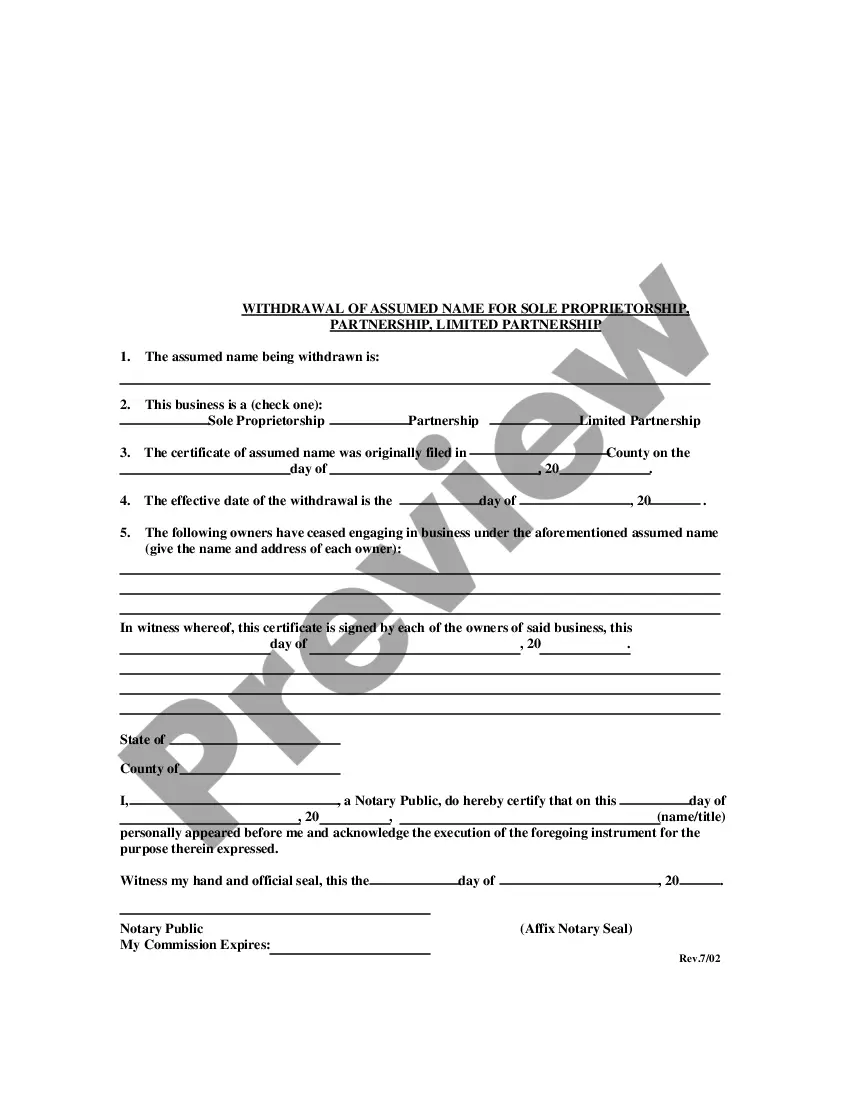

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Fullerton California Summary of Account — Standard and Simplified Accounts: A Detailed Description In Fullerton, California, the Summary of Account is a crucial document that provides a comprehensive overview of an individual's financial transactions and overall financial health. This summary serves as a valuable tool for individuals, businesses, and financial institutions to monitor their financial activities, identify trends, and make informed decisions. 1. Standard Accounts: Fullerton California offers a standard form of Summary of Account, which is designed to present detailed information about a customer's banking transactions and various financial activities. The standard account summary provides an exhaustive breakdown of deposits, withdrawals, checks cleared and issued, fund transfers, interest earned, charges incurred, and account balances for a specified period. Key Features of Standard Accounts: a. Comprehensive Transaction Details: The summary includes specific details such as transaction dates, descriptions, and amounts, enabling individuals to track every financial activity associated with their account efficiently. b. Account Balances: The summary displays current and previous account balances, allowing customers to monitor their fund availability and analyze spending patterns. c. Clearing Status: It provides information about the status of checks cleared (paid) and issued (received) during the given period, assuring accurate record-keeping. d. Interest Earned: If applicable, the summary reveals the interest earned on savings accounts, fixed deposits, or other interest-bearing instruments, providing a clear picture of the return on investment. 2. Simplified Accounts: To cater to the diverse needs of their customers, Fullerton California also offers Simplified Accounts. This streamlined version of the Summary of Account aims to provide a concise overview of essential financial information, making it easily accessible and understandable for individuals with limited financial knowledge. Key Features of Simplified Accounts: a. Summarized Transactions: Rather than providing an itemized breakdown, this account summary presents consolidated information, highlighting the total amounts of deposits, withdrawals, and transfers made during a specific period. b. Account Balance Highlights: The summary emphasizes the current and previous account balances, allowing customers to quickly assess their financial situation without delving into minute details. c. Notable Transactions: The summary may include significant transactions or events, such as large withdrawals or deposits, that require immediate attention. d. Simple Language: The simplified account summary uses non-technical and user-friendly language, enabling customers with limited financial literacy to understand their financial status effortlessly. Both Standard and Simplified Accounts aim to facilitate easy comprehension of an account holder's financial activities. However, the level of detail and presentation style differ based on customer preferences, requirements, and financial knowledge. By offering different types of account summaries, Fullerton California ensures that individuals can conveniently manage their finances, make informed decisions, and maintain a healthy and transparent banking relationship. Whether customers prefer a comprehensive breakdown or a simplified overview, Fullerton California's Summary of Account serves as an invaluable tool in assessing financial well-being.