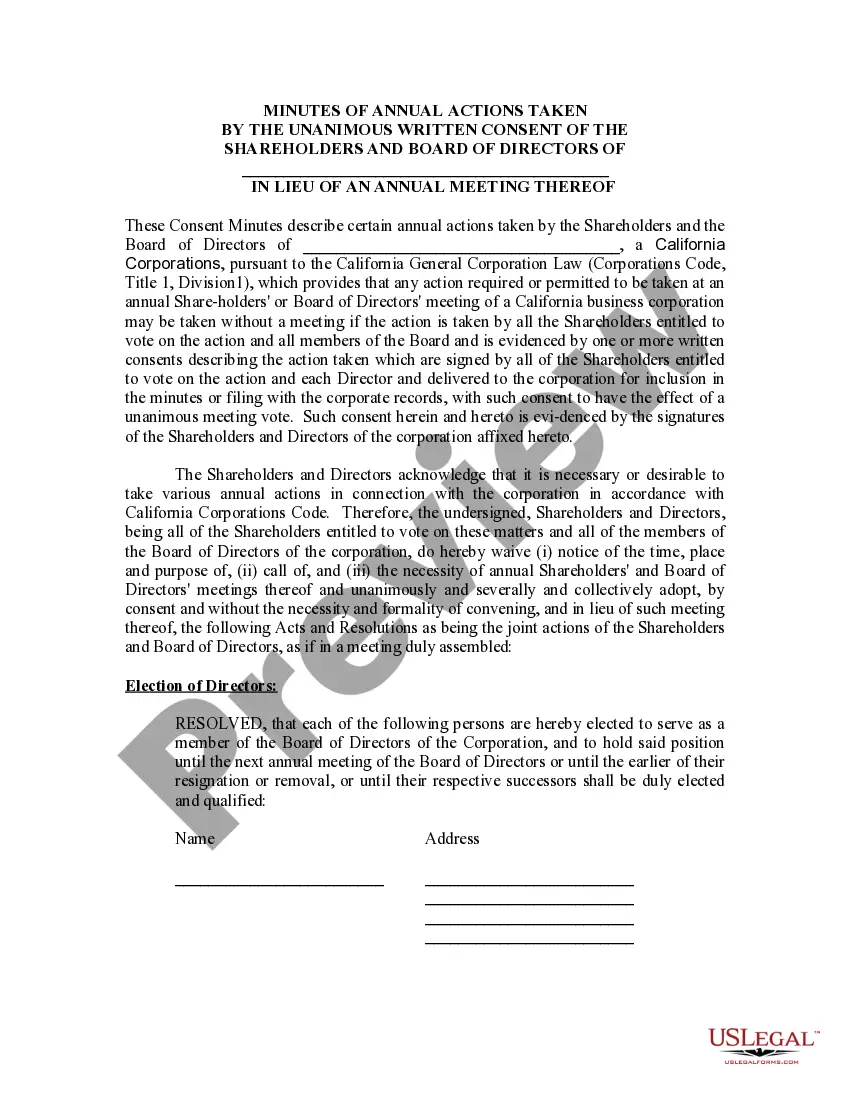

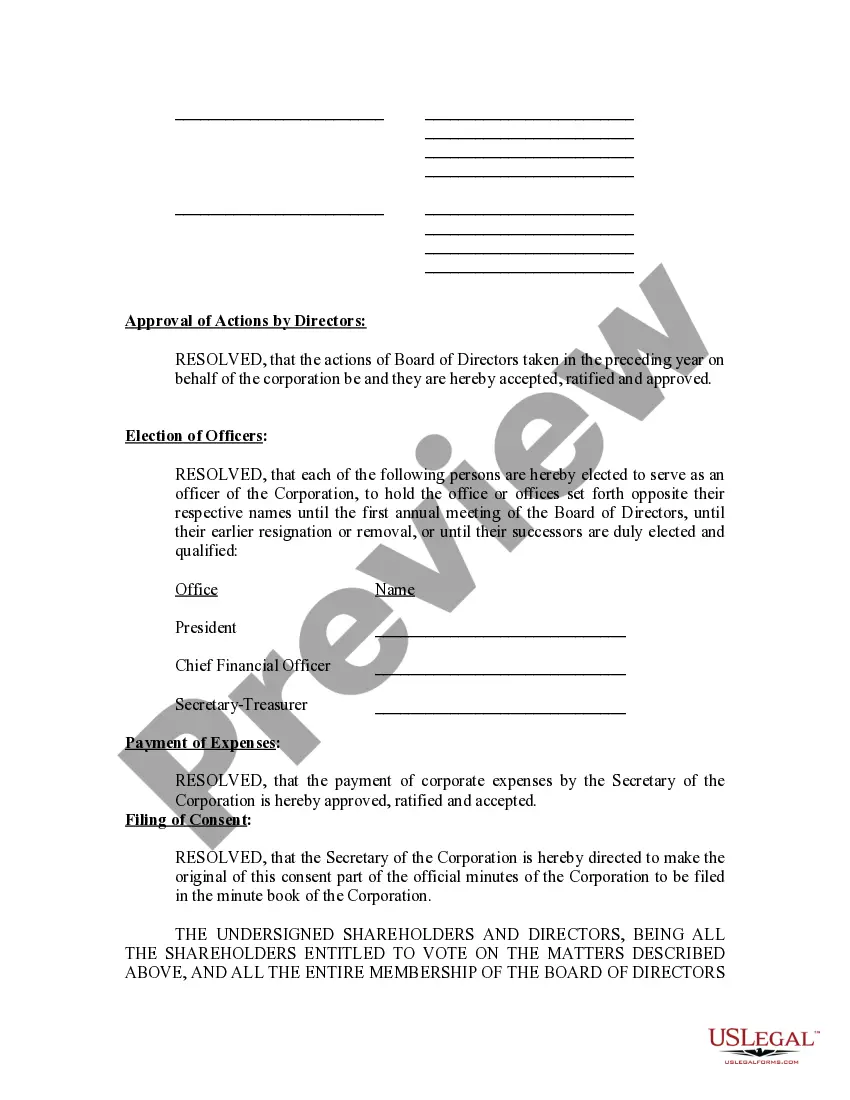

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Corona Annual Minutes is a crucial document that every corporation in California must prepare and maintain annually to ensure legal compliance and maintain accurate records of corporate proceedings. These minutes serve as a comprehensive record of the decisions, actions, and discussions made during the corporation's yearly shareholder and director meetings. The Corona Annual Minutes — California not only reflect the corporation's transparency and accountability but also provide significant protection in cases of shareholder disputes, lawsuits, or audits. It is mandatory to keep these minutes up-to-date and readily accessible to shareholders, directors, or any authorized personnel. Here are different types of Corona Annual Minutes that may be prepared for various types of California corporations: 1. General Corporation Annual Minutes: These are designed for standard corporations (C Corporations) in California and typically include a detailed summary of the corporation's annual shareholder meetings, board of directors meetings, and committee meetings. 2. S Corporation Annual Minutes: This type of Corona Annual Minutes applies to corporations with S Corporation tax election status in California. With this election, corporations are subject to specific requirements and restrictions outlined under the Internal Revenue Code. The minutes may contain specific provisions related to S Corporation taxation, such as limitations on the number and type of shareholders. 3. Nonprofit Corporation Annual Minutes: Nonprofit corporations in California, including charitable organizations, religious institutions, and educational establishments, have their specific requirements for maintaining annual minutes. These minutes should highlight compliance with nonprofit regulations and address matters like fundraising, program updates, elections, and financial reports. 4. Limited Liability Company (LLC) Annual Minutes: Though an LLC is not required to hold annual meetings in California, it is best practice to maintain minutes as a record of major decisions, updates, and member meetings. These minutes may include discussions on membership changes, distribution of profits, amendments to the LLC operating agreement, and other significant events. 5. Professional Corporation Annual Minutes: Professional corporations (PCs) in California, such as law firms, medical practices, or accounting firms, must adhere to additional regulations specific to their profession. The minutes may cover topics specific to professional licensing, insurance requirements, certifications, and any professional conduct issues addressed during annual meetings. It is crucial to consult with legal professionals or use professional services to ensure accurate and compliant Corona Annual Minutes. Key areas covered in these minutes typically include the date, time, and location of the meeting, attendees, matters discussed, decisions made, voting outcomes, and any other relevant details.