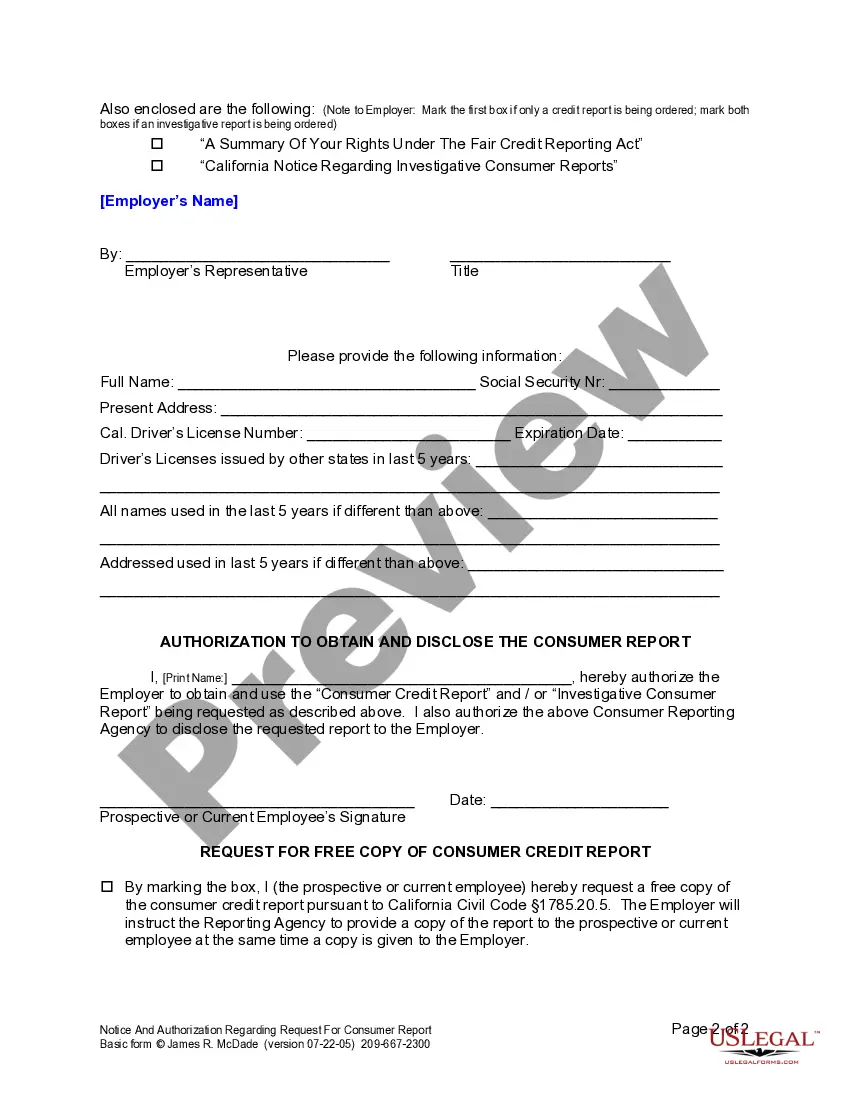

This form is used to obtain permission from an employee or prospective employee prior to the employer requesting a consumer credit report or background investigation.

Carlsbad California Notice and Authorization Regarding Consumer Report is a legal document that outlines the rights and privacy protections afforded to individuals when their consumer reports are being obtained or accessed by entities in Carlsbad, California. This notice is crucial in maintaining transparency and ensuring compliance with the Fair Credit Reporting Act (FCRA) and other relevant laws. The Carlsbad California Notice and Authorization Regarding Consumer Report notifies individuals that their consumer reports may be requested for various purposes, such as employment screening, credit evaluation, rental applications, insurance underwriting, and more. It emphasizes on individuals' rights to privacy and the importance of obtaining their consent before accessing their consumer reports. Some common types of Carlsbad California Notice and Authorization Regarding Consumer Report include: 1. Employment Screening: This type of notice and authorization is most commonly used by employers in Carlsbad, California, during the hiring process. It informs job applicants that their consumer reports may be used to assess their qualifications, character, and trustworthiness for employment purposes. 2. Tenant Screening: Landlords and rental agencies in Carlsbad, California, often utilize this notice to inform prospective tenants that their consumer reports may be requested to evaluate their rental applications. It ensures that individuals are aware of the information being accessed to verify previous rental history, creditworthiness, and other relevant factors. 3. Insurance Underwriting: Insurance companies in Carlsbad, California, may provide this notice to individuals when assessing their eligibility and premium rates for various insurance policies. It clarifies that consumer reports may be obtained to evaluate risk factors, driving records, credit history, or medical conditions, depending on the type of insurance being applied for. 4. Financial Transactions: Financial institutions, such as banks or credit unions in Carlsbad, California, may require this notice and authorization when individuals apply for loans, mortgages, or credit cards. It discloses that their consumer reports may be reviewed to assess their creditworthiness, payment history, current debts, and other financial factors crucial for approval. In conclusion, the Carlsbad California Notice and Authorization Regarding Consumer Report is a vital document that ensures individuals are informed about the type and purpose of their consumer reports' utilization. It establishes transparency, protects individual privacy rights, and aligns with the FCRA guidelines. It is important for both individuals and entities to understand and comply with the notice and authorization requirements to foster a fair and lawful consumer reporting system.Carlsbad California Notice and Authorization Regarding Consumer Report is a legal document that outlines the rights and privacy protections afforded to individuals when their consumer reports are being obtained or accessed by entities in Carlsbad, California. This notice is crucial in maintaining transparency and ensuring compliance with the Fair Credit Reporting Act (FCRA) and other relevant laws. The Carlsbad California Notice and Authorization Regarding Consumer Report notifies individuals that their consumer reports may be requested for various purposes, such as employment screening, credit evaluation, rental applications, insurance underwriting, and more. It emphasizes on individuals' rights to privacy and the importance of obtaining their consent before accessing their consumer reports. Some common types of Carlsbad California Notice and Authorization Regarding Consumer Report include: 1. Employment Screening: This type of notice and authorization is most commonly used by employers in Carlsbad, California, during the hiring process. It informs job applicants that their consumer reports may be used to assess their qualifications, character, and trustworthiness for employment purposes. 2. Tenant Screening: Landlords and rental agencies in Carlsbad, California, often utilize this notice to inform prospective tenants that their consumer reports may be requested to evaluate their rental applications. It ensures that individuals are aware of the information being accessed to verify previous rental history, creditworthiness, and other relevant factors. 3. Insurance Underwriting: Insurance companies in Carlsbad, California, may provide this notice to individuals when assessing their eligibility and premium rates for various insurance policies. It clarifies that consumer reports may be obtained to evaluate risk factors, driving records, credit history, or medical conditions, depending on the type of insurance being applied for. 4. Financial Transactions: Financial institutions, such as banks or credit unions in Carlsbad, California, may require this notice and authorization when individuals apply for loans, mortgages, or credit cards. It discloses that their consumer reports may be reviewed to assess their creditworthiness, payment history, current debts, and other financial factors crucial for approval. In conclusion, the Carlsbad California Notice and Authorization Regarding Consumer Report is a vital document that ensures individuals are informed about the type and purpose of their consumer reports' utilization. It establishes transparency, protects individual privacy rights, and aligns with the FCRA guidelines. It is important for both individuals and entities to understand and comply with the notice and authorization requirements to foster a fair and lawful consumer reporting system.