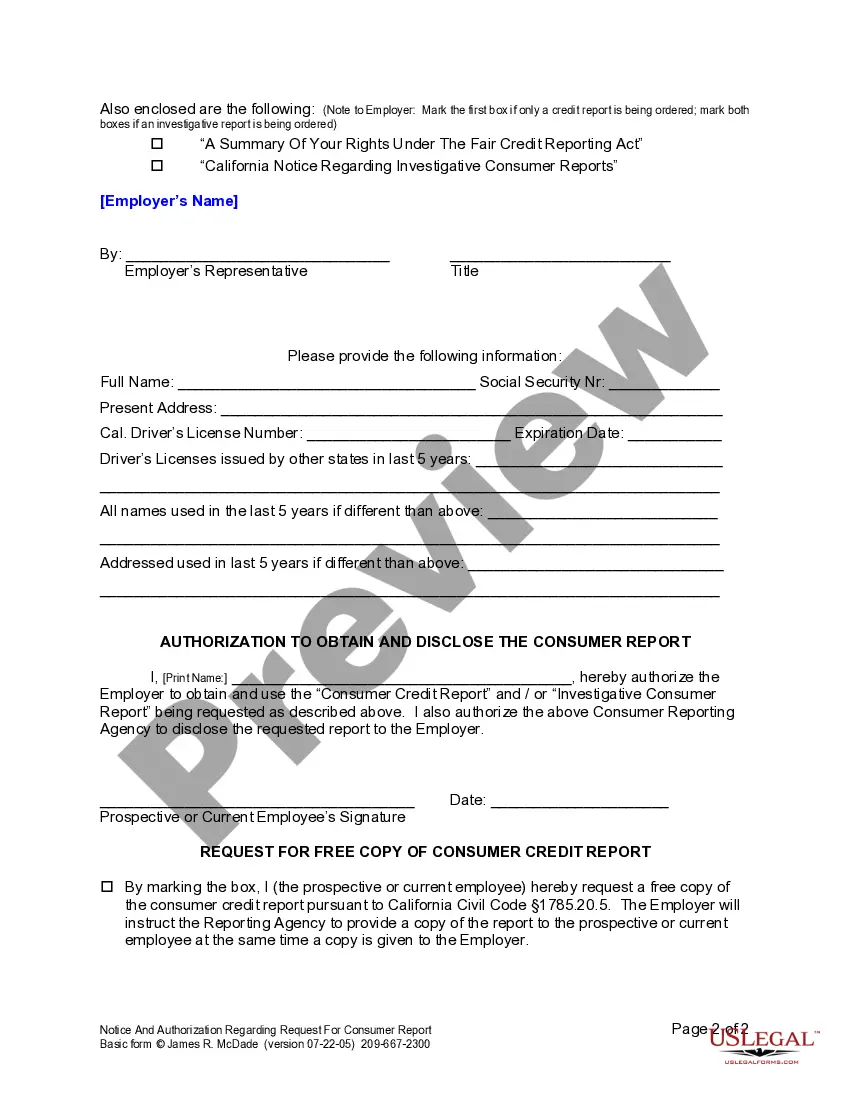

This form is used to obtain permission from an employee or prospective employee prior to the employer requesting a consumer credit report or background investigation.

Orange California Notice and Authorization Regarding Consumer Report is a legal document that provides important information to individuals in Orange, California, regarding their rights and consent in relation to consumer reports. This document is essential for both employers and individuals seeking to obtain or provide consumer reports. Consumer reports, also known as background checks, are relied upon by employers, landlords, lenders, and other entities to assess an individual's creditworthiness, character, and overall suitability for various purposes. These reports often include information such as credit history, employment records, criminal background checks, and more. The Orange California Notice and Authorization Regarding Consumer Report informs individuals about their rights under the Fair Credit Reporting Act (FCRA), a federal law that regulates the collection, dissemination, and use of consumer information. It ensures that individuals in Orange, California, are aware of their rights and protect their privacy and personal information during the consumer report process. This notice includes various key elements, such as: 1. Identifying Information: The document contains the individual's name, address, and other relevant personal details. 2. Explanation of Consumer Reports: The notice provides a clear explanation of what a consumer report entails, including the scope and purpose of the report. 3. Purpose for Obtaining Consumer Report: It details the specific reasons for seeking a consumer report, such as employment, tenancy, or credit application. 4. Rights Under FCRA: The document outlines the rights granted to individuals by the Fair Credit Reporting Act, including the right to be informed and provide consent for the report's procurement. 5. Disclosure: The notice discloses that a consumer report may be obtained and used in the decision-making process by the requesting entity. 6. Limitations on Use: It mentions the restrictions on how consumer reports can be used, ensuring they are lawful and only for permissible purposes. 7. Consent and Release: Individuals are required to sign and provide their authorization, granting permission for the entity to obtain their consumer report. Different types of Orange California Notice and Authorization Regarding Consumer Report may exist varying according to the purpose and entity involved. Some common variations include: 1. Employment-Related Consumer Reports: This specific type is used by employers during the pre-employment screening process to evaluate job applicants' background, credentials, and suitability for a position. 2. Tenant Screening Consumer Reports: Landlords and property managers may request these reports to assess the rental eligibility and reliability of potential tenants. 3. Credit Application Consumer Reports: Financial institutions and lenders utilize these reports to evaluate an individual's creditworthiness and determine whether to extend credit, such as loans or credit cards. In conclusion, the Orange California Notice and Authorization Regarding Consumer Report is a necessary legal document that ensures individuals in Orange, California, are informed of their rights and give explicit consent before their consumer reports are obtained. Whether for employment, tenancy, or credit purposes, this document safeguards privacy and establishes transparency during the background check process.Orange California Notice and Authorization Regarding Consumer Report is a legal document that provides important information to individuals in Orange, California, regarding their rights and consent in relation to consumer reports. This document is essential for both employers and individuals seeking to obtain or provide consumer reports. Consumer reports, also known as background checks, are relied upon by employers, landlords, lenders, and other entities to assess an individual's creditworthiness, character, and overall suitability for various purposes. These reports often include information such as credit history, employment records, criminal background checks, and more. The Orange California Notice and Authorization Regarding Consumer Report informs individuals about their rights under the Fair Credit Reporting Act (FCRA), a federal law that regulates the collection, dissemination, and use of consumer information. It ensures that individuals in Orange, California, are aware of their rights and protect their privacy and personal information during the consumer report process. This notice includes various key elements, such as: 1. Identifying Information: The document contains the individual's name, address, and other relevant personal details. 2. Explanation of Consumer Reports: The notice provides a clear explanation of what a consumer report entails, including the scope and purpose of the report. 3. Purpose for Obtaining Consumer Report: It details the specific reasons for seeking a consumer report, such as employment, tenancy, or credit application. 4. Rights Under FCRA: The document outlines the rights granted to individuals by the Fair Credit Reporting Act, including the right to be informed and provide consent for the report's procurement. 5. Disclosure: The notice discloses that a consumer report may be obtained and used in the decision-making process by the requesting entity. 6. Limitations on Use: It mentions the restrictions on how consumer reports can be used, ensuring they are lawful and only for permissible purposes. 7. Consent and Release: Individuals are required to sign and provide their authorization, granting permission for the entity to obtain their consumer report. Different types of Orange California Notice and Authorization Regarding Consumer Report may exist varying according to the purpose and entity involved. Some common variations include: 1. Employment-Related Consumer Reports: This specific type is used by employers during the pre-employment screening process to evaluate job applicants' background, credentials, and suitability for a position. 2. Tenant Screening Consumer Reports: Landlords and property managers may request these reports to assess the rental eligibility and reliability of potential tenants. 3. Credit Application Consumer Reports: Financial institutions and lenders utilize these reports to evaluate an individual's creditworthiness and determine whether to extend credit, such as loans or credit cards. In conclusion, the Orange California Notice and Authorization Regarding Consumer Report is a necessary legal document that ensures individuals in Orange, California, are informed of their rights and give explicit consent before their consumer reports are obtained. Whether for employment, tenancy, or credit purposes, this document safeguards privacy and establishes transparency during the background check process.