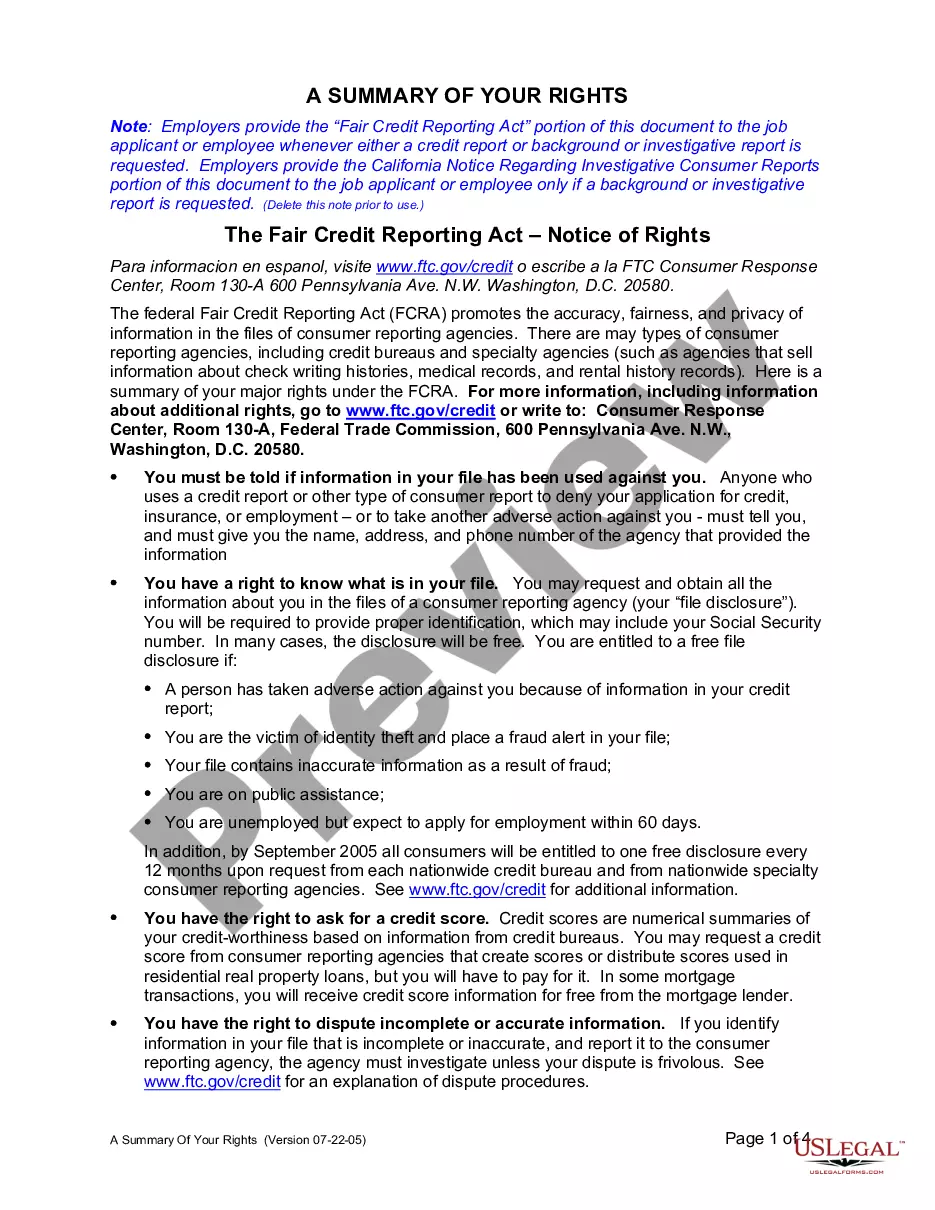

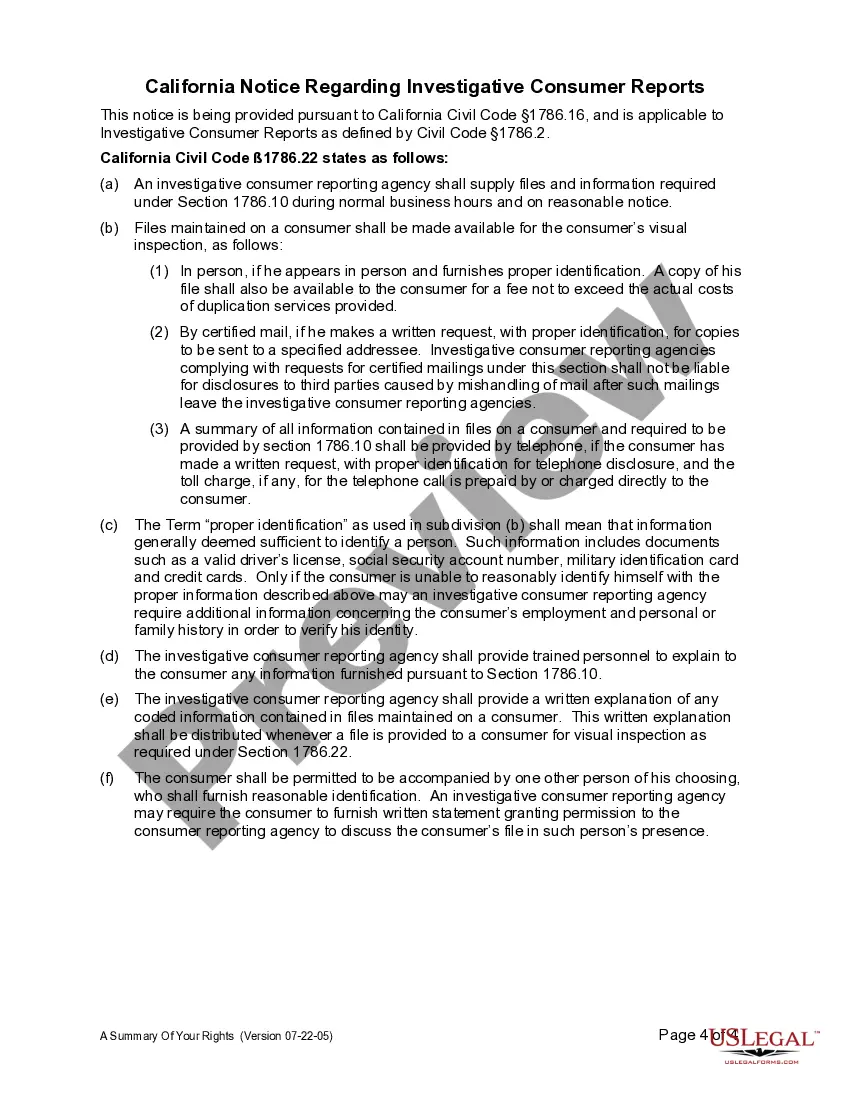

Employers provide the “Fair Credit Reporting Act” portion of this document to the job applicant or employee whenever either a credit report or background or investigative report is requested. Employers provide the California Notice Regarding Investigative Consumer Reports portion of this document to the job applicant or employee only if a background or investigative report is requested.

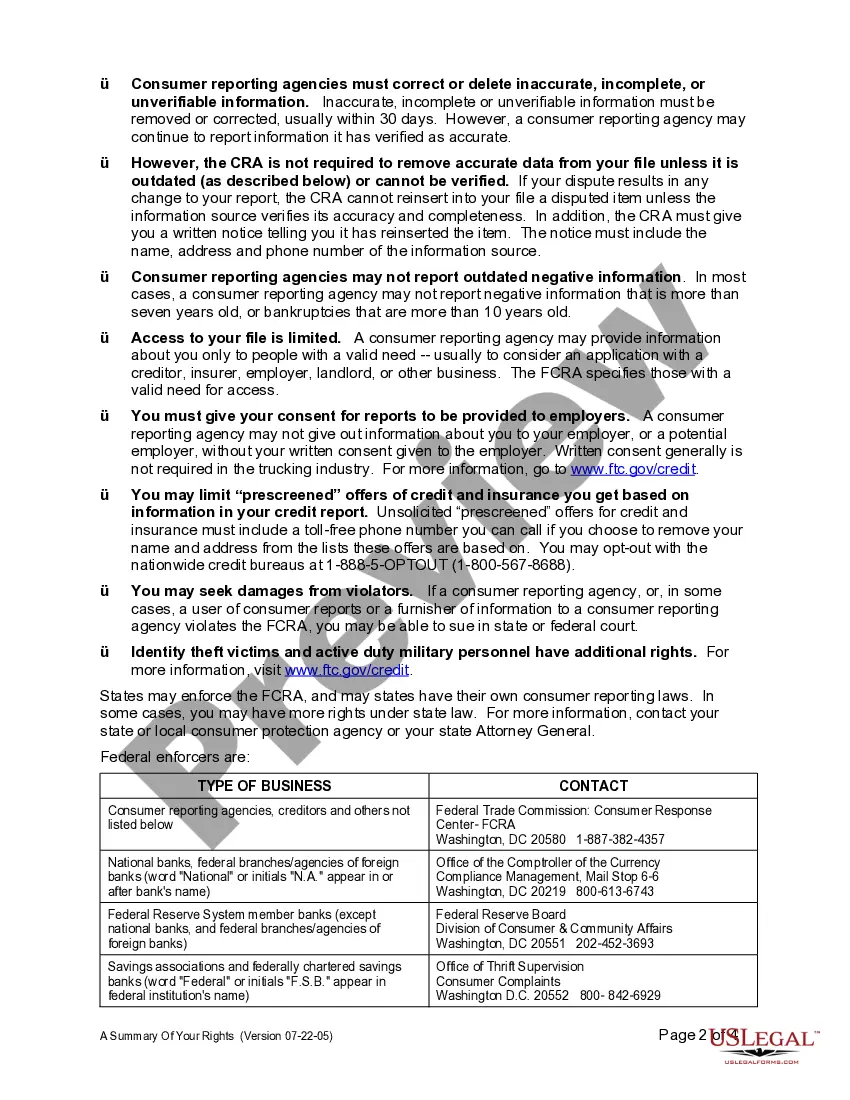

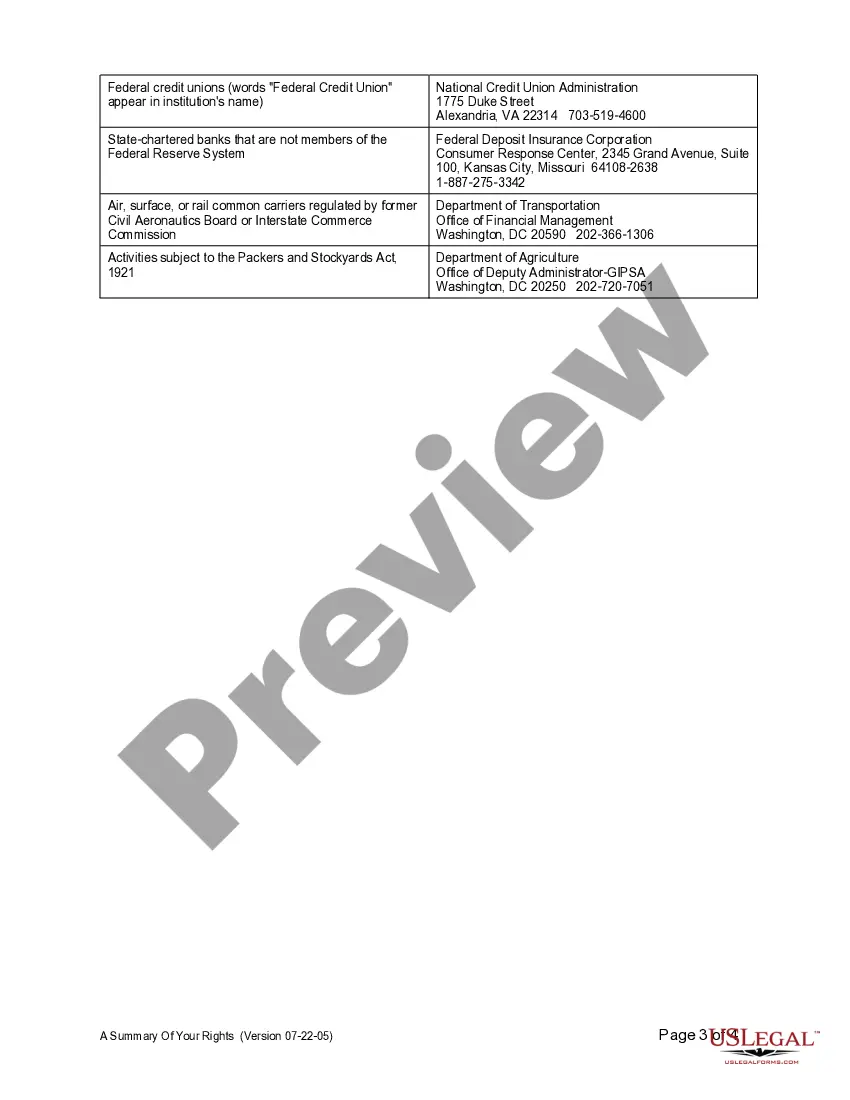

Title: Understanding Your Fair Credit Reporting Act Rights in Bakersfield, California Introduction: The Fair Credit Reporting Act (FCRA) is a crucial piece of federal legislation designed to protect consumers' rights when it comes to their credit information. This article will provide a detailed description of Bakersfield, California's Summary of Fair Credit Reporting Act Rights, ensuring residents are aware of their rights and can actively protect their credit information. We will explore various aspects of the FCRA as it pertains to Bakersfield residents. 1. Bakersfield California Fair Credit Reporting Act Rights: Under the FCRA, Bakersfield residents are entitled to a number of rights that ensure the accuracy, fairness, and privacy of their credit information. These include: a) The Right to Request a Free Credit Report Annually: Bakersfield residents can obtain a free copy of their credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually. This report allows individuals to review their credit history and ensure its accuracy. b) The Right to Dispute Inaccurate or Incomplete Information: If Bakersfield residents discover any inaccuracies in their credit report, they have the right to dispute the information. The credit reporting agencies must conduct a reasonable investigation within 30 days and correct any errors found. c) The Right to Limit Access to Credit Reports: Bakersfield consumers have control over who can access their credit reports. They can choose to grant access to potential employers, landlords, creditors, and other parties with a legitimate purpose. However, consent must be given, and any unauthorized access is actionable. d) The Right to Limit Unsolicited Offers: Bakersfield residents can opt-out of receiving pre-approved credit offers through the official website or phone number provided by credit reporting agencies. This reduces the risk of identity theft and unwanted solicitations. e) The Right to Notification When Negative Information is Reported: If any adverse information is added to a Bakersfield resident's credit report, they have the right to receive notification within a reasonable timeframe. This allows individuals to take necessary steps to resolve the issue promptly. f) The Right to Seek Damages for Violations: Bakersfield consumers have the right to seek damages from credit reporting agencies, creditors, or other entities that violate their FCRA rights. This empowers individuals to protect themselves against any unlawful or negligent actions that may harm their credit standing. Conclusion: Being aware of your Fair Credit Reporting Act rights is essential for all Bakersfield residents. By understanding these rights, individuals can take an active role in monitoring their credit information and protecting themselves against inaccuracies, fraud, and identity theft. Remember that the FCRA provides vital consumer protections, ensuring a fair and accurate representation of your credit history. Stay informed, exercise your rights, and take control of your credit in Bakersfield, California.Title: Understanding Your Fair Credit Reporting Act Rights in Bakersfield, California Introduction: The Fair Credit Reporting Act (FCRA) is a crucial piece of federal legislation designed to protect consumers' rights when it comes to their credit information. This article will provide a detailed description of Bakersfield, California's Summary of Fair Credit Reporting Act Rights, ensuring residents are aware of their rights and can actively protect their credit information. We will explore various aspects of the FCRA as it pertains to Bakersfield residents. 1. Bakersfield California Fair Credit Reporting Act Rights: Under the FCRA, Bakersfield residents are entitled to a number of rights that ensure the accuracy, fairness, and privacy of their credit information. These include: a) The Right to Request a Free Credit Report Annually: Bakersfield residents can obtain a free copy of their credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually. This report allows individuals to review their credit history and ensure its accuracy. b) The Right to Dispute Inaccurate or Incomplete Information: If Bakersfield residents discover any inaccuracies in their credit report, they have the right to dispute the information. The credit reporting agencies must conduct a reasonable investigation within 30 days and correct any errors found. c) The Right to Limit Access to Credit Reports: Bakersfield consumers have control over who can access their credit reports. They can choose to grant access to potential employers, landlords, creditors, and other parties with a legitimate purpose. However, consent must be given, and any unauthorized access is actionable. d) The Right to Limit Unsolicited Offers: Bakersfield residents can opt-out of receiving pre-approved credit offers through the official website or phone number provided by credit reporting agencies. This reduces the risk of identity theft and unwanted solicitations. e) The Right to Notification When Negative Information is Reported: If any adverse information is added to a Bakersfield resident's credit report, they have the right to receive notification within a reasonable timeframe. This allows individuals to take necessary steps to resolve the issue promptly. f) The Right to Seek Damages for Violations: Bakersfield consumers have the right to seek damages from credit reporting agencies, creditors, or other entities that violate their FCRA rights. This empowers individuals to protect themselves against any unlawful or negligent actions that may harm their credit standing. Conclusion: Being aware of your Fair Credit Reporting Act rights is essential for all Bakersfield residents. By understanding these rights, individuals can take an active role in monitoring their credit information and protecting themselves against inaccuracies, fraud, and identity theft. Remember that the FCRA provides vital consumer protections, ensuring a fair and accurate representation of your credit history. Stay informed, exercise your rights, and take control of your credit in Bakersfield, California.