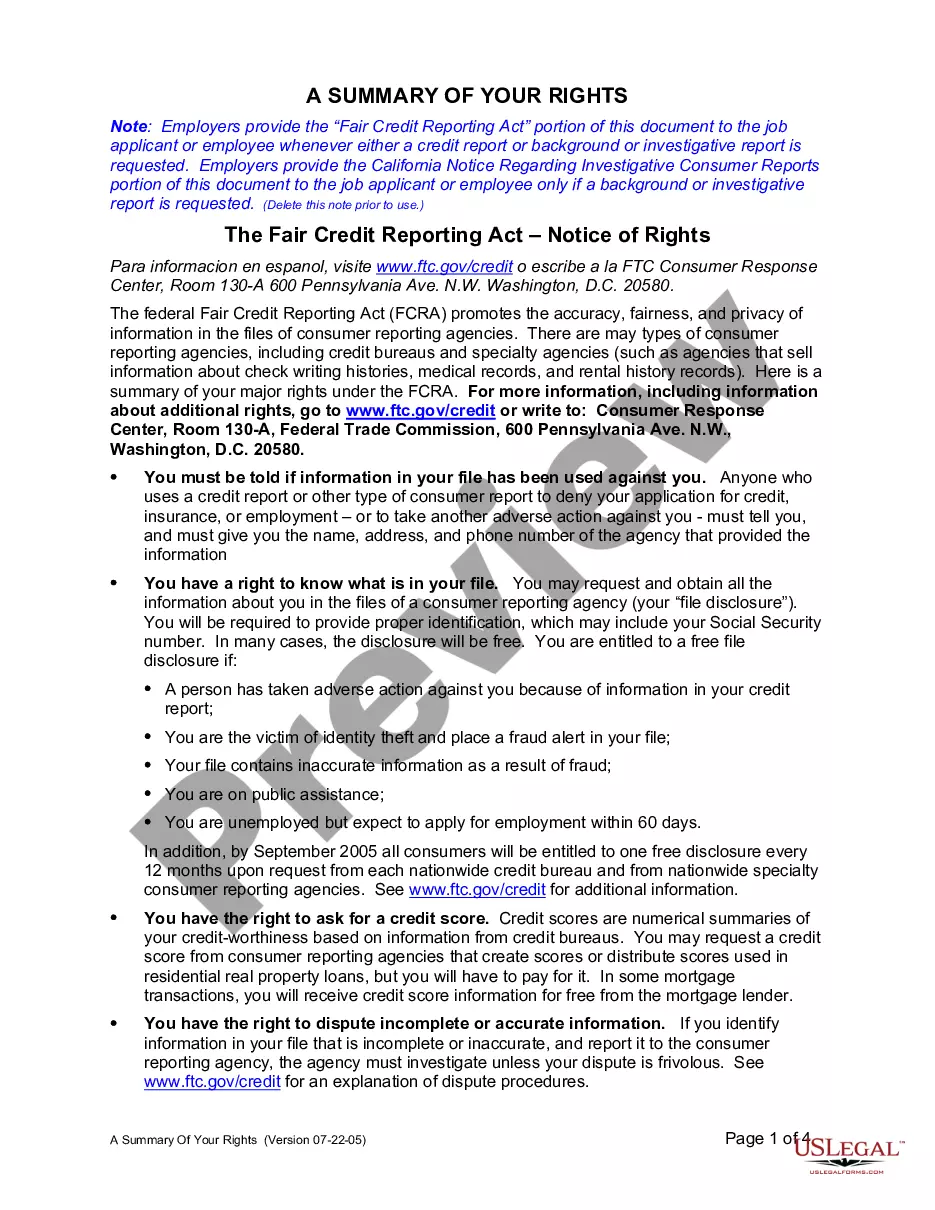

Employers provide the “Fair Credit Reporting Act” portion of this document to the job applicant or employee whenever either a credit report or background or investigative report is requested. Employers provide the California Notice Regarding Investigative Consumer Reports portion of this document to the job applicant or employee only if a background or investigative report is requested.

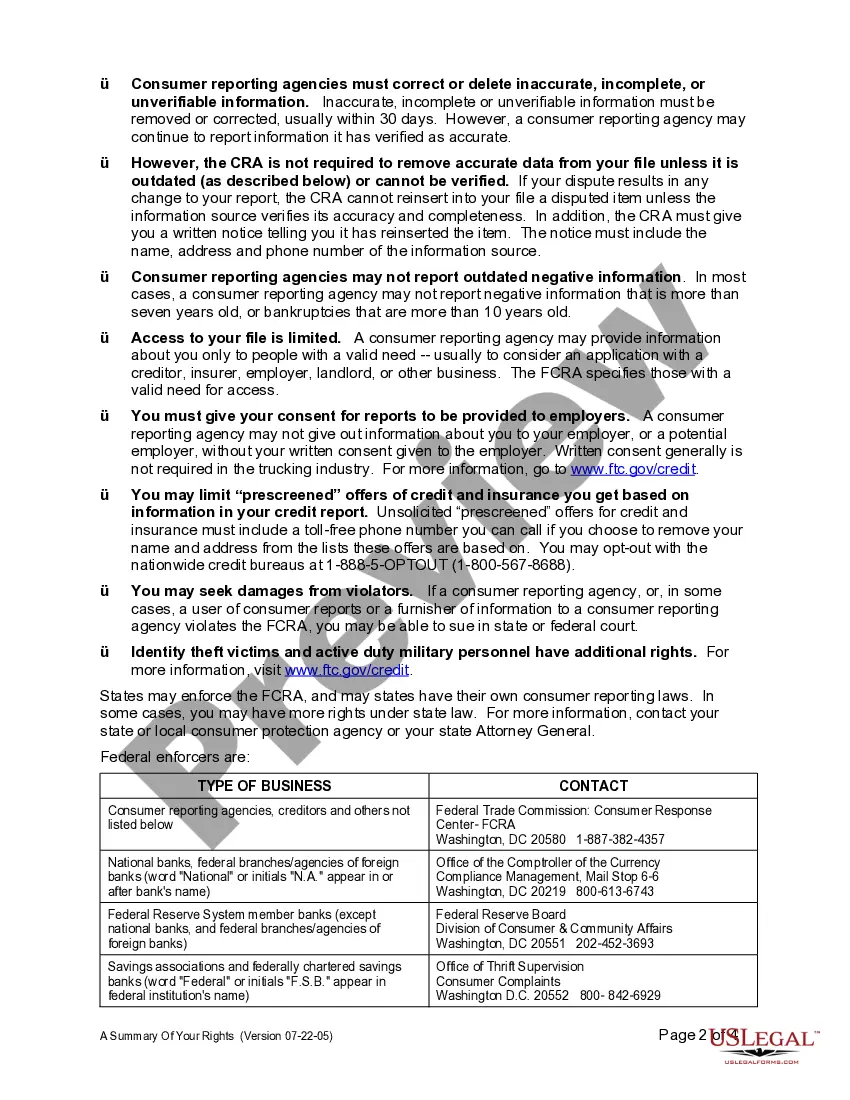

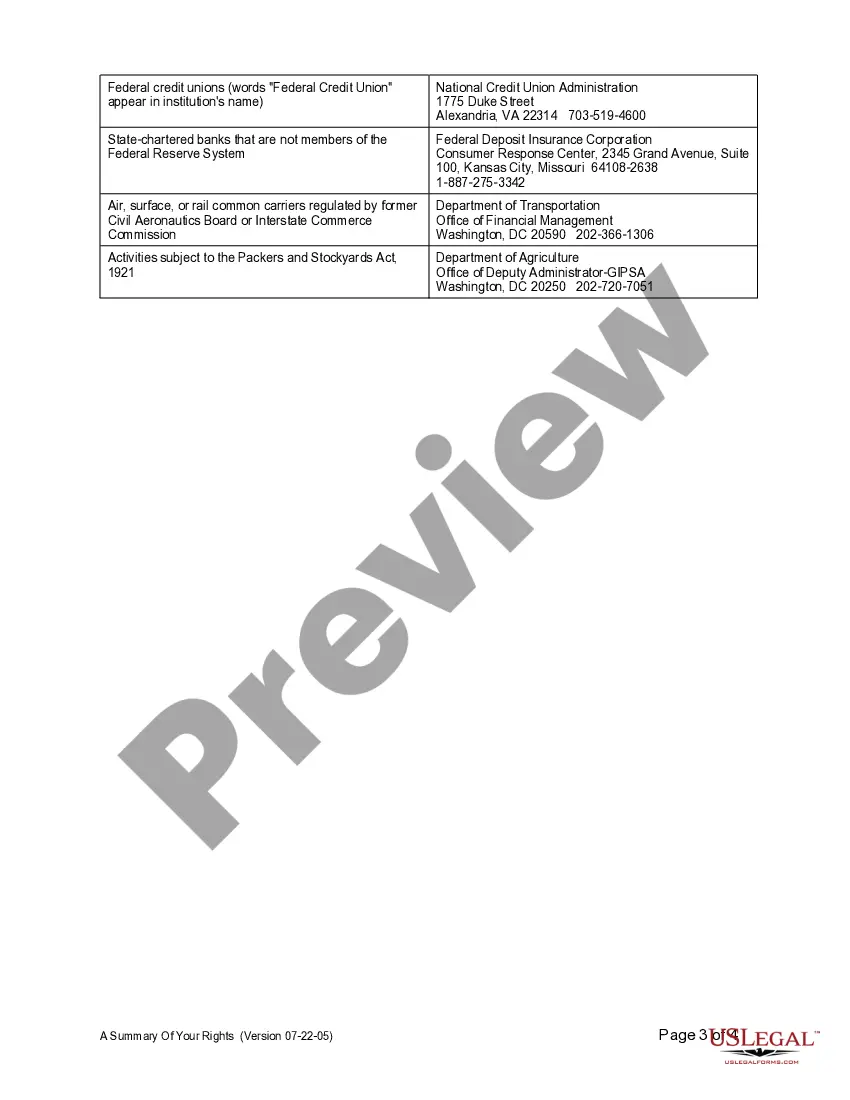

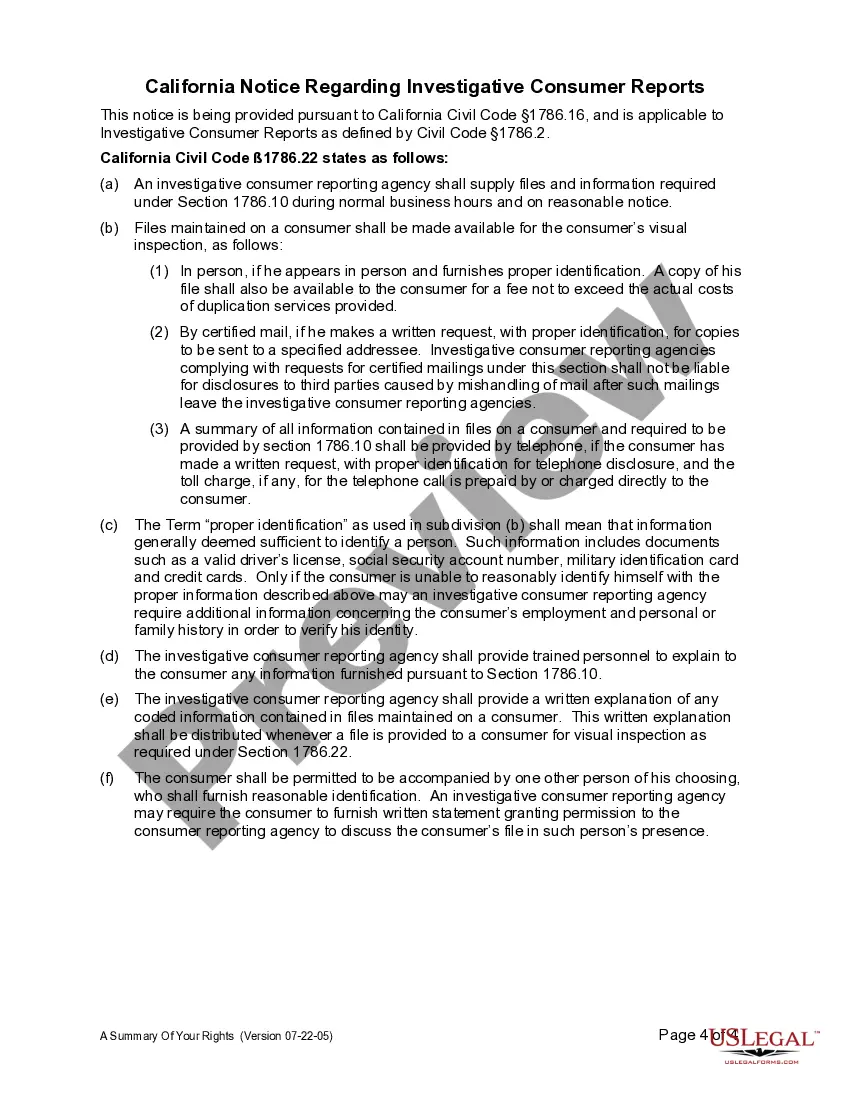

Chico California Summary of Fair Credit Reporting Act Rights is a comprehensive guide that outlines the fundamental rights individuals have under the Fair Credit Reporting Act (FCRA). FCRA is a federal law enacted to promote accuracy, fairness, and privacy in the information collected and reported by consumer reporting agencies (Crash), also known as credit bureaus. This summary specifically caters to residents of Chico, California, ensuring that they are aware of their rights and can take necessary actions if they believe their consumer reports contain inaccurate or misleading information. By understanding these rights, Chico residents can assert more control over their credit information and protect themselves from potential harm or discrimination. The various types of Chico California Summary of Fair Credit Reporting Act Rights that can be elaborated upon include: 1. Access to Your Credit Report: This section emphasizes an individual's right to obtain a free credit report from each of the three major credit bureaus — Equifax, Experian, and TransUnion – once every 12 months. Chico residents are encouraged to review their reports regularly and ensure the information is accurate and up-to-date. 2. Disputing Inaccurate Information: This section educates individuals about their right to dispute incomplete, inaccurate, or outdated information that appears on their credit reports. It outlines the process of filing a dispute with the credit bureau and how they should respond within 30 days. 3. Freezing and Unfreezing Credit Reports: Chico residents are informed of their right to place a security freeze on their credit reports, which restricts access by potential creditors unless authorized. The summary also explains the process of temporarily lifting the freeze when necessary, such as when seeking new credit. 4. Limitations on the Use of Credit Reports: This section sheds light on the circumstances in which an individual's credit report can be accessed by third parties, such as potential employers, landlords, and insurance companies. It explains that consent must be obtained, and additional information may be required for certain purposes. 5. Fraud and Identity Theft Protection: The summary outlines the steps individuals can take to detect, prevent, and recover from identity theft or fraud, as well as the rights they possess if they become victims. It highlights the importance of promptly reporting any suspicious activity and obtaining an extended fraud alert or credit freeze. 6. Your Rights in Case of Adverse Actions: Chico residents are informed about their entitlement to receive a notice if adverse actions, such as denial of credit, employment, or insurance, are taken based on their credit reports. This section explains the necessary steps to request a copy of the report that influenced the decision and dispute any inaccuracies. Chico California Summary of Fair Credit Reporting Act Rights helps individuals navigate the complex world of credit reporting and empowers them to take control of their financial well-being. By understanding and exercising these rights, Chico residents can ensure the accuracy and privacy of their credit information, leading to better financial opportunities and security.Chico California Summary of Fair Credit Reporting Act Rights is a comprehensive guide that outlines the fundamental rights individuals have under the Fair Credit Reporting Act (FCRA). FCRA is a federal law enacted to promote accuracy, fairness, and privacy in the information collected and reported by consumer reporting agencies (Crash), also known as credit bureaus. This summary specifically caters to residents of Chico, California, ensuring that they are aware of their rights and can take necessary actions if they believe their consumer reports contain inaccurate or misleading information. By understanding these rights, Chico residents can assert more control over their credit information and protect themselves from potential harm or discrimination. The various types of Chico California Summary of Fair Credit Reporting Act Rights that can be elaborated upon include: 1. Access to Your Credit Report: This section emphasizes an individual's right to obtain a free credit report from each of the three major credit bureaus — Equifax, Experian, and TransUnion – once every 12 months. Chico residents are encouraged to review their reports regularly and ensure the information is accurate and up-to-date. 2. Disputing Inaccurate Information: This section educates individuals about their right to dispute incomplete, inaccurate, or outdated information that appears on their credit reports. It outlines the process of filing a dispute with the credit bureau and how they should respond within 30 days. 3. Freezing and Unfreezing Credit Reports: Chico residents are informed of their right to place a security freeze on their credit reports, which restricts access by potential creditors unless authorized. The summary also explains the process of temporarily lifting the freeze when necessary, such as when seeking new credit. 4. Limitations on the Use of Credit Reports: This section sheds light on the circumstances in which an individual's credit report can be accessed by third parties, such as potential employers, landlords, and insurance companies. It explains that consent must be obtained, and additional information may be required for certain purposes. 5. Fraud and Identity Theft Protection: The summary outlines the steps individuals can take to detect, prevent, and recover from identity theft or fraud, as well as the rights they possess if they become victims. It highlights the importance of promptly reporting any suspicious activity and obtaining an extended fraud alert or credit freeze. 6. Your Rights in Case of Adverse Actions: Chico residents are informed about their entitlement to receive a notice if adverse actions, such as denial of credit, employment, or insurance, are taken based on their credit reports. This section explains the necessary steps to request a copy of the report that influenced the decision and dispute any inaccuracies. Chico California Summary of Fair Credit Reporting Act Rights helps individuals navigate the complex world of credit reporting and empowers them to take control of their financial well-being. By understanding and exercising these rights, Chico residents can ensure the accuracy and privacy of their credit information, leading to better financial opportunities and security.