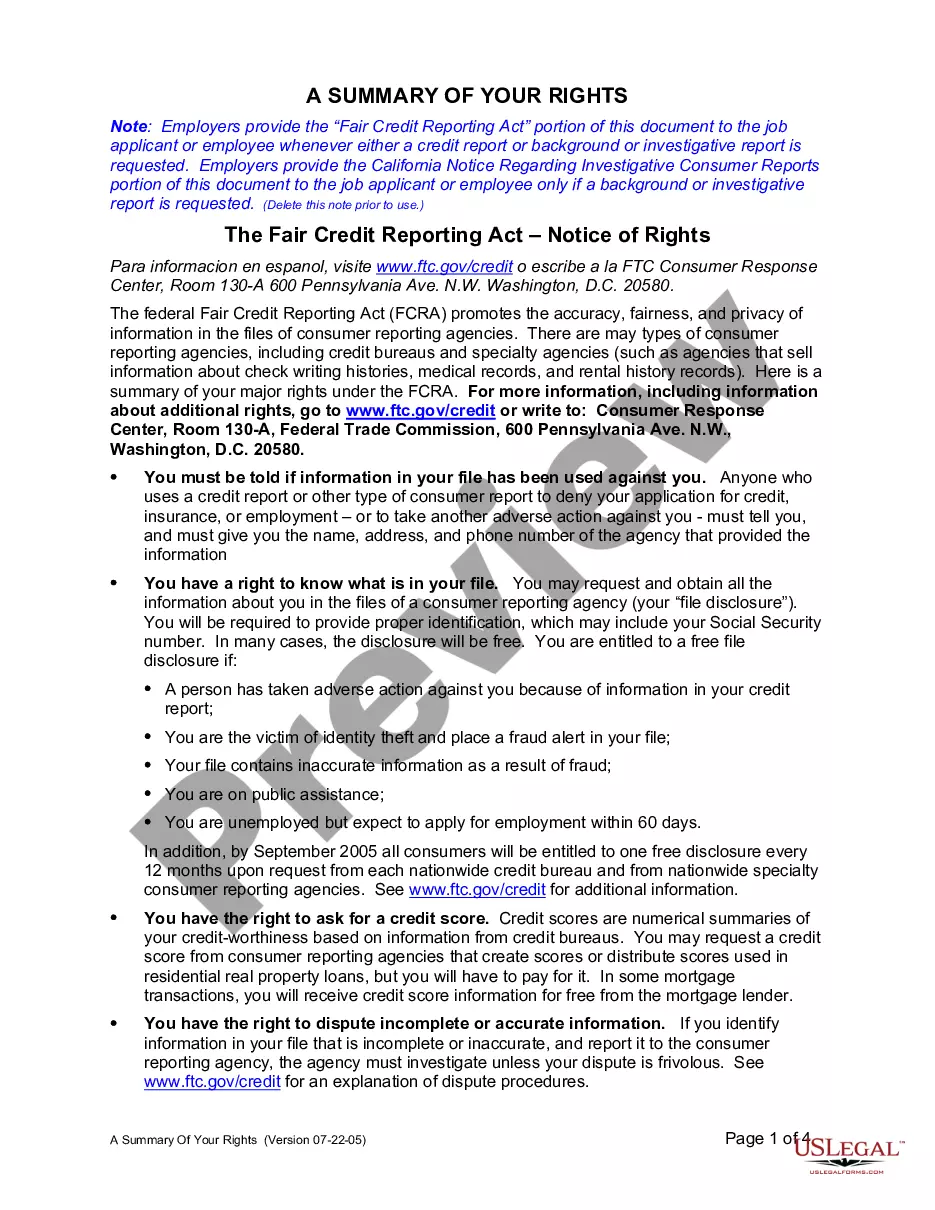

Employers provide the “Fair Credit Reporting Act” portion of this document to the job applicant or employee whenever either a credit report or background or investigative report is requested. Employers provide the California Notice Regarding Investigative Consumer Reports portion of this document to the job applicant or employee only if a background or investigative report is requested.

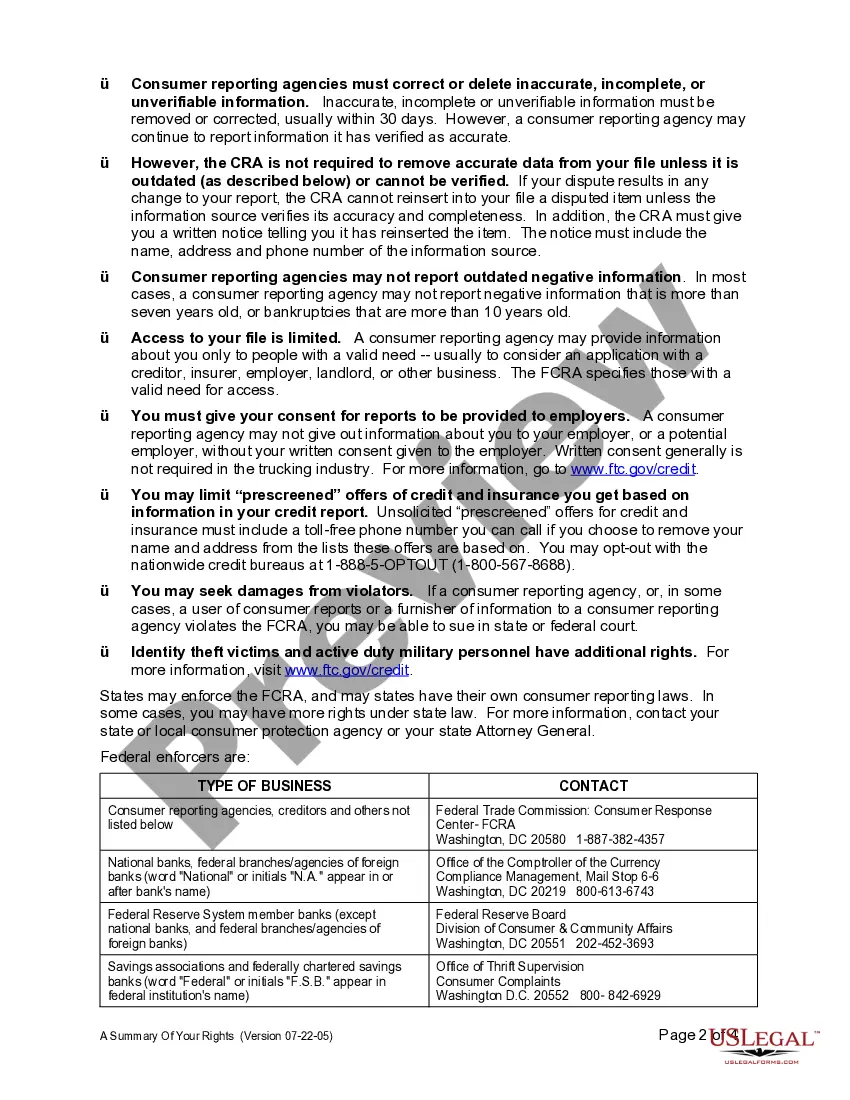

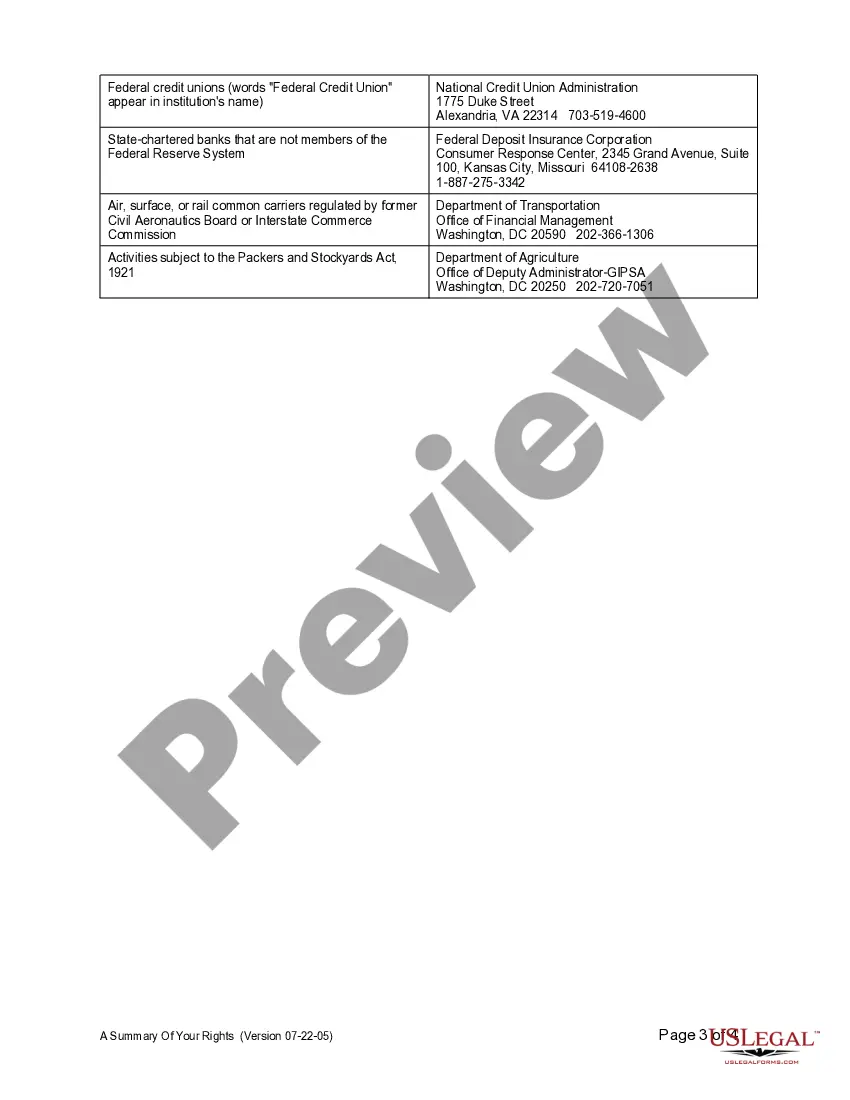

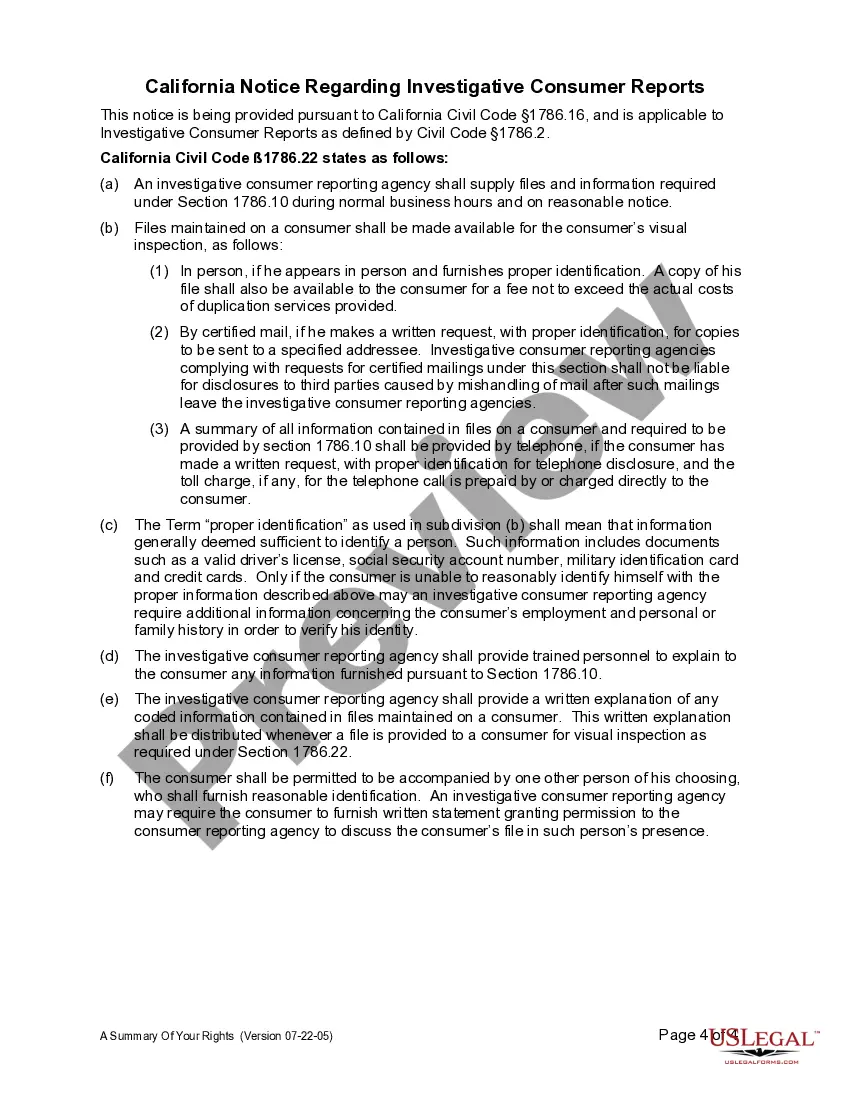

The Fair Credit Reporting Act (FCRA) is a federal consumer protection law that regulates the collection, dissemination, and use of consumer credit information. This summary will provide a detailed description of the Corona California Summary of Fair Credit Reporting Act Rights, outlining the different types and essential aspects of these rights. 1. Introduction to the FCRA: The FCRA is designed to protect individuals from the misuse of their credit information by ensuring accuracy, fairness, and privacy rights. This summary focuses on the specific application of FCRA rights within the context of Corona, California. 2. Access to Credit Reports: The FCRA entitles individuals to request and obtain a free copy of their credit report annually from each of the three major credit reporting agencies — Equifax, Experian, and TransUnion. Corona residents have the right to access and review their credit report for accuracy and potential discrepancies. 3. Dispute Process: If Corona residents identify any errors or discrepancies within their credit report, the FCRA provides the right to dispute and correct these inaccuracies. The summary will explain the step-by-step process of initiating a dispute, including how to contact credit reporting agencies and furnish supporting documentation. 4. Adverse Action Notices: Under the FCRA, individuals must receive an adverse action notice if they are denied credit, employment, or insurance based on information obtained from their credit report. This summary will outline the rights of Corona residents to receive timely notification, including the right to know the specific reasons for the adverse action. 5. Identity Theft Protection: The FCRA offers provisions to protect individuals against identity theft. In the event of suspected identity theft, Corona residents have the right to place a fraud alert or security freeze on their credit file, making it challenging for potential fraudsters to access their credit information. 6. Opting Out of Pre-Screened Offers: Corona residents can exercise their right to opt-out of receiving pre-screened credit and insurance offers, reducing the amount of unsolicited mail and potential identity theft risks. The summary will guide readers on how to opt-out via the official channels provided by the credit reporting agencies. 7. Rights to Privacy and Data Security: The FCRA ensures that credit reporting agencies maintain the privacy and security of individuals' credit information. This summary will highlight the specific requirements to protect consumer data and repercussions for breaching these obligations to ensure the privacy rights of Corona residents. 8. Enforcement and Remedies: The summary will provide information on the available enforcement mechanisms and remedies available to Corona residents in case of FCRA violations. This includes pursuing legal action, potential damages, and the possibility of class-action lawsuits. By providing a comprehensive overview of the Corona California Summary of Fair Credit Reporting Act Rights, this content targets individuals seeking specific information on their rights and privileges under the FCRA within the context of Corona, California.The Fair Credit Reporting Act (FCRA) is a federal consumer protection law that regulates the collection, dissemination, and use of consumer credit information. This summary will provide a detailed description of the Corona California Summary of Fair Credit Reporting Act Rights, outlining the different types and essential aspects of these rights. 1. Introduction to the FCRA: The FCRA is designed to protect individuals from the misuse of their credit information by ensuring accuracy, fairness, and privacy rights. This summary focuses on the specific application of FCRA rights within the context of Corona, California. 2. Access to Credit Reports: The FCRA entitles individuals to request and obtain a free copy of their credit report annually from each of the three major credit reporting agencies — Equifax, Experian, and TransUnion. Corona residents have the right to access and review their credit report for accuracy and potential discrepancies. 3. Dispute Process: If Corona residents identify any errors or discrepancies within their credit report, the FCRA provides the right to dispute and correct these inaccuracies. The summary will explain the step-by-step process of initiating a dispute, including how to contact credit reporting agencies and furnish supporting documentation. 4. Adverse Action Notices: Under the FCRA, individuals must receive an adverse action notice if they are denied credit, employment, or insurance based on information obtained from their credit report. This summary will outline the rights of Corona residents to receive timely notification, including the right to know the specific reasons for the adverse action. 5. Identity Theft Protection: The FCRA offers provisions to protect individuals against identity theft. In the event of suspected identity theft, Corona residents have the right to place a fraud alert or security freeze on their credit file, making it challenging for potential fraudsters to access their credit information. 6. Opting Out of Pre-Screened Offers: Corona residents can exercise their right to opt-out of receiving pre-screened credit and insurance offers, reducing the amount of unsolicited mail and potential identity theft risks. The summary will guide readers on how to opt-out via the official channels provided by the credit reporting agencies. 7. Rights to Privacy and Data Security: The FCRA ensures that credit reporting agencies maintain the privacy and security of individuals' credit information. This summary will highlight the specific requirements to protect consumer data and repercussions for breaching these obligations to ensure the privacy rights of Corona residents. 8. Enforcement and Remedies: The summary will provide information on the available enforcement mechanisms and remedies available to Corona residents in case of FCRA violations. This includes pursuing legal action, potential damages, and the possibility of class-action lawsuits. By providing a comprehensive overview of the Corona California Summary of Fair Credit Reporting Act Rights, this content targets individuals seeking specific information on their rights and privileges under the FCRA within the context of Corona, California.