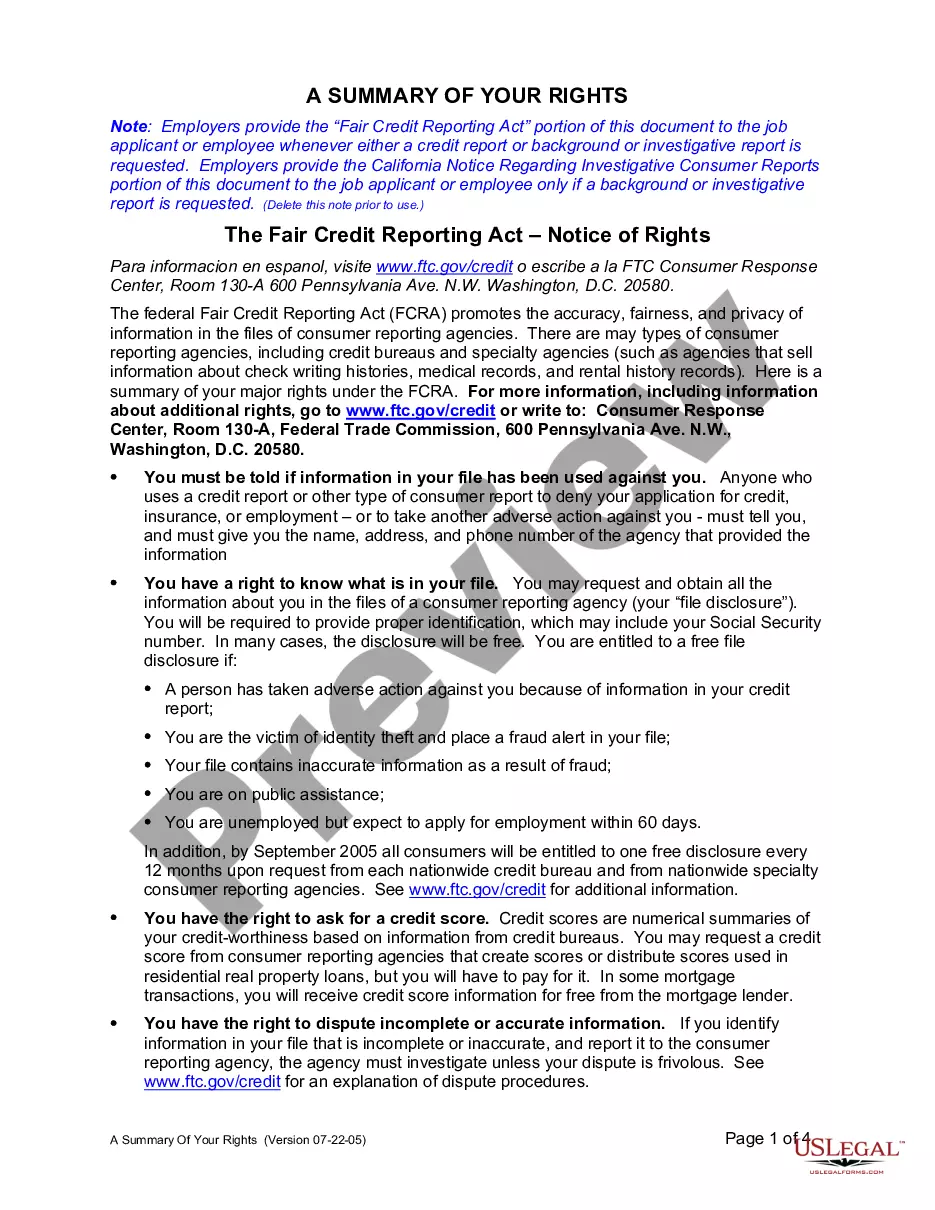

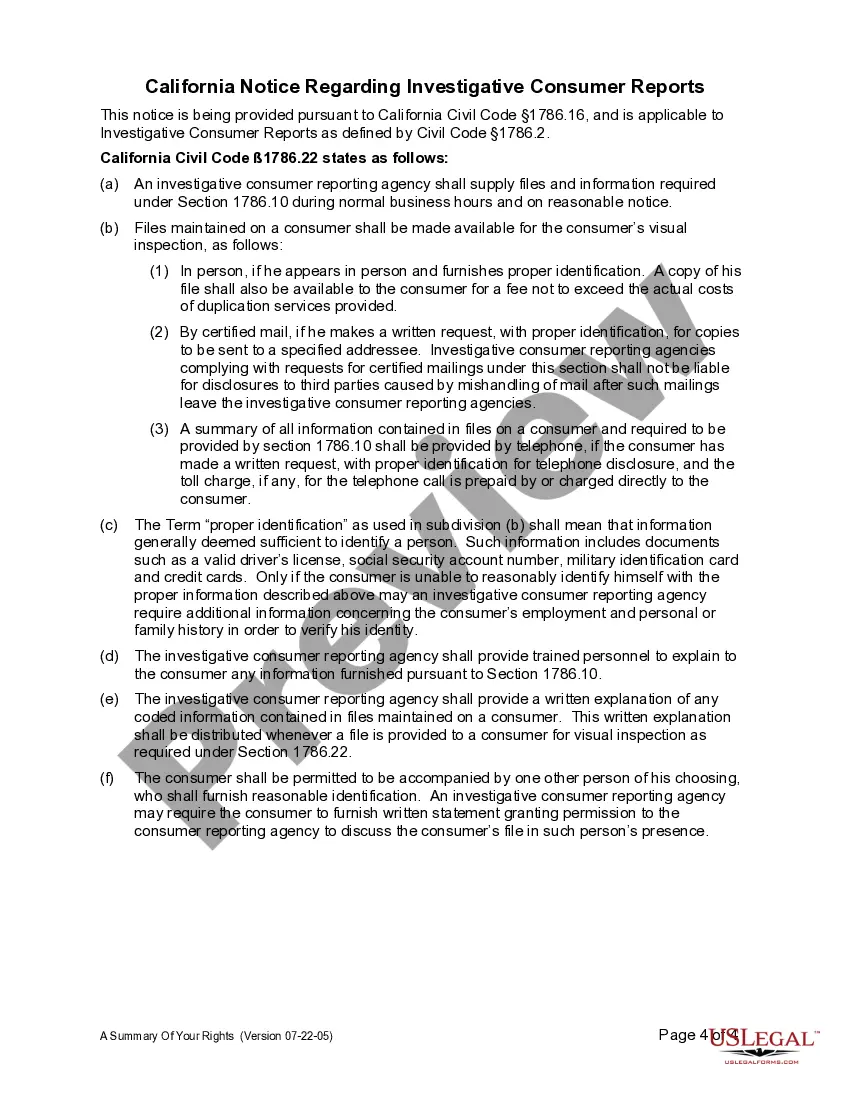

Employers provide the “Fair Credit Reporting Act” portion of this document to the job applicant or employee whenever either a credit report or background or investigative report is requested. Employers provide the California Notice Regarding Investigative Consumer Reports portion of this document to the job applicant or employee only if a background or investigative report is requested.

Los Angeles California Summary of Fair Credit Reporting Act Rights

Description

How to fill out California Summary Of Fair Credit Reporting Act Rights?

Regardless of societal or occupational standing, completing legal forms is a regrettable requisite in the current professional landscape.

Too frequently, it's nearly unfeasible for an individual lacking legal knowledge to formulate such documents from scratch, primarily due to the complicated terminology and legal subtleties they entail.

This is where US Legal Forms comes in to assist.

Verify that the form you have selected is appropriate for your region since the regulations of one state or locality do not apply to another.

You are all set! Now you can continue to print the document or fill it out online. If you encounter any difficulties finding your purchased forms, you can conveniently access them in the My documents section.

- Our service provides an extensive assortment of over 85,000 ready-to-use state-specific forms applicable for nearly any legal circumstance.

- US Legal Forms also acts as an invaluable resource for associates or legal advisors aiming to enhance their efficiency with our DIY templates.

- Whether you need the Los Angeles California Summary of Fair Credit Reporting Act Rights or any other document that will suit your state or locality, US Legal Forms has everything available at your fingertips.

- Here’s how you can quickly obtain the Los Angeles California Summary of Fair Credit Reporting Act Rights using our reliable service.

- If you are already a subscriber, you can proceed to Log In to your account to access the required form.

- If you are unfamiliar with our platform, make sure to follow these steps before acquiring the Los Angeles California Summary of Fair Credit Reporting Act Rights.

Form popularity

FAQ

The summary of rights under the Fair Credit Reporting Act outlines essential protections for consumers. It includes your rights to access, dispute inaccuracies, and protect your privacy regarding credit information. This summary serves as a valuable resource to help you understand and navigate the complexities of credit reporting. For detailed assistance, USLegalForms can provide you with the necessary tools to understand the Los Angeles California Summary of Fair Credit Reporting Act Rights effectively.

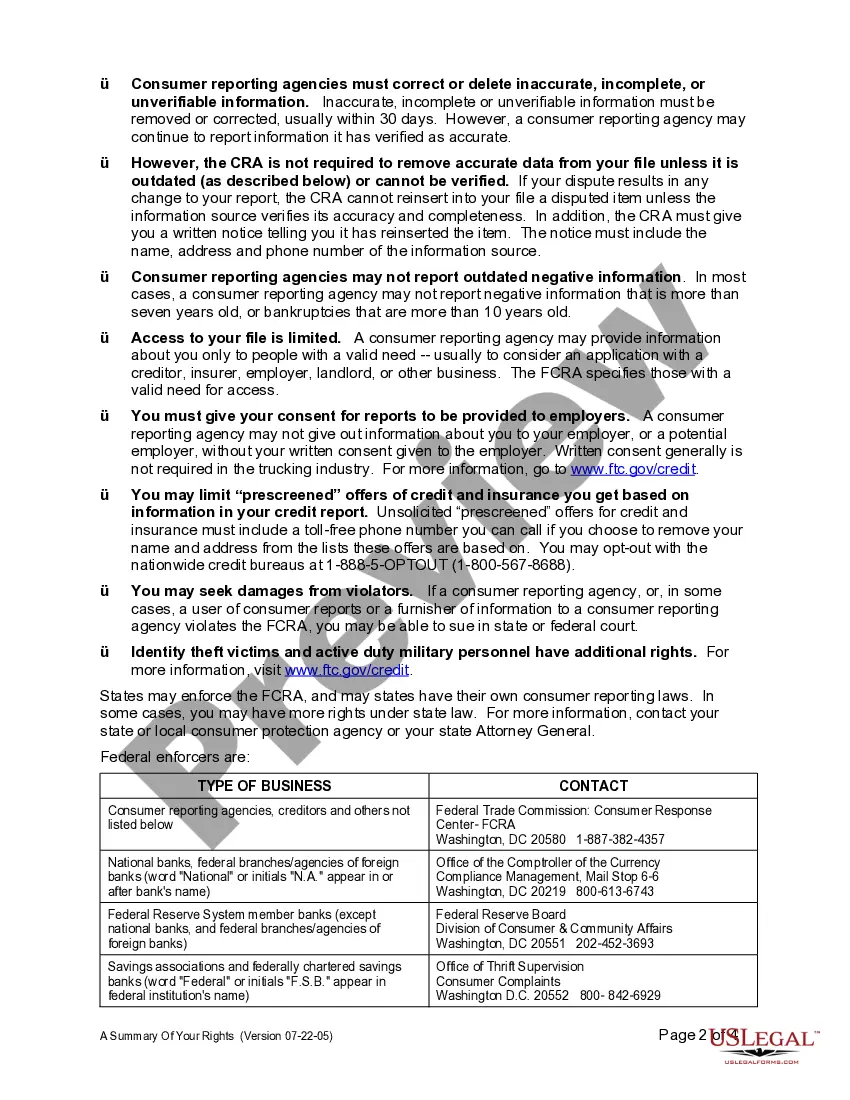

Under the Fair Credit Reporting Act, several key rights exist, including your right to access your credit report and dispute inaccurate information. If you identify errors, you can request that the credit reporting agency investigates those issues. Moreover, you have the right to limit the sharing of your information with certain entities. Knowing these rights enhances your understanding of the Los Angeles California Summary of Fair Credit Reporting Act Rights and empowers you to take action.

The Fair Credit Billing Act entitles consumers to specific rights regarding billing practices. You can challenge billing errors and request an investigation, giving you control over discrepancies. Additionally, you are protected against unfair collection practices, ensuring your ability to manage your credit accounts without undue pressure. Understanding your rights is essential for effective financial management, especially under the Los Angeles California Summary of Fair Credit Reporting Act Rights.

To report a violation of the Fair Credit Reporting Act, you should first gather all relevant information and documentation. Then, file a complaint with the Consumer Financial Protection Bureau or contact a consumer protection agency in your area. Utilizing platforms like uslegalforms can help guide you through the documentation process effectively, ensuring you address your concerns related to the Los Angeles California Summary of Fair Credit Reporting Act Rights.

A summary of your rights under the Fair Credit Reporting Act includes the right to access your credit report, dispute information, and be notified of adverse action taken based on your report. This summary helps you maintain an accurate credit file and understand how your financial activities impact your credit profile. Familiarizing yourself with these rights is essential to make informed decisions, which is the core of the Los Angeles California Summary of Fair Credit Reporting Act Rights.

Under the Fair Credit Reporting Act, individuals have the right to know what information is in their credit reports, dispute any inaccuracies, and limit access to their reports. You can also request that your credit report be used for legitimate purposes only. Understanding your rights within this framework is crucial, especially as it lays the foundation for the Los Angeles California Summary of Fair Credit Reporting Act Rights.

To opt out of certain reporting practices under the Fair Credit Reporting Act, you can request to limit the sharing of your information by contacting credit reporting agencies. This process allows you increased control over who views your credit report. Understanding the Los Angeles California Summary of Fair Credit Reporting Act Rights simplifies this process and helps you make informed decisions.

A summary of rights is an official document that outlines your protections under the Fair Credit Reporting Act. It details your rights concerning credit reporting, how you can correct errors, and what to do if your rights are violated. The Los Angeles California Summary of Fair Credit Reporting Act Rights serves as a vital resource for consumers wanting to stay informed.

Your rights under the Fair Credit Reporting Act include the right to access your credit report, dispute inaccurate information, and be informed if your credit report affects your chances of receiving credit. It is essential to understand the Los Angeles California Summary of Fair Credit Reporting Act Rights to ensure your financial well-being and protect your credit status.

If you believe that a violation of the Fair Credit Reporting Act has occurred, take prompt action by documenting the issue and seeking legal advice. You can also file a complaint with the Consumer Financial Protection Bureau. Knowing your Los Angeles California Summary of Fair Credit Reporting Act Rights can empower you to effectively address these violations.