Employers provide the “Fair Credit Reporting Act” portion of this document to the job applicant or employee whenever either a credit report or background or investigative report is requested. Employers provide the California Notice Regarding Investigative Consumer Reports portion of this document to the job applicant or employee only if a background or investigative report is requested.

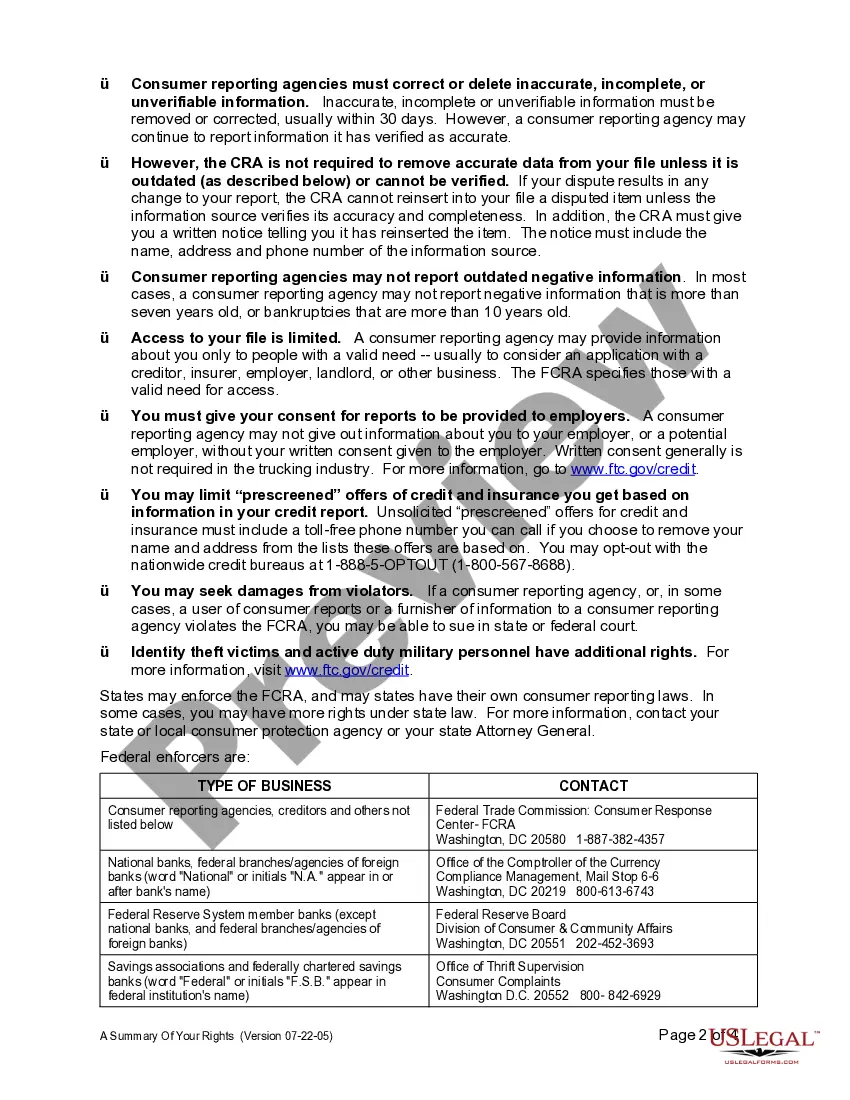

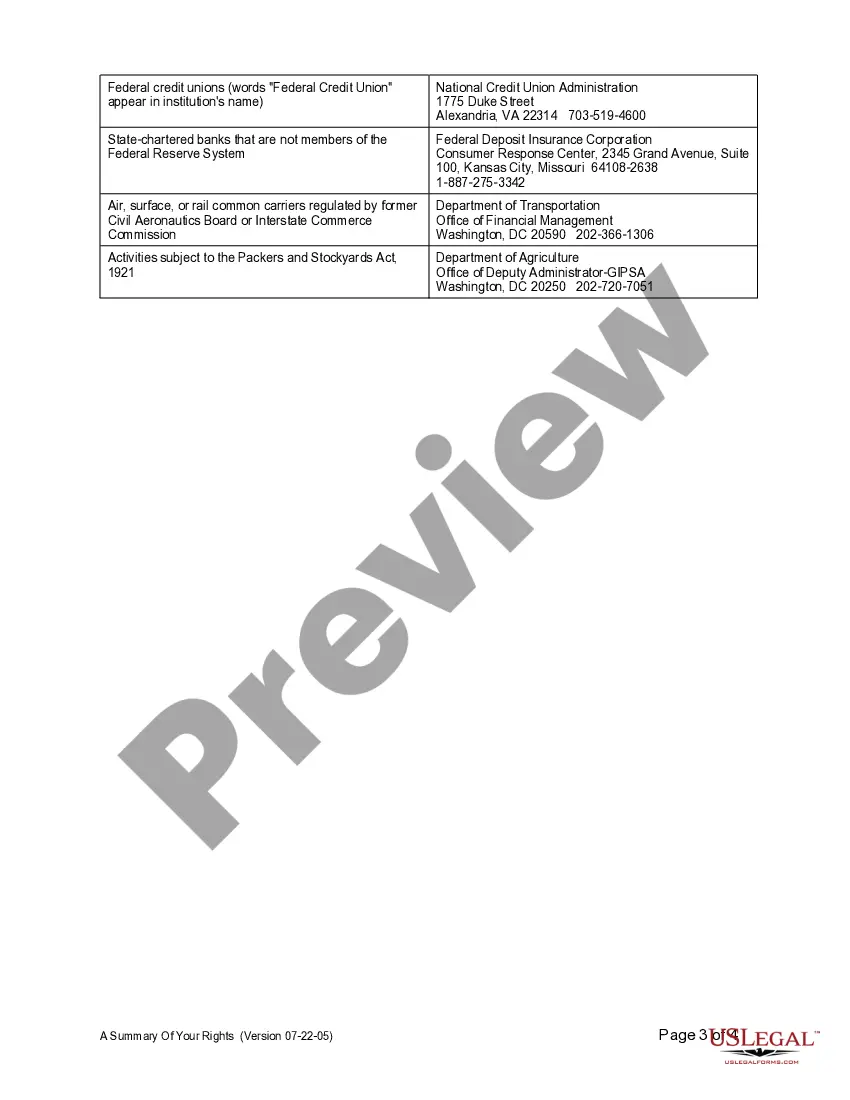

Orange California Summary of Fair Credit Reporting Act Rights is a comprehensive guide that outlines the various rights and protections granted to individuals under the Fair Credit Reporting Act (FCRA). The FCRA is a federal law that regulates the collection, accuracy, and use of consumer credit information, ensuring fairness, accuracy, and privacy for consumers. The Orange California Summary of Fair Credit Reporting Act Rights encompasses several key aspects of the FCRA, including but not limited to: 1. Access to Credit Reports: Individuals have the right to obtain a free copy of their credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once every 12 months. This right aims to allow consumers to monitor their creditworthiness and detect any potential errors or fraudulent activities. 2. Accuracy and Dispute of Credit Information: The FCRA mandates credit bureaus to maintain accurate and up-to-date information about consumers. If individuals identify any inaccuracies or incomplete information on their credit reports, they have the right to dispute it directly with both the credit bureau and the information provider. The credit reporting agencies must investigate such disputes within 30 days. 3. Consent for Credit Report Access: The FCRA requires individuals to provide consent before any party can access their credit report. This includes lenders, landlords, employers, insurers, and other entities seeking to evaluate an individual's creditworthiness. Without consent, these entities cannot access or use consumer credit information for their decision-making processes. 4. Limitations on Credit Report Usage: The FCRA imposes limits on who can access an individual's credit report and for what purposes. It prohibits unauthorized access and restricts access to only those with a legitimate need for the information. The Act also stipulates that adverse actions, such as denial of credit or employment, must be informed to individuals along with the specific reason behind the decision. 5. Privacy and Security: The FCRA includes provisions to safeguard consumer privacy and protect against identity theft. It forbids the inclusion of certain types of sensitive information, such as medical records, in credit reports. It also mandates credit bureaus to take appropriate measures to ensure the security of consumer data. The Orange California Summary of Fair Credit Reporting Act Rights serves as a valuable resource for Orange residents, providing them with a clear understanding of their rights and protections under the FCRA. It empowers individuals to make informed decisions regarding their credit and take necessary steps to correct any inaccuracies or resolve disputes. Overall, the Orange California Summary of Fair Credit Reporting Act Rights works towards promoting fairness, accuracy, and transparency in the credit reporting process, ultimately contributing to consumers' financial well-being and confidence in credit-related transactions.Orange California Summary of Fair Credit Reporting Act Rights is a comprehensive guide that outlines the various rights and protections granted to individuals under the Fair Credit Reporting Act (FCRA). The FCRA is a federal law that regulates the collection, accuracy, and use of consumer credit information, ensuring fairness, accuracy, and privacy for consumers. The Orange California Summary of Fair Credit Reporting Act Rights encompasses several key aspects of the FCRA, including but not limited to: 1. Access to Credit Reports: Individuals have the right to obtain a free copy of their credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once every 12 months. This right aims to allow consumers to monitor their creditworthiness and detect any potential errors or fraudulent activities. 2. Accuracy and Dispute of Credit Information: The FCRA mandates credit bureaus to maintain accurate and up-to-date information about consumers. If individuals identify any inaccuracies or incomplete information on their credit reports, they have the right to dispute it directly with both the credit bureau and the information provider. The credit reporting agencies must investigate such disputes within 30 days. 3. Consent for Credit Report Access: The FCRA requires individuals to provide consent before any party can access their credit report. This includes lenders, landlords, employers, insurers, and other entities seeking to evaluate an individual's creditworthiness. Without consent, these entities cannot access or use consumer credit information for their decision-making processes. 4. Limitations on Credit Report Usage: The FCRA imposes limits on who can access an individual's credit report and for what purposes. It prohibits unauthorized access and restricts access to only those with a legitimate need for the information. The Act also stipulates that adverse actions, such as denial of credit or employment, must be informed to individuals along with the specific reason behind the decision. 5. Privacy and Security: The FCRA includes provisions to safeguard consumer privacy and protect against identity theft. It forbids the inclusion of certain types of sensitive information, such as medical records, in credit reports. It also mandates credit bureaus to take appropriate measures to ensure the security of consumer data. The Orange California Summary of Fair Credit Reporting Act Rights serves as a valuable resource for Orange residents, providing them with a clear understanding of their rights and protections under the FCRA. It empowers individuals to make informed decisions regarding their credit and take necessary steps to correct any inaccuracies or resolve disputes. Overall, the Orange California Summary of Fair Credit Reporting Act Rights works towards promoting fairness, accuracy, and transparency in the credit reporting process, ultimately contributing to consumers' financial well-being and confidence in credit-related transactions.