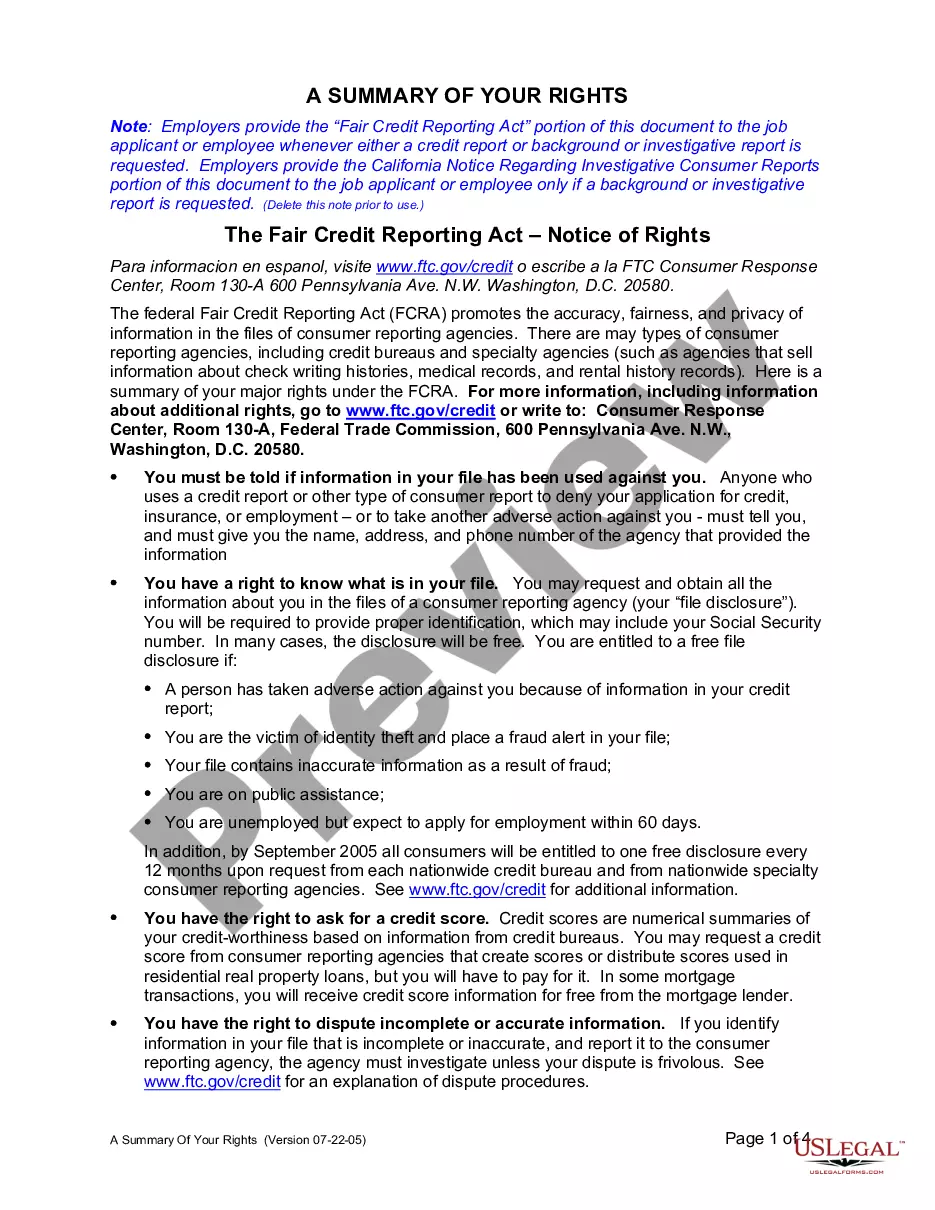

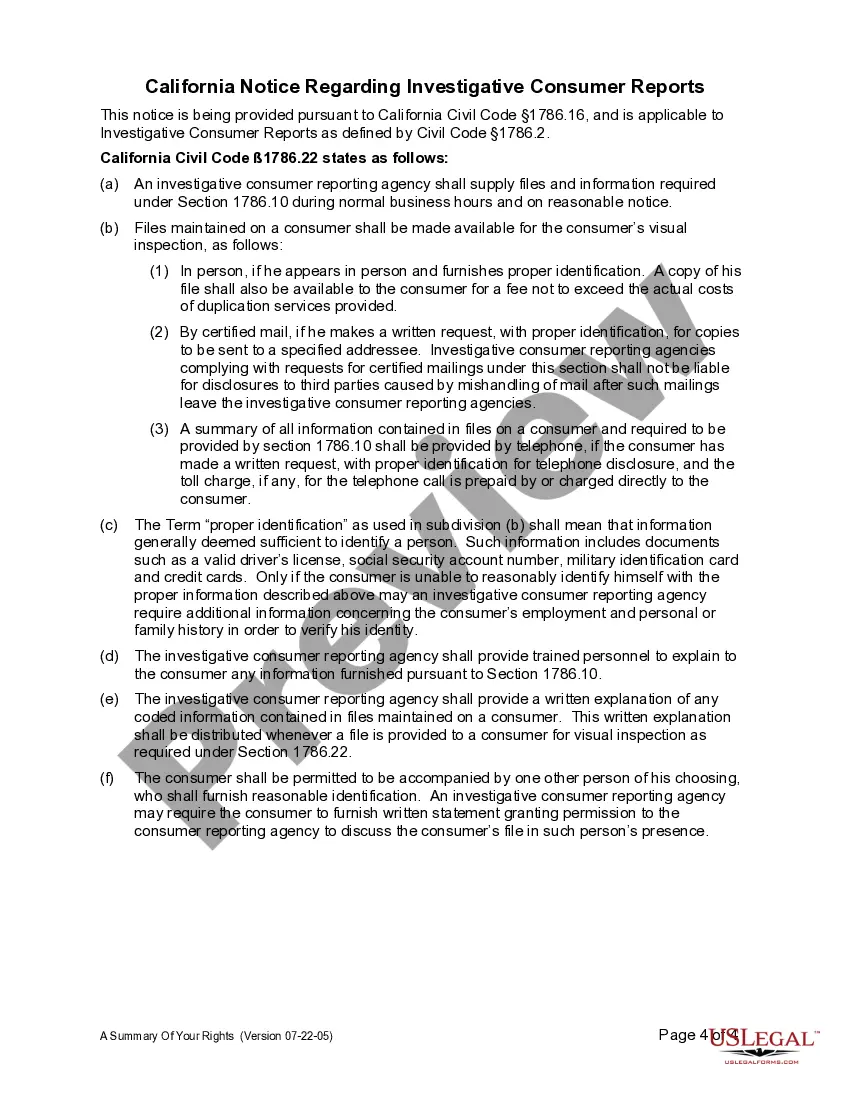

Employers provide the “Fair Credit Reporting Act” portion of this document to the job applicant or employee whenever either a credit report or background or investigative report is requested. Employers provide the California Notice Regarding Investigative Consumer Reports portion of this document to the job applicant or employee only if a background or investigative report is requested.

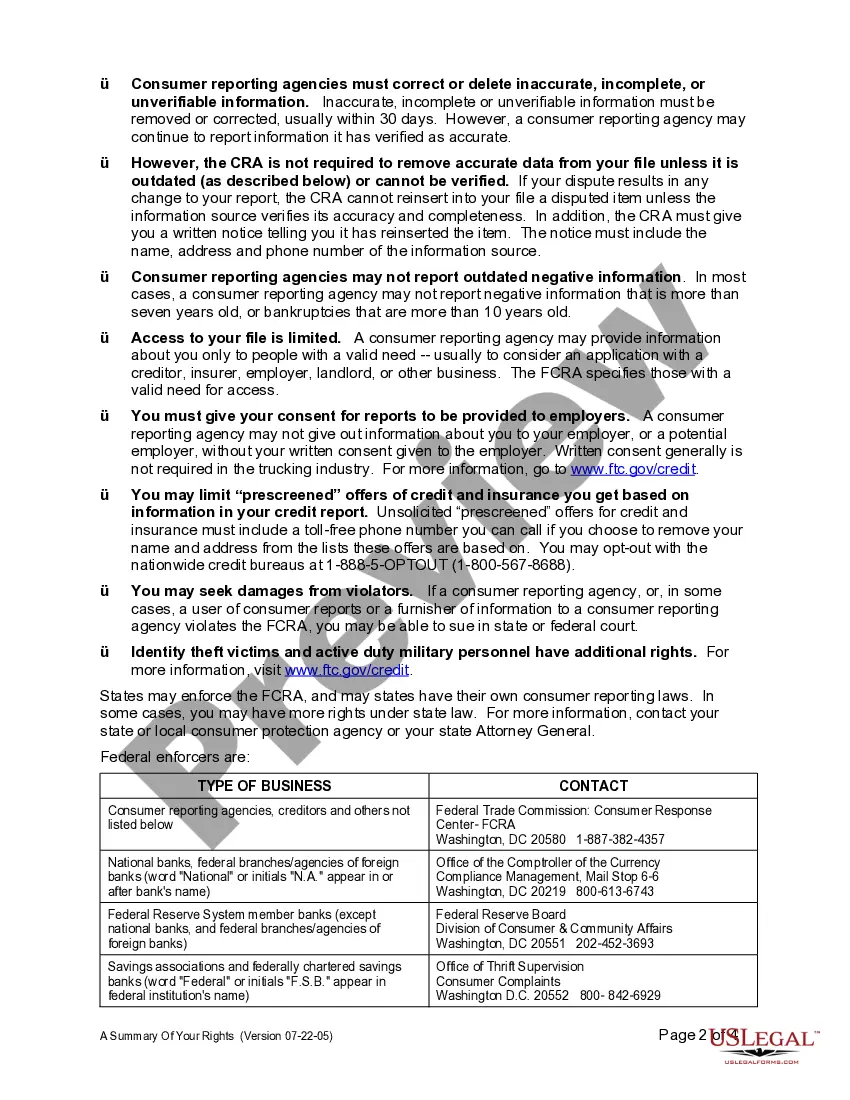

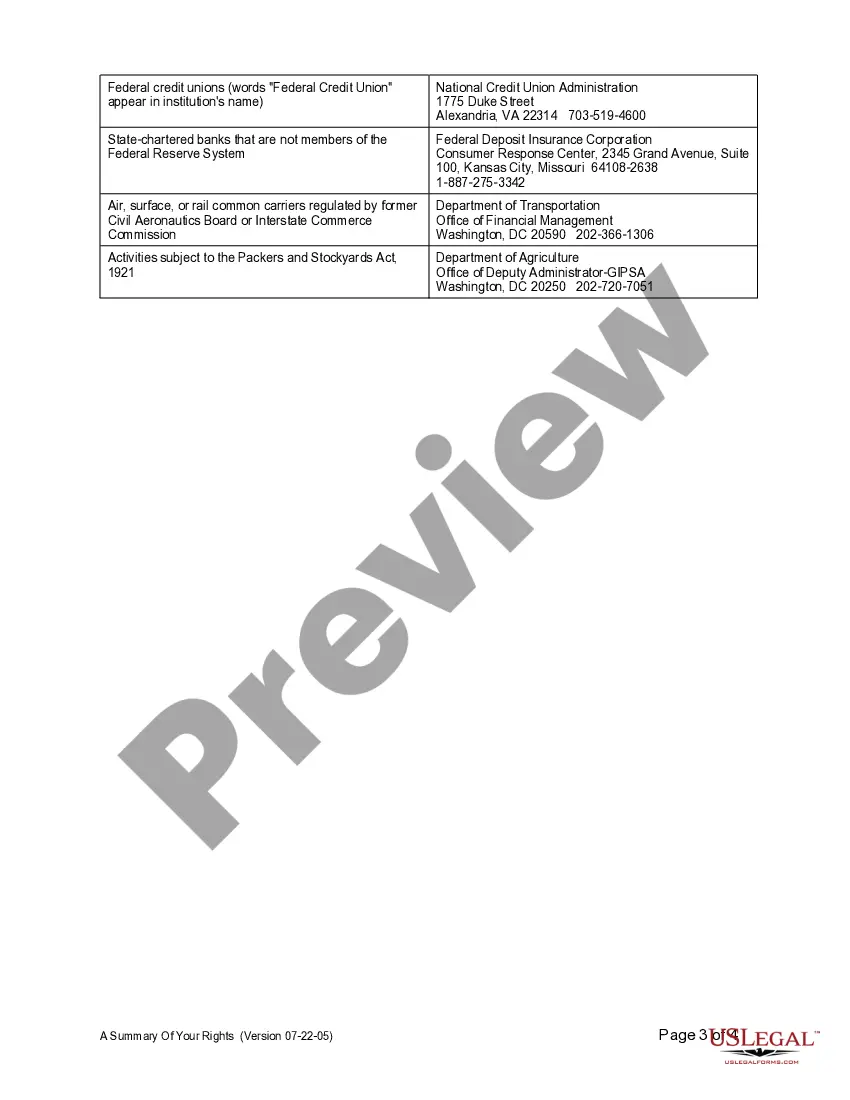

Title: Understanding Pomona California Summary of Fair Credit Reporting Act (FCRA) Rights Keywords: Pomona California, Fair Credit Reporting Act, FCRA, consumer rights, credit reports, credit bureaus, accurate information, dispute process. Introduction: The Pomona California Summary of Fair Credit Reporting Act (FCRA) Rights outlines the fundamental privileges afforded to residents in Pomona, California, regarding their credit reports and personal information. This legislation aims to protect consumers' interests by ensuring fair, accurate, and private reporting practices among credit bureaus and businesses. 1. Consumer Rights under Pomona California FCRA: The Pomona California FCRA Summary grants consumers in the city various rights to maintain accurate credit reports and the right to privacy. Key provisions include: a) Access to Free Annual Credit Reports: Residents of Pomona, California have the right to obtain a free copy of their credit report annually from each of the major credit reporting agencies. b) Right to Accurate Credit Information: Individuals have the right to expect that the information contained within their credit report is accurate, complete, and up-to-date. Inaccurate or outdated information can significantly impact creditworthiness. c) Dispute Process: Pomona residents have the right to dispute any inaccurate or incomplete information in their credit report. Credit reporting agencies must investigate the dispute within 30 days and correct any errors or provide a written explanation if the information is found to be accurate. d) Consent for Credit Reports: Businesses and lenders are required to obtain consumer consent before accessing their credit reports for any purpose not related to credit approval, employment screening, or other permissible purposes outlined in the FCRA. 2. Additional Protections under Pomona California FCRA: In addition to the general rights outlined above, Pomona, California residents are also entitled to certain specific protections under the FCRA. These include: a) Identity Theft Prevention and Remediation: The FCRA provides measures to help individuals prevent and recover from identity theft, such as placing fraud alerts or credit freezes on their accounts. b) Consumer Reporting Agency Contact Information: Pomona residents have the right to contact credit reporting agencies to obtain information about the consumer reporting process and their rights under the FCRA. c) Transparency: The FCRA ensures transparency regarding the sources and nature of information reported by credit bureaus. Consumers have the right to know who has requested their credit report within certain time frames. Conclusion: Understanding the Pomona California Summary of Fair Credit Reporting Act Rights is crucial for residents of Pomona. It empowers them to ensure the accuracy of their credit reports, protects against identity theft, and promotes fair credit reporting practices. By prioritizing these rights, individuals can maintain their financial well-being and make informed decisions based on reliable credit information.Title: Understanding Pomona California Summary of Fair Credit Reporting Act (FCRA) Rights Keywords: Pomona California, Fair Credit Reporting Act, FCRA, consumer rights, credit reports, credit bureaus, accurate information, dispute process. Introduction: The Pomona California Summary of Fair Credit Reporting Act (FCRA) Rights outlines the fundamental privileges afforded to residents in Pomona, California, regarding their credit reports and personal information. This legislation aims to protect consumers' interests by ensuring fair, accurate, and private reporting practices among credit bureaus and businesses. 1. Consumer Rights under Pomona California FCRA: The Pomona California FCRA Summary grants consumers in the city various rights to maintain accurate credit reports and the right to privacy. Key provisions include: a) Access to Free Annual Credit Reports: Residents of Pomona, California have the right to obtain a free copy of their credit report annually from each of the major credit reporting agencies. b) Right to Accurate Credit Information: Individuals have the right to expect that the information contained within their credit report is accurate, complete, and up-to-date. Inaccurate or outdated information can significantly impact creditworthiness. c) Dispute Process: Pomona residents have the right to dispute any inaccurate or incomplete information in their credit report. Credit reporting agencies must investigate the dispute within 30 days and correct any errors or provide a written explanation if the information is found to be accurate. d) Consent for Credit Reports: Businesses and lenders are required to obtain consumer consent before accessing their credit reports for any purpose not related to credit approval, employment screening, or other permissible purposes outlined in the FCRA. 2. Additional Protections under Pomona California FCRA: In addition to the general rights outlined above, Pomona, California residents are also entitled to certain specific protections under the FCRA. These include: a) Identity Theft Prevention and Remediation: The FCRA provides measures to help individuals prevent and recover from identity theft, such as placing fraud alerts or credit freezes on their accounts. b) Consumer Reporting Agency Contact Information: Pomona residents have the right to contact credit reporting agencies to obtain information about the consumer reporting process and their rights under the FCRA. c) Transparency: The FCRA ensures transparency regarding the sources and nature of information reported by credit bureaus. Consumers have the right to know who has requested their credit report within certain time frames. Conclusion: Understanding the Pomona California Summary of Fair Credit Reporting Act Rights is crucial for residents of Pomona. It empowers them to ensure the accuracy of their credit reports, protects against identity theft, and promotes fair credit reporting practices. By prioritizing these rights, individuals can maintain their financial well-being and make informed decisions based on reliable credit information.