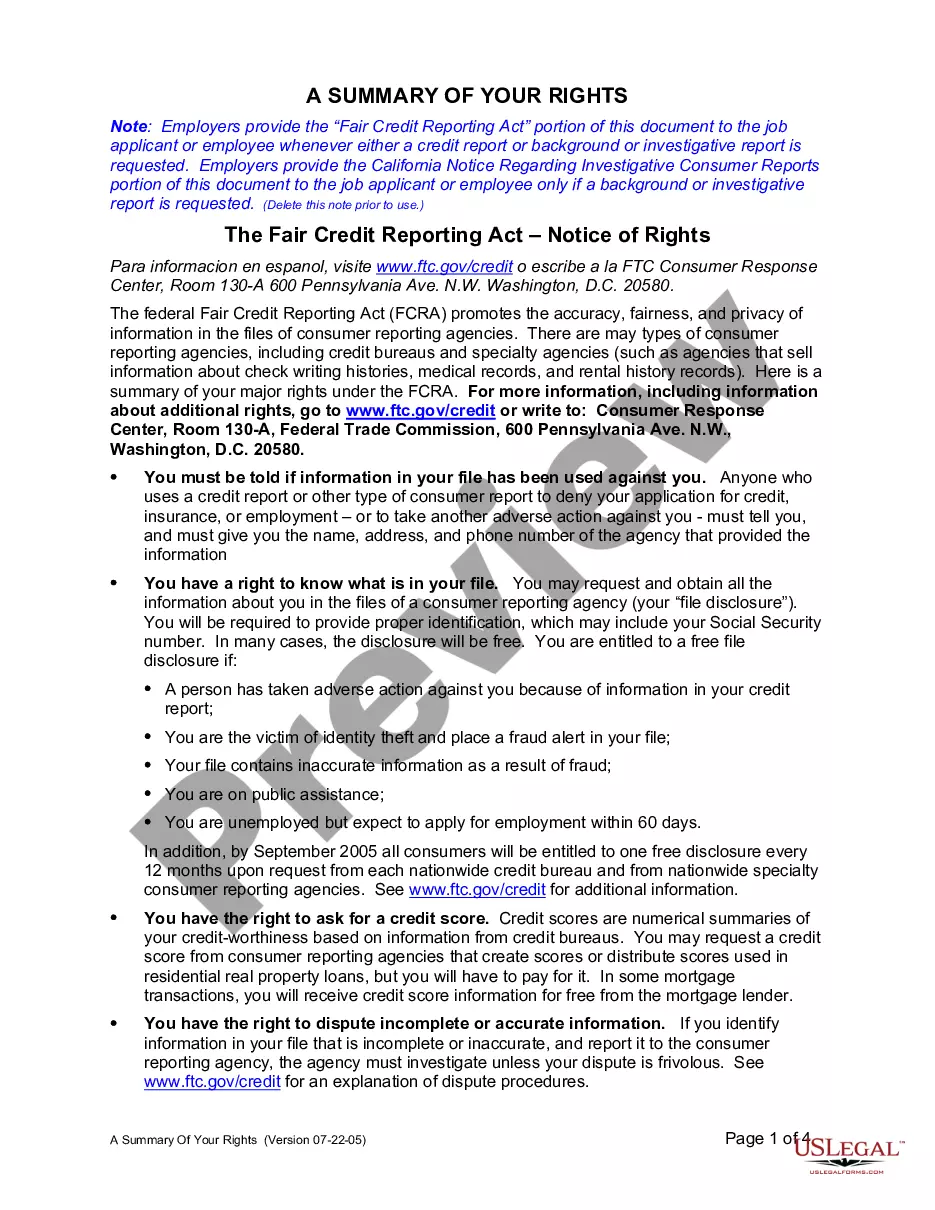

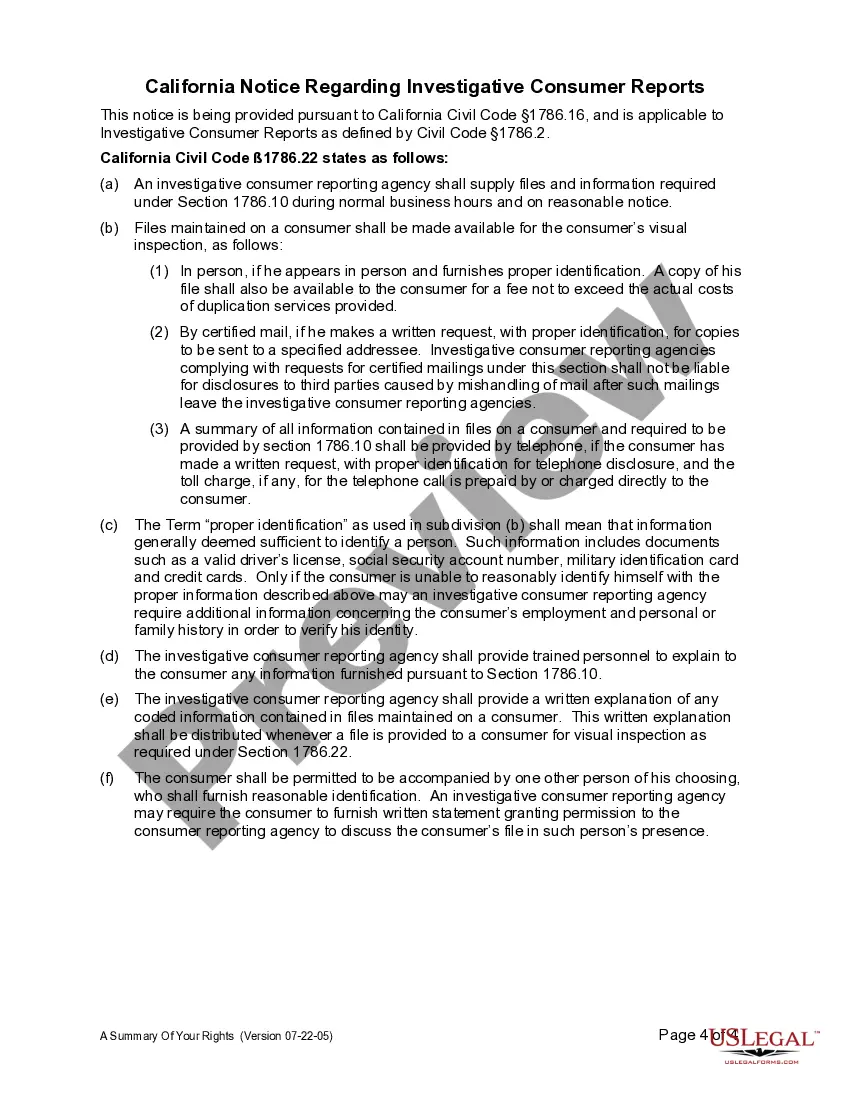

Employers provide the “Fair Credit Reporting Act” portion of this document to the job applicant or employee whenever either a credit report or background or investigative report is requested. Employers provide the California Notice Regarding Investigative Consumer Reports portion of this document to the job applicant or employee only if a background or investigative report is requested.

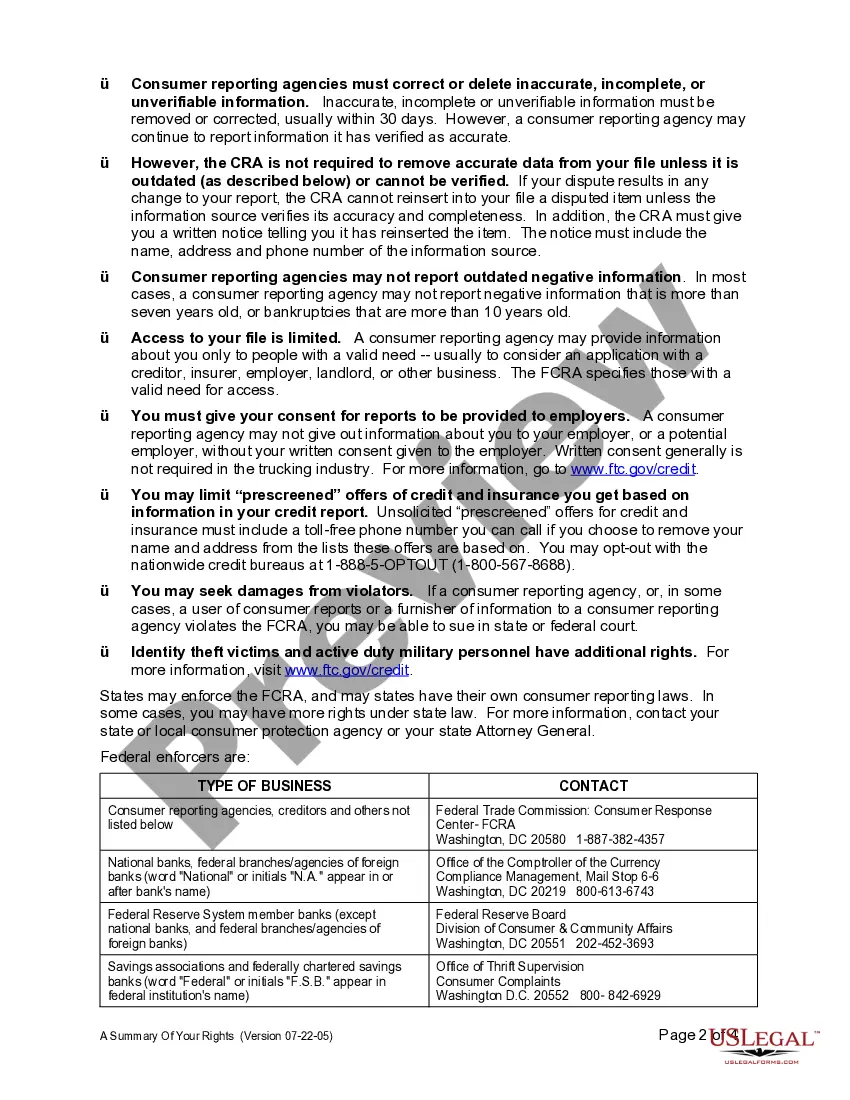

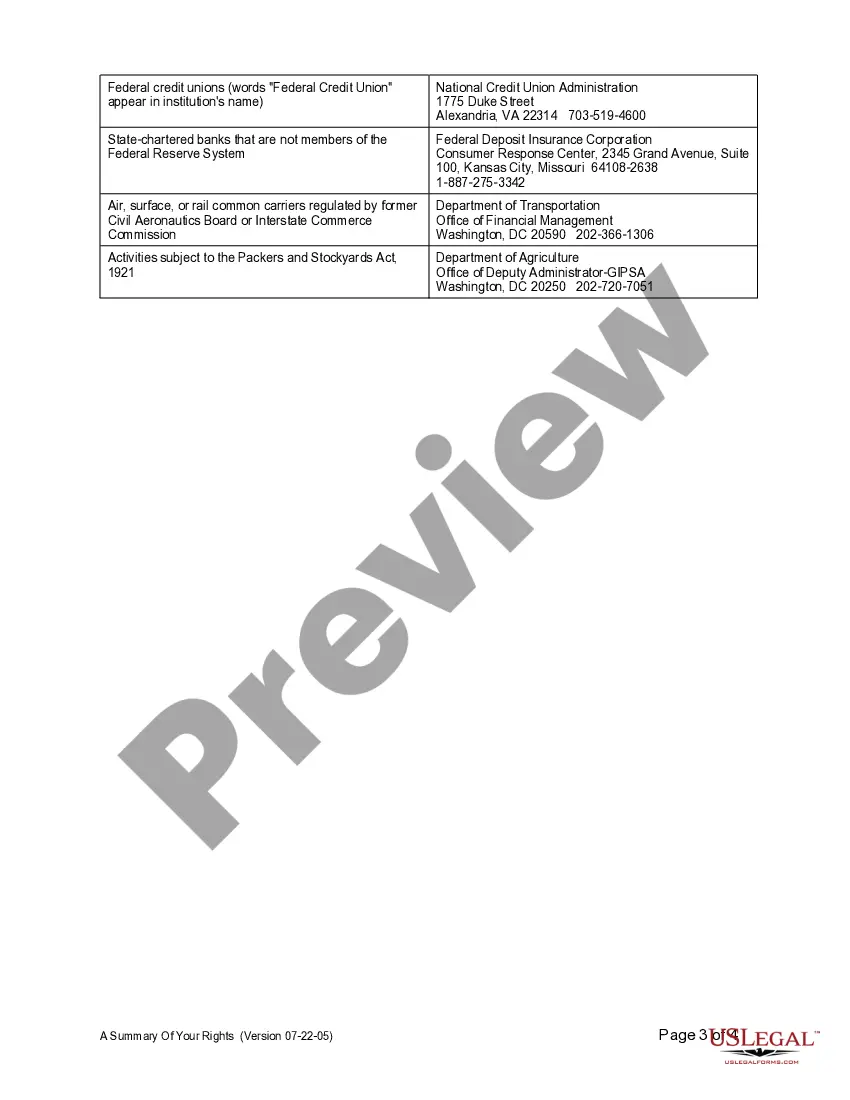

The Riverside California Summary of Fair Credit Reporting Act (FCRA) Rights is an essential document that outlines the rights and protections afforded to consumers in relation to their credit information. This comprehensive summary ensures that individuals have a clear understanding of their rights under the FCRA and can take necessary actions to protect their creditworthiness. Here is a detailed description of these rights and their significance: 1. Access to Information: The FCRA grants consumers the right to access their credit reports from consumer reporting agencies (Crash) such as Equifax, Experian, and TransUnion. Riverside California residents can request a free copy of their credit report once every 12 months to review the accuracy and completeness of their credit history. 2. Accuracy and Integrity of Credit Information: Consumers have the right to dispute any incorrect or outdated information present on their credit reports. The FCRA mandates that Crash investigate and correct any discrepancies found within 30 days of receiving a dispute. 3. Consent for Credit Checks: Individuals in Riverside California, like anywhere else in the United States, must provide written consent before their credit information is accessed by potential creditors, employers, or insurance companies. They have the right to receive a notice stating the purpose of the credit check and the entity requesting the report. 4. Adverse Action Notices: If a consumer's credit report negatively influences a decision made by a creditor, employer, or insurer, they must be provided with an adverse action notice explaining the reason for the unfavorable decision and the source of the credit information used. This enables consumers to identify and address any potentially harmful errors on their credit reports. 5. Limitations on Information Retention: The FCRA imposes time limits on how long certain types of negative information can remain on a consumer's credit report. For example, most derogatory information such as bankruptcies and foreclosures can be reported for a maximum of seven years, while some information, like tax liens, can be reported for up to ten years. 6. Identity Theft Protections: The FCRA offers important safeguards for consumers in Riverside California who are victims of identity theft. It enables them to place fraud alerts on their credit reports, request the deletion of fraudulent information, and restrict access to their credit reports without their consent. These rights ensure that Riverside California residents have control over their credit information and are treated fairly by consumer reporting agencies. By understanding these rights, individuals can actively monitor their credit profiles and challenge any inaccuracies or suspicious activities, ultimately safeguarding their financial well-being.The Riverside California Summary of Fair Credit Reporting Act (FCRA) Rights is an essential document that outlines the rights and protections afforded to consumers in relation to their credit information. This comprehensive summary ensures that individuals have a clear understanding of their rights under the FCRA and can take necessary actions to protect their creditworthiness. Here is a detailed description of these rights and their significance: 1. Access to Information: The FCRA grants consumers the right to access their credit reports from consumer reporting agencies (Crash) such as Equifax, Experian, and TransUnion. Riverside California residents can request a free copy of their credit report once every 12 months to review the accuracy and completeness of their credit history. 2. Accuracy and Integrity of Credit Information: Consumers have the right to dispute any incorrect or outdated information present on their credit reports. The FCRA mandates that Crash investigate and correct any discrepancies found within 30 days of receiving a dispute. 3. Consent for Credit Checks: Individuals in Riverside California, like anywhere else in the United States, must provide written consent before their credit information is accessed by potential creditors, employers, or insurance companies. They have the right to receive a notice stating the purpose of the credit check and the entity requesting the report. 4. Adverse Action Notices: If a consumer's credit report negatively influences a decision made by a creditor, employer, or insurer, they must be provided with an adverse action notice explaining the reason for the unfavorable decision and the source of the credit information used. This enables consumers to identify and address any potentially harmful errors on their credit reports. 5. Limitations on Information Retention: The FCRA imposes time limits on how long certain types of negative information can remain on a consumer's credit report. For example, most derogatory information such as bankruptcies and foreclosures can be reported for a maximum of seven years, while some information, like tax liens, can be reported for up to ten years. 6. Identity Theft Protections: The FCRA offers important safeguards for consumers in Riverside California who are victims of identity theft. It enables them to place fraud alerts on their credit reports, request the deletion of fraudulent information, and restrict access to their credit reports without their consent. These rights ensure that Riverside California residents have control over their credit information and are treated fairly by consumer reporting agencies. By understanding these rights, individuals can actively monitor their credit profiles and challenge any inaccuracies or suspicious activities, ultimately safeguarding their financial well-being.