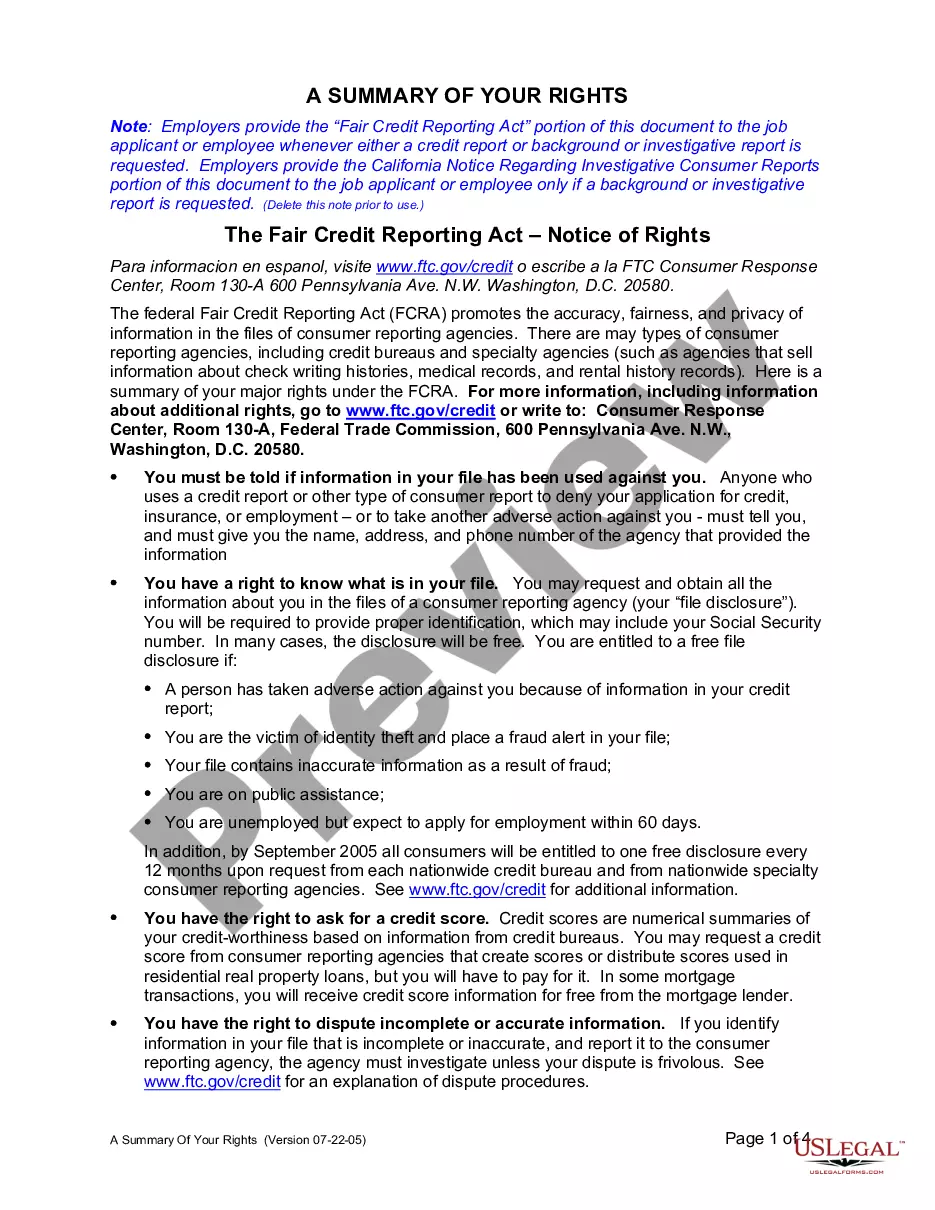

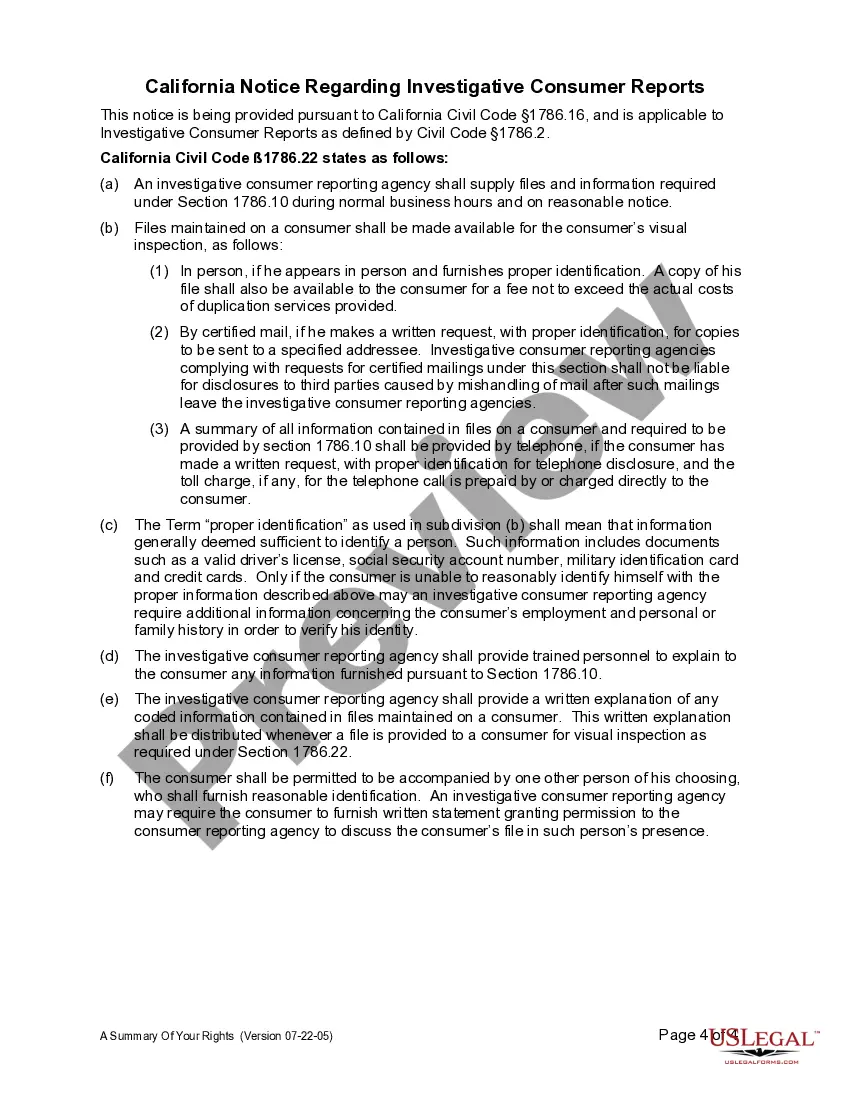

Employers provide the “Fair Credit Reporting Act” portion of this document to the job applicant or employee whenever either a credit report or background or investigative report is requested. Employers provide the California Notice Regarding Investigative Consumer Reports portion of this document to the job applicant or employee only if a background or investigative report is requested.

Santa Maria California Summary of Fair Credit Reporting Act Rights

Description

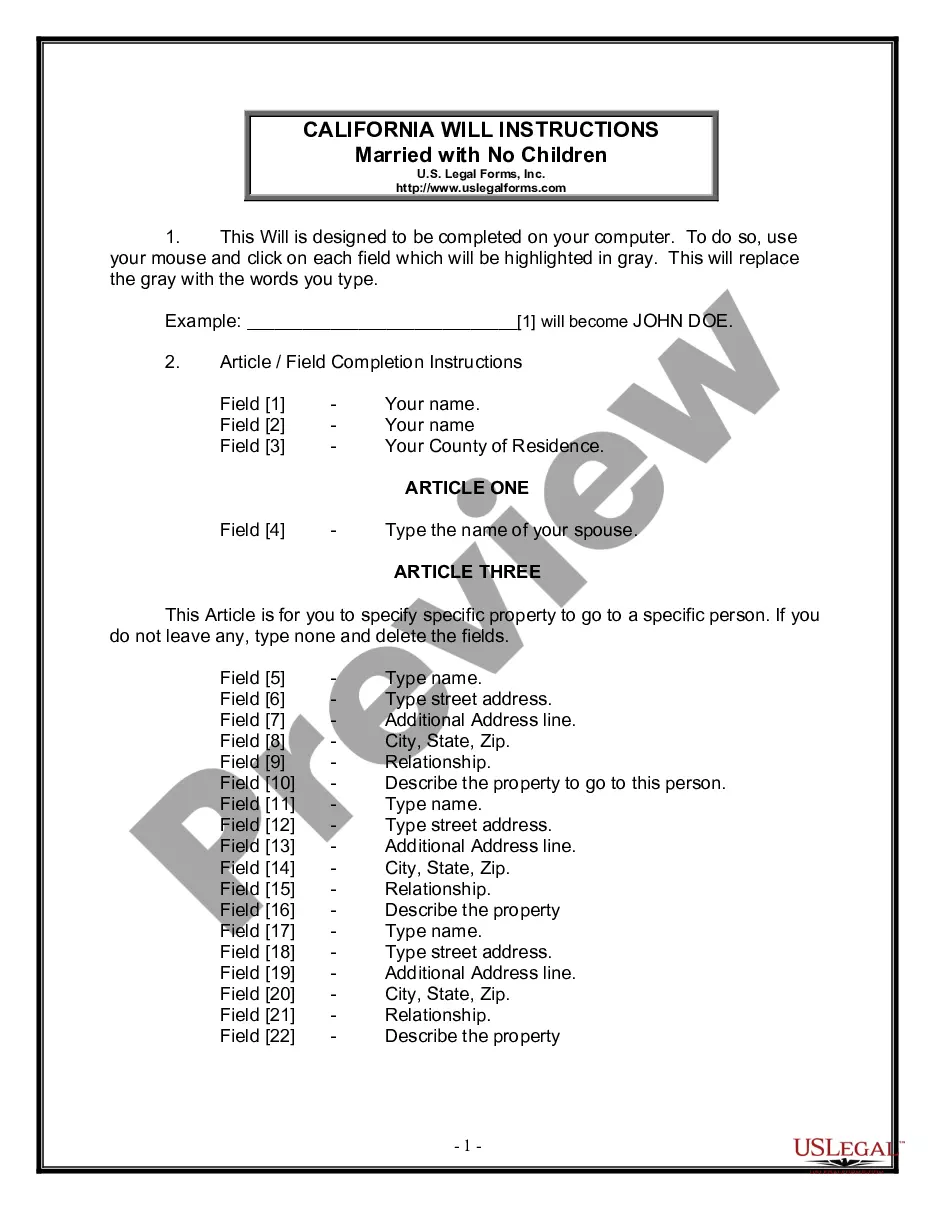

How to fill out California Summary Of Fair Credit Reporting Act Rights?

Are you in search of a trustworthy and budget-friendly provider of legal forms to purchase the Santa Maria California Summary of Fair Credit Reporting Act Rights? US Legal Forms is your best choice.

Whether you need a simple agreement to establish guidelines for living with your partner or a collection of documents to facilitate your divorce through the court system, we have you covered.

Our platform offers over 85,000 current legal document templates for both personal and business applications. All the templates we provide are not generic and are structured in accordance with the requirements of specific states and counties.

To obtain the form, you must Log In to your account, find the desired template, and click the Download button adjacent to it. Please keep in mind that you can download your previously acquired form templates at any time in the My documents section.

Now you can register your account. Next, choose a subscription plan and complete the payment. Once the payment is processed, download the Santa Maria California Summary of Fair Credit Reporting Act Rights in any available file format. You can revisit the website anytime and redownload the form at no additional cost.

Obtaining current legal documents has never been simpler. Try US Legal Forms today, and say goodbye to spending countless hours researching legal papers online.

- Is this your first visit to our website? No need to worry.

- You can easily create an account, but before doing so, ensure to follow these steps.

- Verify if the Santa Maria California Summary of Fair Credit Reporting Act Rights meets the regulations of your state and locality.

- Review the details of the form (if available) to understand who and what the form is meant for.

- Start over in your search if the template does not suit your specific situation.

Form popularity

FAQ

A summary of rights generally outlines the protections and options available to consumers regarding their personal information. In the context of the Fair Credit Reporting Act, this summary includes the right to know what information is reported about you and the right to dispute errors. Understanding this summary is crucial in empowering you in maintaining your credit standing in Santa Maria, California.

A summary of your rights under the Fair Credit Reporting Act includes your right to access your credit report and dispute inaccuracies. You also have the right to be notified if adverse actions are taken based on information in your report. Knowing this summary can enhance your understanding and ability to manage your financial data in Santa Maria and beyond.

One key right found in the Fair Credit Reporting Act is your right to dispute inaccurate information. This ensures that consumers can protect their credit scores and financial reputation. It's vital to be aware of your rights under the Santa Maria California Summary of Fair Credit Reporting Act Rights to utilize them effectively.

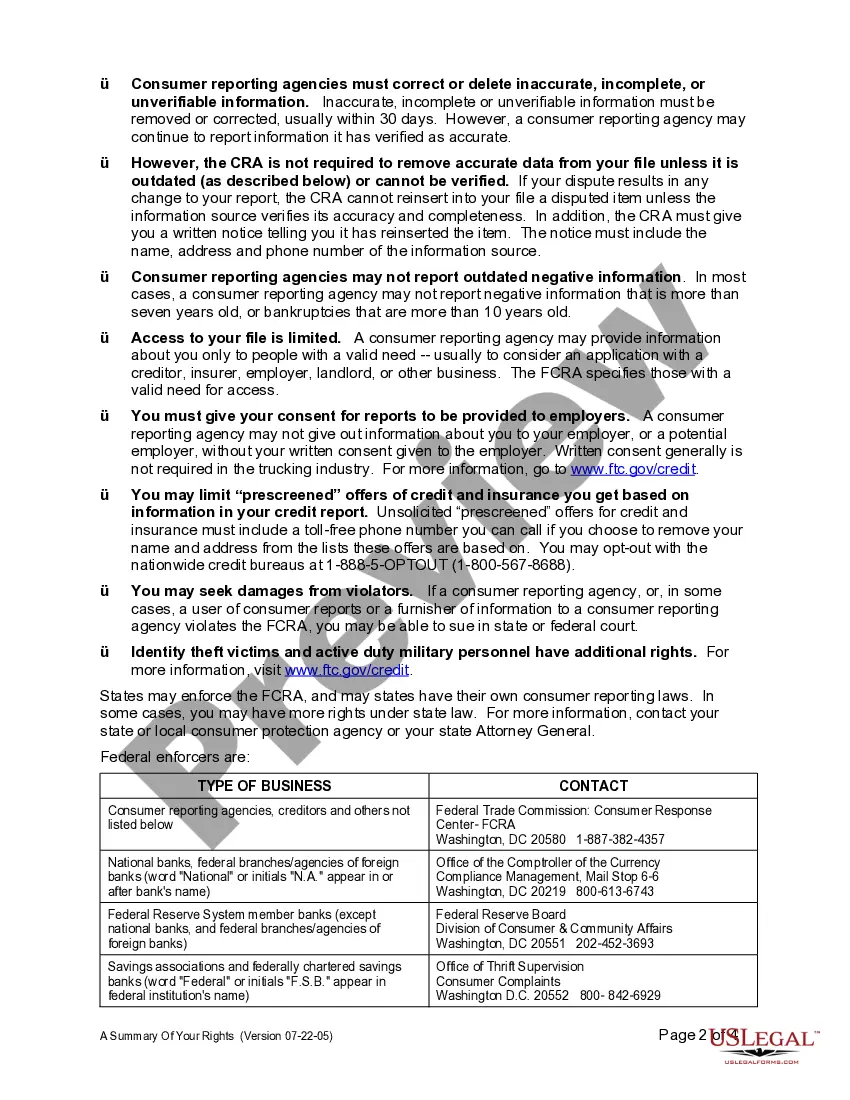

If you suspect a violation of the Fair Credit Reporting Act, you should first gather relevant documentation. Then, contact the credit reporting agency to report the issue and file a dispute. Additionally, you may consider seeking legal advice to understand your options better. Reviewing the Santa Maria California Summary of Fair Credit Reporting Act Rights can help you navigate this process.

Opting out of certain aspects of the Fair Credit Reporting Act involves notifying the credit bureaus. You can do this by requesting to exclude your name from marketing lists. This helps protect your privacy and limits unsolicited offers. For a clearer understanding, refer to the Santa Maria California Summary of Fair Credit Reporting Act Rights, which details your options.

Consumer law rights encompass various protections that ensure consumers are treated fairly in transactions, including the right to honest advertising, safe products, and accurate credit reporting. These rights help maintain a balanced relationship between consumers and businesses. By exploring the Santa Maria California Summary of Fair Credit Reporting Act Rights, you can safeguard yourself against unfair practices and assert your consumer rights confidently.

The summary of rights under the Fair Credit Reporting Act outlines your ability to review your credit report, dispute information, and be informed about your rights when lenders access your report. This summary serves as an essential resource for consumers to understand their credit rights and responsibilities. By referring to the Santa Maria California Summary of Fair Credit Reporting Act Rights, you can gain clearer insights into your legal protections.

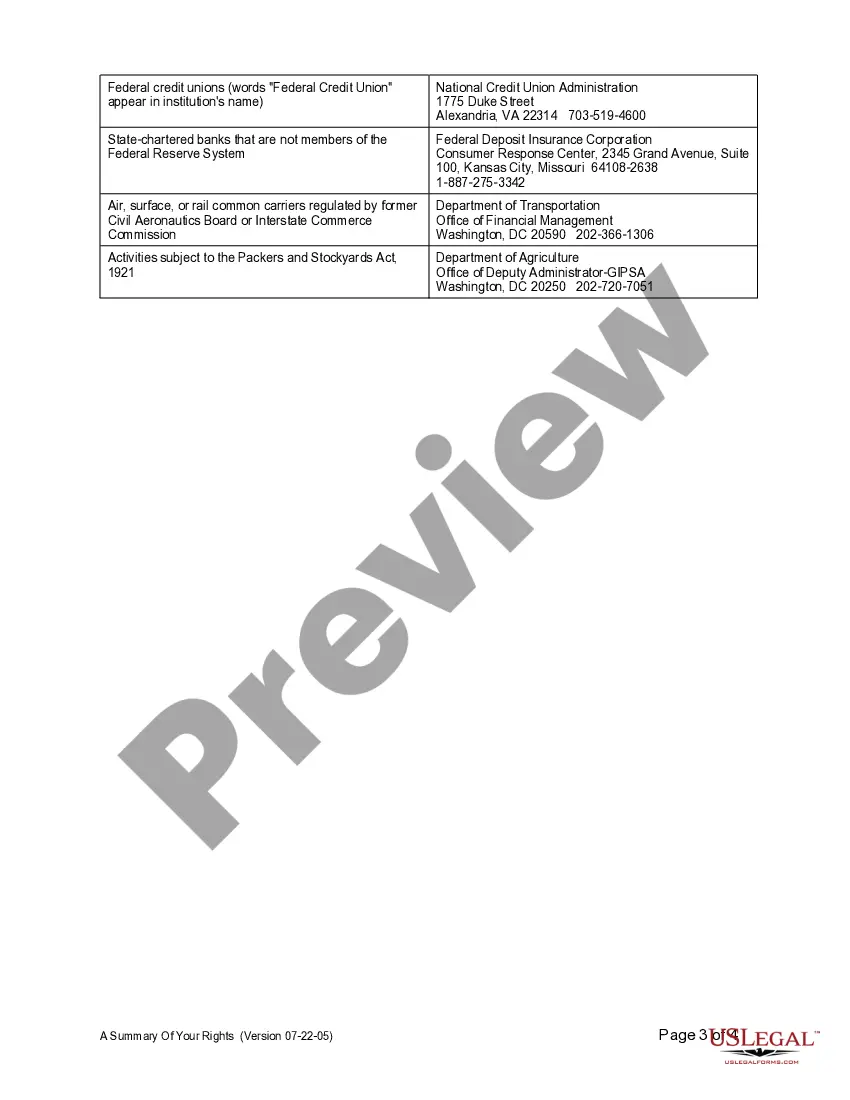

Under the Fair Credit Reporting Act (FCRA), consumers have the right to obtain their credit reports, dispute inaccuracies, and be notified when their credit report is used against them. These rights are vital for maintaining a healthy credit profile and for holding credit reporting agencies accountable. The Santa Maria California Summary of Fair Credit Reporting Act Rights can guide you in exercising these rights effectively.

Customers are entitled to accurate credit reporting, clear communication of account terms, and protections against unfair practices under the consumer credit act. This framework establishes your rights and the responsibilities of creditors when it comes to credit transactions. Understanding the Santa Maria California Summary of Fair Credit Reporting Act Rights can help you navigate disputes and ensure fair treatment.

Under consumer credit laws, you have the right to be informed about your rights, the ability to dispute errors, and the right to not face discrimination based on credit history. These laws provide a framework for fair treatment by creditors and aim to promote transparency. Familiarizing yourself with the Santa Maria California Summary of Fair Credit Reporting Act Rights is essential for protecting your personal credit.