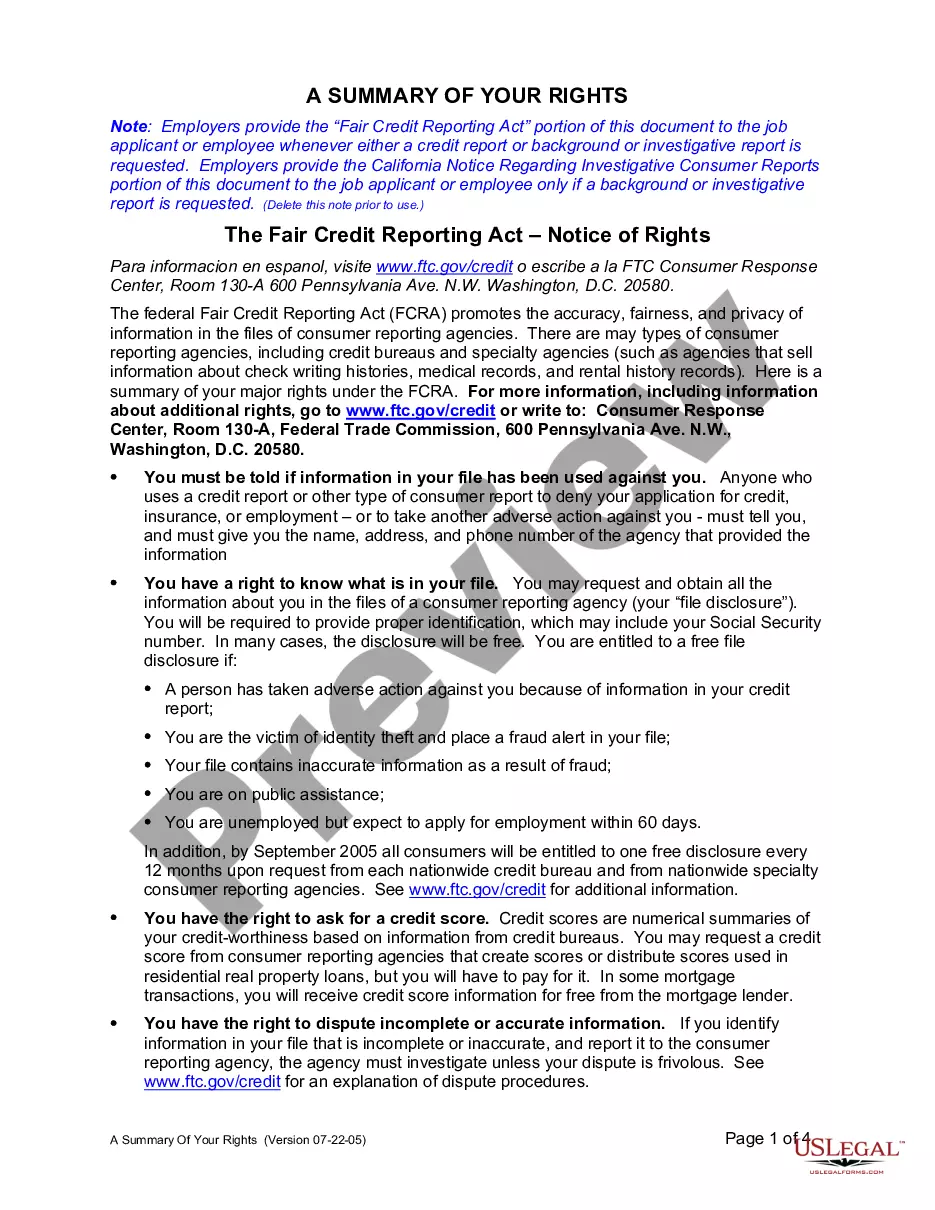

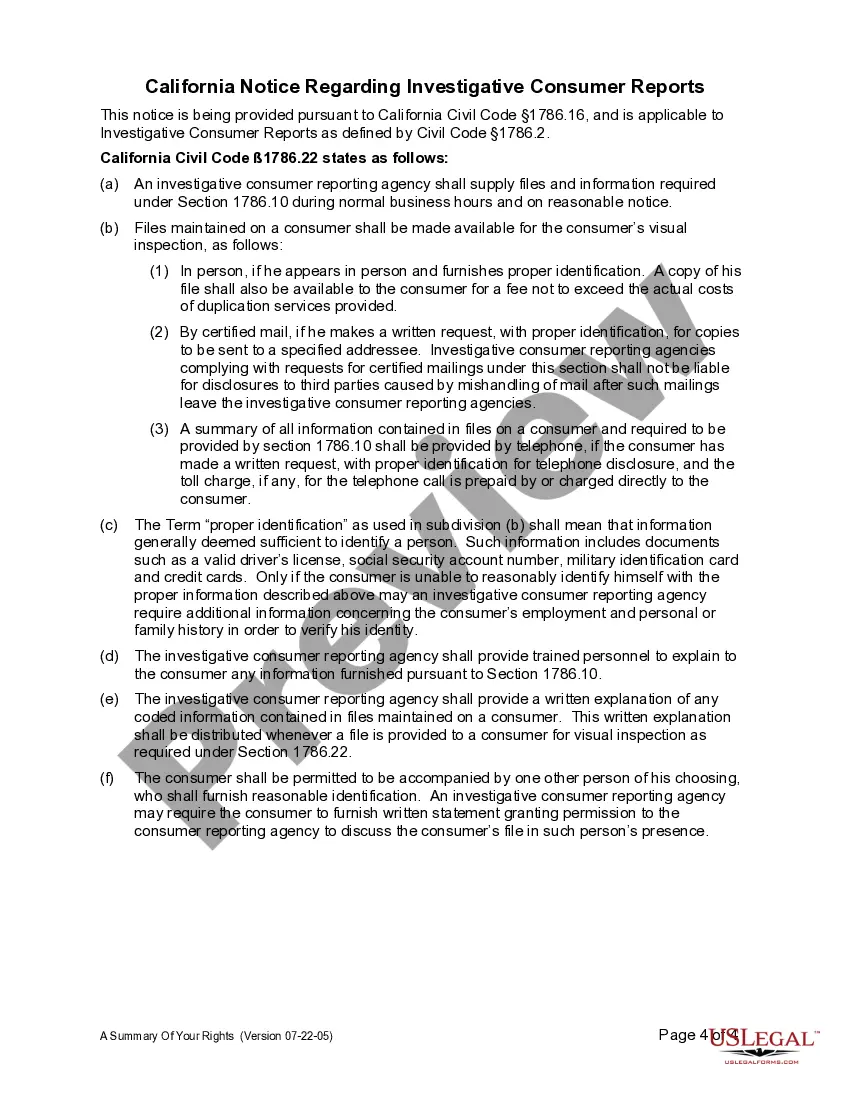

Employers provide the “Fair Credit Reporting Act” portion of this document to the job applicant or employee whenever either a credit report or background or investigative report is requested. Employers provide the California Notice Regarding Investigative Consumer Reports portion of this document to the job applicant or employee only if a background or investigative report is requested.

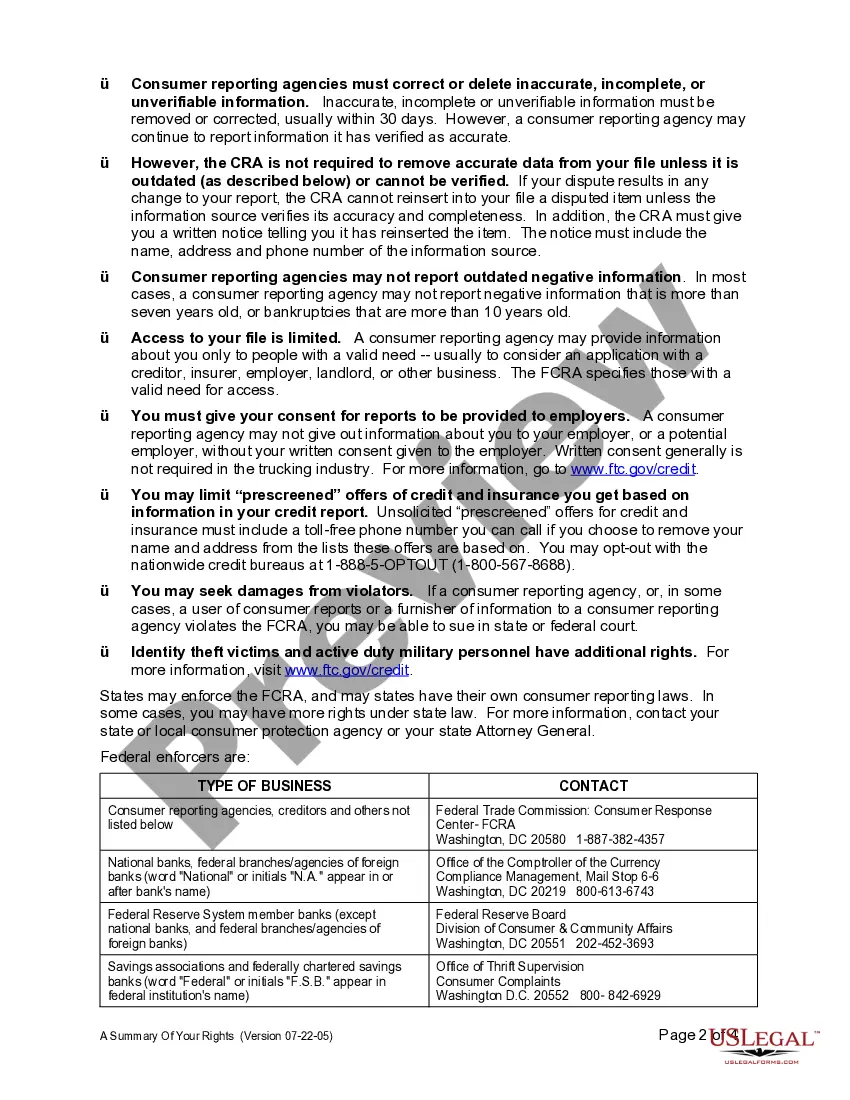

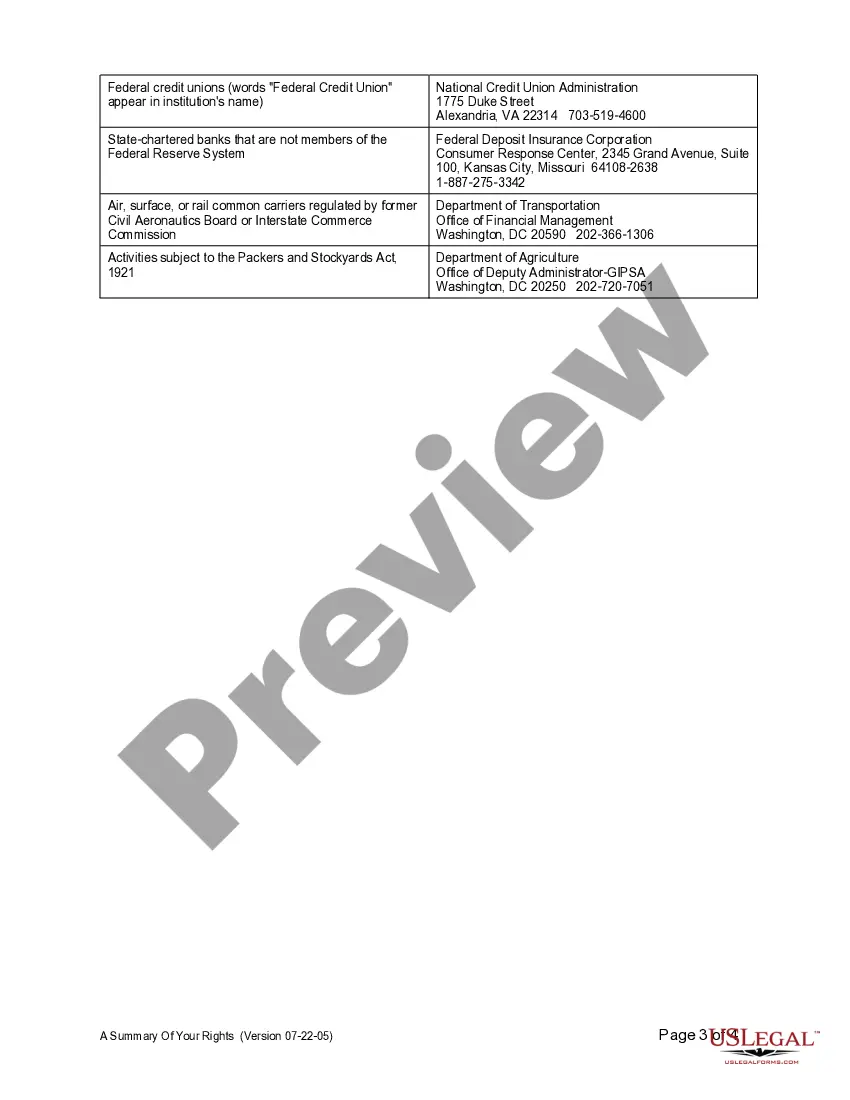

In Stockton, California, residents have certain rights under the Fair Credit Reporting Act (FCRA) to ensure fair and accurate information in their credit reports. The FCRA is a federal law that promotes accuracy, fairness, and privacy of information in consumer credit reports. Here is a detailed summary of the Stockton California Summary of Fair Credit Reporting Act Rights, including the various types: 1. Access to your credit report: As a Stockton resident, you have the right to obtain a copy of your credit report from each nationwide credit reporting agency (CRA) once every 12 months. This allows you to review the information being reported about you by creditors, lenders, and other sources. 2. Accuracy of your credit report: You have the right to dispute incomplete or inaccurate information in your credit report. If you find any errors or discrepancies, you can request an investigation by the CRA that issued the report. They must correct or delete any information found to be inaccurate, incomplete, or unverifiable. 3. Consent for credit checks: Before a Stockton employer or creditor can access your credit report, they must obtain your written consent. This ensures that you are aware of and agree to the potential impact on your credit and privacy. 4. Notification of negative information: If any negative information appears on your credit report, such as late payments or defaults, the creditor or lender must notify you about it. This gives you an opportunity to resolve any issues or errors affecting your creditworthiness. 5. Credit reporting agency responsibilities: The Crash are required to ensure the accuracy and privacy of your credit report. They must investigate and respond to your disputes within a reasonable time period (usually 30 days), providing you with the investigation results in writing. 6. Free credit report security freeze: As a resident of Stockton, you have the right to place a security freeze on your credit report for free. This prevents potential creditors from accessing your credit information without your permission, helping protect against identity theft and fraud. 7. Prescreened offers opt-out: You have the right to opt-out of receiving pre-approved credit offers or insurance based on information in your credit report. This reduces unsolicited offers and protects your privacy. By understanding and exercising your Stockton California Summary of Fair Credit Reporting Act Rights, you can actively monitor and manage your credit profile. This ensures that the information being reported accurately reflects your financial history and helps in maintaining a healthy credit score.In Stockton, California, residents have certain rights under the Fair Credit Reporting Act (FCRA) to ensure fair and accurate information in their credit reports. The FCRA is a federal law that promotes accuracy, fairness, and privacy of information in consumer credit reports. Here is a detailed summary of the Stockton California Summary of Fair Credit Reporting Act Rights, including the various types: 1. Access to your credit report: As a Stockton resident, you have the right to obtain a copy of your credit report from each nationwide credit reporting agency (CRA) once every 12 months. This allows you to review the information being reported about you by creditors, lenders, and other sources. 2. Accuracy of your credit report: You have the right to dispute incomplete or inaccurate information in your credit report. If you find any errors or discrepancies, you can request an investigation by the CRA that issued the report. They must correct or delete any information found to be inaccurate, incomplete, or unverifiable. 3. Consent for credit checks: Before a Stockton employer or creditor can access your credit report, they must obtain your written consent. This ensures that you are aware of and agree to the potential impact on your credit and privacy. 4. Notification of negative information: If any negative information appears on your credit report, such as late payments or defaults, the creditor or lender must notify you about it. This gives you an opportunity to resolve any issues or errors affecting your creditworthiness. 5. Credit reporting agency responsibilities: The Crash are required to ensure the accuracy and privacy of your credit report. They must investigate and respond to your disputes within a reasonable time period (usually 30 days), providing you with the investigation results in writing. 6. Free credit report security freeze: As a resident of Stockton, you have the right to place a security freeze on your credit report for free. This prevents potential creditors from accessing your credit information without your permission, helping protect against identity theft and fraud. 7. Prescreened offers opt-out: You have the right to opt-out of receiving pre-approved credit offers or insurance based on information in your credit report. This reduces unsolicited offers and protects your privacy. By understanding and exercising your Stockton California Summary of Fair Credit Reporting Act Rights, you can actively monitor and manage your credit profile. This ensures that the information being reported accurately reflects your financial history and helps in maintaining a healthy credit score.