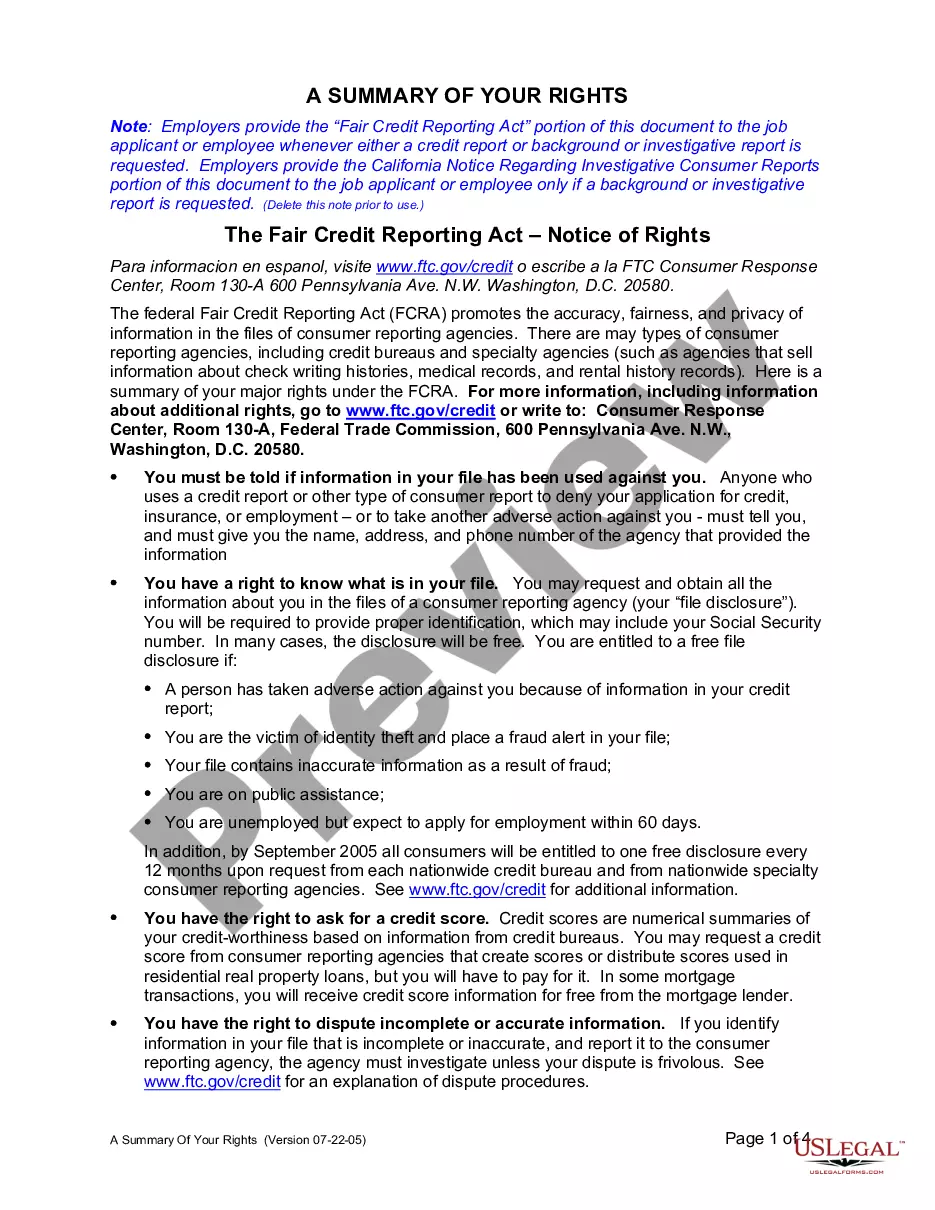

Employers provide the “Fair Credit Reporting Act” portion of this document to the job applicant or employee whenever either a credit report or background or investigative report is requested. Employers provide the California Notice Regarding Investigative Consumer Reports portion of this document to the job applicant or employee only if a background or investigative report is requested.

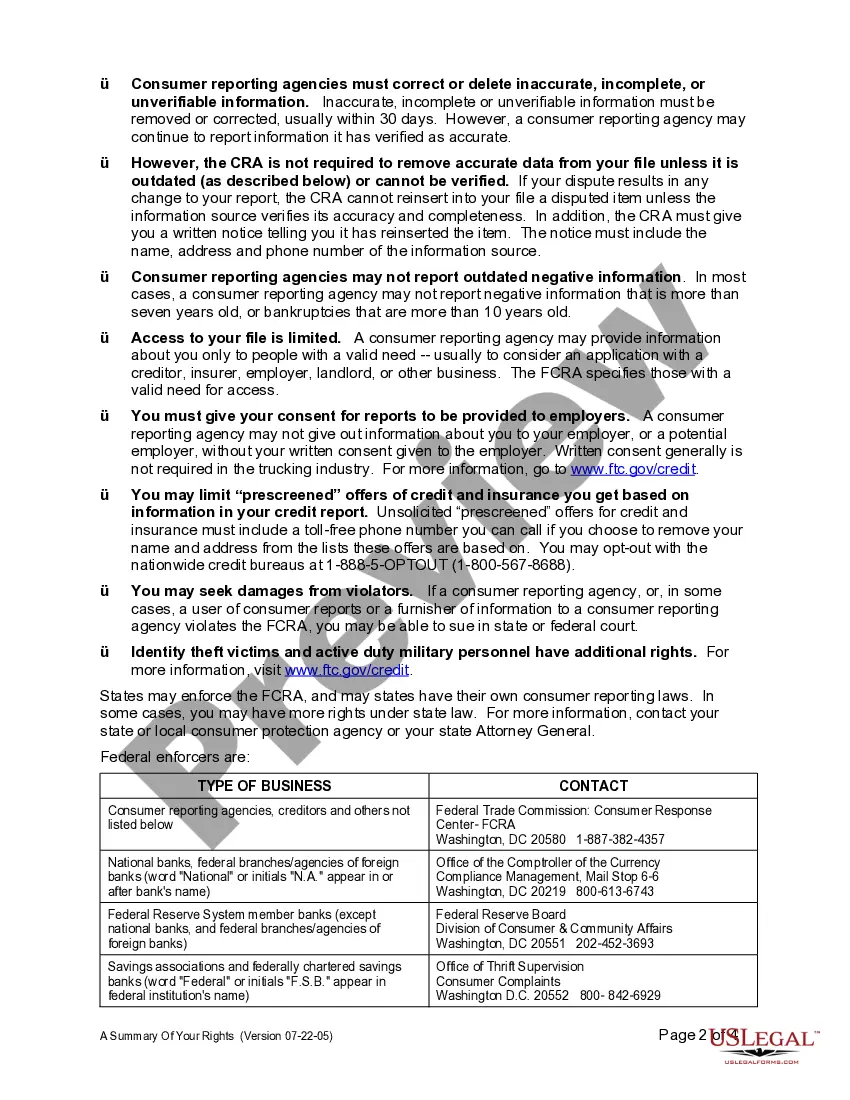

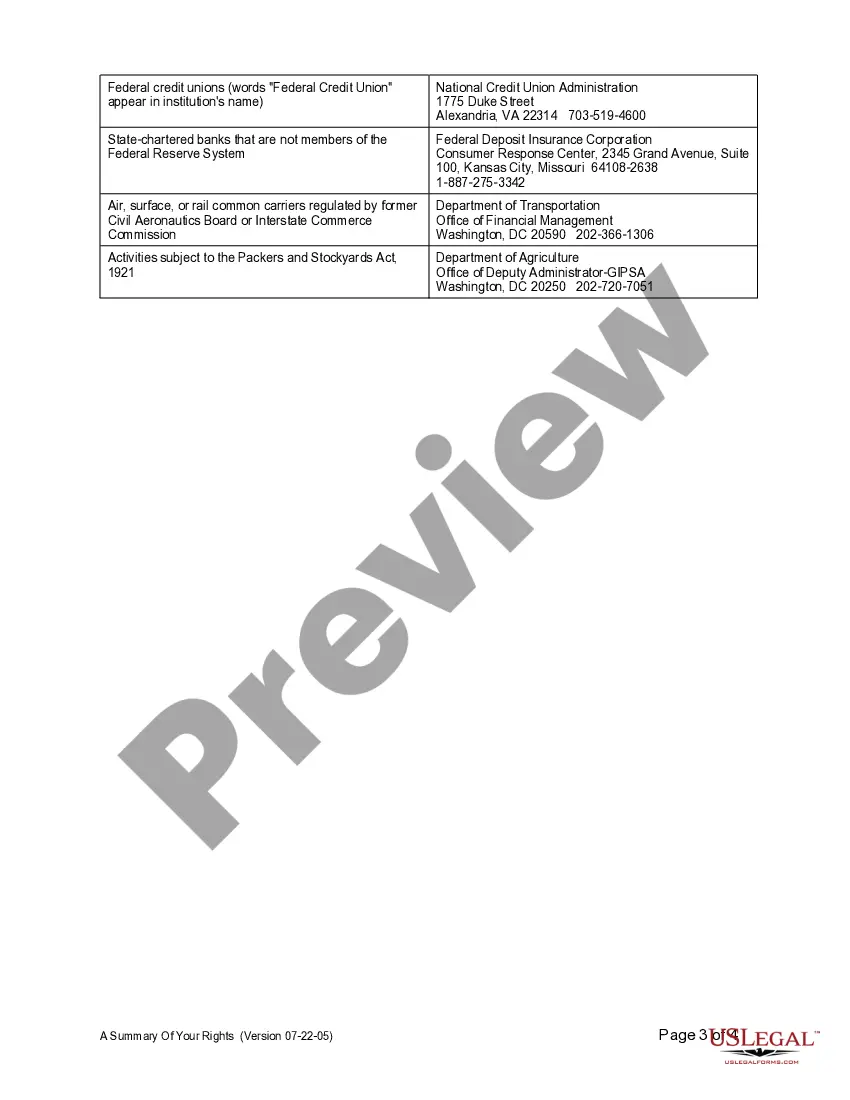

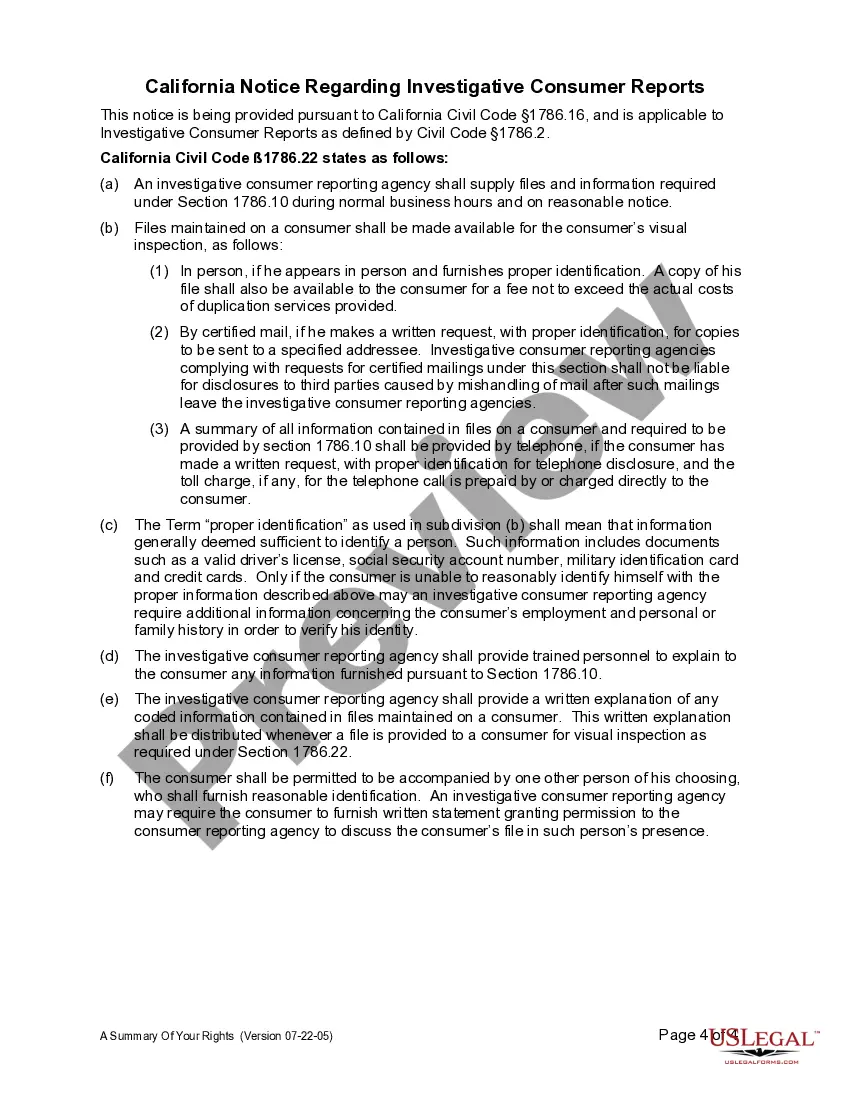

Summary of Fair Credit Reporting Act Rights in Temecula, California The Fair Credit Reporting Act (FCRA) is a federal law that aims to promote the accuracy, fairness, and privacy of consumer information collected by credit reporting agencies. As a resident of Temecula, California, it is crucial to be aware of your rights under the FCRA. Here is a detailed description of the Temecula California Summary of Fair Credit Reporting Act Rights: 1. Access to Your Credit Report: The FCRA grants you the right to obtain a free copy of your credit report from each of the three major credit reporting agencies — Equifax, Experian, anTransUnionio— - once every 12 months. By reviewing your credit report regularly, you can ensure that the information it contains is accurate. 2. Dispute Inaccurate Information: If you find any inaccurate or incomplete information on your credit report, you have the right to dispute it. The FCRA requires credit reporting agencies to investigate these disputes within 30 days and correct any errors. You can file a dispute online, by mail, or by phone. 3. Identity Theft Protection: In case you suspect or have been a victim of identity theft, the FCRA provides specific rights to protect your credit. You can place a fraud alert on your credit report, which requires potential lenders to take additional precautions to verify your identity before extending credit. Moreover, you have the right to place a credit freeze, which restricts access to your credit report, making it difficult for identity thieves to open new accounts in your name. 4. Information Disclosure: The FCRA ensures that individuals are aware of who has accessed their credit report. You have the right to know the names of all entities that obtained your credit report within the past year for various purposes, such as credit applications, employment, insurance, or rental applications. 5. Right to Opt-Out: The FCRA provides the opportunity to opt-out of receiving pre-approved credit offers by mail. These offers usually result from information obtained from your credit report. By opting out, you can reduce the risk of identity theft and unwanted solicitations. 6. Adverse Actions Notification: If you experience adverse action, such as denial of credit, employment, or insurance based on your credit report, the FCRA requires the entity taking such action to provide you with a notice. This notice should include the contact information of the credit reporting agency that provided the report, giving you an opportunity to review the information used in the decision. By understanding and exercising your rights under the Fair Credit Reporting Act, you can protect your credit and ensure its accuracy. It is essential to stay informed about these rights to effectively manage your financial well-being in Temecula, California. (Note: There is no differentiation between different types of Temecula California Summary of Fair Credit Reporting Act Rights. The rights mentioned above apply to all individuals in Temecula, California, under the FCRA.)Summary of Fair Credit Reporting Act Rights in Temecula, California The Fair Credit Reporting Act (FCRA) is a federal law that aims to promote the accuracy, fairness, and privacy of consumer information collected by credit reporting agencies. As a resident of Temecula, California, it is crucial to be aware of your rights under the FCRA. Here is a detailed description of the Temecula California Summary of Fair Credit Reporting Act Rights: 1. Access to Your Credit Report: The FCRA grants you the right to obtain a free copy of your credit report from each of the three major credit reporting agencies — Equifax, Experian, anTransUnionio— - once every 12 months. By reviewing your credit report regularly, you can ensure that the information it contains is accurate. 2. Dispute Inaccurate Information: If you find any inaccurate or incomplete information on your credit report, you have the right to dispute it. The FCRA requires credit reporting agencies to investigate these disputes within 30 days and correct any errors. You can file a dispute online, by mail, or by phone. 3. Identity Theft Protection: In case you suspect or have been a victim of identity theft, the FCRA provides specific rights to protect your credit. You can place a fraud alert on your credit report, which requires potential lenders to take additional precautions to verify your identity before extending credit. Moreover, you have the right to place a credit freeze, which restricts access to your credit report, making it difficult for identity thieves to open new accounts in your name. 4. Information Disclosure: The FCRA ensures that individuals are aware of who has accessed their credit report. You have the right to know the names of all entities that obtained your credit report within the past year for various purposes, such as credit applications, employment, insurance, or rental applications. 5. Right to Opt-Out: The FCRA provides the opportunity to opt-out of receiving pre-approved credit offers by mail. These offers usually result from information obtained from your credit report. By opting out, you can reduce the risk of identity theft and unwanted solicitations. 6. Adverse Actions Notification: If you experience adverse action, such as denial of credit, employment, or insurance based on your credit report, the FCRA requires the entity taking such action to provide you with a notice. This notice should include the contact information of the credit reporting agency that provided the report, giving you an opportunity to review the information used in the decision. By understanding and exercising your rights under the Fair Credit Reporting Act, you can protect your credit and ensure its accuracy. It is essential to stay informed about these rights to effectively manage your financial well-being in Temecula, California. (Note: There is no differentiation between different types of Temecula California Summary of Fair Credit Reporting Act Rights. The rights mentioned above apply to all individuals in Temecula, California, under the FCRA.)