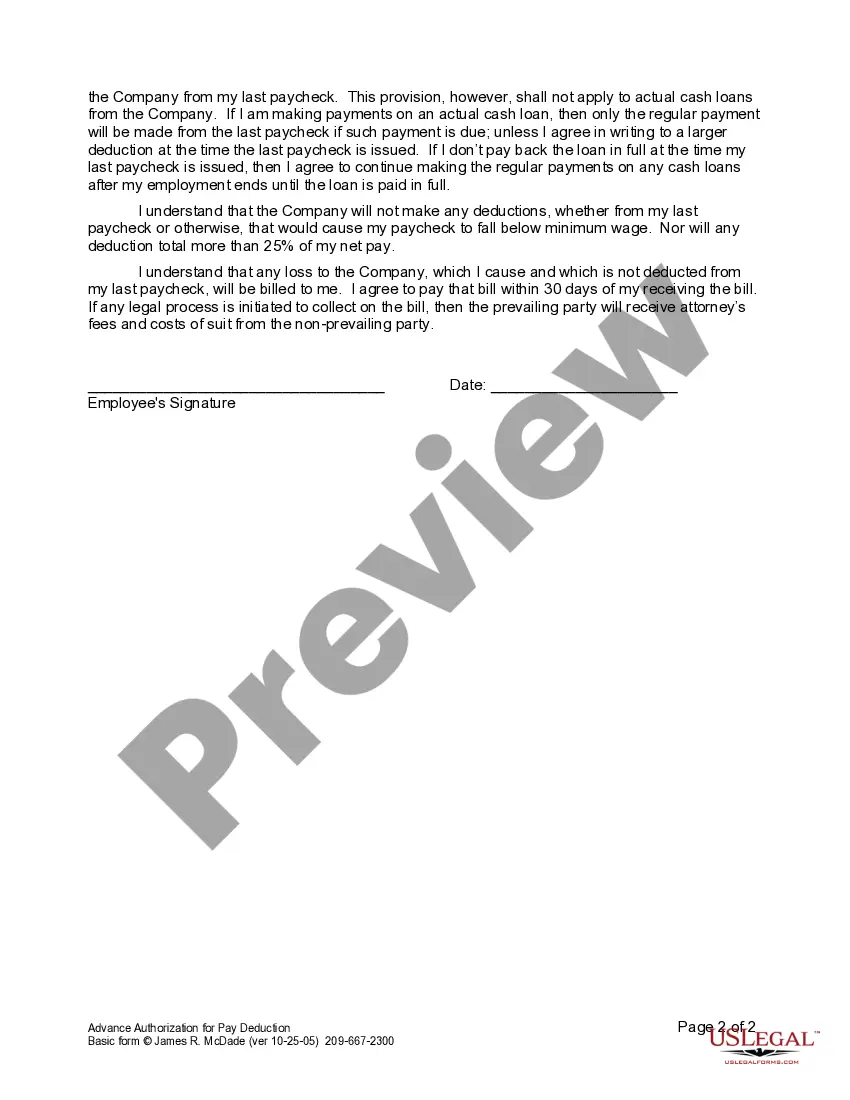

Employers use this form to reinforce with an employee his or her need to return Company property and to obtain authorization for making deductions from an employee's paycheck.

Riverside California Advance Authorization for Pay Deduction is a legal agreement that allows employers to deduct specified amounts from their employees' wages for various purposes. This arrangement ensures that employees grant their consent to have specific deductions made from their paychecks. One of the common types of Riverside California Advance Authorization for Pay Deduction is for healthcare premiums. Many employers offer health insurance coverage to their employees, and the premiums are often deducted directly from their paychecks. By signing an advance authorization agreement, employees allow their employers to deduct the predetermined premium amounts on a regular basis. Another type of Riverside California Advance Authorization for Pay Deduction is for retirement savings contributions. Employees who participate in employer-sponsored retirement plans, such as 401(k)s or IRAs, may authorize their employers to deduct a specific percentage or a fixed amount from their wages and contribute it towards their retirement savings accounts. Additionally, Riverside California Advance Authorization for Pay Deduction can be used for other purposes like loan repayments. If employees have taken out loans from their employers, such as a tuition loan or an emergency loan, they can grant permission to have the loan payments deducted directly from their paychecks. It is essential to note that advance authorization for pay deduction should comply with the wage deduction laws of California. Employers must ensure that the deductions do not bring their employees' wages below the minimum wage requirements. Furthermore, deductions for other purposes, such as purchasing company products or services, are subject to additional restrictions and regulations. In conclusion, Riverside California Advance Authorization for Pay Deduction is a vital tool for employers and employees to establish a transparent agreement regarding wage deductions. By signing this agreement, employees grant their consent for deductions related to healthcare premiums, retirement savings contributions, loan repayments, and possibly other purposes within the legal limits of California's wage deduction laws.Riverside California Advance Authorization for Pay Deduction is a legal agreement that allows employers to deduct specified amounts from their employees' wages for various purposes. This arrangement ensures that employees grant their consent to have specific deductions made from their paychecks. One of the common types of Riverside California Advance Authorization for Pay Deduction is for healthcare premiums. Many employers offer health insurance coverage to their employees, and the premiums are often deducted directly from their paychecks. By signing an advance authorization agreement, employees allow their employers to deduct the predetermined premium amounts on a regular basis. Another type of Riverside California Advance Authorization for Pay Deduction is for retirement savings contributions. Employees who participate in employer-sponsored retirement plans, such as 401(k)s or IRAs, may authorize their employers to deduct a specific percentage or a fixed amount from their wages and contribute it towards their retirement savings accounts. Additionally, Riverside California Advance Authorization for Pay Deduction can be used for other purposes like loan repayments. If employees have taken out loans from their employers, such as a tuition loan or an emergency loan, they can grant permission to have the loan payments deducted directly from their paychecks. It is essential to note that advance authorization for pay deduction should comply with the wage deduction laws of California. Employers must ensure that the deductions do not bring their employees' wages below the minimum wage requirements. Furthermore, deductions for other purposes, such as purchasing company products or services, are subject to additional restrictions and regulations. In conclusion, Riverside California Advance Authorization for Pay Deduction is a vital tool for employers and employees to establish a transparent agreement regarding wage deductions. By signing this agreement, employees grant their consent for deductions related to healthcare premiums, retirement savings contributions, loan repayments, and possibly other purposes within the legal limits of California's wage deduction laws.