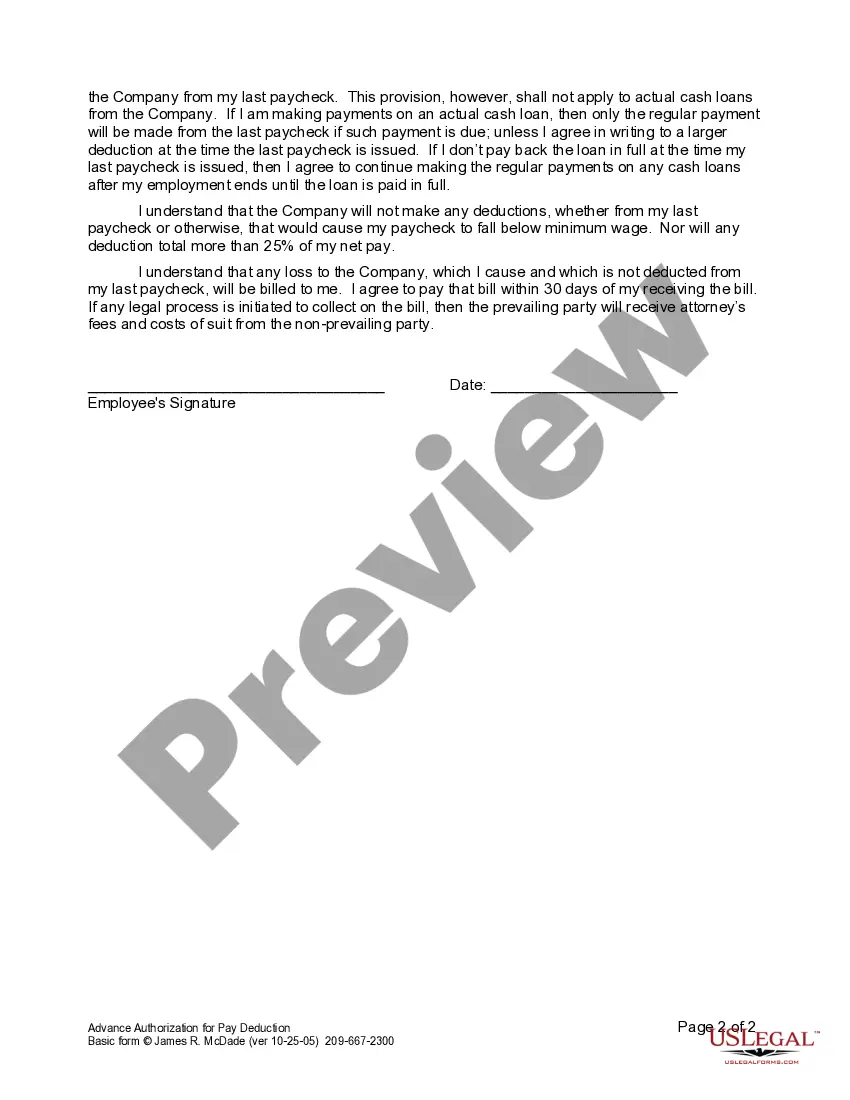

Employers use this form to reinforce with an employee his or her need to return Company property and to obtain authorization for making deductions from an employee's paycheck.

Sacramento California Advance Authorization for Pay Deduction is a legal process that allows employers in Sacramento, California to deduct a certain amount from an employee's wages to cover specific expenses or obligations. This deduction is authorized by the employee in advance, giving consent for the employer to withhold a specified portion of their salary. There are several types of Sacramento California Advance Authorization for Pay Deduction, each designed to cater to different situations and needs. These types include: 1. Salary Advances: Employees in Sacramento, California may request a salary advance from their employer due to unforeseen financial emergencies, such as urgent medical bills or unexpected repairs. The employee can authorize the employer to deduct a certain amount from their future paychecks until the advance is fully reimbursed. 2. Employee Benefit Deductions: Employers often offer various benefits to their employees, such as health insurance, retirement plans, or flexible spending accounts. With an advance authorization for pay deduction, employees can agree to have a predetermined amount deducted from their wages to cover the costs associated with these benefits. 3. Wage Garnishments: In the event of a court order or legal judgment, an employer may be required to withhold a portion of an employee's wages to satisfy outstanding debts or obligations. This type of advance authorization for pay deduction is typically initiated by a third party, such as a creditor or a government agency. 4. Voluntary Deductions: Employees may choose to have specific amounts deducted from their wages for personal reasons, such as contributions to charitable organizations or savings accounts. This advance authorization allows the employee to specify the amount and duration of the deduction, ensuring compliance with relevant laws and regulations. The Sacramento California Advance Authorization for Pay Deduction serves as a formal agreement between the employer and the employee. It outlines the terms and conditions of the deduction, including the amount to be deducted, the frequency of deductions, and the purpose for which the funds will be used. It is important for both employers and employees to understand their rights and responsibilities when it comes to advance authorization for pay deductions in Sacramento, California. Employers must comply with state and federal laws governing wage deductions, ensuring that proper documentation is provided and that the deductions are reasonable and lawful. Employees, on the other hand, should carefully review the terms of the authorization to ensure they fully understand the implications and consequences of the deductions. In summary, the Sacramento California Advance Authorization for Pay Deduction is a legal mechanism that allows employers and employees to coordinate the deduction of wages for various purposes. This process ensures transparency, compliance with regulations, and the protection of both parties' interests.Sacramento California Advance Authorization for Pay Deduction is a legal process that allows employers in Sacramento, California to deduct a certain amount from an employee's wages to cover specific expenses or obligations. This deduction is authorized by the employee in advance, giving consent for the employer to withhold a specified portion of their salary. There are several types of Sacramento California Advance Authorization for Pay Deduction, each designed to cater to different situations and needs. These types include: 1. Salary Advances: Employees in Sacramento, California may request a salary advance from their employer due to unforeseen financial emergencies, such as urgent medical bills or unexpected repairs. The employee can authorize the employer to deduct a certain amount from their future paychecks until the advance is fully reimbursed. 2. Employee Benefit Deductions: Employers often offer various benefits to their employees, such as health insurance, retirement plans, or flexible spending accounts. With an advance authorization for pay deduction, employees can agree to have a predetermined amount deducted from their wages to cover the costs associated with these benefits. 3. Wage Garnishments: In the event of a court order or legal judgment, an employer may be required to withhold a portion of an employee's wages to satisfy outstanding debts or obligations. This type of advance authorization for pay deduction is typically initiated by a third party, such as a creditor or a government agency. 4. Voluntary Deductions: Employees may choose to have specific amounts deducted from their wages for personal reasons, such as contributions to charitable organizations or savings accounts. This advance authorization allows the employee to specify the amount and duration of the deduction, ensuring compliance with relevant laws and regulations. The Sacramento California Advance Authorization for Pay Deduction serves as a formal agreement between the employer and the employee. It outlines the terms and conditions of the deduction, including the amount to be deducted, the frequency of deductions, and the purpose for which the funds will be used. It is important for both employers and employees to understand their rights and responsibilities when it comes to advance authorization for pay deductions in Sacramento, California. Employers must comply with state and federal laws governing wage deductions, ensuring that proper documentation is provided and that the deductions are reasonable and lawful. Employees, on the other hand, should carefully review the terms of the authorization to ensure they fully understand the implications and consequences of the deductions. In summary, the Sacramento California Advance Authorization for Pay Deduction is a legal mechanism that allows employers and employees to coordinate the deduction of wages for various purposes. This process ensures transparency, compliance with regulations, and the protection of both parties' interests.