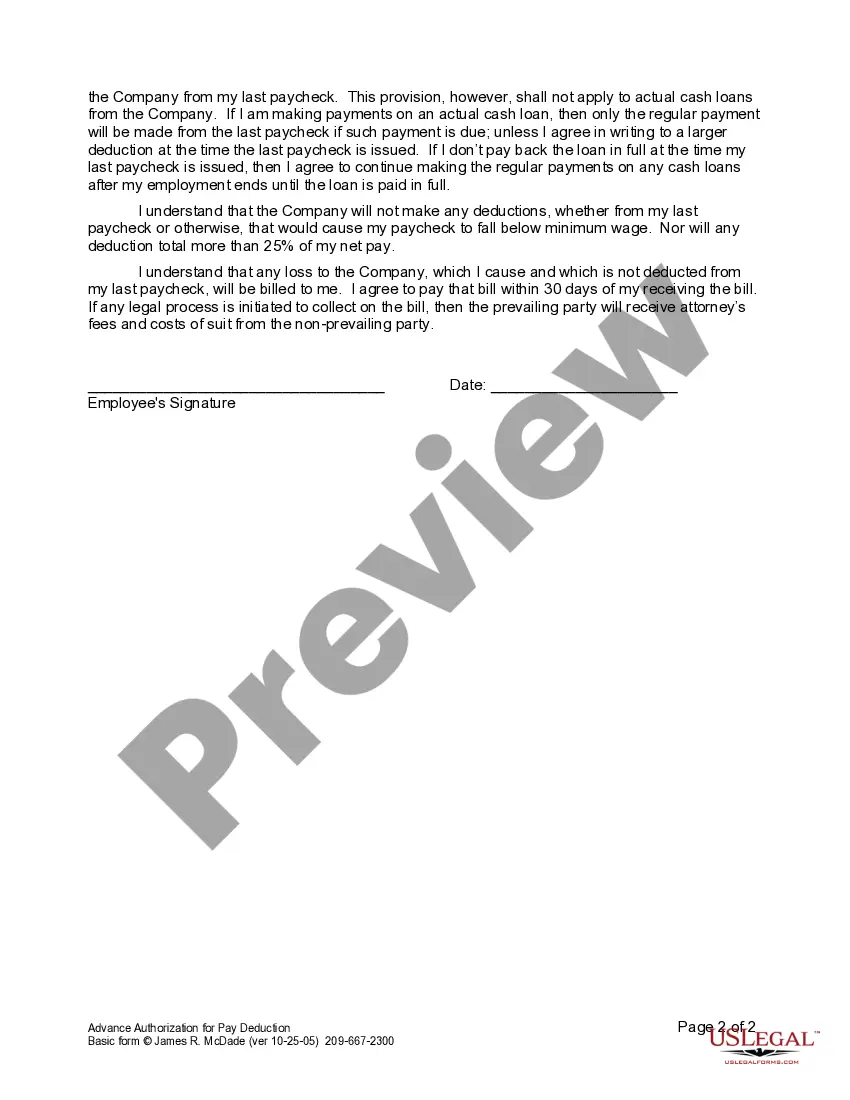

Employers use this form to reinforce with an employee his or her need to return Company property and to obtain authorization for making deductions from an employee's paycheck.

Stockton California Advance Authorization for Pay Deduction is a legal agreement that allows employers in Stockton, California to deduct money from an employee's wages for various purposes. This agreement ensures that both the employer and employee are aware of the terms and conditions surrounding the deductions, and it provides a framework for a smooth and transparent process. There are different types of Stockton California Advance Authorization for Pay Deduction, which include: 1. Wage Garnishment Authorization: This type of deduction occurs when an employee has a court-ordered debt or owes money to a creditor. It allows the employer to deduct a specific amount from the employee's wages to repay the debt. 2. Tax Withholding Authorization: Under this category, the employee provides consent to the employer to deduct a certain amount from their paychecks to cover federal, state, and local taxes. It ensures that the employee is compliant with tax regulations, and the employer fulfills its responsibilities as a tax withholding agent. 3. Health Insurance Deduction Authorization: This form of deduction grants the employer permission to deduct a portion of the employee's wages to cover their health insurance premiums. It helps ensure that employees have access to adequate healthcare coverage and simplifies the payment process. 4. Retirement Contribution Authorization: Employees may authorize deductions from their wages to contribute to a retirement savings plan, such as a 401(k) or an IRA. This deduction allows employees to save for their future, and it often comes with employer matching contributions, encouraging long-term financial security. 5. Loan Repayment Authorization: In cases where an employee has taken out a loan from their employer, the Stockton California Advance Authorization for Pay Deduction allows the employer to deduct the agreed-upon repayment amount directly from the employee's wages. It helps facilitate timely loan repayment and minimizes the administrative burden for both parties. It is crucial to understand the terms and conditions of any Stockton California Advance Authorization for Pay Deduction agreement as an employee. Employers must provide clear explanations, outline the purpose and duration of the deductions, and ensure compliance with applicable labor laws and regulations. Employees should read and review the agreement thoroughly before granting their authorization to ensure their rights are protected while maintaining a fair and transparent working relationship with their employer.Stockton California Advance Authorization for Pay Deduction is a legal agreement that allows employers in Stockton, California to deduct money from an employee's wages for various purposes. This agreement ensures that both the employer and employee are aware of the terms and conditions surrounding the deductions, and it provides a framework for a smooth and transparent process. There are different types of Stockton California Advance Authorization for Pay Deduction, which include: 1. Wage Garnishment Authorization: This type of deduction occurs when an employee has a court-ordered debt or owes money to a creditor. It allows the employer to deduct a specific amount from the employee's wages to repay the debt. 2. Tax Withholding Authorization: Under this category, the employee provides consent to the employer to deduct a certain amount from their paychecks to cover federal, state, and local taxes. It ensures that the employee is compliant with tax regulations, and the employer fulfills its responsibilities as a tax withholding agent. 3. Health Insurance Deduction Authorization: This form of deduction grants the employer permission to deduct a portion of the employee's wages to cover their health insurance premiums. It helps ensure that employees have access to adequate healthcare coverage and simplifies the payment process. 4. Retirement Contribution Authorization: Employees may authorize deductions from their wages to contribute to a retirement savings plan, such as a 401(k) or an IRA. This deduction allows employees to save for their future, and it often comes with employer matching contributions, encouraging long-term financial security. 5. Loan Repayment Authorization: In cases where an employee has taken out a loan from their employer, the Stockton California Advance Authorization for Pay Deduction allows the employer to deduct the agreed-upon repayment amount directly from the employee's wages. It helps facilitate timely loan repayment and minimizes the administrative burden for both parties. It is crucial to understand the terms and conditions of any Stockton California Advance Authorization for Pay Deduction agreement as an employee. Employers must provide clear explanations, outline the purpose and duration of the deductions, and ensure compliance with applicable labor laws and regulations. Employees should read and review the agreement thoroughly before granting their authorization to ensure their rights are protected while maintaining a fair and transparent working relationship with their employer.