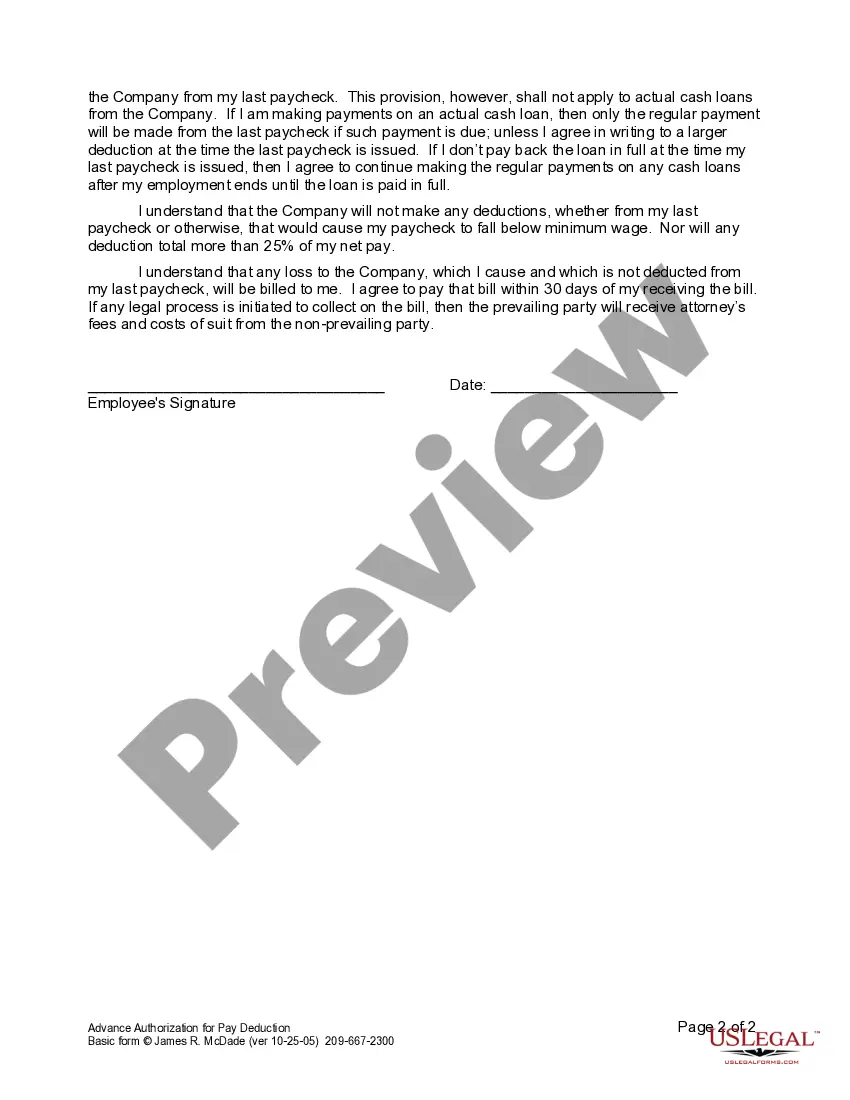

Employers use this form to reinforce with an employee his or her need to return Company property and to obtain authorization for making deductions from an employee's paycheck.

West Covina California Advance Authorization for Pay Deduction is a legal agreement provided by employers to their employees in the city of West Covina, California. This authorization allows the employer to deduct specific amounts from an employee's paycheck in advance for various purposes. The authorized deductions are typically meant to cover expenses or debts owed to the employer or other entities. One type of West Covina California Advance Authorization for Pay Deduction is for loans or cash advance services provided by employers. In some cases, employees may need a financial boost to cover unexpected expenses or emergencies. With this type of authorization, employees can request a deduction from their upcoming paychecks to repay the borrowed amount from the employer. Another type of advance authorization involves deductions for benefits and insurance premiums. Employers in West Covina, California, often provide their employees with an array of benefits, such as health insurance, dental coverage, or retirement plans. To ensure these benefits remain active, employees may need to authorize their employer to deduct the corresponding premium amounts from their paychecks. Advance authorizations can also be applicable for expenses related to company-sponsored training or educational programs. In such cases, employers may offer employees the opportunity to enhance their skills or knowledge through professional development courses. With the employee's consent, the employer deducts the cost of the training program from their wages, making it convenient for both parties. The West Covina California Advance Authorization for Pay Deduction acts as a legally binding agreement between the employer and the employee. It outlines important details such as the purpose of the deduction, the specific amount or percentage to be deducted, and the duration of the deduction period. This agreement ensures transparency and protects the interests of both the employer and the employee. It is important to note that any deductions made under this authorization must comply with the applicable employment laws and regulations in West Covina, California. Employers should ensure they adhere to the legal requirements and provide clear documentation to employees regarding the deductions made from their paychecks. In summary, West Covina California Advance Authorization for Pay Deduction allows employers and employees in the city to arrange deductions from an employee's wages for various purposes such as loans, benefits premiums, or educational expenses. These authorizations serve to streamline financial processes and provide employees with convenient options for addressing their financial needs.West Covina California Advance Authorization for Pay Deduction is a legal agreement provided by employers to their employees in the city of West Covina, California. This authorization allows the employer to deduct specific amounts from an employee's paycheck in advance for various purposes. The authorized deductions are typically meant to cover expenses or debts owed to the employer or other entities. One type of West Covina California Advance Authorization for Pay Deduction is for loans or cash advance services provided by employers. In some cases, employees may need a financial boost to cover unexpected expenses or emergencies. With this type of authorization, employees can request a deduction from their upcoming paychecks to repay the borrowed amount from the employer. Another type of advance authorization involves deductions for benefits and insurance premiums. Employers in West Covina, California, often provide their employees with an array of benefits, such as health insurance, dental coverage, or retirement plans. To ensure these benefits remain active, employees may need to authorize their employer to deduct the corresponding premium amounts from their paychecks. Advance authorizations can also be applicable for expenses related to company-sponsored training or educational programs. In such cases, employers may offer employees the opportunity to enhance their skills or knowledge through professional development courses. With the employee's consent, the employer deducts the cost of the training program from their wages, making it convenient for both parties. The West Covina California Advance Authorization for Pay Deduction acts as a legally binding agreement between the employer and the employee. It outlines important details such as the purpose of the deduction, the specific amount or percentage to be deducted, and the duration of the deduction period. This agreement ensures transparency and protects the interests of both the employer and the employee. It is important to note that any deductions made under this authorization must comply with the applicable employment laws and regulations in West Covina, California. Employers should ensure they adhere to the legal requirements and provide clear documentation to employees regarding the deductions made from their paychecks. In summary, West Covina California Advance Authorization for Pay Deduction allows employers and employees in the city to arrange deductions from an employee's wages for various purposes such as loans, benefits premiums, or educational expenses. These authorizations serve to streamline financial processes and provide employees with convenient options for addressing their financial needs.