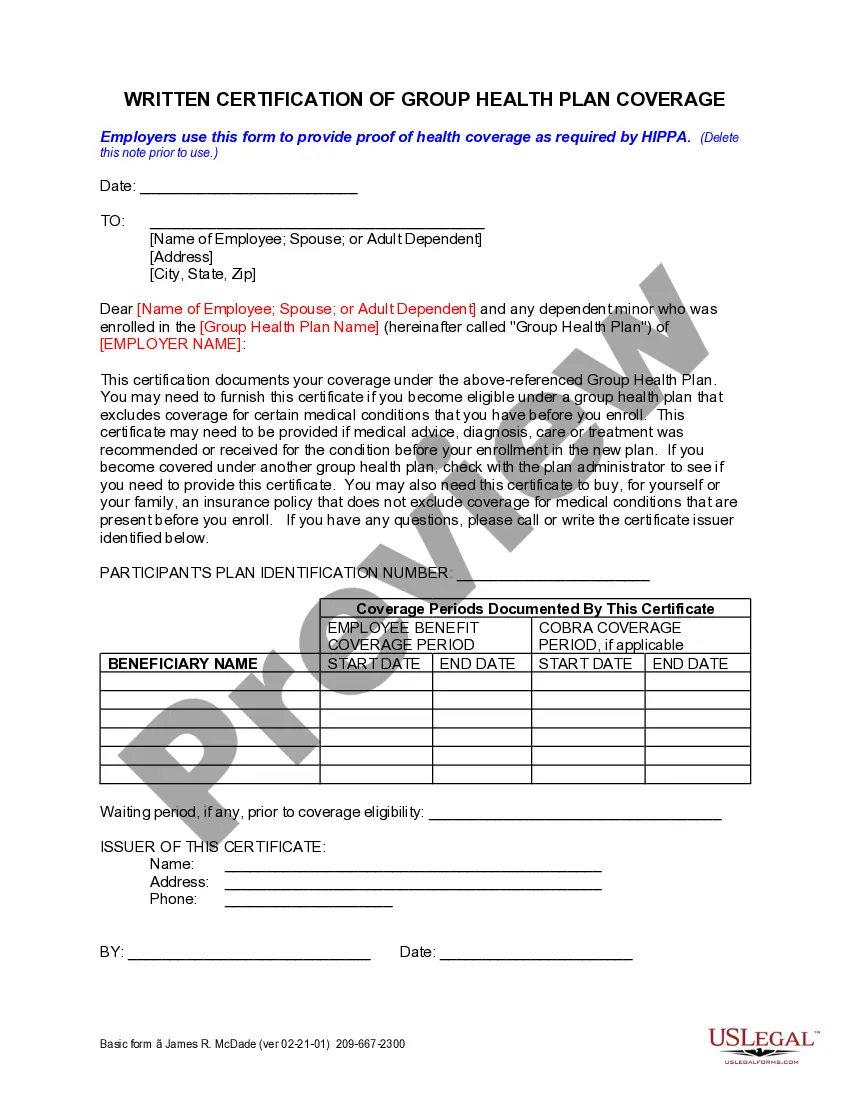

Employers use this form to provide proof to the employee of health coverage as required by HIPPA.

Antioch California Certification of Group Health Plan Coverage is a legal document that verifies the eligibility of a group health plan provided by an employer in Antioch, California. This certification ensures that the group health plan meets the regulatory requirements set by the state of California. The Antioch California Certification of Group Health Plan Coverage is necessary for employers offering health benefits to their employees in California. It serves as proof that the employer's group health plan meets the necessary standards, such as offering minimum essential coverage, meeting affordability criteria, and providing essential health benefits as outlined by state law. There are different types of Antioch California Certification of Group Health Plan Coverage, depending on the nature of the employer's health plan. These can include: 1. Fully-Insured Group Health Plans: These are health plans where the employer purchases coverage from an insurance company. The insurance carrier is responsible for administering the plan and assuming the financial risk. 2. Self-Funded Group Health Plans: In self-funded plans, the employer acts as the insurer and assumes the financial risk. They pay the claims using their own funds, often with the assistance of a third-party administrator (TPA) to handle claims processing and administrative tasks. 3. Health Maintenance Organization (HMO) Plans: are a type of managed care health plan that provides care through specific networks of doctors and hospitals. In this model, members must choose a primary care physician who coordinates their care and makes referrals for specialists. 4. Preferred Provider Organization (PPO) Plans: PPO's offer more flexibility in choosing healthcare providers. Members can receive care from both in-network and out-of-network providers, although coverage is usually less extensive for out-of-network providers. 5. Point of Service (POS) Plans: POS plans combine features of both HMO's and PPO's. Members can choose a primary care physician who coordinates their care, similar to an HMO, but also have the option to go out-of-network, similar to a PPO, albeit with higher out-of-pocket costs. Employers in Antioch, California must obtain the specific type of certification that corresponds to their group health plan. This certification assures compliance with state regulations and allows employers to provide comprehensive and compliant health coverage for their employees. It is essential for employers to regularly renew and update their certifications to ensure continuity of coverage and legal compliance.Antioch California Certification of Group Health Plan Coverage is a legal document that verifies the eligibility of a group health plan provided by an employer in Antioch, California. This certification ensures that the group health plan meets the regulatory requirements set by the state of California. The Antioch California Certification of Group Health Plan Coverage is necessary for employers offering health benefits to their employees in California. It serves as proof that the employer's group health plan meets the necessary standards, such as offering minimum essential coverage, meeting affordability criteria, and providing essential health benefits as outlined by state law. There are different types of Antioch California Certification of Group Health Plan Coverage, depending on the nature of the employer's health plan. These can include: 1. Fully-Insured Group Health Plans: These are health plans where the employer purchases coverage from an insurance company. The insurance carrier is responsible for administering the plan and assuming the financial risk. 2. Self-Funded Group Health Plans: In self-funded plans, the employer acts as the insurer and assumes the financial risk. They pay the claims using their own funds, often with the assistance of a third-party administrator (TPA) to handle claims processing and administrative tasks. 3. Health Maintenance Organization (HMO) Plans: are a type of managed care health plan that provides care through specific networks of doctors and hospitals. In this model, members must choose a primary care physician who coordinates their care and makes referrals for specialists. 4. Preferred Provider Organization (PPO) Plans: PPO's offer more flexibility in choosing healthcare providers. Members can receive care from both in-network and out-of-network providers, although coverage is usually less extensive for out-of-network providers. 5. Point of Service (POS) Plans: POS plans combine features of both HMO's and PPO's. Members can choose a primary care physician who coordinates their care, similar to an HMO, but also have the option to go out-of-network, similar to a PPO, albeit with higher out-of-pocket costs. Employers in Antioch, California must obtain the specific type of certification that corresponds to their group health plan. This certification assures compliance with state regulations and allows employers to provide comprehensive and compliant health coverage for their employees. It is essential for employers to regularly renew and update their certifications to ensure continuity of coverage and legal compliance.